Flex has been treading water for the past six months, recording a small loss of 1.7% while holding steady at $34.65.

Is there a buying opportunity in Flex, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We're cautious about Flex. Here are three reasons why there are better opportunities than FLEX and a stock we'd rather own.

Why Is Flex Not Exciting?

Originally known as Flextronics until its 2016 rebranding, Flex (NASDAQ: FLEX) is a global manufacturing partner that designs, engineers, and builds products for companies across industries from medical devices to solar trackers.

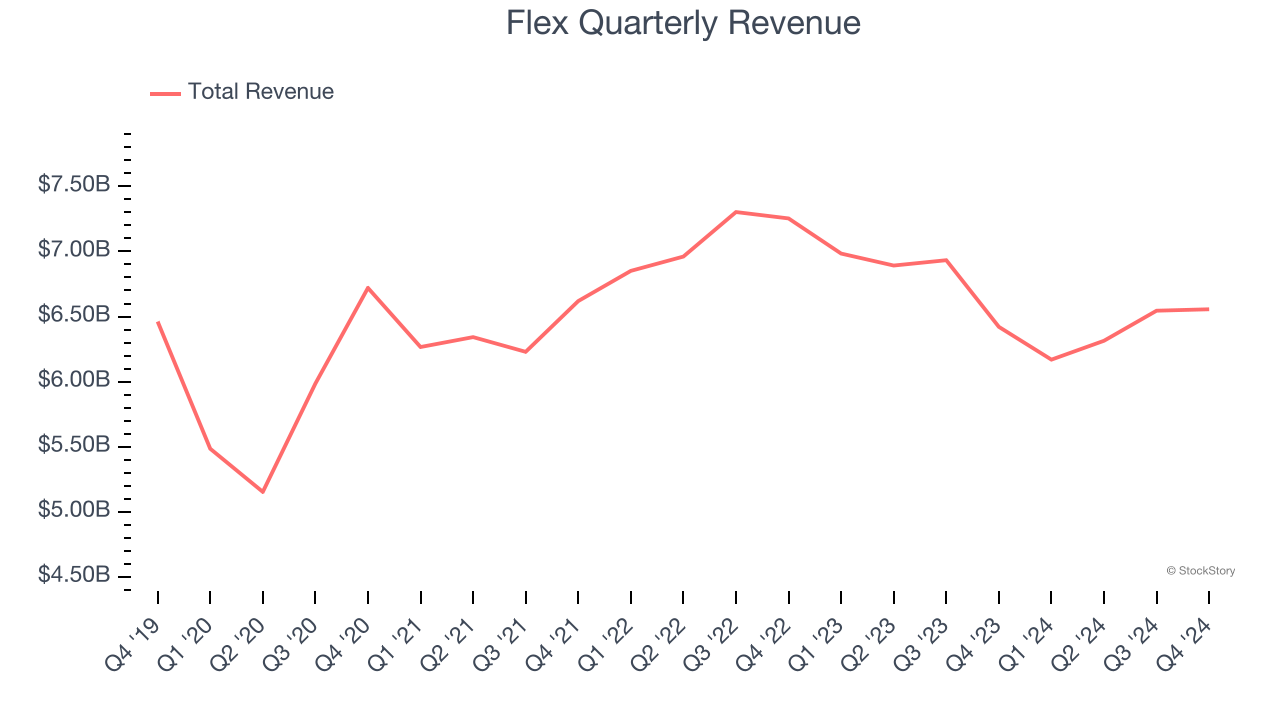

1. Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Flex struggled to consistently increase demand as its $25.58 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a lower quality business.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Flex’s revenue to rise by 1.1%. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

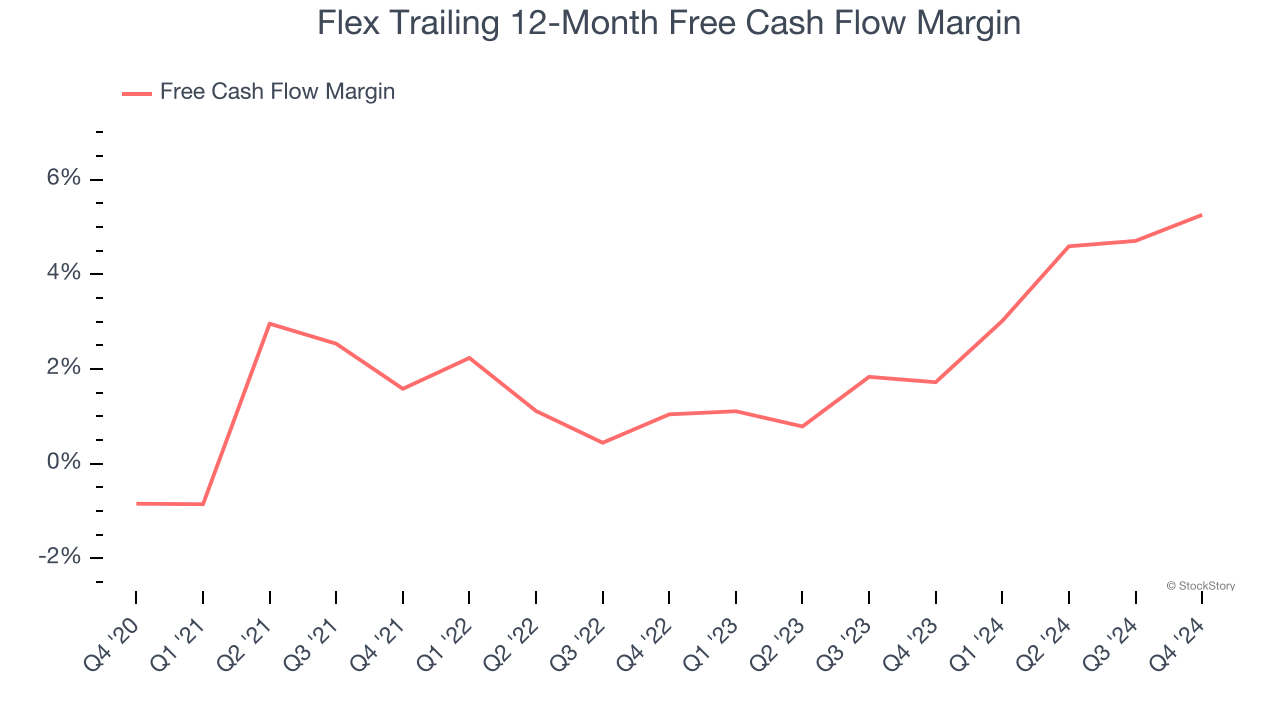

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Flex has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.8%, lousy for a business services business.

Final Judgment

Flex isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 12.8× forward price-to-earnings (or $34.65 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Flex

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.