This is about borrowing to spend, indicating positive spending and GDP: Pressures easing here: And this may indicate global spending is holding up: So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However […] The post Consumer credit, Supply Chain, China exports appeared first on Mosler Economics / Modern Monetary Theory .

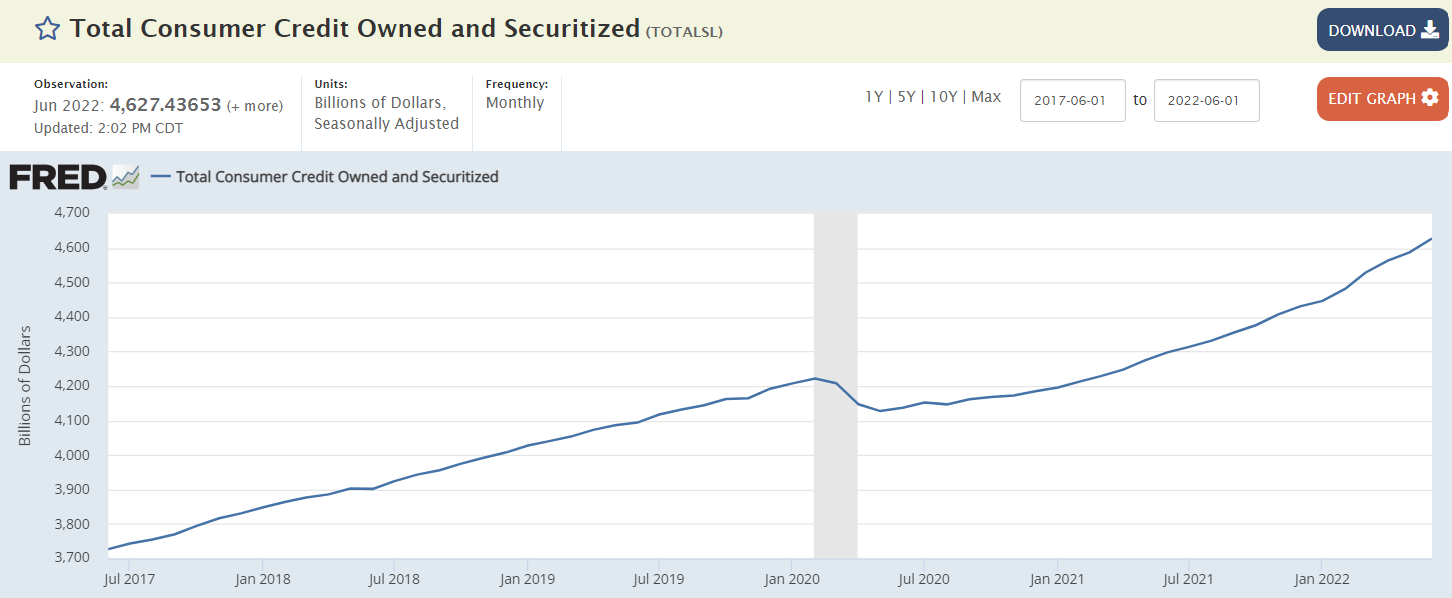

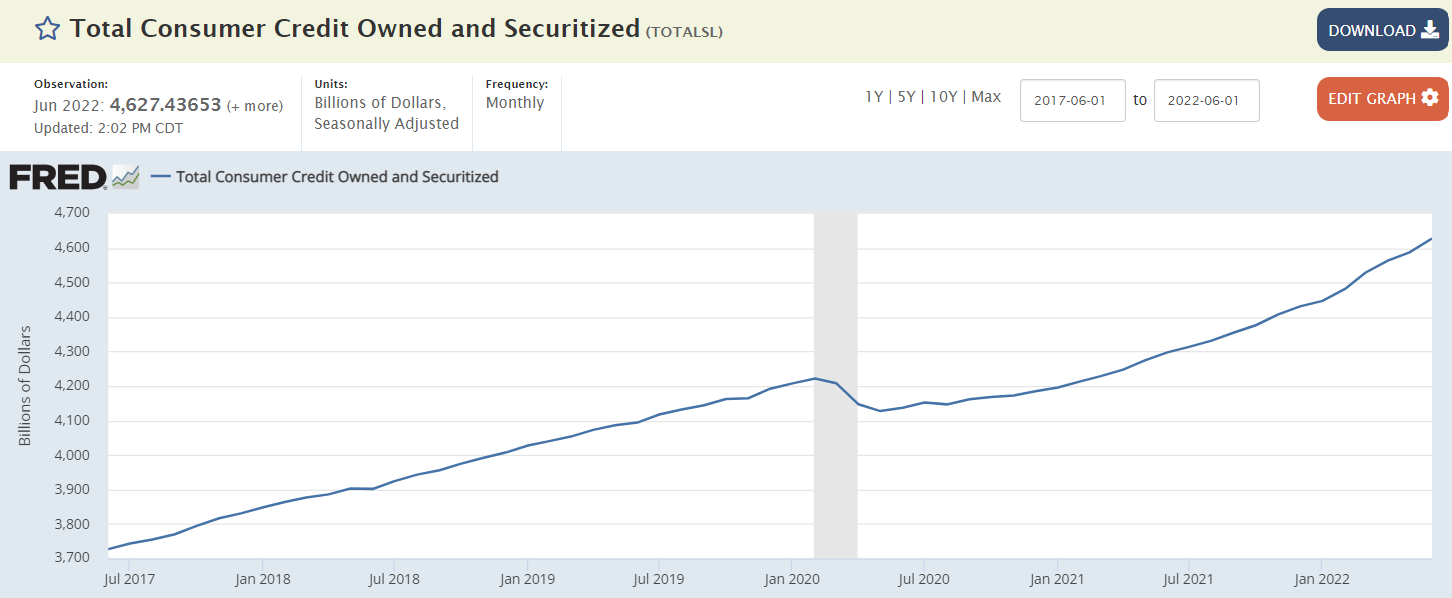

This is about borrowing to spend, indicating positive spending and GDP:

This is about borrowing to spend, indicating positive spending and GDP:

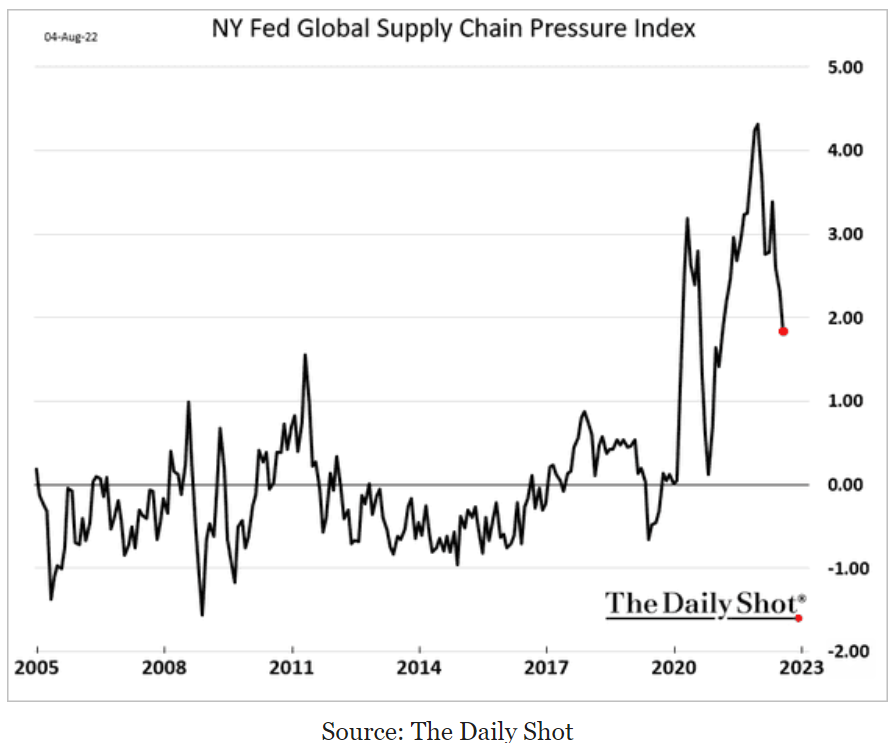

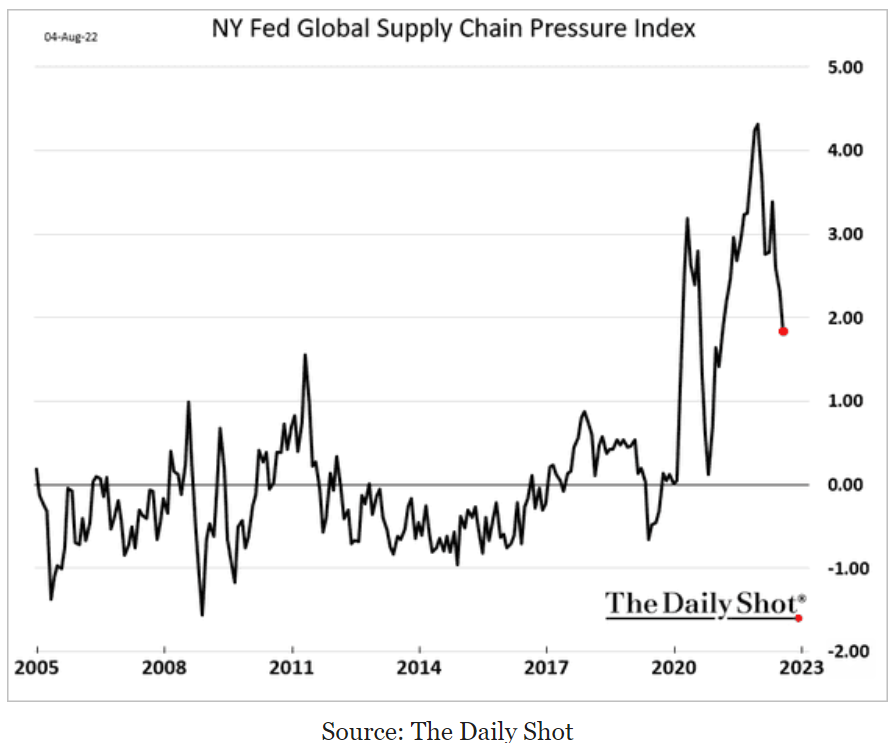

Pressures easing here:

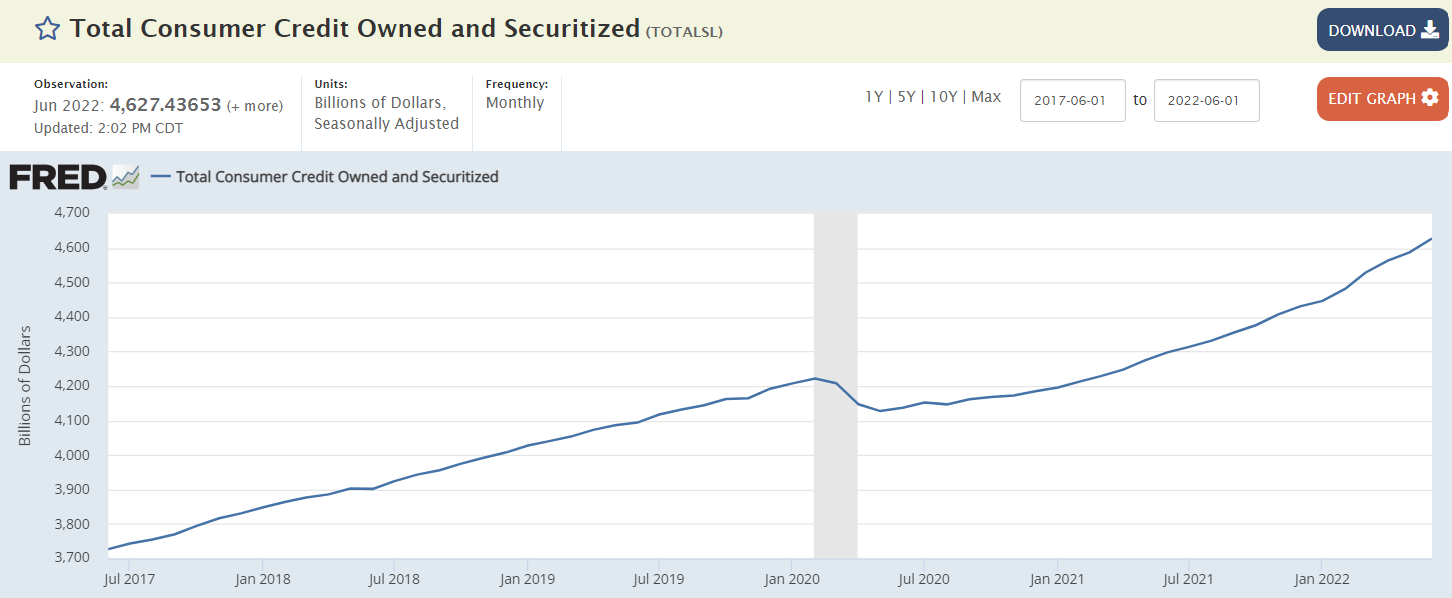

And this may indicate global spending is holding up:

So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However sufficient deficit spending remains (about 5% of GDP) to sustain more modest levels of growth.Share

The post Consumer credit, Supply Chain, China exports appeared first on Mosler Economics / Modern Monetary Theory.

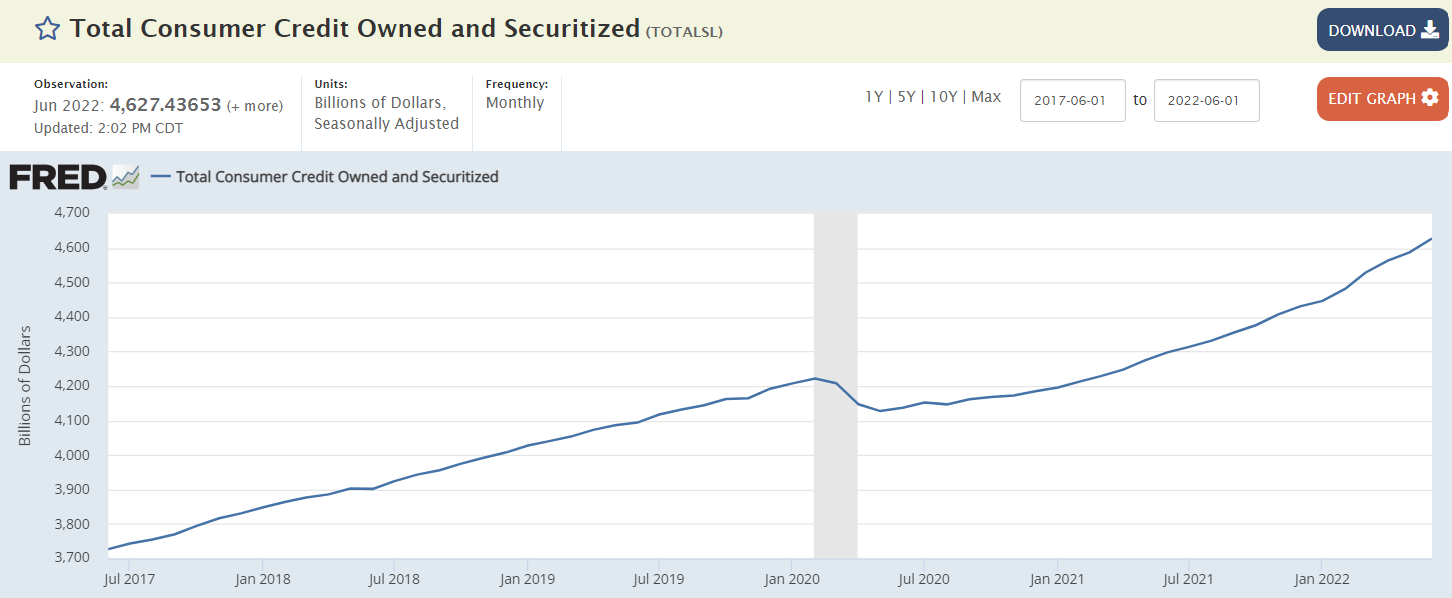

This is about borrowing to spend, indicating positive spending and GDP:

This is about borrowing to spend, indicating positive spending and GDP: