SoFi has been on fire lately. In the past six months alone, the company’s stock price has rocketed 71.4%, reaching $27.17 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy SOFI? Find out in our full research report, it’s free for active Edge members.

Why Is SoFi a Good Business?

Starting as a student loan refinancing company founded by Stanford business school students in 2011, SoFi Technologies (NASDAQ: SOFI) operates a digital financial platform offering lending, banking, investing, and other financial services to help members borrow, save, spend, invest, and protect their money.

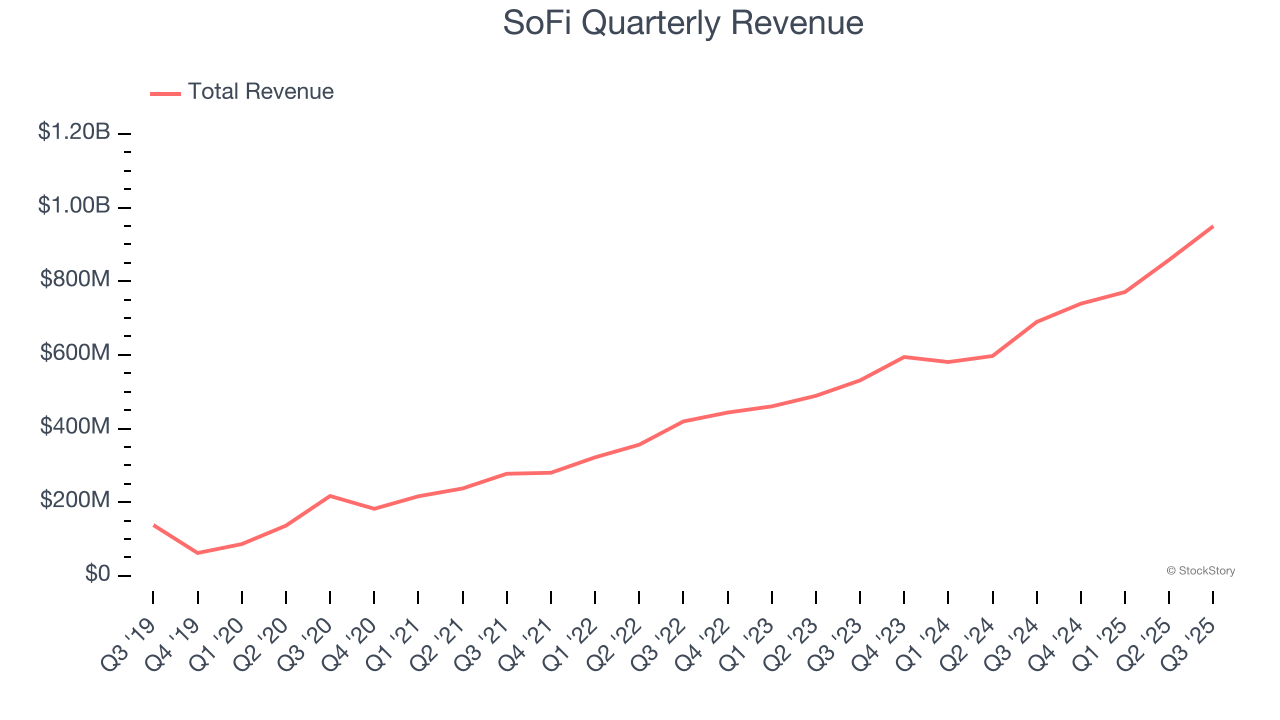

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

Thankfully, SoFi’s 45.9% annualized revenue growth over the last five years was incredible. Its growth beat the average financials company and shows its offerings resonate with customers.

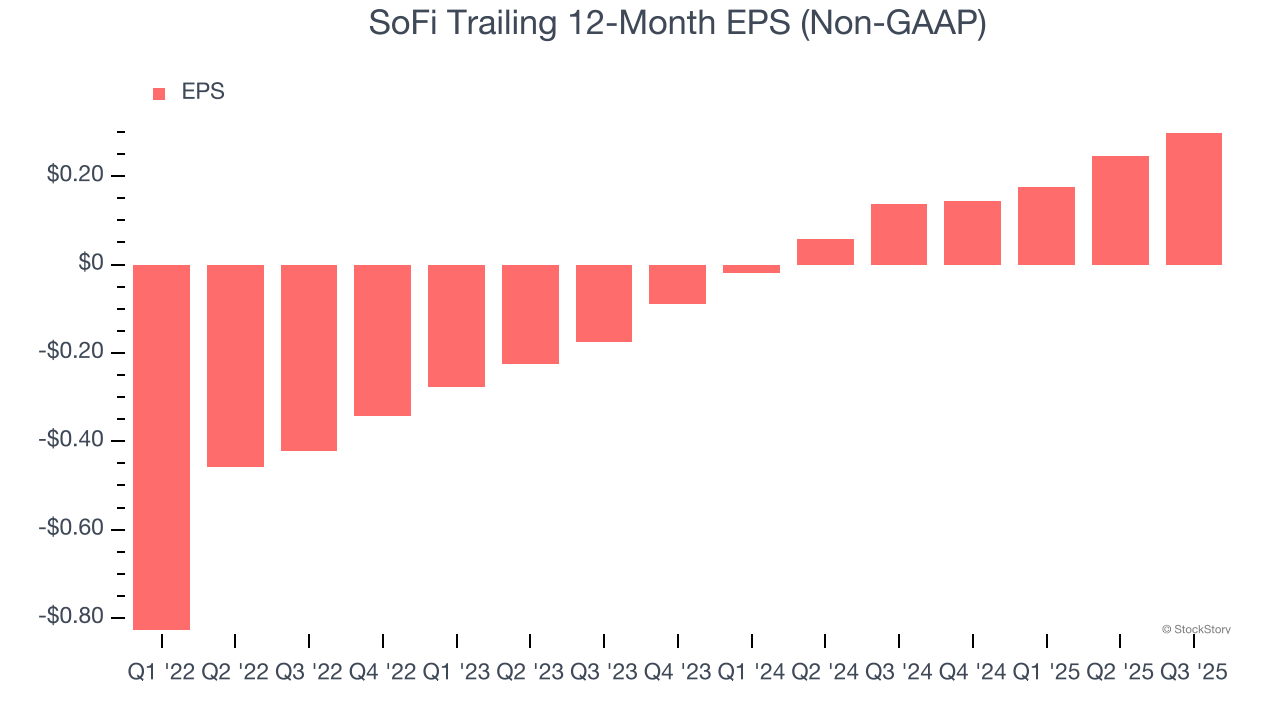

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

SoFi’s full-year EPS flipped from negative to positive over the last four years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons why we're bullish on SoFi, and after the recent rally, the stock trades at 49.9× forward P/E (or $27.17 per share). Is now a good time to buy despite the apparent froth? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than SoFi

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.