What a brutal six months it’s been for Skyworks Solutions. The stock has dropped 22.1% and now trades at $68.92, rattling many shareholders. This might have investors contemplating their next move.

Is there a buying opportunity in Skyworks Solutions, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Skyworks Solutions Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than SWKS and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

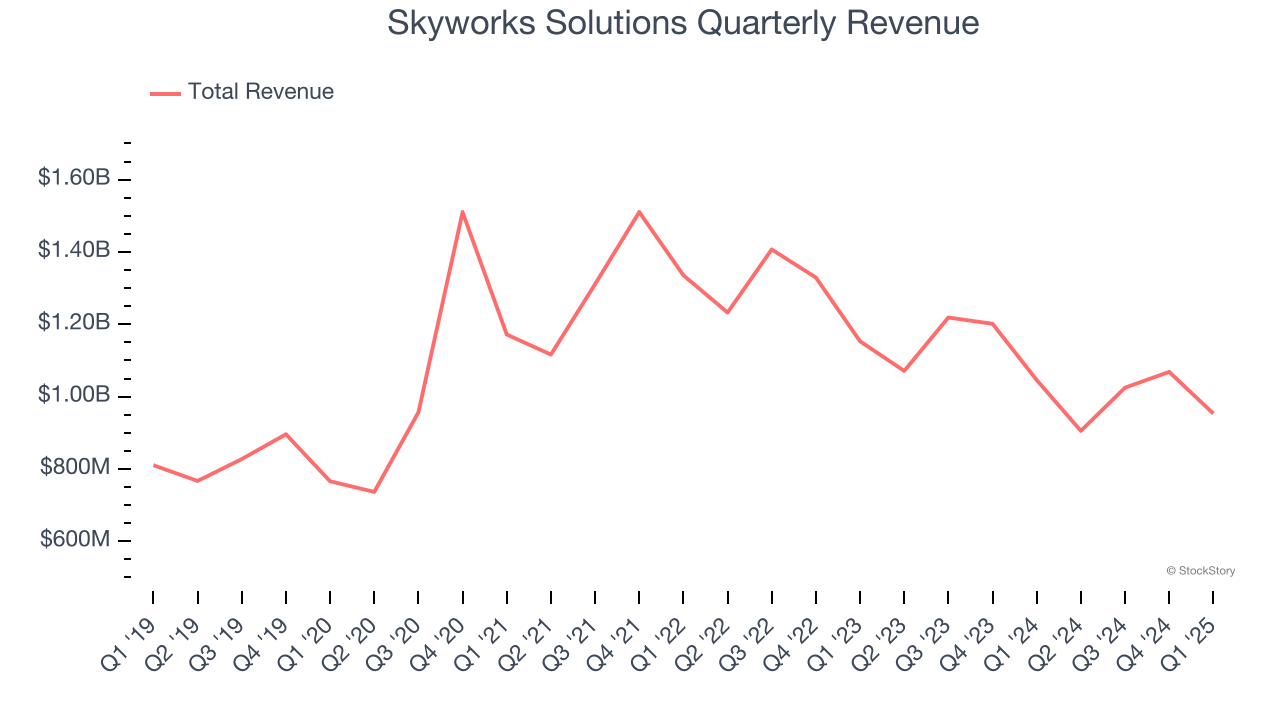

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Skyworks Solutions grew its sales at a sluggish 3.9% compounded annual growth rate. This was below our standard for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Skyworks Solutions’s revenue to drop by 8.5%. While this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

3. Shrinking Operating Margin

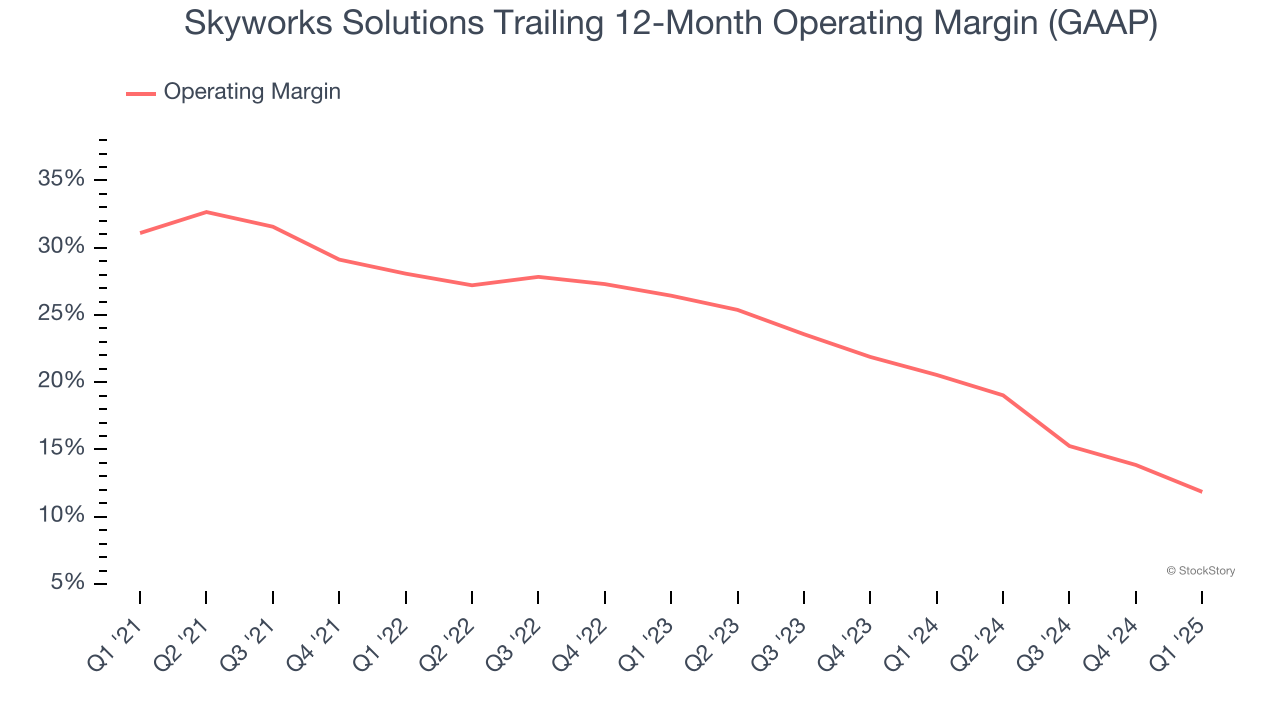

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, Skyworks Solutions’s operating margin decreased by 19.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 11.8%.

Final Judgment

We see the value of companies furthering technological innovation, but in the case of Skyworks Solutions, we’re out. Following the recent decline, the stock trades at 17.5× forward P/E (or $68.92 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Skyworks Solutions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.