Sprouts has gotten torched over the last six months - since April 2025, its stock price has dropped 31.1% to $105.59 per share. This might have investors contemplating their next move.

Following the pullback, is now the time to buy SFM? Find out in our full research report, it’s free.

Why Are We Positive On SFM?

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ: SFM) is a grocery store chain emphasizing natural and organic products.

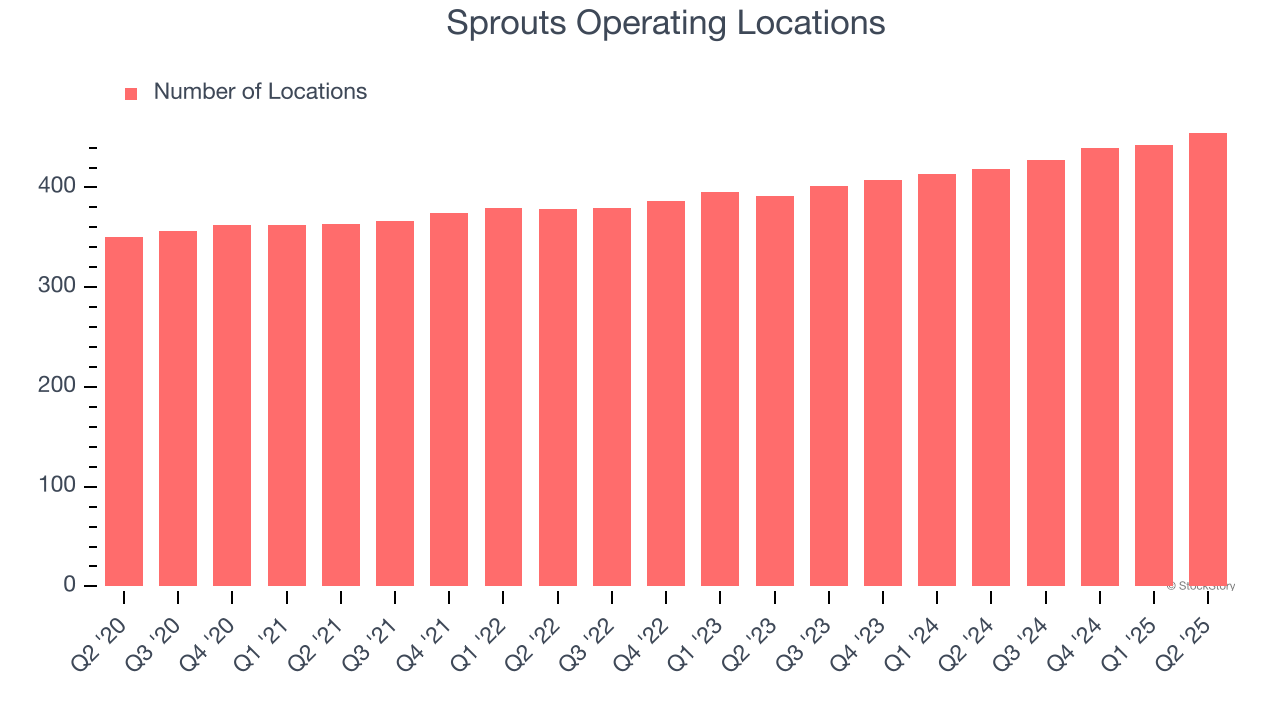

1. Store Growth Signals an Offensive Strategy

A retailer’s store count often determines how much revenue it can generate.

Sprouts sported 455 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 6.7% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

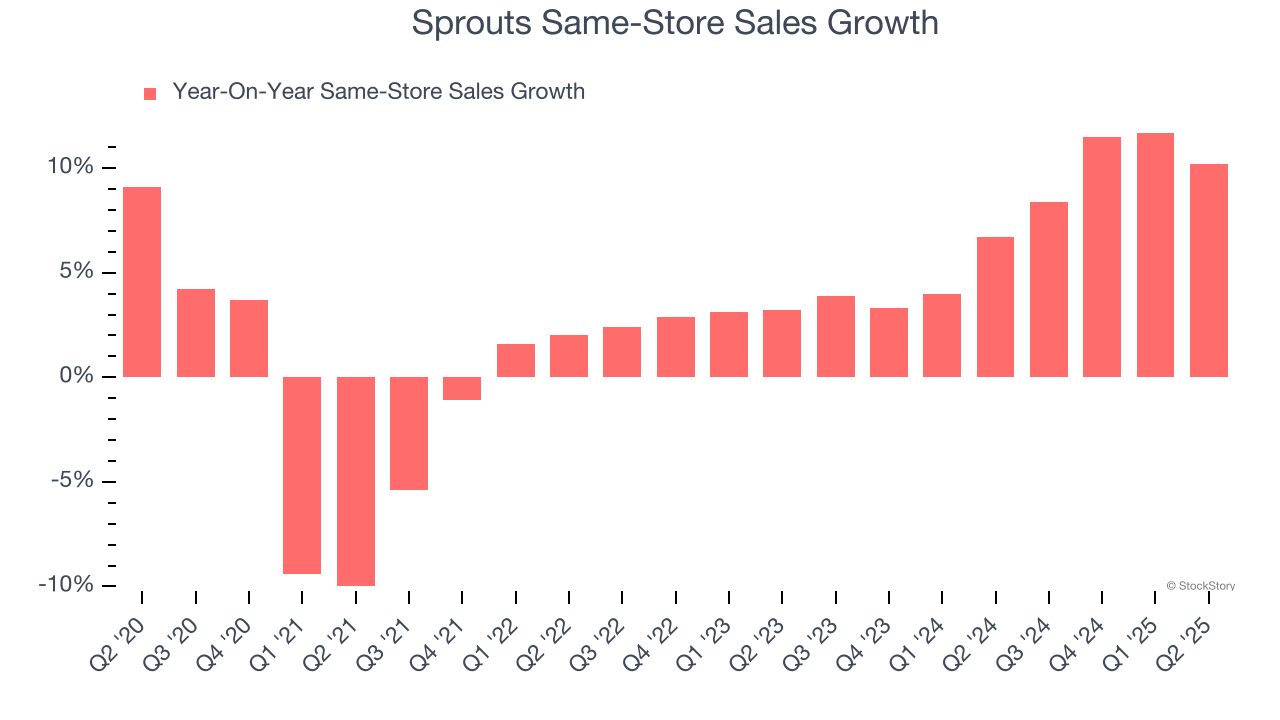

2. Surging Same-Store Sales Show Increasing Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sprouts has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 7.5%.

3. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Sprouts’s revenue to rise by 11.8%, an improvement versus This projection is eye-popping and indicates its newer products will spur better top-line performance.

Final Judgment

These are just a few reasons why we think Sprouts is a great business. With the recent decline, the stock trades at 19.5× forward P/E (or $105.59 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.