The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Light & Wonder (NASDAQ: LNW) and the rest of the gaming solutions stocks fared in Q1.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 2.4%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q1: Light & Wonder (NASDAQ: LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

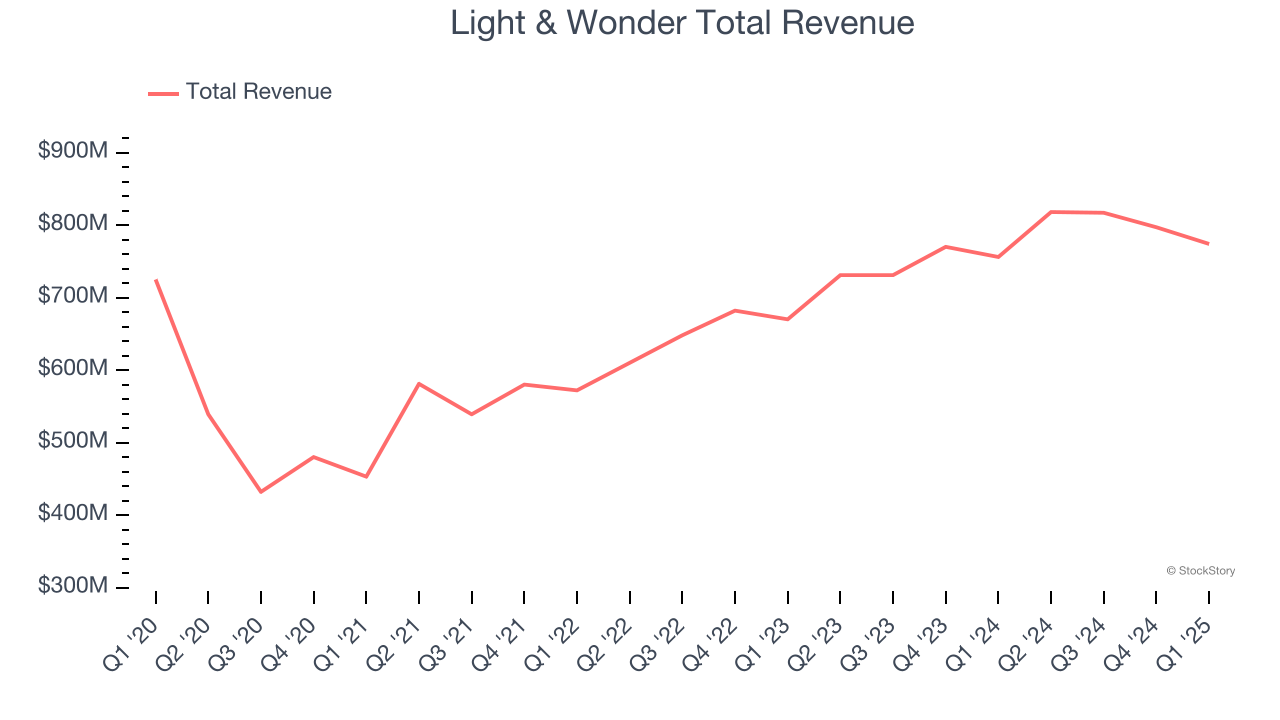

Light & Wonder reported revenues of $774 million, up 2.4% year on year. This print fell short of analysts’ expectations by 4.3%. Overall, it was a softer quarter for the company with a miss of analysts’ Gaming revenue estimates and a significant miss of analysts’ EPS estimates.

Matt Wilson, President and Chief Executive Officer of Light & Wonder, said, “Our R&D investment, vast array of product offerings and comprehensive content strategy continue to deliver success in game deployment and franchise expansions. We continue to see our omni-channel strategy prosper with enhanced game development and performance fueling our existing businesses, and further opportunity to extend this strategy with the pending Grover Charitable Gaming Acquisition. We remain confident in the various avenues of growth that we see for 2025 with continued execution on our robust product roadmap driving performance across the business. We are committed to executing off the strong foundation of world class talent and game portfolio that we have built for long-term success.”

The stock is down 6.1% since reporting and currently trades at $87.93.

Read our full report on Light & Wonder here, it’s free.

Best Q1: Rush Street Interactive (NYSE: RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE: RSI) is an operator of digital gaming platforms.

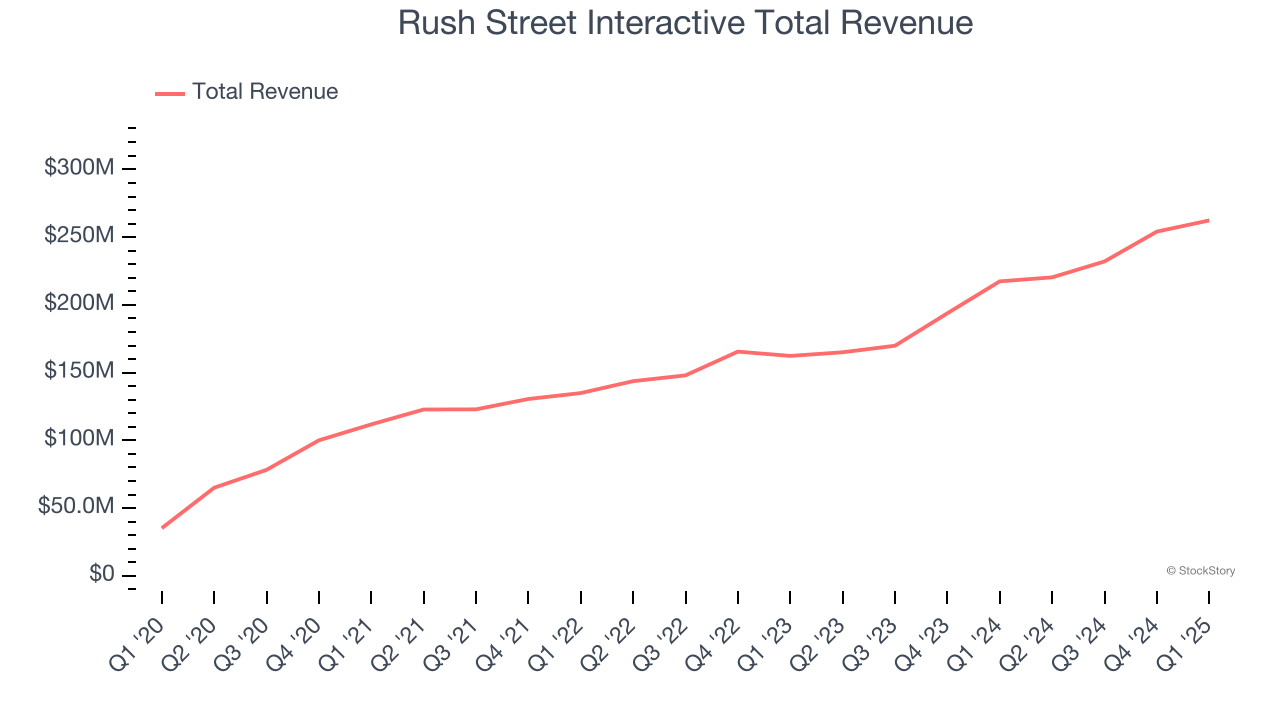

Rush Street Interactive reported revenues of $262.4 million, up 20.7% year on year, outperforming analysts’ expectations by 0.5%. The business had a strong quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Rush Street Interactive scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 4.7% since reporting. It currently trades at $12.69.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free.

Inspired (NASDAQ: INSE)

Specializing in digital casino gaming, Inspired (NASDAQ: INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $60.4 million, down 3% year on year, falling short of analysts’ expectations by 10%. It was a slower quarter as it posted a miss of analysts’ Leisure revenue and adjusted operating income estimates.

Inspired delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 5.2% since the results and currently trades at $7.82.

Read our full analysis of Inspired’s results here.

DraftKings (NASDAQ: DKNG)

Getting its start in daily fantasy sports, DraftKings (NASDAQ: DKNG) is a digital sports entertainment and gaming company.

DraftKings reported revenues of $1.41 billion, up 19.9% year on year. This result missed analysts’ expectations by 3.1%. Overall, it was a slower quarter as it also recorded full-year EBITDA guidance missing analysts’ expectations.

DraftKings had the weakest full-year guidance update among its peers. The company reported 4.3 million users, up 26.5% year on year. The stock is up 1.2% since reporting and currently trades at $35.84.

Read our full, actionable report on DraftKings here, it’s free.

Churchill Downs (NASDAQ: CHDN)

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ: CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Churchill Downs reported revenues of $642.6 million, up 8.7% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 9.6% since reporting and currently trades at $95.08.

Read our full, actionable report on Churchill Downs here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.