As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the advertising & marketing services industry, including Omnicom Group (NYSE: OMC) and its peers.

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

The 5 advertising & marketing services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

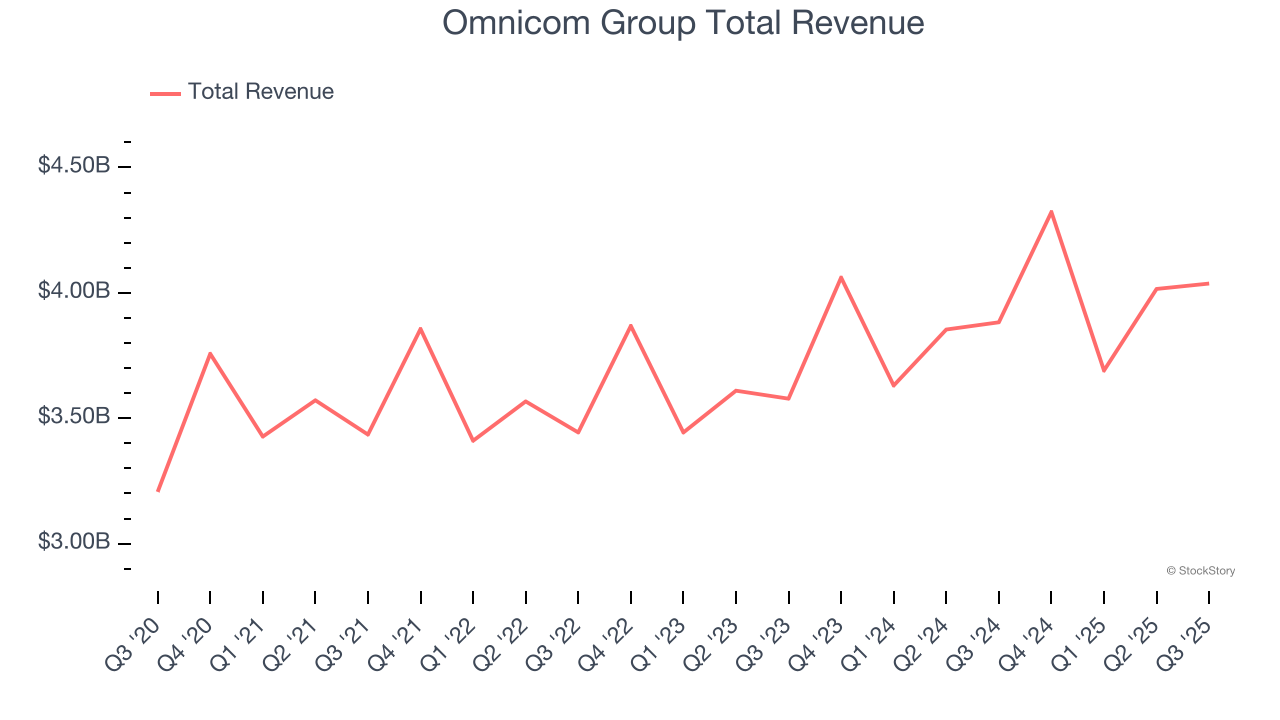

Omnicom Group (NYSE: OMC)

With a vast network of creative agencies that helped craft some of the most memorable ad campaigns in history, Omnicom Group (NYSE: OMC) is a strategic holding company that provides advertising, marketing, and communications services to many of the world's largest companies.

Omnicom Group reported revenues of $4.04 billion, up 4% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but organic revenue in line with analysts’ estimates.

"We expect to close the Interpublic acquisition next month, creating the world's leading marketing and sales company. Together, we will emerge with the industry's most talented team and a powerful platform designed to accelerate growth through strategic advantages in data, media, creativity, production, and technology," said John Wren, Chairman and Chief Executive Officer of Omnicom.

Omnicom Group delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 1.3% since reporting and currently trades at $79.70.

Is now the time to buy Omnicom Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

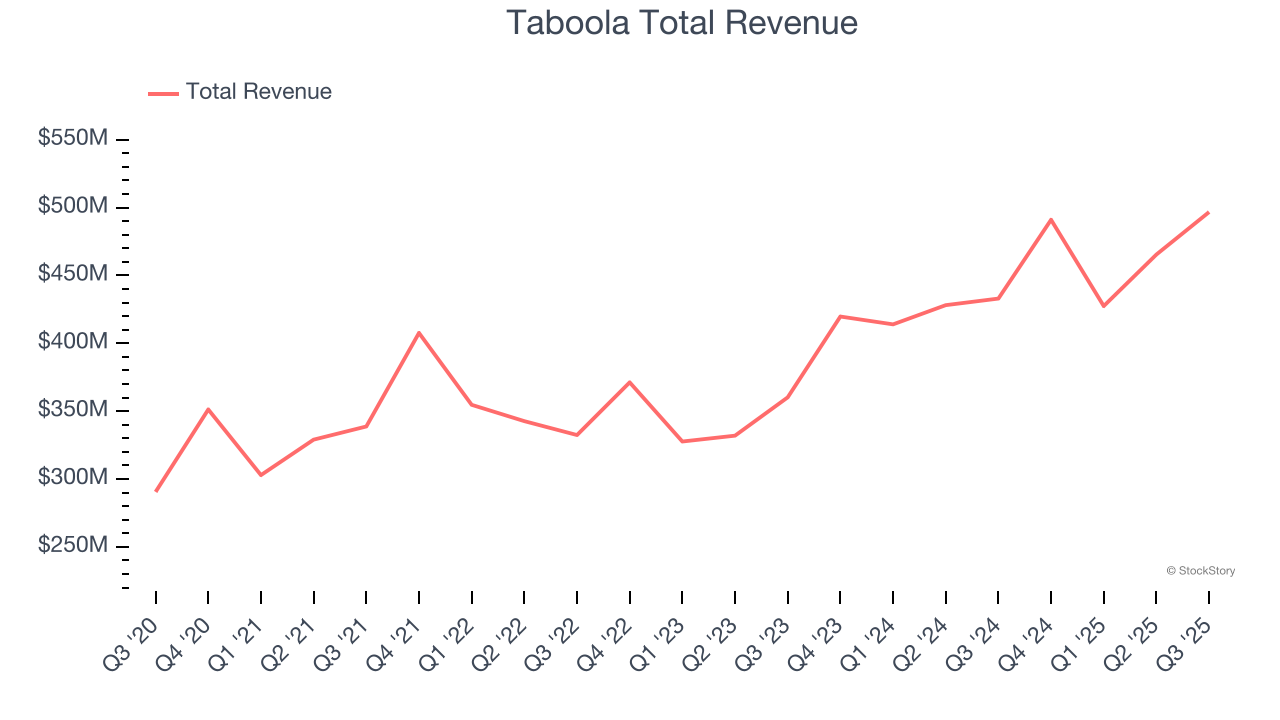

Best Q3: Taboola (NASDAQ: TBLA)

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola (NASDAQ: TBLA) operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

Taboola reported revenues of $496.8 million, up 14.7% year on year, outperforming analysts’ expectations by 6.3%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

Taboola achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 31.6% since reporting. It currently trades at $4.38.

Is now the time to buy Taboola? Access our full analysis of the earnings results here, it’s free for active Edge members.

Ibotta (NYSE: IBTA)

Originally launched as a way to make grocery shopping more rewarding for budget-conscious consumers, Ibotta (NYSE: IBTA) is a mobile shopping app that allows consumers to earn cash back on everyday purchases by completing tasks and submitting receipts.

Ibotta reported revenues of $83.26 million, down 15.6% year on year, exceeding analysts’ expectations by 1.6%. It was a satisfactory quarter as it also posted a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations.

Ibotta delivered the slowest revenue growth in the group. As expected, the stock is down 31.5% since the results and currently trades at $22.43.

Read our full analysis of Ibotta’s results here.

Magnite (NASDAQ: MGNI)

Born from the 2020 merger of Rubicon Project and Telaria, Magnite (NASDAQ: MGNI) operates the world's largest independent sell-side advertising platform that automates the buying and selling of digital advertising inventory across all channels and formats.

Magnite reported revenues of $179.5 million, up 10.8% year on year. This print surpassed analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter as it also produced a narrow beat of analysts’ revenue estimates.

The stock is down 8.9% since reporting and currently trades at $16.27.

Read our full, actionable report on Magnite here, it’s free for active Edge members.

QuinStreet (NASDAQ: QNST)

Founded during the dot-com era in 1999 and specializing in high-intent consumer traffic, QuinStreet (NASDAQ: QNST) operates digital performance marketplaces that connect clients in financial and home services with consumers actively searching for their products.

QuinStreet reported revenues of $285.9 million, up 2.4% year on year. This number beat analysts’ expectations by 2.1%. Aside from that, it was a satisfactory quarter as it also produced an impressive beat of analysts’ revenue estimates but revenue guidance for next quarter meeting analysts’ expectations.

The stock is up 5.6% since reporting and currently trades at $14.65.

Read our full, actionable report on QuinStreet here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.