Over the past six months, Natera has been a great trade, beating the S&P 500 by 24.2%. Its stock price has climbed to $235.65, representing a healthy 37.1% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy NTRA? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Natera?

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ: NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

1. Elevated Demand Drives Higher Sales Volumes

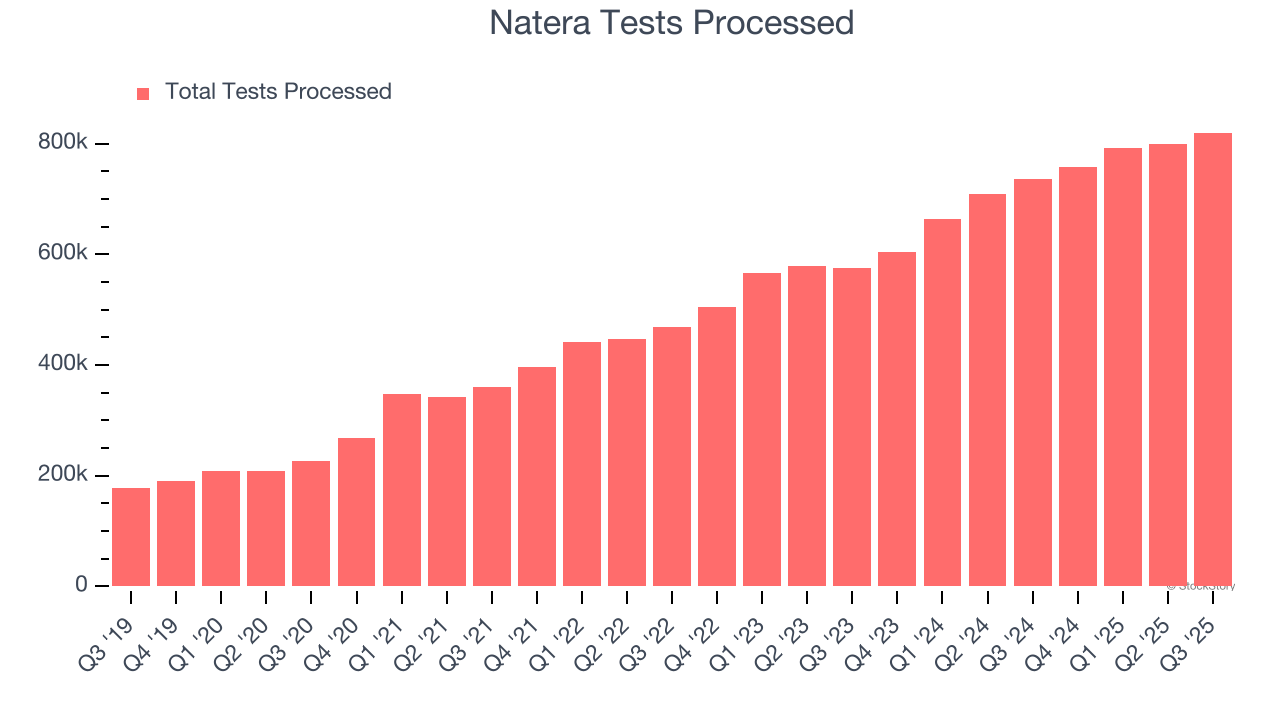

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Immuno-Oncology company because there’s a ceiling to what customers will pay.

Natera’s tests processed punched in at 819,900 in the latest quarter, and over the last two years, averaged 19.6% year-on-year growth. This performance was fantastic and shows its offerings have a unique value proposition (and perhaps some degree of customer loyalty).

2. Adjusted Operating Margin Rising, Profits Up

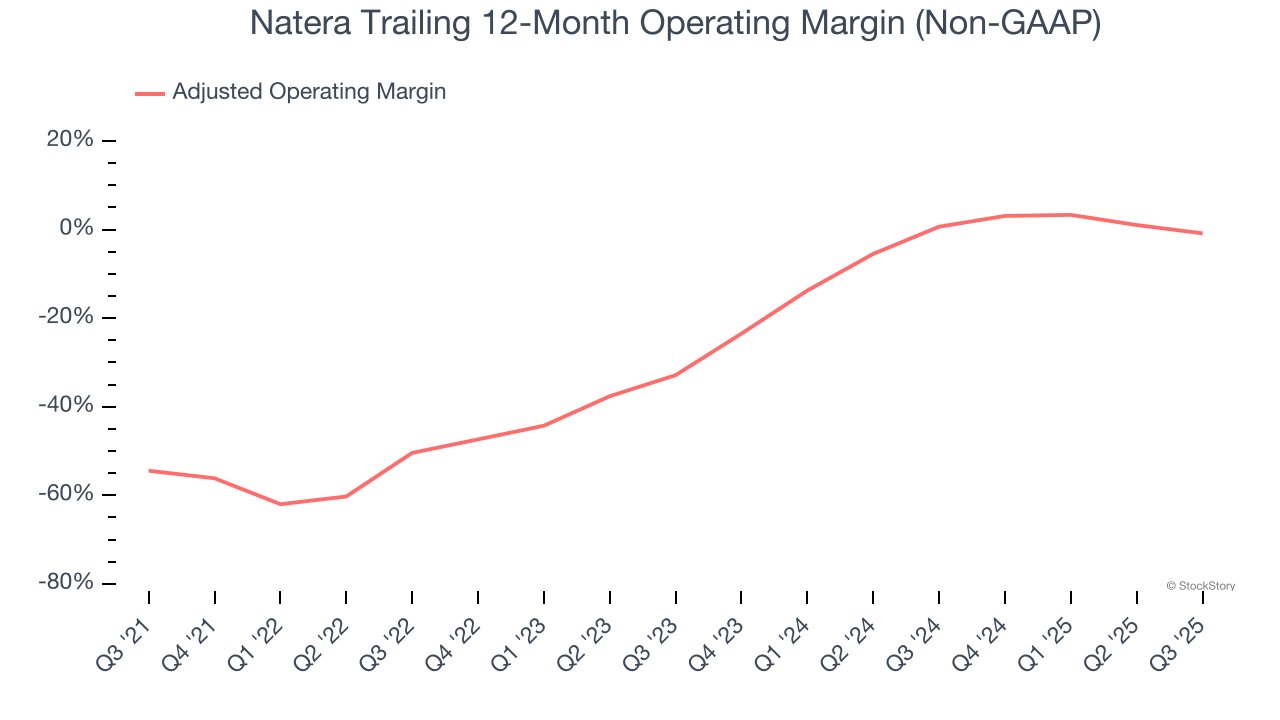

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Natera’s adjusted operating margin rose by 32 percentage points over the last two years, as its sales growth gave it operating leverage. Its adjusted operating margin for the trailing 12 months was breakeven.

3. Increasing Free Cash Flow Margin Juices Financials

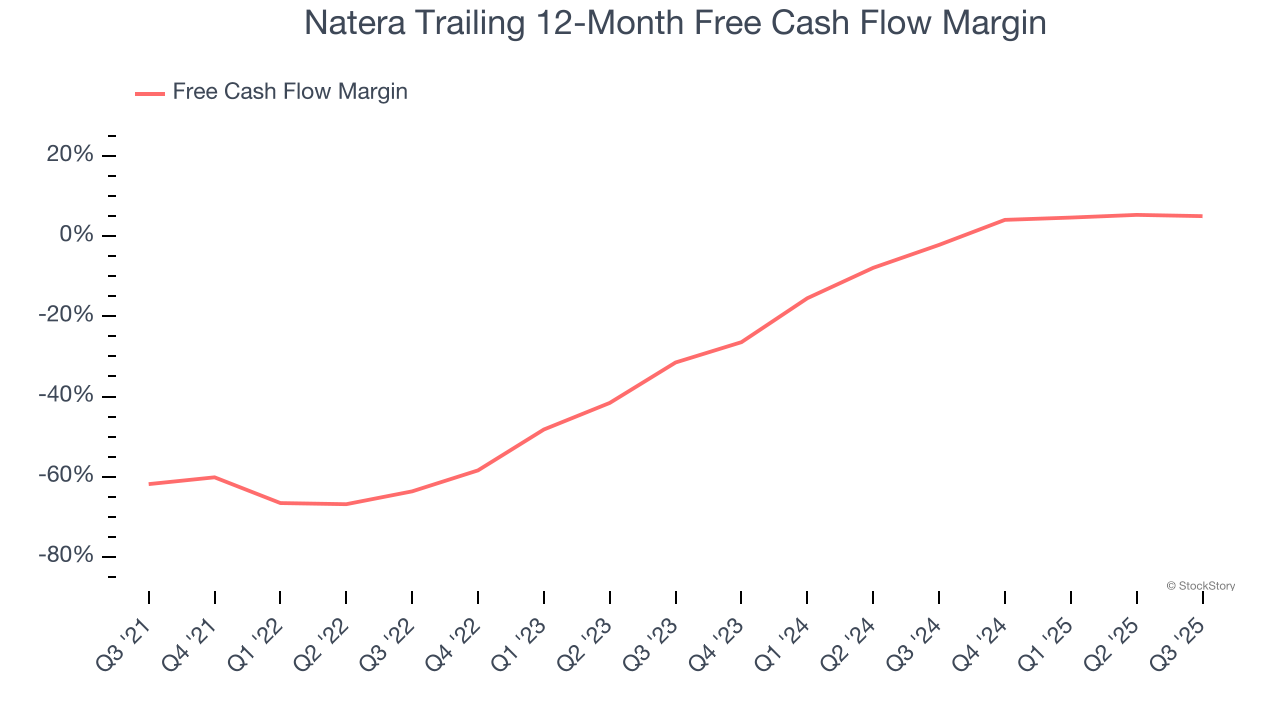

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Natera’s margin expanded by 66.9 percentage points over the last five years. Natera’s free cash flow margin for the trailing 12 months was 5%.

Final Judgment

These are just a few reasons why we're bullish on Natera, and with its shares beating the market recently, the stock trades at $235.65 per share (or a forward price-to-sales ratio of 13×). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.