Over the past six months, Herc’s shares (currently trading at $127.93) have posted a disappointing 11.8% loss, well below the S&P 500’s 10.3% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Herc, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Herc Not Exciting?

Even though the stock has become cheaper, we're cautious about Herc. Here are three reasons why HRI doesn't excite us and a stock we'd rather own.

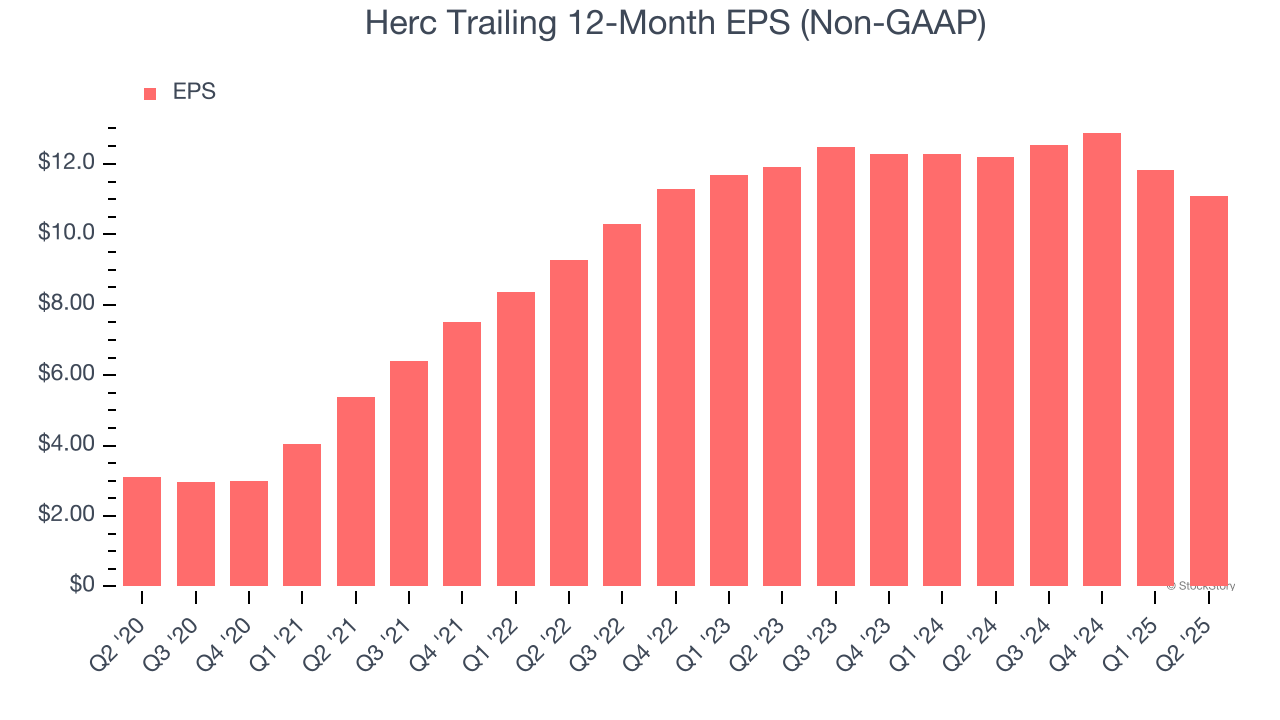

1. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Herc, its EPS declined by 3.4% annually over the last two years while its revenue grew by 10.9%. This tells us the company became less profitable on a per-share basis as it expanded.

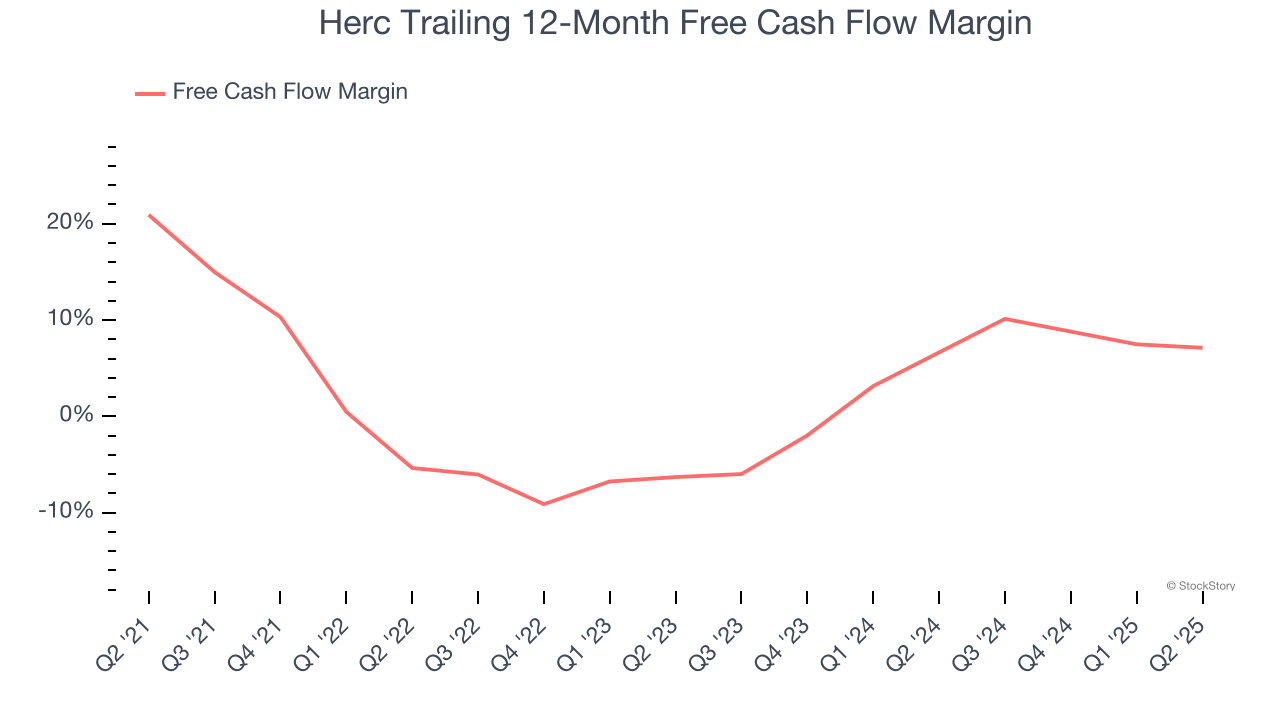

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Herc’s margin dropped by 13.8 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Herc’s free cash flow margin for the trailing 12 months was 7.1%.

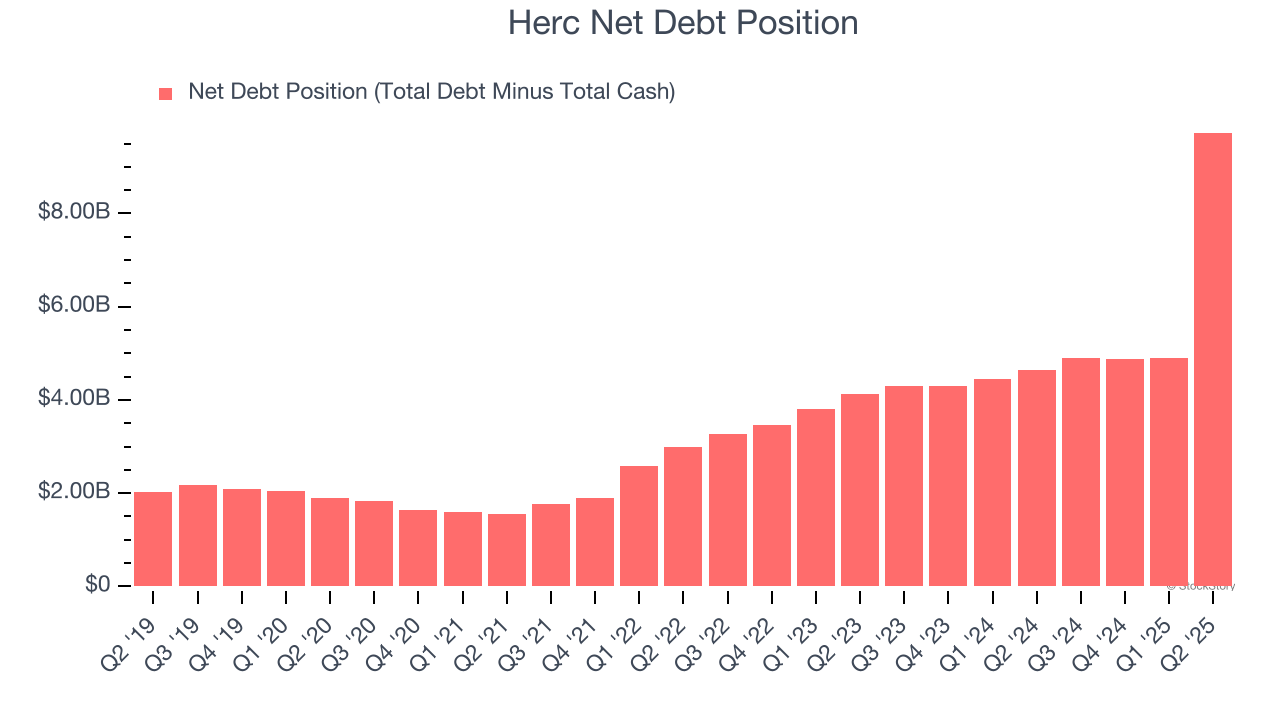

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Herc’s $9.79 billion of debt exceeds the $53 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $1.63 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Herc could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Herc can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Herc’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 10.4× forward P/E (or $127.93 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Herc

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.