Since December 2024, Lincoln Financial Group has been in a holding pattern, posting a small return of 3.2% while floating around $33.15.

Is there a buying opportunity in Lincoln Financial Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Lincoln Financial Group Will Underperform?

We're sitting this one out for now. Here are three reasons why we avoid LNC and a stock we'd rather own.

1. Net Premiums Earned Hits a Plateau

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Lincoln Financial Group’s net premiums earned was flat over the last four years, much worse than the broader insurance industry.

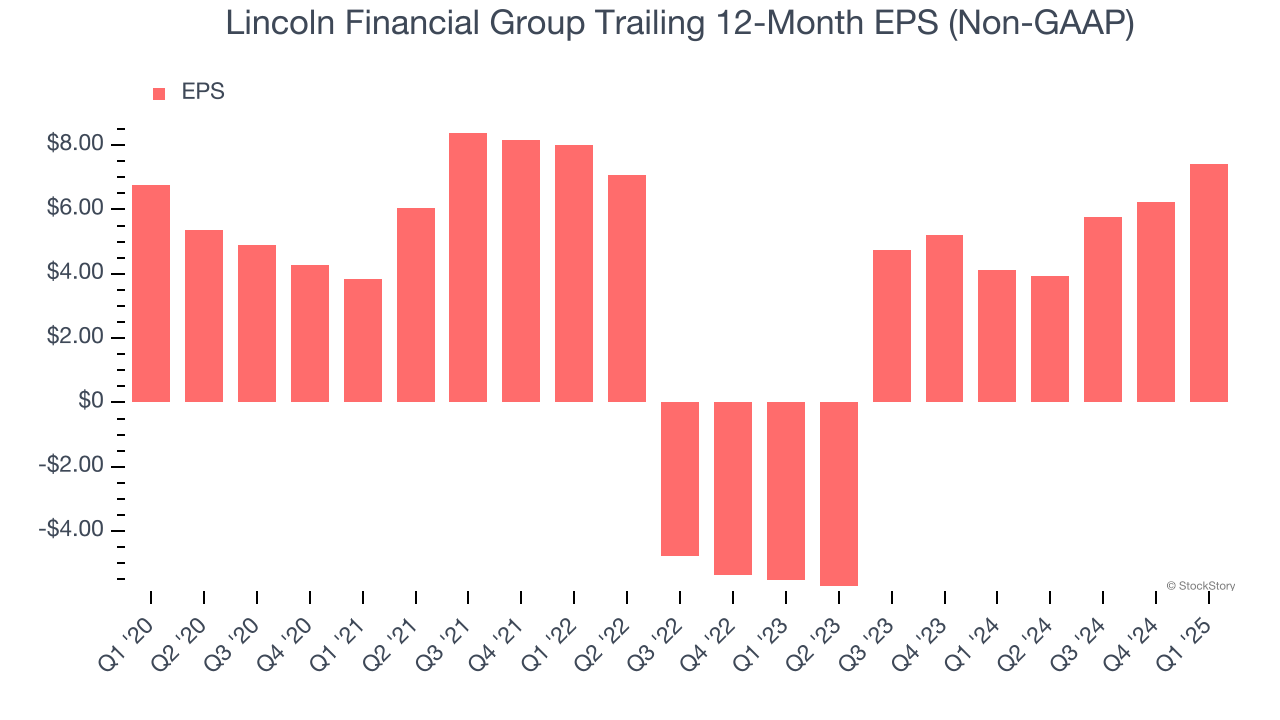

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Lincoln Financial Group’s weak 1.9% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

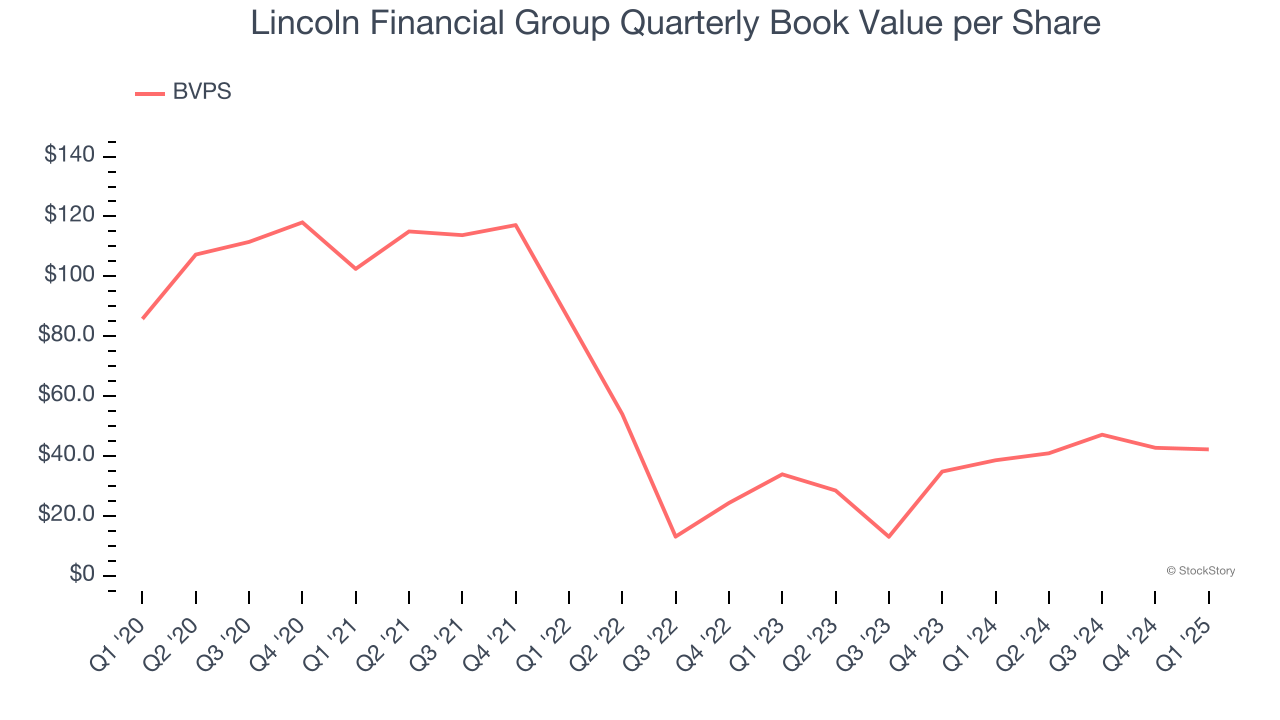

3. Substandard BVPS Growth Indicates Limited Asset Expansion

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Disappointingly for investors, Lincoln Financial Group’s BVPS grew at a mediocre 11.6% annual clip over the last two years.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Lincoln Financial Group, we’ll be cheering from the sidelines. That said, the stock currently trades at 0.7× forward P/B (or $33.15 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.