Data storage company NetApp (NASDAQ: NTAP) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 3.8% year on year to $1.73 billion. On the other hand, next quarter’s revenue guidance of $1.53 billion was less impressive, coming in 4.5% below analysts’ estimates. Its non-GAAP profit of $1.93 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy NetApp? Find out by accessing our full research report, it’s free.

NetApp (NTAP) Q1 CY2025 Highlights:

- Revenue: $1.73 billion vs analyst estimates of $1.72 billion (3.8% year-on-year growth, 0.7% beat)

- Adjusted EPS: $1.93 vs analyst estimates of $1.90 (1.8% beat)

- Adjusted EBITDA: $496 million vs analyst estimates of $542.5 million (28.6% margin, 8.6% miss)

- Revenue Guidance for Q2 CY2025 is $1.53 billion at the midpoint, below analyst estimates of $1.60 billion

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.75 at the midpoint, beating analyst estimates by 0.6%

- Operating Margin: 20.1%, down from 21.9% in the same quarter last year

- Free Cash Flow Margin: 37%, up from 34% in the same quarter last year

- Market Capitalization: $20.27 billion

“Fiscal Year 2025 marked many revenue and profitability records, driven by significant market share gains in all-flash storage and accelerating growth in our first party and marketplace storage services. During the year, we refreshed our entire systems portfolio, sharpened the focus of our cloud services, and positioned ourselves to lead in the enterprise AI market,” said George Kurian, Chief Executive Officer.

Company Overview

Founded in 1992 as a pioneer in networked storage technology, NetApp (NASDAQ: NTAP) provides data storage and management solutions that help organizations store, protect, and optimize their data across on-premises data centers and public clouds.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $6.57 billion in revenue over the past 12 months, NetApp is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, NetApp likely needs to tweak its prices, innovate with new offerings, or enter new markets.

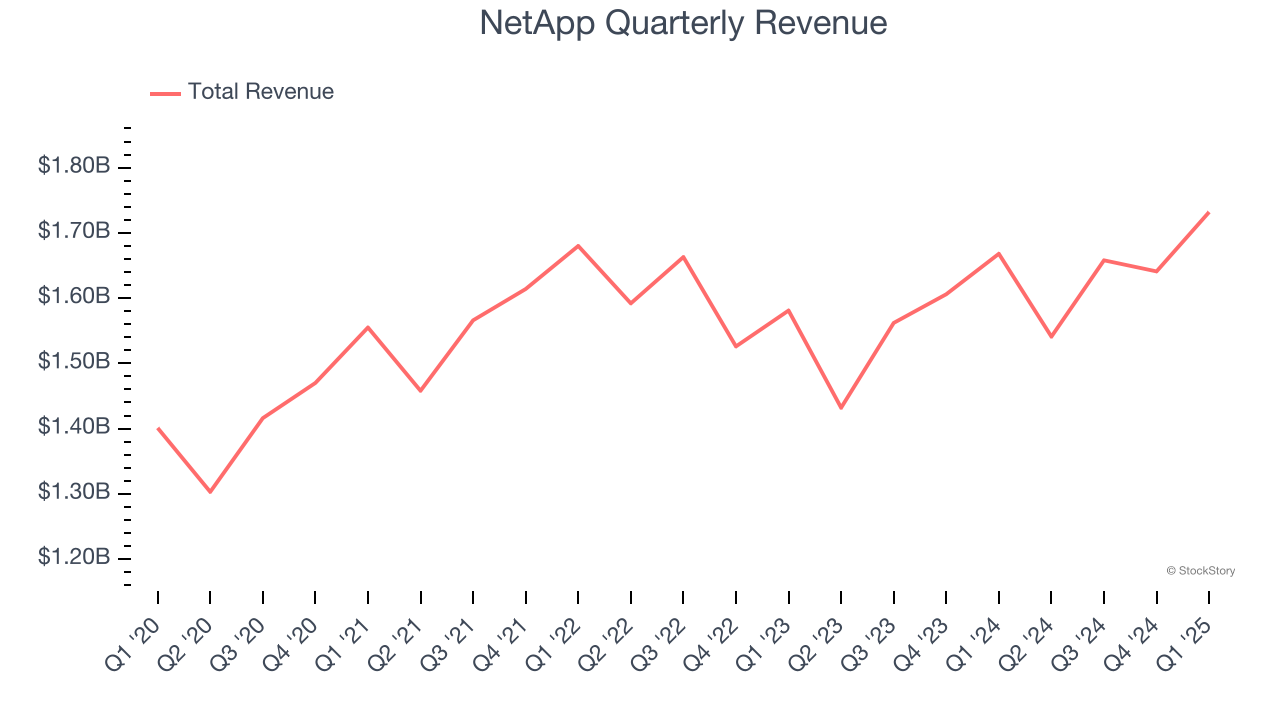

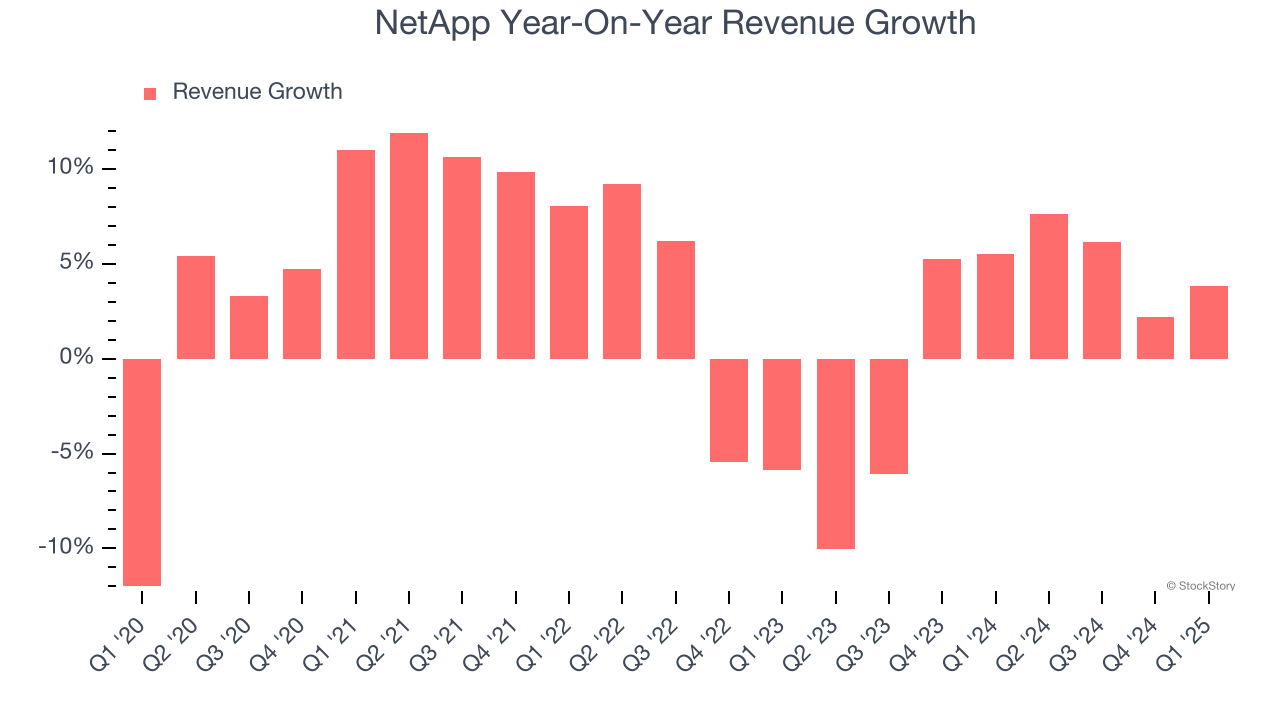

As you can see below, NetApp’s 4% annualized revenue growth over the last five years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. NetApp’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend.

This quarter, NetApp reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 0.7%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

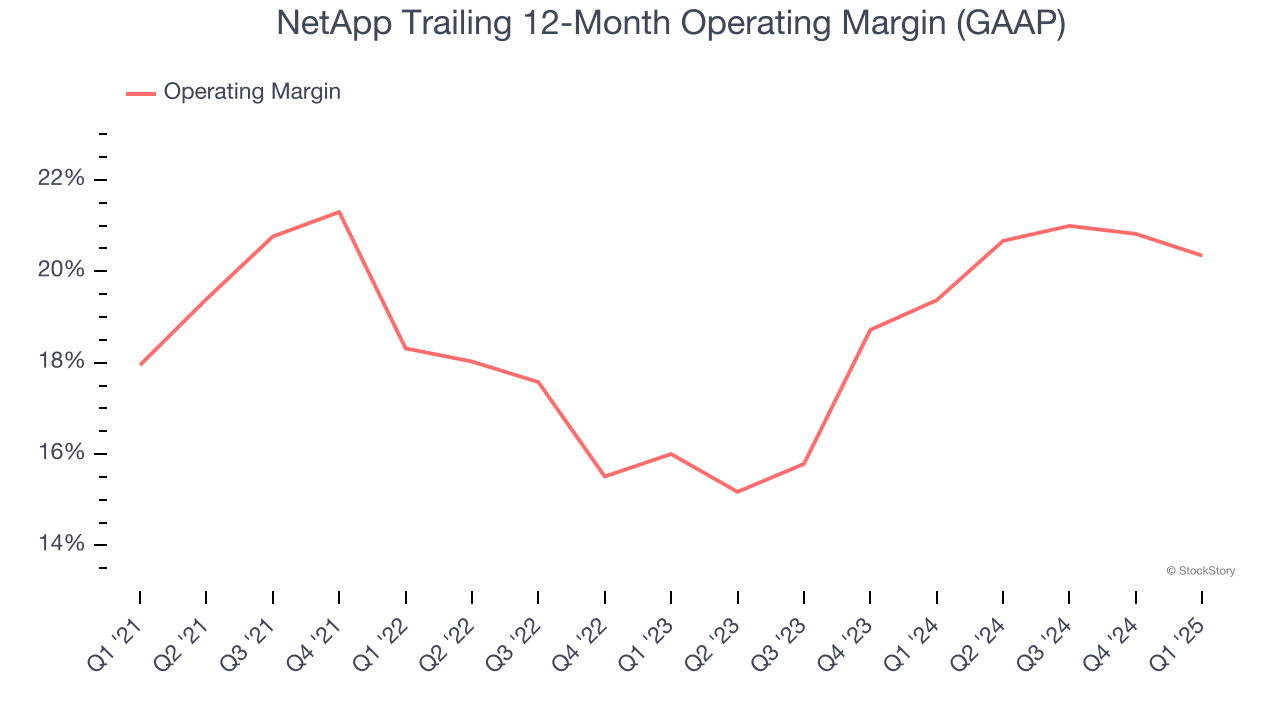

NetApp has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 18.4%.

Looking at the trend in its profitability, NetApp’s operating margin rose by 2.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, NetApp generated an operating margin profit margin of 20.1%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

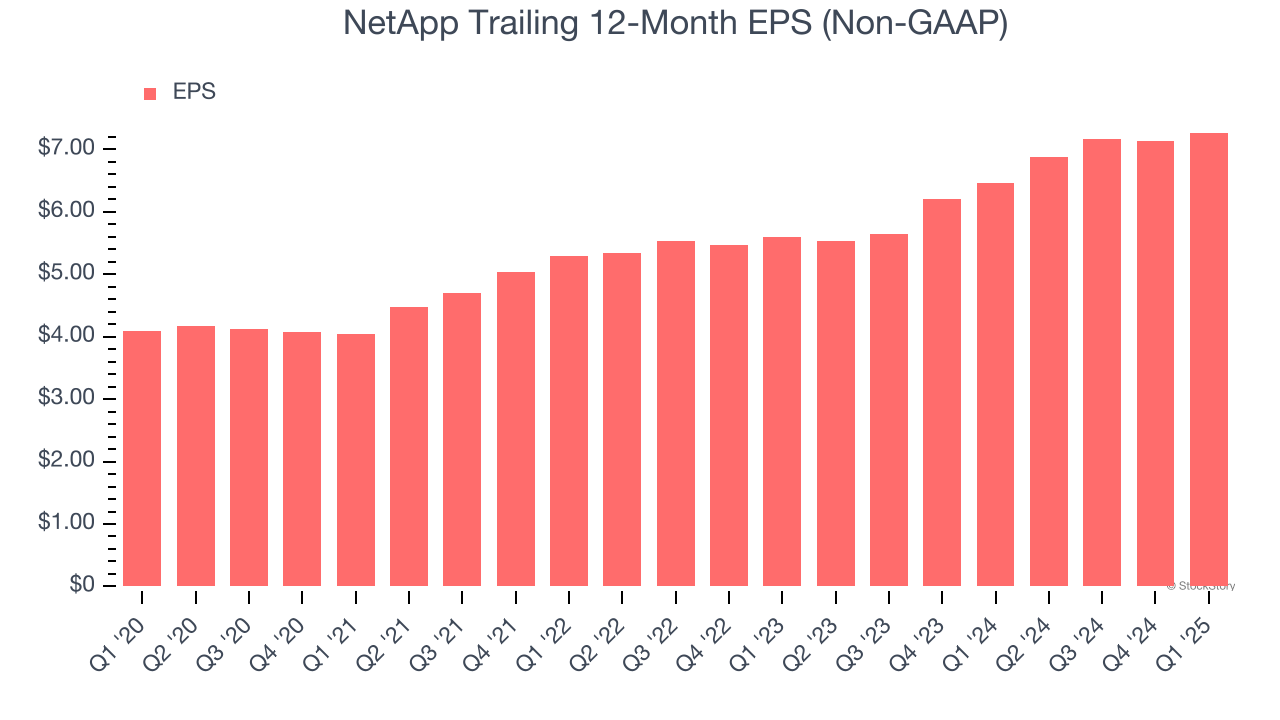

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

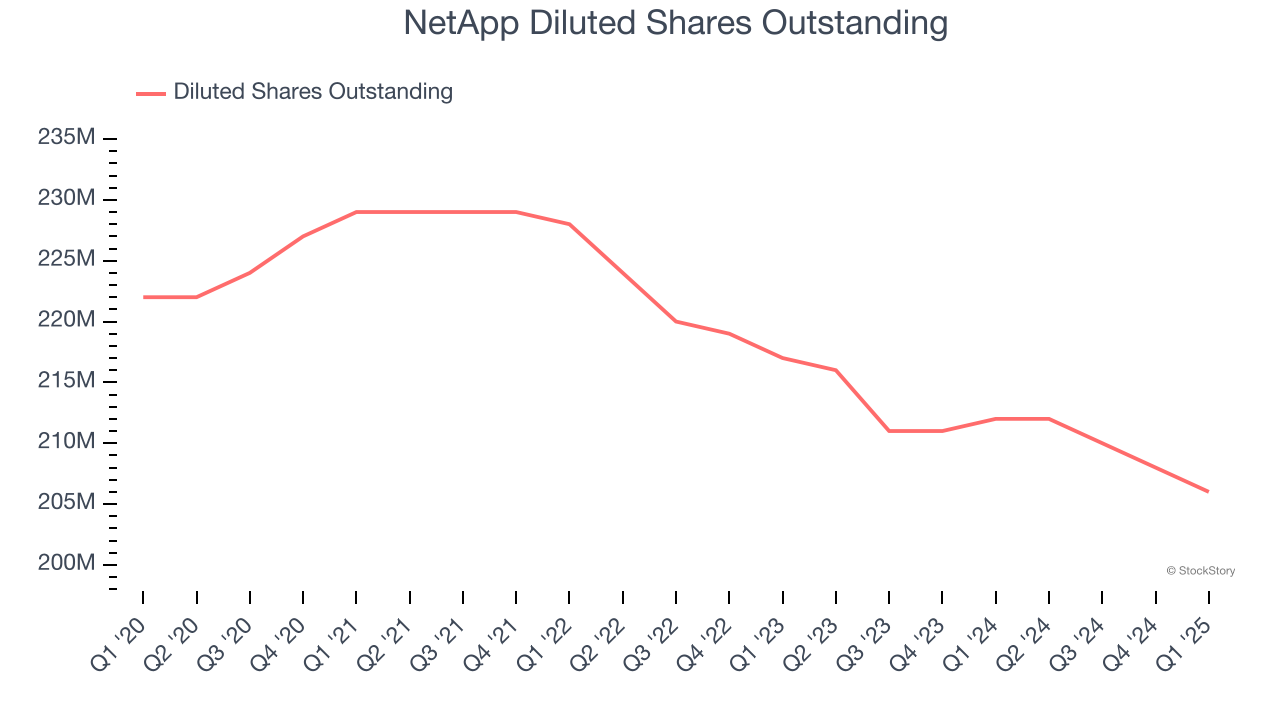

NetApp’s EPS grew at a remarkable 12.2% compounded annual growth rate over the last five years, higher than its 4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of NetApp’s earnings can give us a better understanding of its performance. As we mentioned earlier, NetApp’s operating margin declined this quarter but expanded by 2.4 percentage points over the last five years. Its share count also shrank by 7.2%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q1, NetApp reported EPS at $1.93, up from $1.80 in the same quarter last year. This print beat analysts’ estimates by 1.8%. Over the next 12 months, Wall Street expects NetApp’s full-year EPS of $7.27 to grow 5.8%.

Key Takeaways from NetApp’s Q1 Results

It was good to see NetApp narrowly top analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and revenue guidance for next quarter fell short. Overall, this was a weaker quarter. The stock traded down 5.1% to $94.25 immediately after reporting.

The latest quarter from NetApp’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.