Wrapping up Q2 earnings, we look at the numbers and key takeaways for the vertical software stocks, including Doximity (NYSE: DOCS) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

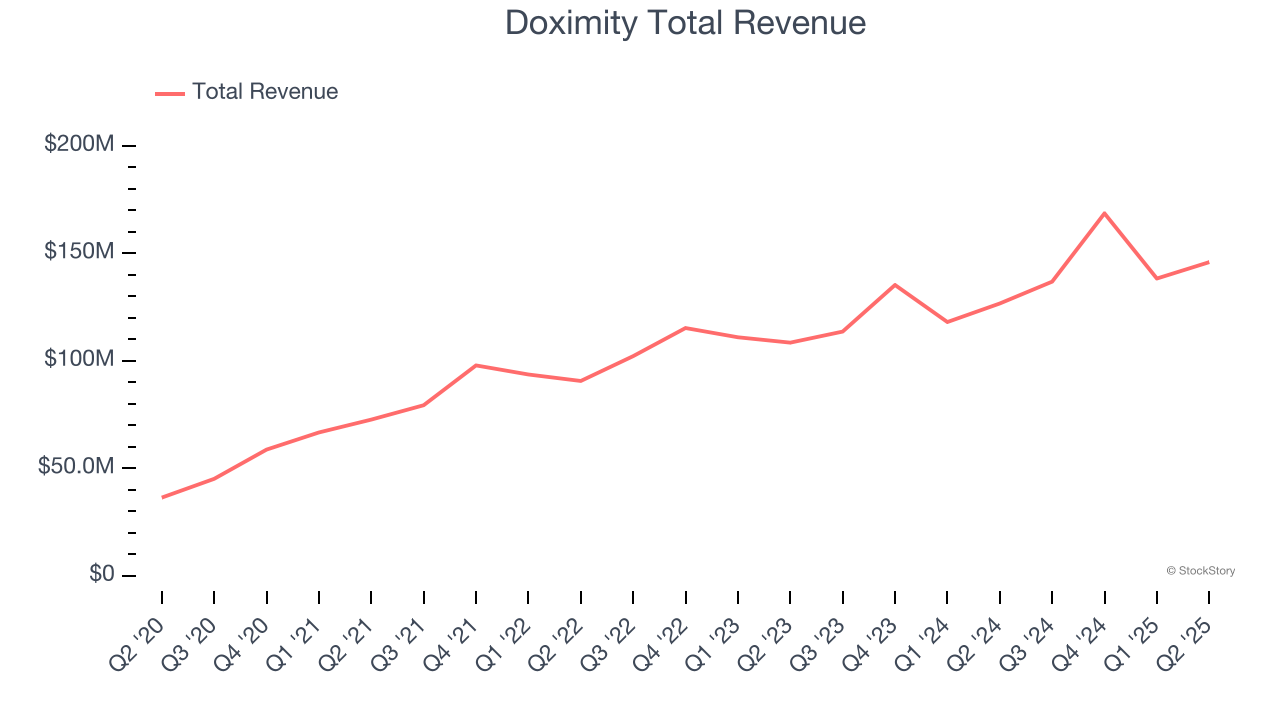

Doximity (NYSE: DOCS)

With over 80% of U.S. physicians as members of its digital community, Doximity (NYSE: DOCS) operates a digital platform that enables physicians and other healthcare professionals to collaborate, stay current with medical news, manage their careers, and conduct virtual patient visits.

Doximity reported revenues of $145.9 million, up 15.2% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ billings estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

“We began our year with strong profit growth and record engagement across our newsfeed, workflow, and AI products,” said Jeff Tangney, co-founder and CEO of Doximity.

Interestingly, the stock is up 18.2% since reporting and currently trades at $69.40.

We think Doximity is a good business, but is it a buy today? Read our full report here, it’s free.

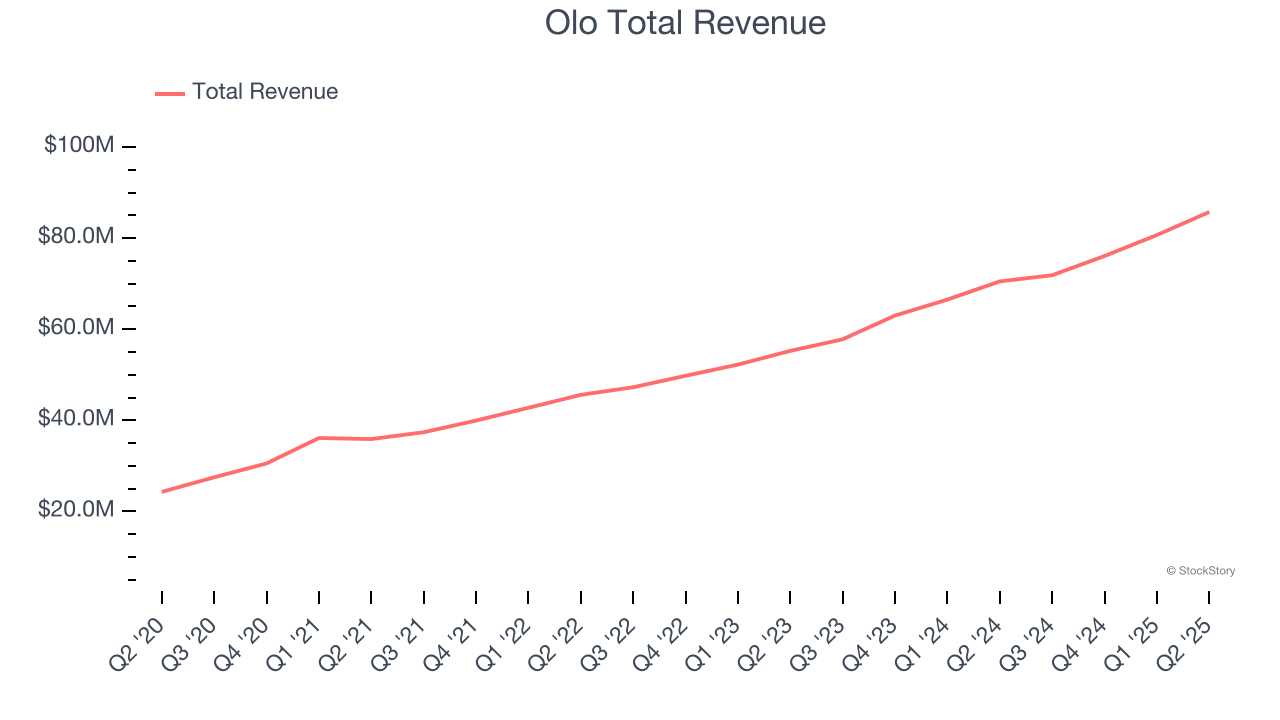

Best Q2: Olo (NYSE: OLO)

Processing over two million orders daily across 80,000 restaurant locations nationwide, Olo (NYSE: OLO) provides an enterprise-grade SaaS platform that powers digital ordering, delivery, and payment systems for restaurant brands across the United States.

Olo reported revenues of $85.72 million, up 21.6% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.1% since reporting. It currently trades at $10.26.

Is now the time to buy Olo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Agilysys (NASDAQ: AGYS)

With a tech stack that powers everything from check-in to checkout at some of the world's top hospitality venues, Agilysys (NASDAQ: AGYS) develops and provides cloud-based and on-premise software solutions for hotels, resorts, casinos, and restaurants to manage operations and enhance guest experiences.

Agilysys reported revenues of $76.68 million, up 20.7% year on year, exceeding analysts’ expectations by 3.1%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

Agilysys delivered the weakest full-year guidance update in the group. As expected, the stock is down 5.6% since the results and currently trades at $110.56.

Read our full analysis of Agilysys’s results here.

Toast (NYSE: TOST)

Born from the frustrations of three friends waiting too long for their restaurant bill, Toast (NYSE: TOST) provides a cloud-based digital technology platform with software, payment processing, and hardware solutions built specifically for restaurants.

Toast reported revenues of $1.55 billion, up 24.8% year on year. This number beat analysts’ expectations by 2.1%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

The stock is down 13.9% since reporting and currently trades at $41.10.

Read our full, actionable report on Toast here, it’s free.

Adobe (NASDAQ: ADBE)

Originally named after Adobe Creek that ran behind co-founder John Warnock's house, Adobe (NASDAQ: ADBE) develops software products used for digital content creation, document management, and marketing solutions across desktop, mobile, and cloud platforms.

Adobe reported revenues of $5.87 billion, up 10.6% year on year. This result topped analysts’ expectations by 1.5%. It was a strong quarter as it also produced a solid beat of analysts’ billings estimates and full-year EPS guidance slightly topping analysts’ expectations.

The stock is down 15.8% since reporting and currently trades at $348.50.

Read our full, actionable report on Adobe here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.