Looking back on personal care stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Herbalife (NYSE: HLF) and its peers.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 12 personal care stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was 6% below.

Luckily, personal care stocks have performed well with share prices up 24.4% on average since the latest earnings results.

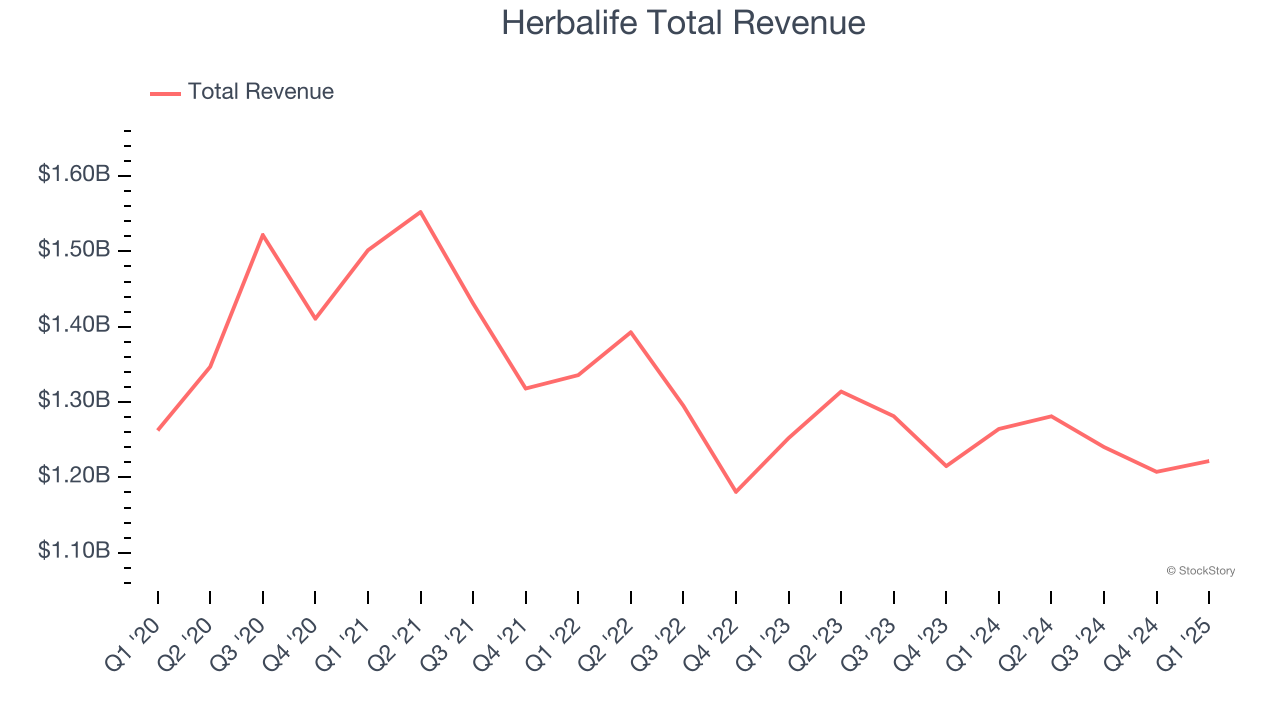

Herbalife (NYSE: HLF)

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE: HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

Herbalife reported revenues of $1.22 billion, down 3.4% year on year. This print fell short of analysts’ expectations by 0.5%, but it was still a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates.

“As I transition into the role of CEO, I am committed to honoring Herbalife’s 45-year legacy of empowering our communities through health, wellness and a strong entrepreneurial opportunity," said Stephan Gratziani.

Interestingly, the stock is up 50.6% since reporting and currently trades at $10.81.

Is now the time to buy Herbalife? Access our full analysis of the earnings results here, it’s free.

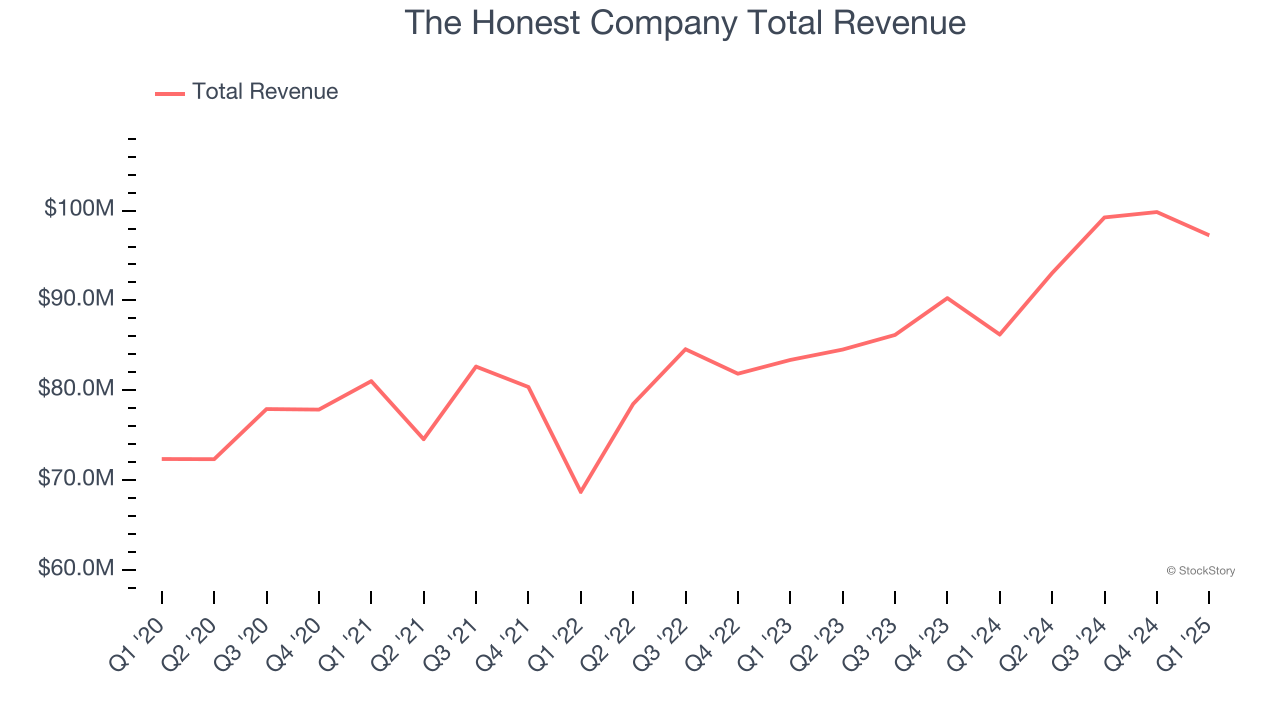

Best Q1: The Honest Company (NASDAQ: HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ: HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $97.25 million, up 12.8% year on year, outperforming analysts’ expectations by 5.7%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The Honest Company scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.1% since reporting. It currently trades at $4.84.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Edgewell Personal Care (NYSE: EPC)

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE: EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Edgewell Personal Care reported revenues of $580.7 million, down 3.1% year on year, falling short of analysts’ expectations by 1.8%. It was a slower quarter as it posted a miss of analysts’ organic revenue estimates and full-year EBITDA guidance missing analysts’ expectations.

Edgewell Personal Care delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10% since the results and currently trades at $27.02.

Read our full analysis of Edgewell Personal Care’s results here.

Nature's Sunshine (NASDAQ: NATR)

Started on a kitchen table in Utah, Nature’s Sunshine (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

Nature's Sunshine reported revenues of $113.2 million, up 2% year on year. This print surpassed analysts’ expectations by 3.6%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Nature's Sunshine had the weakest full-year guidance update among its peers. The stock is up 20.2% since reporting and currently trades at $14.98.

Read our full, actionable report on Nature's Sunshine here, it’s free.

USANA (NYSE: USNA)

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE: USNA) manufactures and sells nutritional, personal care, and skincare products.

USANA reported revenues of $235.8 million, up 10.8% year on year. This number beat analysts’ expectations by 4.7%. It was an exceptional quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

USANA achieved the highest full-year guidance raise among its peers. The stock is up 12.4% since reporting and currently trades at $35.43.

Read our full, actionable report on USANA here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.