Since December 2024, Orion has been in a holding pattern, posting a small loss of 4.6% while floating around $8.24.

Is there a buying opportunity in Orion, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Orion Will Underperform?

We're sitting this one out for now. Here are three reasons why ORN doesn't excite us and a stock we'd rather own.

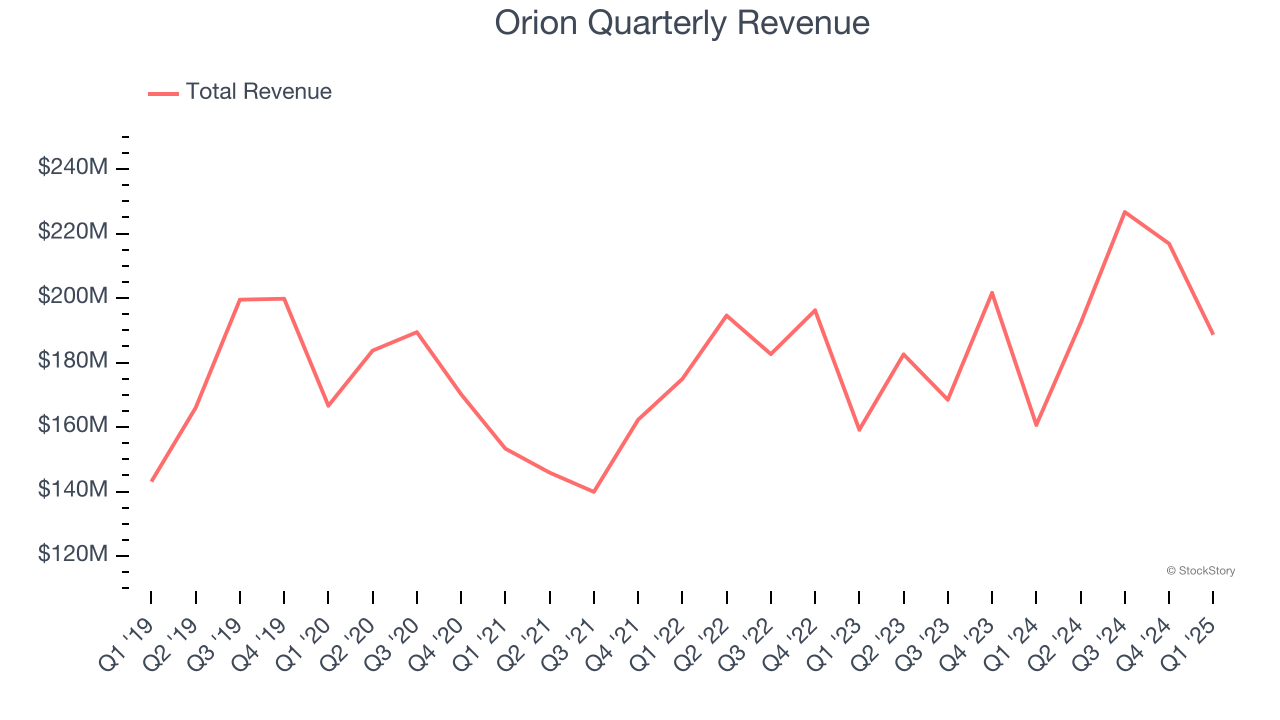

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Orion’s sales grew at a sluggish 2.4% compounded annual growth rate over the last five years. This fell short of our benchmarks.

2. EPS Trending Down

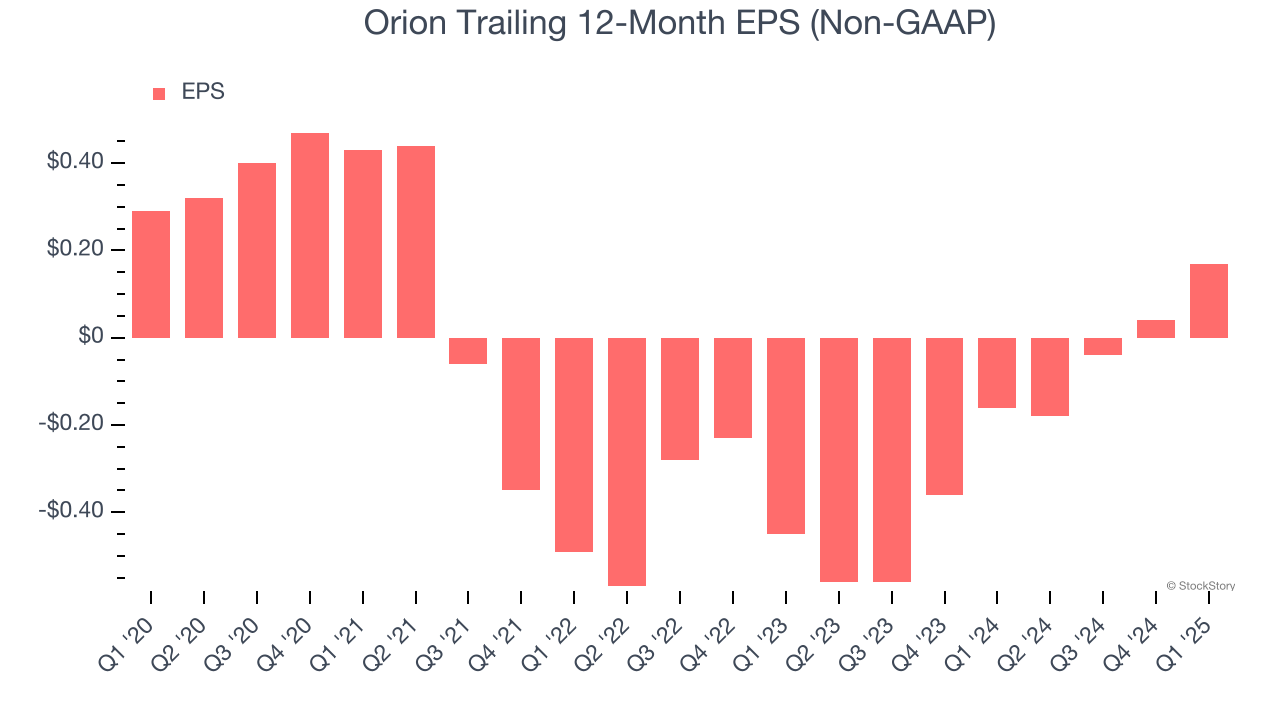

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Orion, its EPS declined by 10.1% annually over the last five years while its revenue grew by 2.4%. This tells us the company became less profitable on a per-share basis as it expanded.

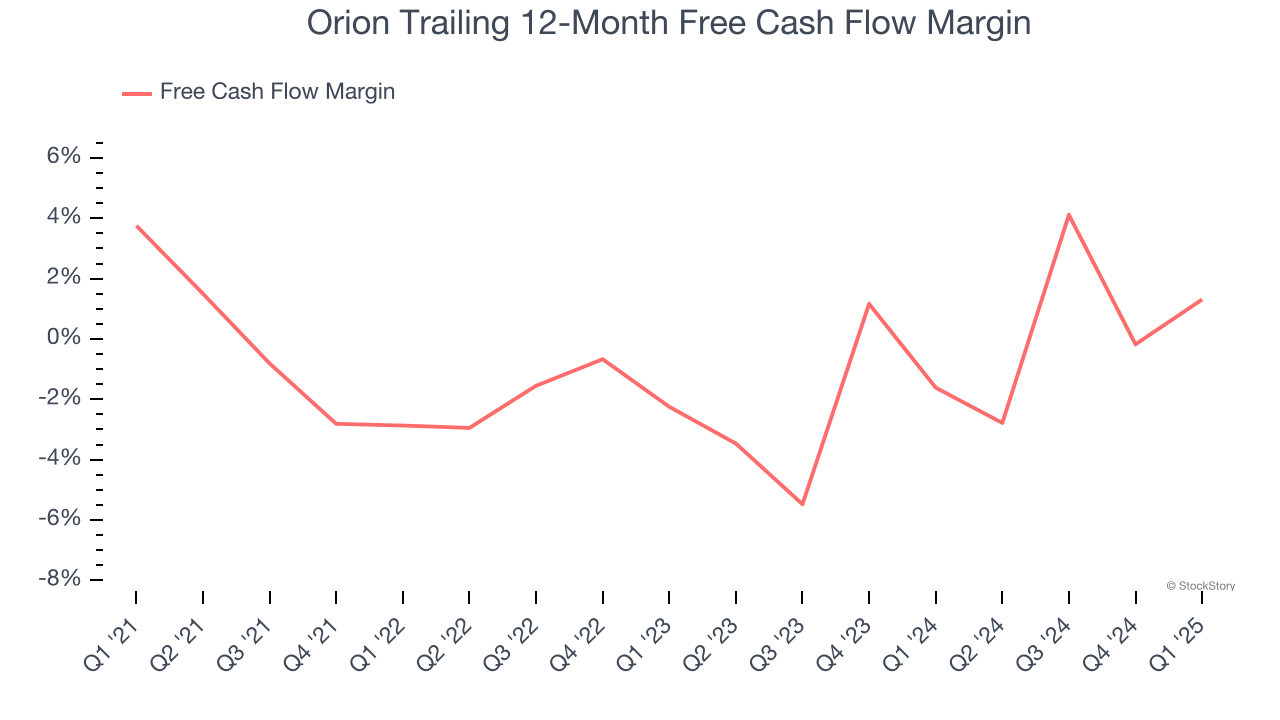

3. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Orion broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Orion, we’ll be cheering from the sidelines. That said, the stock currently trades at 50.6× forward P/E (or $8.24 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of Orion

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.