Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Lantheus (NASDAQ: LNTH) and the best and worst performers in the medical devices & supplies - imaging, diagnostics industry.

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

The 4 medical devices & supplies - imaging, diagnostics stocks we track reported a slower Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q1: Lantheus (NASDAQ: LNTH)

Pioneering the "Find, Fight and Follow" approach to disease management, Lantheus Holdings (NASDAQGM:LNTH) develops and commercializes radiopharmaceuticals and other imaging agents that help healthcare professionals detect, diagnose, and treat diseases.

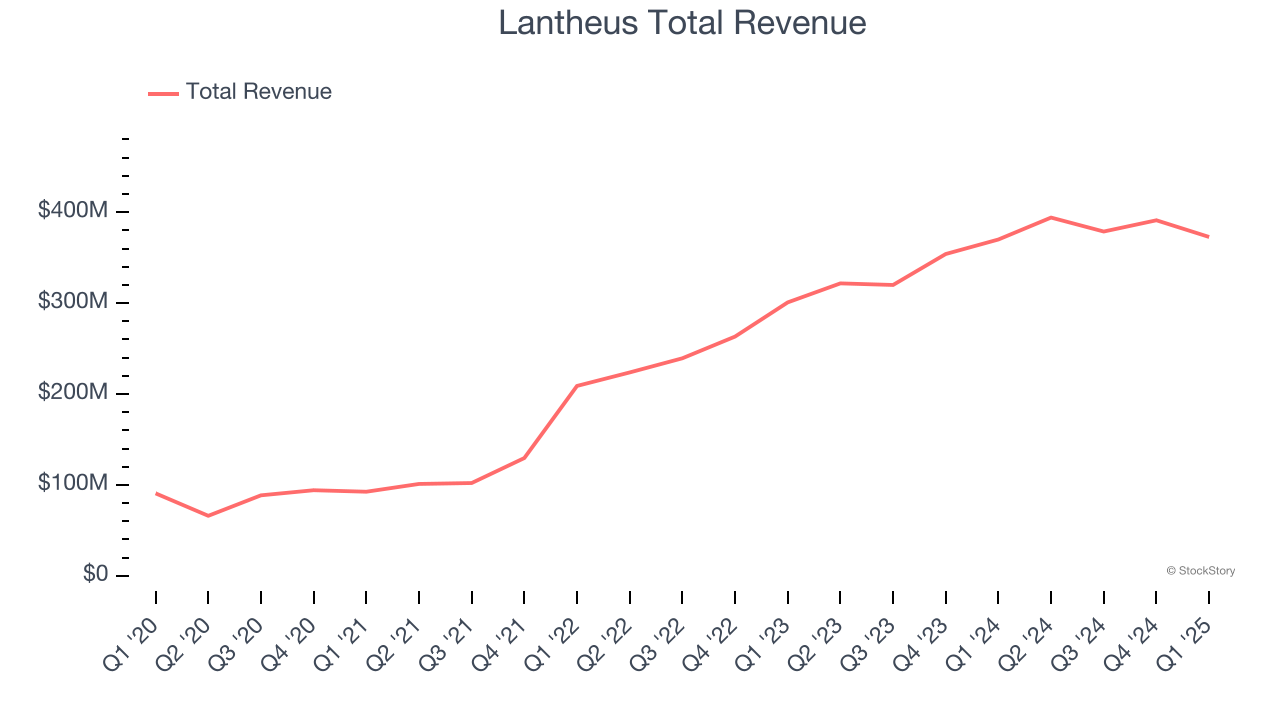

Lantheus reported revenues of $372.8 million, flat year on year. This print fell short of analysts’ expectations by 1.6%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ full-year EPS guidance estimates.

"We are laying the foundation for the next chapter of Lantheus’ business with the acquisition of Evergreen Theragnostics and planned acquisition of Life Molecular Imaging, both of which add growth drivers that complement our business and diversify our revenues. These transactions also add exciting new pipeline programs in both late- and early-stage development and key capabilities that enable Lantheus to progress novel programs from bench to clinic," said Brian Markison, Chief Executive Officer at Lantheus.

Lantheus delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 22.7% since reporting and currently trades at $81.

Is now the time to buy Lantheus? Access our full analysis of the earnings results here, it’s free.

Best Q1: GE HealthCare (NASDAQ: GEHC)

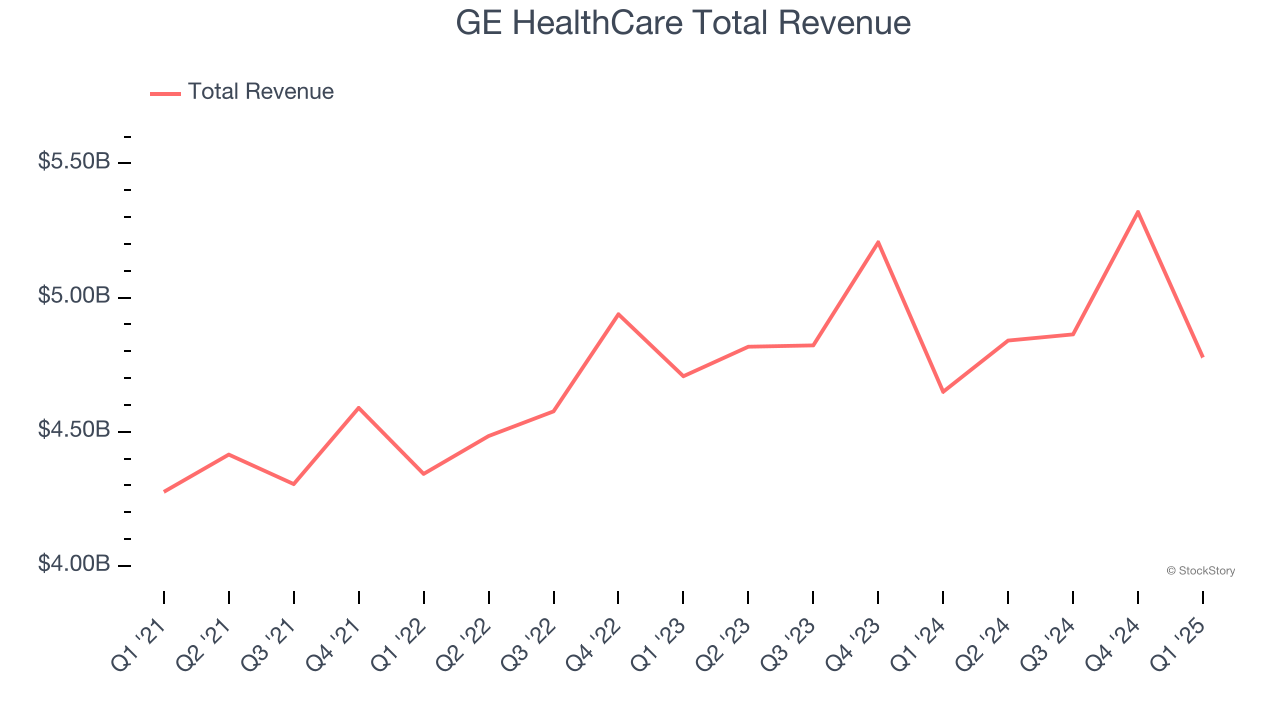

Spun off from industrial giant General Electric in 2023 after over a century as its healthcare division, GE HealthCare (NASDAQ: GEHC) provides medical imaging equipment, patient monitoring systems, diagnostic pharmaceuticals, and AI-enabled healthcare solutions to hospitals and clinics worldwide.

GE HealthCare reported revenues of $4.78 billion, up 2.8% year on year, outperforming analysts’ expectations by 2.5%. The business had a satisfactory quarter with a solid beat of analysts’ organic revenue estimates.

GE HealthCare scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 2.4% since reporting. It currently trades at $69.75.

Is now the time to buy GE HealthCare? Access our full analysis of the earnings results here, it’s free.

Hologic (NASDAQ: HOLX)

As a pioneer in 3D mammography technology that has revolutionized breast cancer detection, Hologic (NASDAQ: HOLX) develops and manufactures diagnostic products, medical imaging systems, and surgical devices focused primarily on women's health and wellness.

Hologic reported revenues of $1.01 billion, down 1.2% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a slight miss of analysts’ full-year EPS expectations.

Interestingly, the stock is up 11.4% since the results and currently trades at $63.76.

Read our full analysis of Hologic’s results here.

QuidelOrtho (NASDAQ: QDEL)

Born from the 2022 merger of Quidel and Ortho Clinical Diagnostics, QuidelOrtho (NASDAQ: QDEL) develops and manufactures diagnostic testing solutions for healthcare providers, from rapid point-of-care tests to complex laboratory instruments and systems.

QuidelOrtho reported revenues of $692.8 million, down 2.6% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also logged an impressive beat of analysts’ EPS estimates but a slight miss of analysts’ full-year EPS guidance estimates.

QuidelOrtho scored the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is up 9.1% since reporting and currently trades at $28.16.

Read our full, actionable report on QuidelOrtho here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.