Pharmaceutical company Organon (NYSE: OGN) reported Q2 CY2025 results topping the market’s revenue expectations, but sales were flat year on year at $1.59 billion. The company expects the full year’s revenue to be around $6.23 billion, close to analysts’ estimates. Its non-GAAP profit of $1 per share was 6.4% above analysts’ consensus estimates.

Is now the time to buy Organon? Find out by accessing our full research report, it’s free.

Organon (OGN) Q2 CY2025 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.55 billion (flat year on year, 2.8% beat)

- Adjusted EPS: $1 vs analyst estimates of $0.94 (6.4% beat)

- Adjusted EBITDA: $522 million vs analyst estimates of $475.3 million (32.7% margin, 9.8% beat)

- Operating Margin: 20.5%, down from 23.1% in the same quarter last year

- Market Capitalization: $2.51 billion

“During the quarter we paid down principal on our long-term debt and began implementing meaningful cost savings, which together set us on a path to achieve net leverage below 4.0x by the end of this year. We will aim to drive further improvement, with the goal of achieving net leverage of 3.5x or below by the end of 2026,” said Kevin Ali, Organon’s Chief Executive Officer.

Company Overview

Spun off from Merck in 2021 to create a company dedicated to addressing unmet needs in women's health, Organon (NYSE: OGN) is a global healthcare company focused on improving women's health through prescription therapies, medical devices, biosimilars, and established medicines.

Revenue Growth

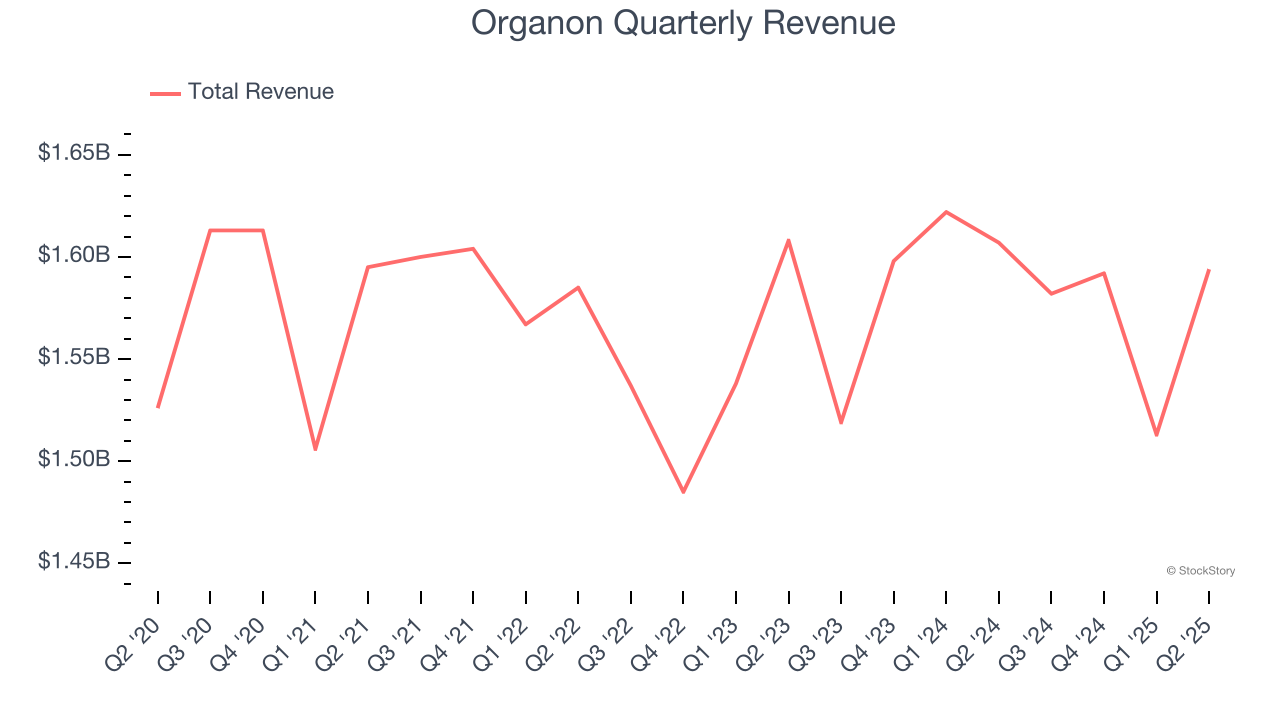

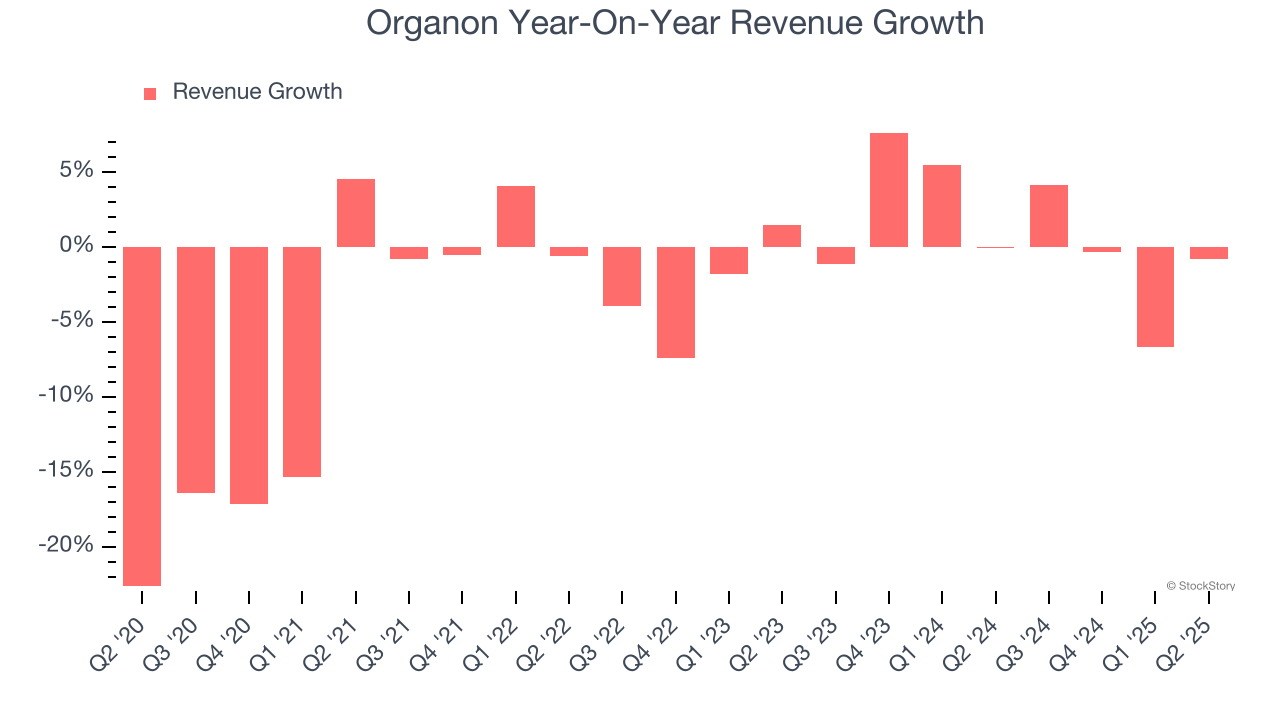

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Organon struggled to consistently generate demand over the last five years as its sales dropped at a 2.6% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Organon’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

This quarter, Organon’s $1.59 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

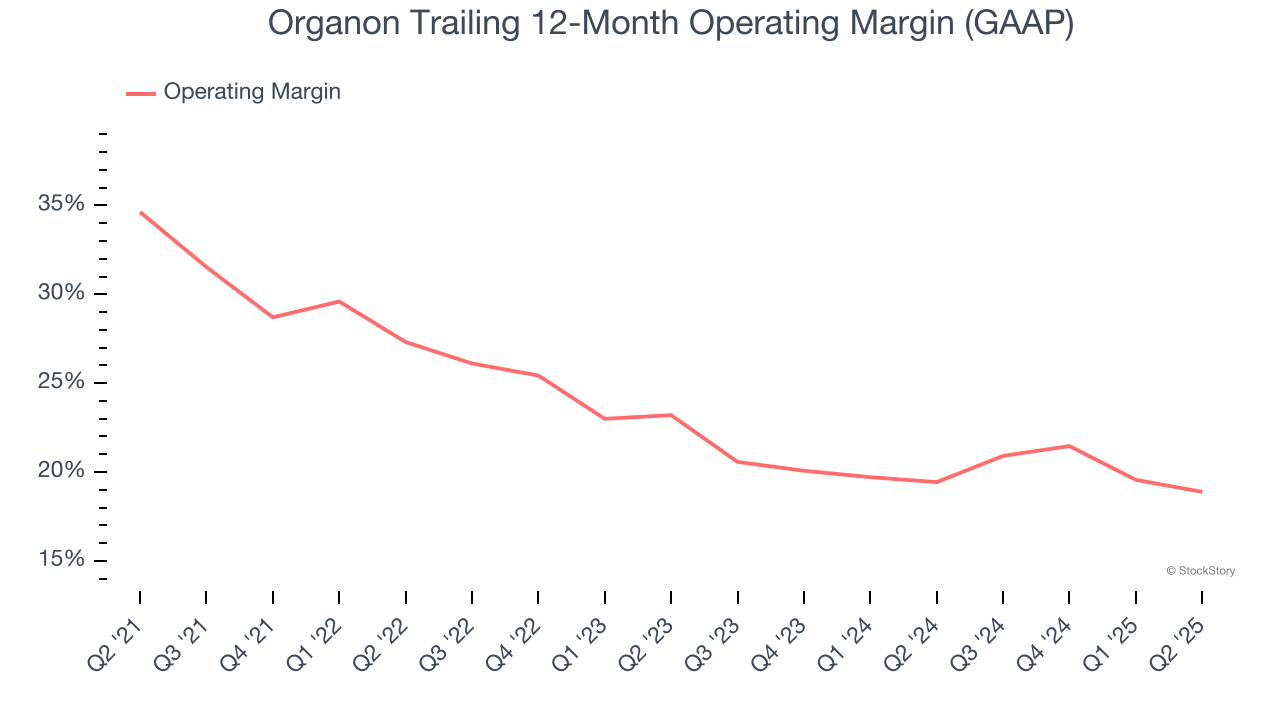

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Organon has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 24.7%.

Looking at the trend in its profitability, Organon’s operating margin decreased by 15.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 4.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Organon generated an operating margin profit margin of 20.5%, down 2.6 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

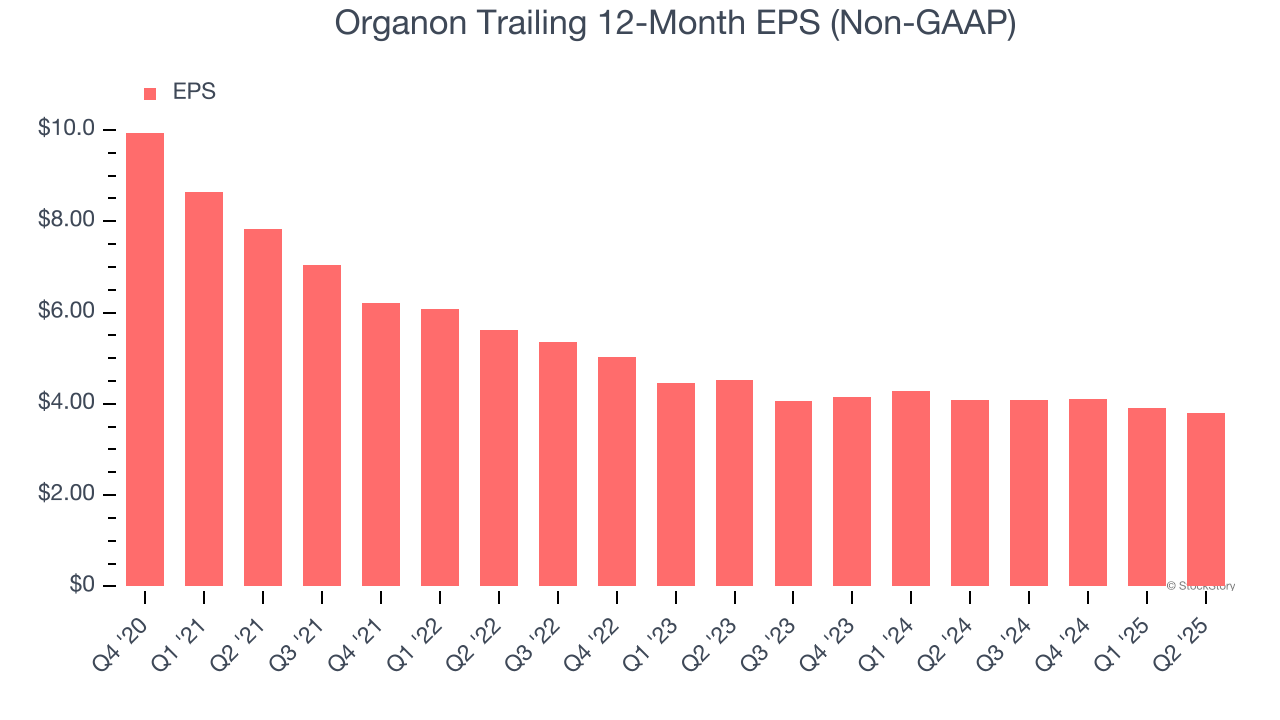

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Organon, its EPS declined by 18.5% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Organon’s earnings to better understand the drivers of its performance. As we mentioned earlier, Organon’s operating margin declined by 15.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Organon reported adjusted EPS at $1, down from $1.12 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street expects Organon’s full-year EPS of $3.79 to grow 1.9%.

Key Takeaways from Organon’s Q2 Results

We enjoyed seeing Organon beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 6.5% to $10.30 immediately after reporting.

Indeed, Organon had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.