Molina Healthcare has been treading water for the past six months, recording a small loss of 0.6% while holding steady at $300.

Given the underwhelming price action, is now a good time to buy MOH? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does MOH Stock Spark Debate?

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE: MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Two Positive Attributes:

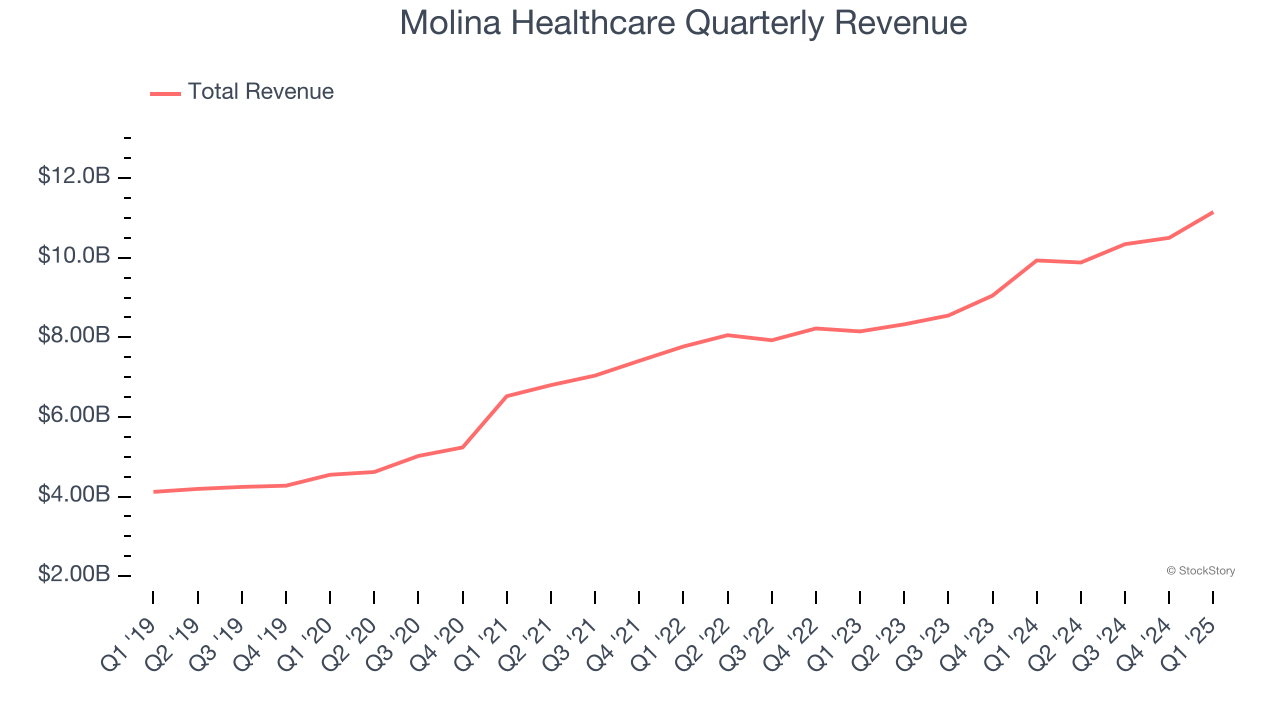

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Molina Healthcare’s sales grew at an impressive 19.4% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

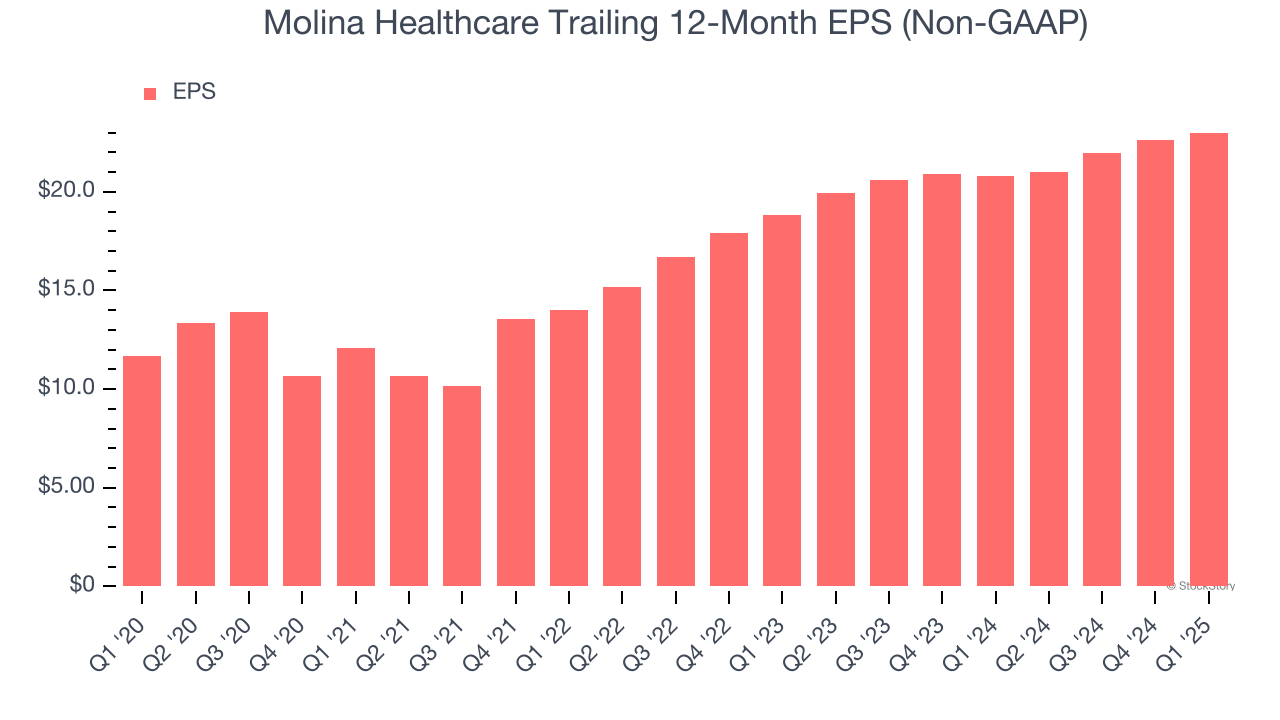

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Molina Healthcare’s EPS grew at a spectacular 14.6% compounded annual growth rate over the last five years. This performance was better than most healthcare businesses.

One Reason to be Careful:

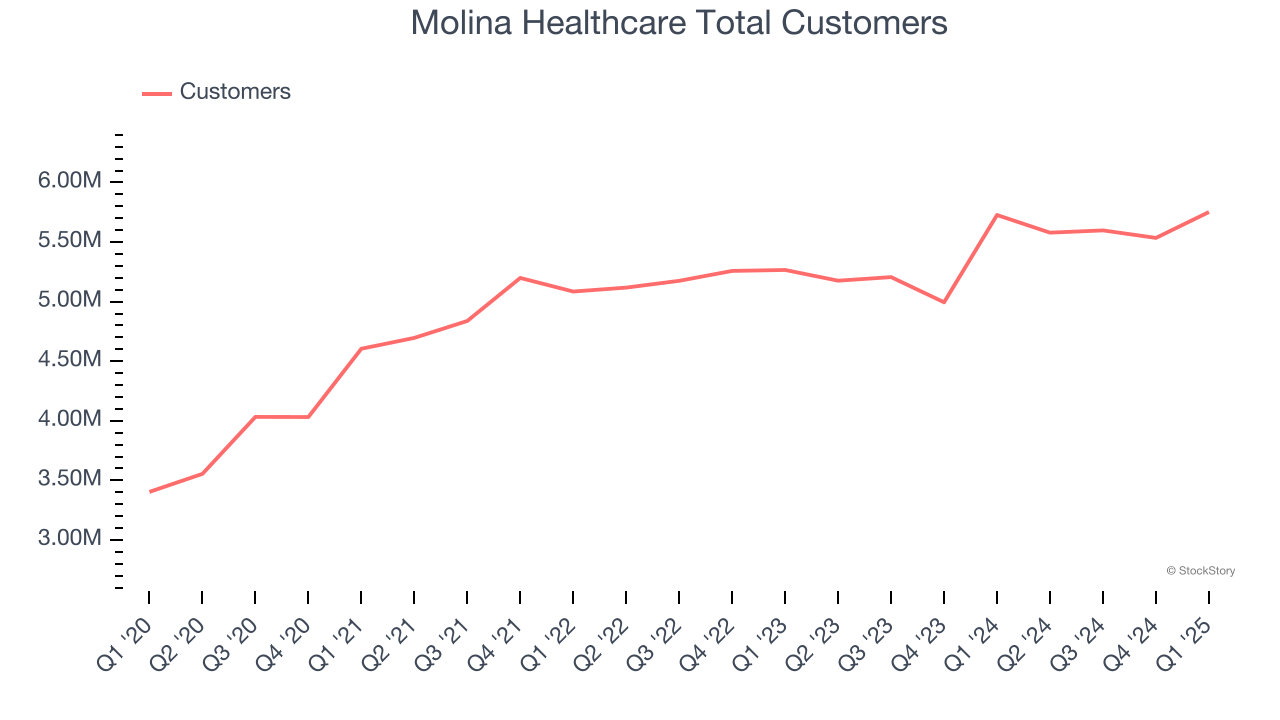

Weak Customer Growth Points to Soft Demand

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

Molina Healthcare’s total customers came in at 5.75 million in the latest quarter, and over the last two years, their count averaged 4% year-on-year growth. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in landing new contracts.

Final Judgment

Molina Healthcare has huge potential even though it has some open questions, but at $300 per share (or 11.9× forward P/E), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Molina Healthcare

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.