Since December 2024, Avnet has been in a holding pattern, posting a small loss of 2.6% while floating around $52.33.

Is there a buying opportunity in Avnet, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Avnet Will Underperform?

We're sitting this one out for now. Here are three reasons why we avoid AVT and a stock we'd rather own.

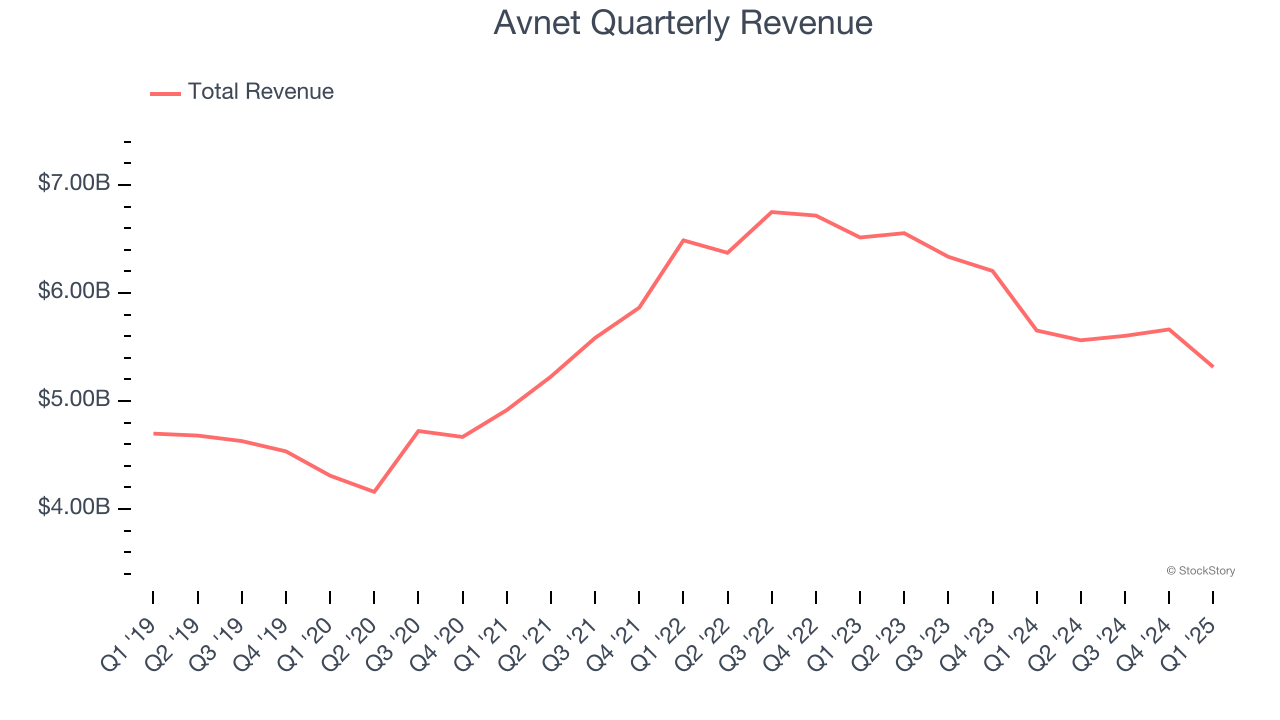

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Avnet grew its sales at a mediocre 4.1% compounded annual growth rate. This fell short of our benchmark for the business services sector.

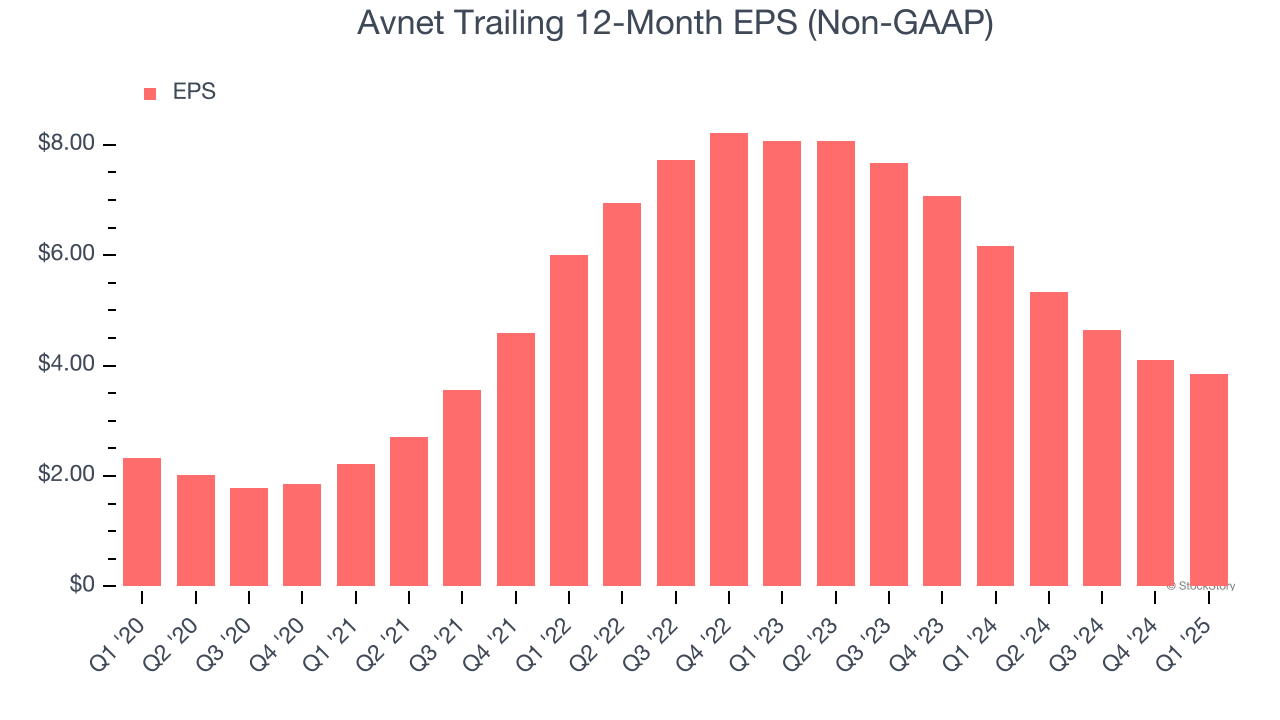

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Avnet, its EPS declined by more than its revenue over the last two years, dropping 30.9%. This tells us the company struggled to adjust to shrinking demand.

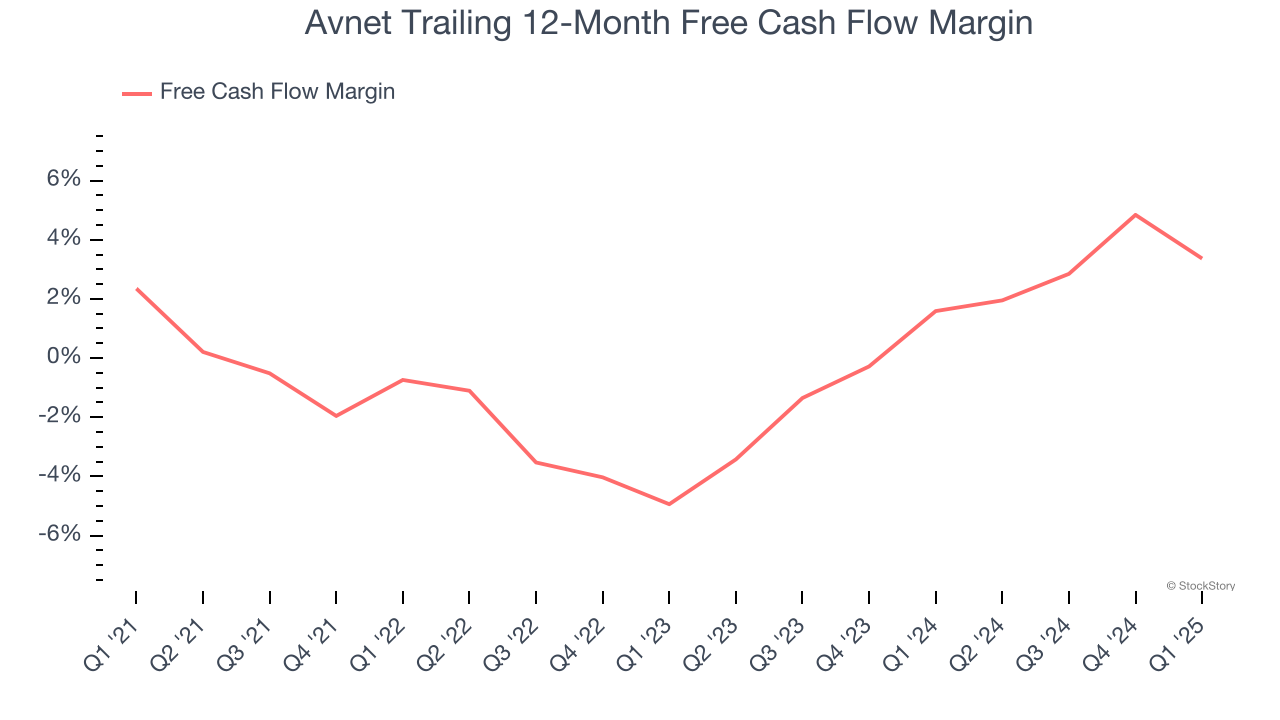

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Avnet broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

Avnet falls short of our quality standards. That said, the stock currently trades at 10.3× forward P/E (or $52.33 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.