Looking back on productivity software stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Atlassian (NASDAQ: TEAM) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.6% since the latest earnings results.

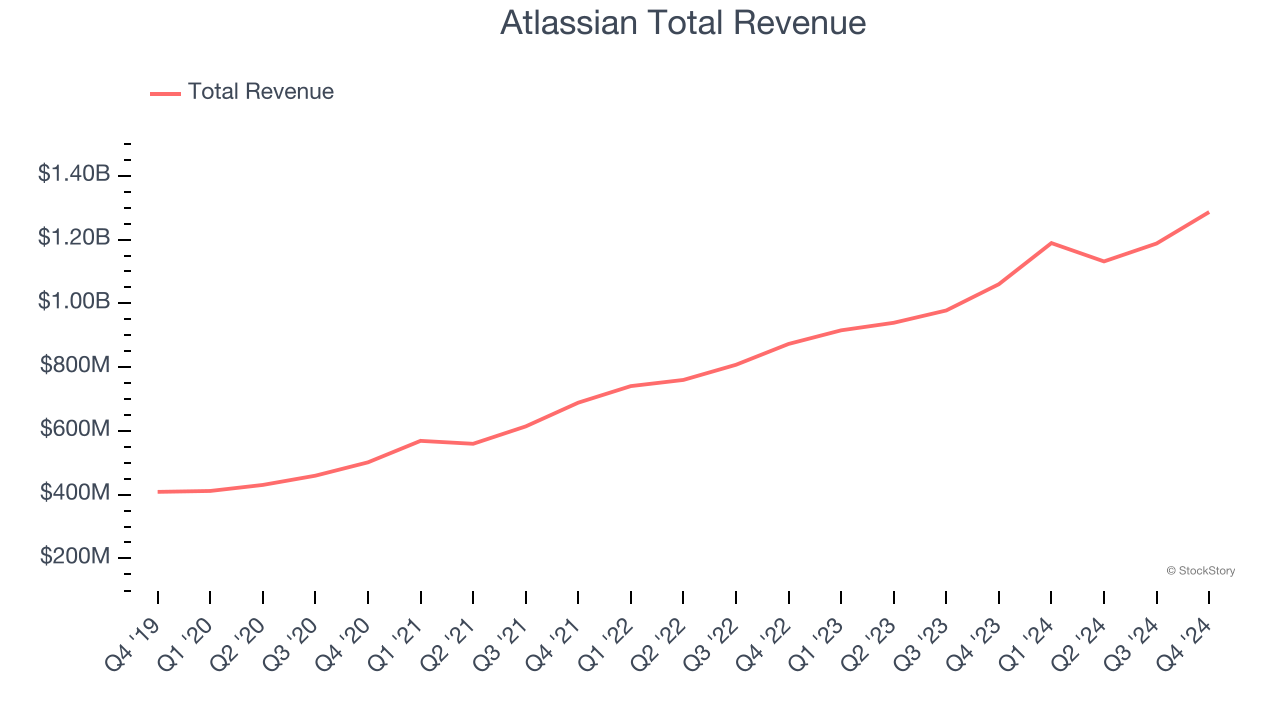

Atlassian (NASDAQ: TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ: TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $1.29 billion, up 21.4% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

“The Atlassian System of Work is resonating with enterprises all over the globe, as business leaders increasingly turn to the Atlassian platform to help teams across their organization collaborate on the opportunities and challenges they face,” said Mike Cannon-Brookes, Atlassian’s CEO and co-Founder.

The stock is down 11.5% since reporting and currently trades at $235.94.

We think Atlassian is a good business, but is it a buy today? Read our full report here, it’s free.

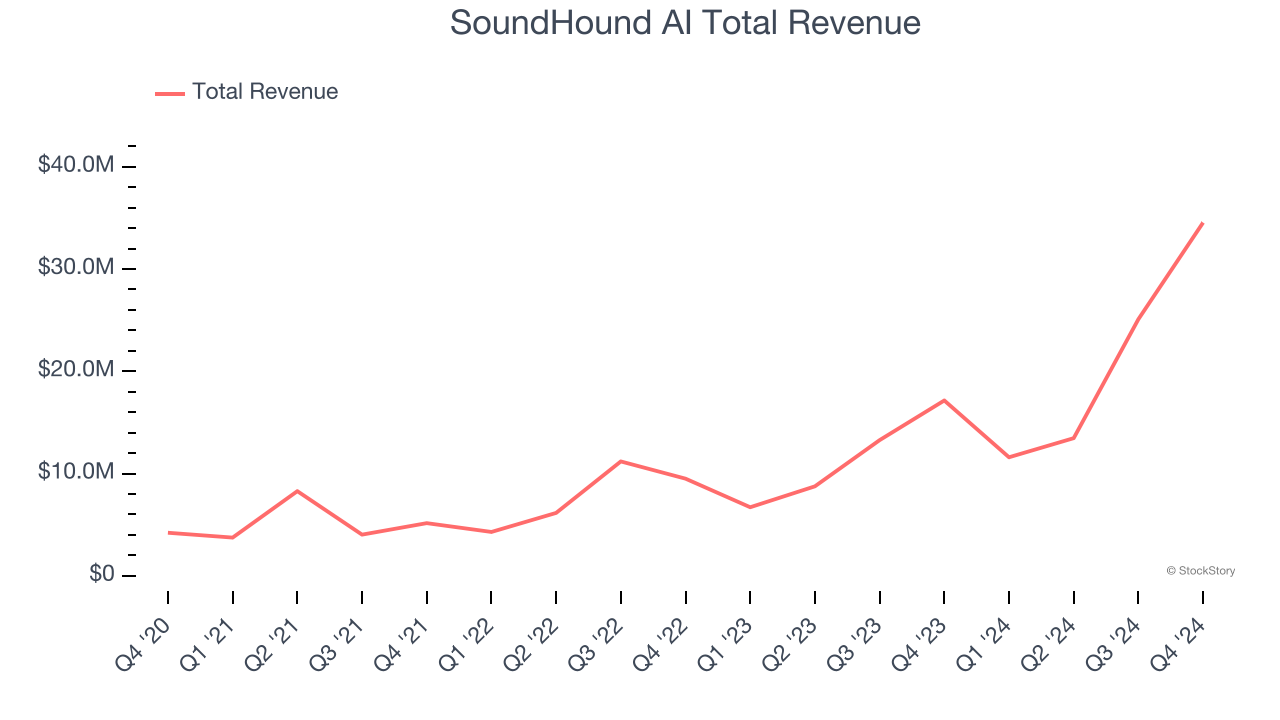

Best Q4: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $34.54 million, up 101% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

SoundHound AI pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.3% since reporting. It currently trades at $10.07.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Box (NYSE: BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE: BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $279.5 million, up 6.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 6.6% since the results and currently trades at $31.32.

Read our full analysis of Box’s results here.

Zoom (NASDAQ: ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ: ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom reported revenues of $1.18 billion, up 3.3% year on year. This result met analysts’ expectations. Taking a step back, it was a mixed quarter as it also logged accelerating growth in large customers but full-year EPS guidance missing analysts’ expectations significantly.

The company added 93 enterprise customers paying more than $100,000 annually to reach a total of 4,088. The stock is down 3.2% since reporting and currently trades at $78.44.

Read our full, actionable report on Zoom here, it’s free.

Microsoft (NASDAQ: MSFT)

Short for microcomputer software, Microsoft (NASDAQ: MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $69.63 billion, up 12.3% year on year. This print surpassed analysts’ expectations by 1.1%. Overall, it was a strong quarter: Microsoft narrowly topped analysts’ revenue expectations, as Personal Computing and Business Services beat while Intelligent Cloud was in line. Within Intelligent Cloud, the all-important Azure constant-currency revenue growth came in at 31%, missing investor expectations of 32-33%.

The stock is down 10.5% since reporting and currently trades at $395.20.

Read our full, actionable report on Microsoft here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.