Global professional services company Jacobs Solutions (NYSE: J) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 5.2% year on year to $3.03 billion. Its non-GAAP profit of $1.62 per share was 5.4% above analysts’ consensus estimates.

Is now the time to buy Jacobs Solutions? Find out by accessing our full research report, it’s free.

Jacobs Solutions (J) Q2 CY2025 Highlights:

- Revenue: $3.03 billion vs analyst estimates of $3.06 billion (5.2% year-on-year growth, 0.9% miss)

- Adjusted EPS: $1.62 vs analyst estimates of $1.54 (5.4% beat)

- Adjusted EBITDA: $314.3 million vs analyst estimates of $314.3 million (10.4% margin, in line)

- Adjusted EPS guidance for the full year is $6.05 at the midpoint, beating analyst estimates by 0.5%

- Operating Margin: 7.8%, up from 5.9% in the same quarter last year

- Free Cash Flow Margin: 8.9%, down from 15.4% in the same quarter last year

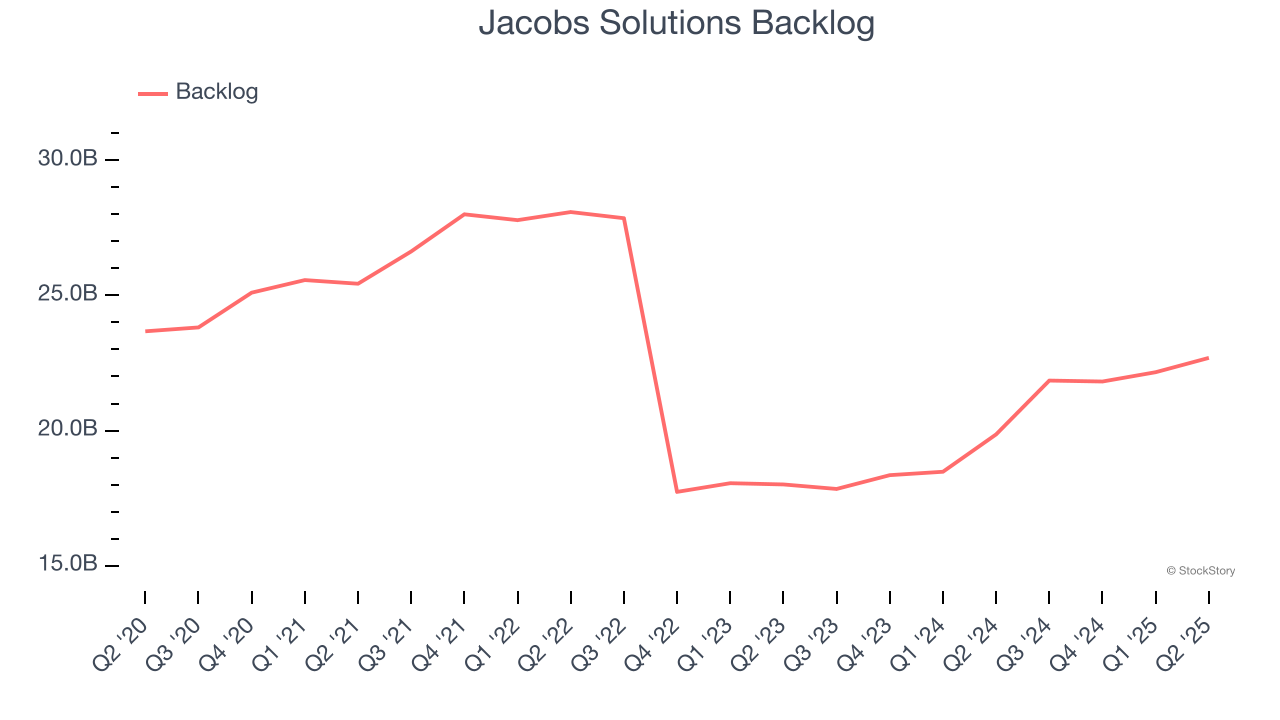

- Backlog: $22.69 billion at quarter end, up 14.3% year on year

- Market Capitalization: $16.79 billion

Company Overview

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE: J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $11.84 billion in revenue over the past 12 months, Jacobs Solutions is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Jacobs Solutions to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

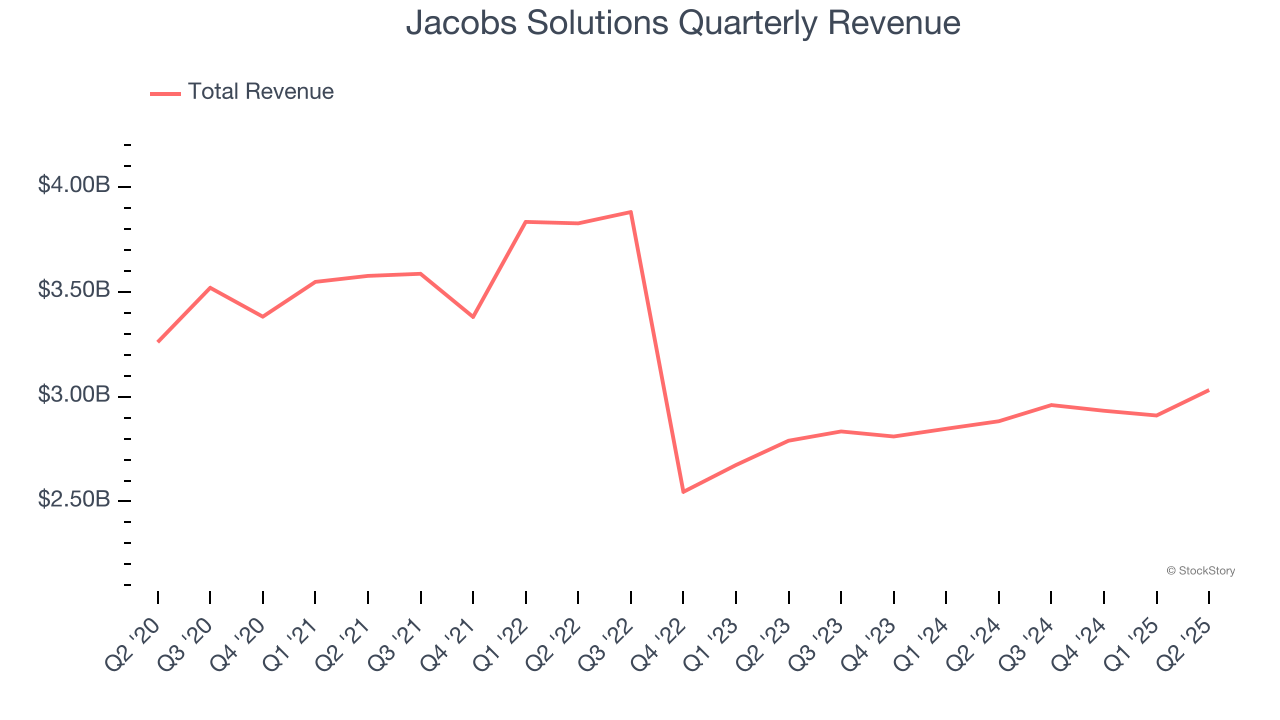

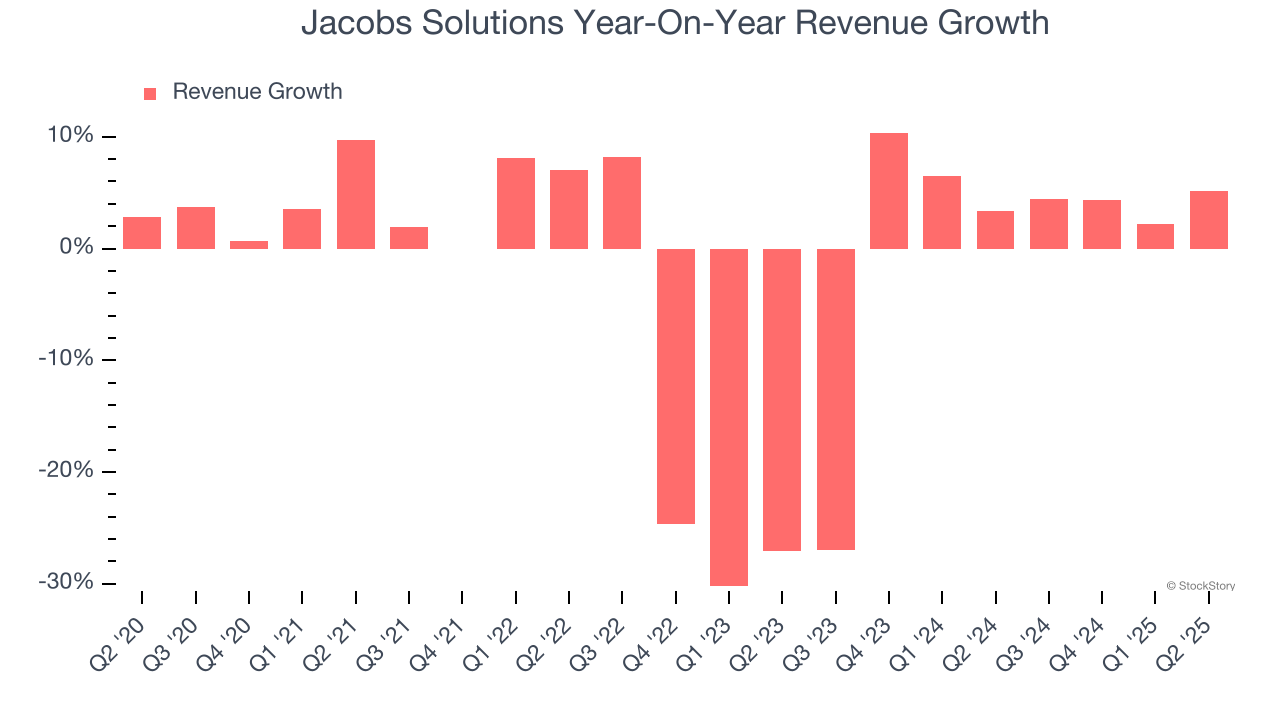

As you can see below, Jacobs Solutions struggled to generate demand over the last five years. Its sales dropped by 2.5% annually, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Jacobs Solutions’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Jacobs Solutions’s backlog reached $22.69 billion in the latest quarter and averaged 7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Jacobs Solutions’s products and services but raises concerns about capacity constraints.

This quarter, Jacobs Solutions’s revenue grew by 5.2% year on year to $3.03 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

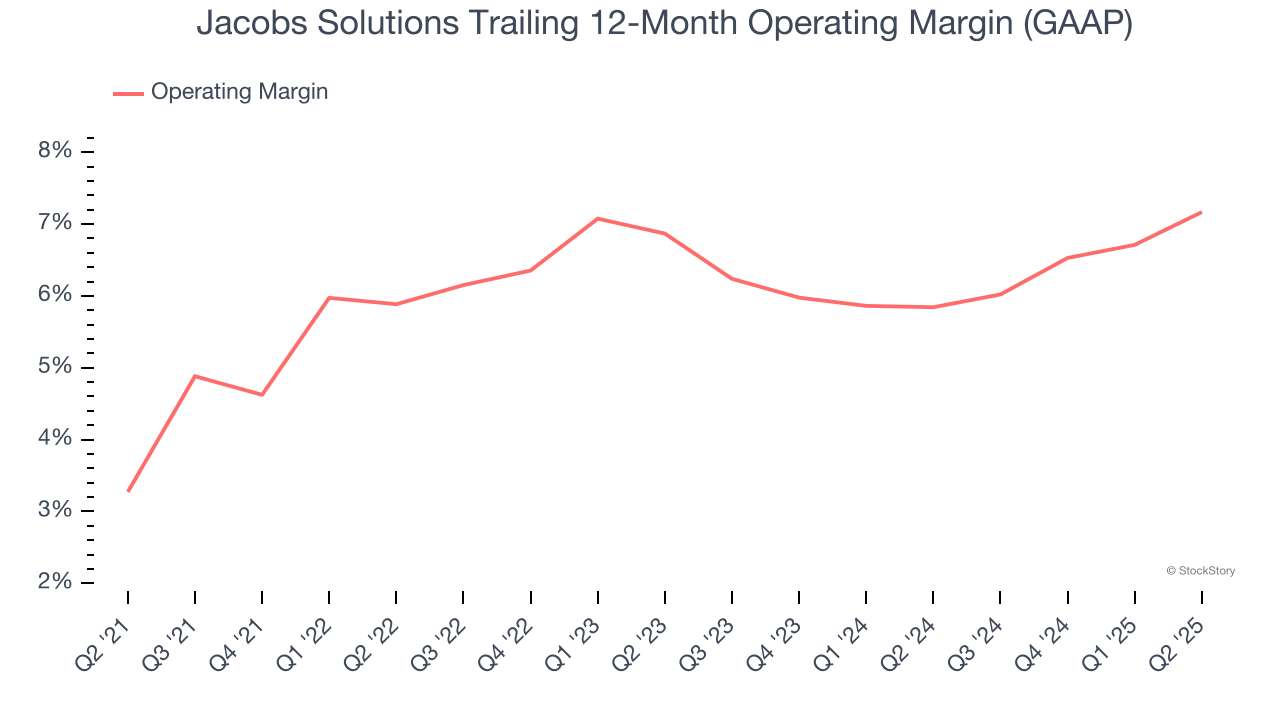

Jacobs Solutions was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.7% was weak for a business services business.

On the plus side, Jacobs Solutions’s operating margin rose by 3.9 percentage points over the last five years.

This quarter, Jacobs Solutions generated an operating margin profit margin of 7.8%, up 1.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

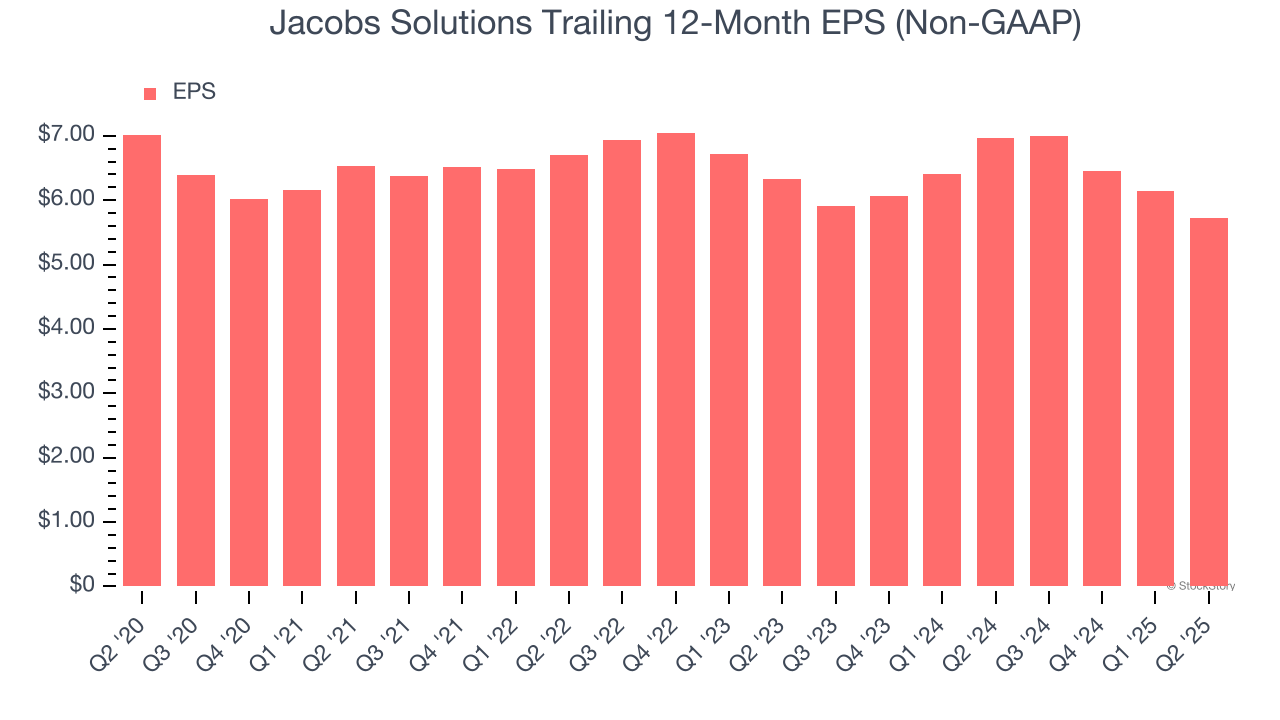

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Jacobs Solutions, its EPS and revenue declined by 4% and 2.5% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Jacobs Solutions’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Jacobs Solutions, its two-year annual EPS declines of 4.9% are similar to its five-year trend. These results were bad no matter how you slice the data.

In Q2, Jacobs Solutions reported adjusted EPS at $1.62, down from $2.04 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 5.4%. Over the next 12 months, Wall Street expects Jacobs Solutions’s full-year EPS of $5.73 to grow 17.1%.

Key Takeaways from Jacobs Solutions’s Q2 Results

We enjoyed seeing Jacobs Solutions beat analysts’ backlog expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, this print had some key positives. The stock traded up 1.4% to $142 immediately after reporting.

So should you invest in Jacobs Solutions right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.