This makes sense to me. We have had a post-Covid war slowdown in federal spending that is evidenced by the decelerating economy. But the federal deficit is still high enough to keep things muddling through at modest growth, helped some by the rate hikes which

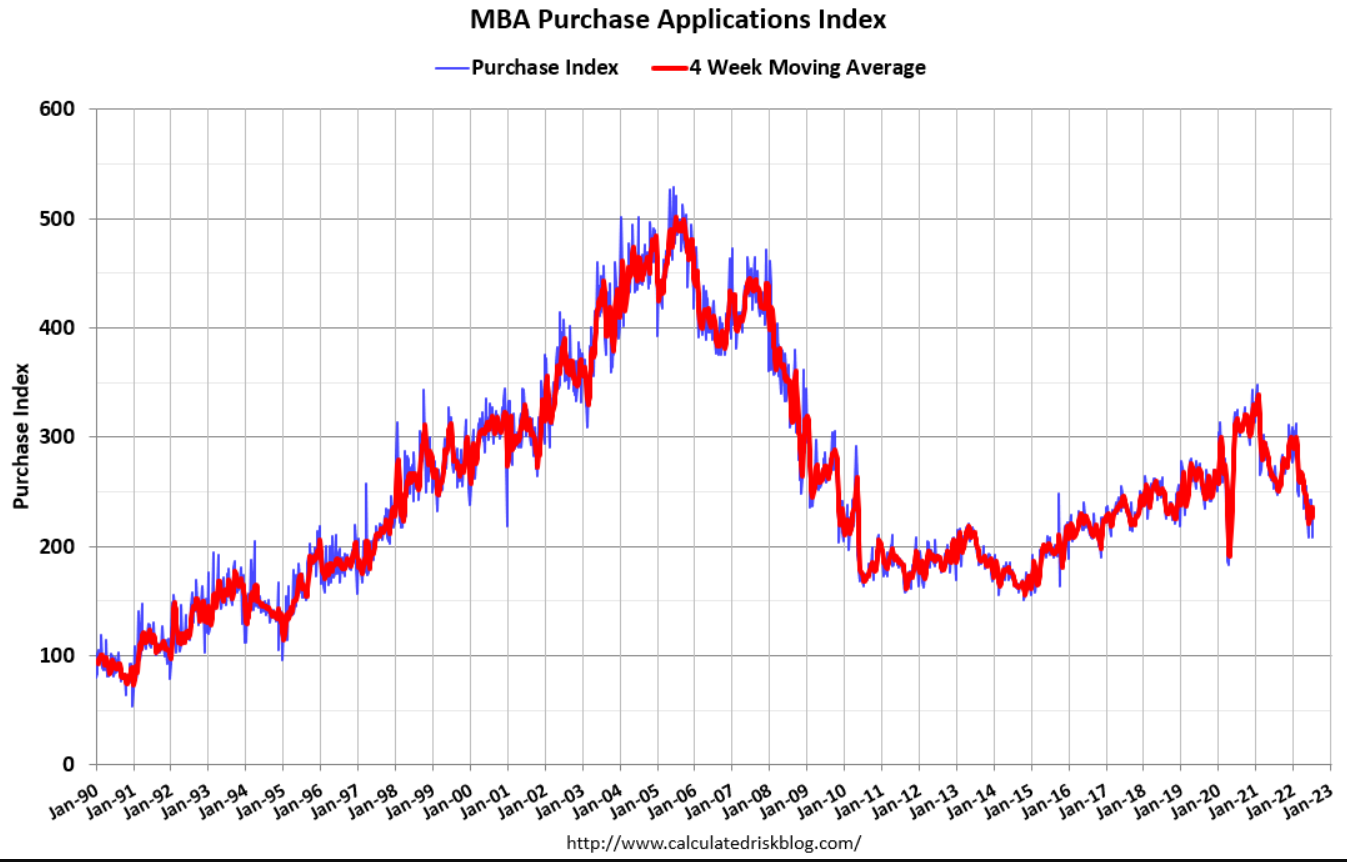

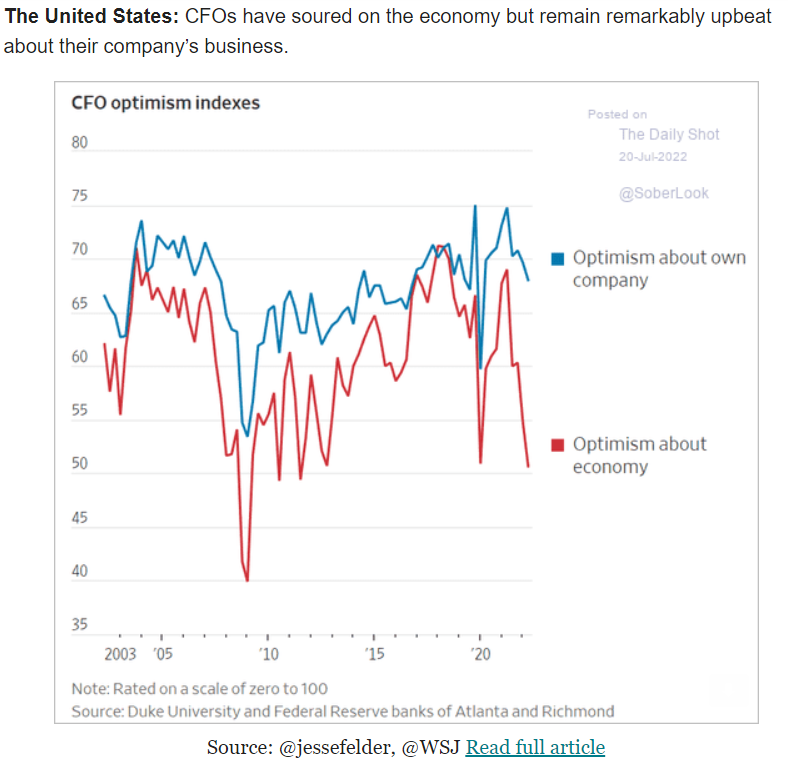

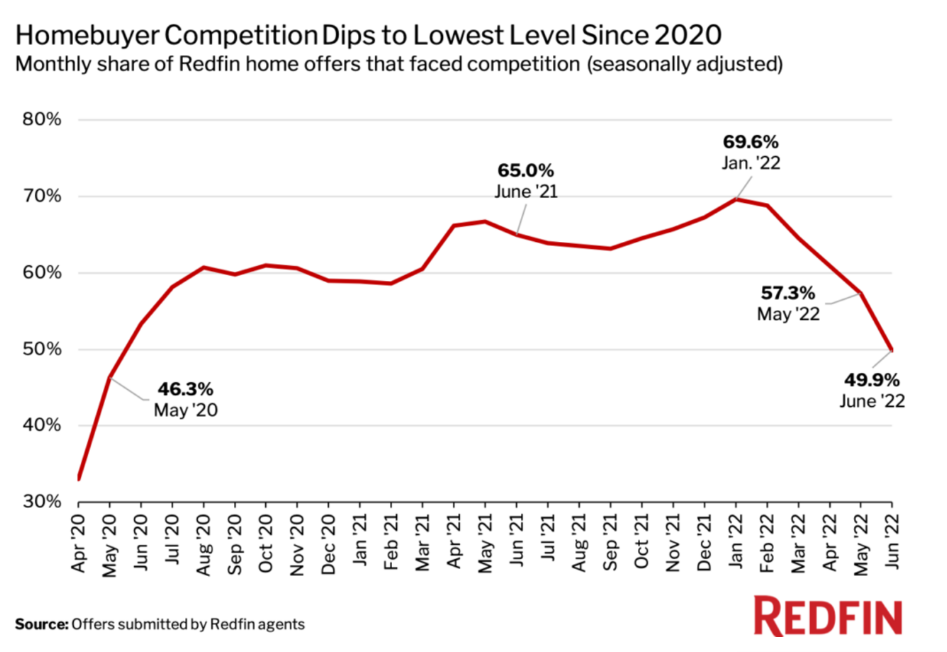

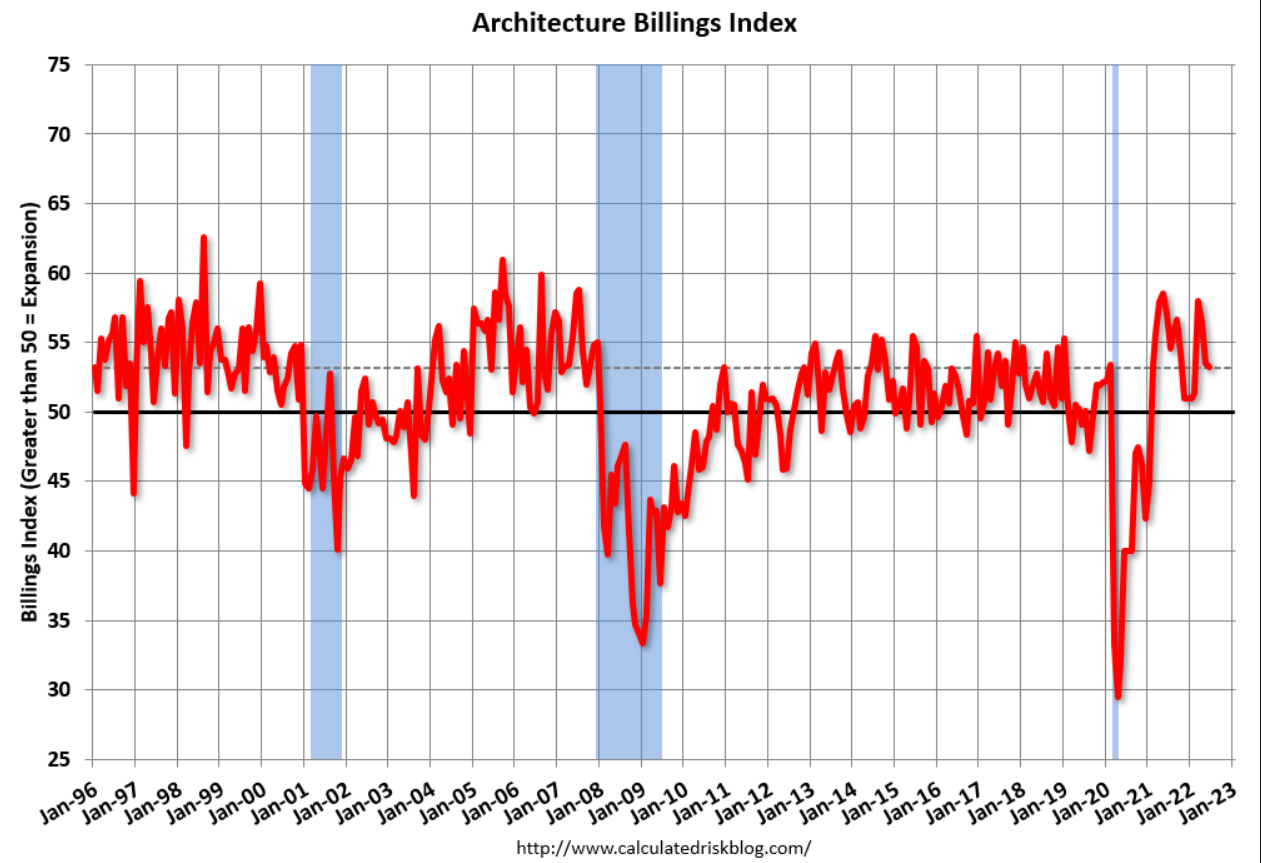

This makes sense to me. We have had a post-Covid war slowdown in federal spending that is evidenced by the decelerating economy. But the federal deficit is still high enough to keep things muddling through at modest growth, helped some by the rate hikes whichare universally believed to slow things down when in fact the increased deficit spending for the additional federal interest expense adds a bit of (highly regressive) support for the economy:

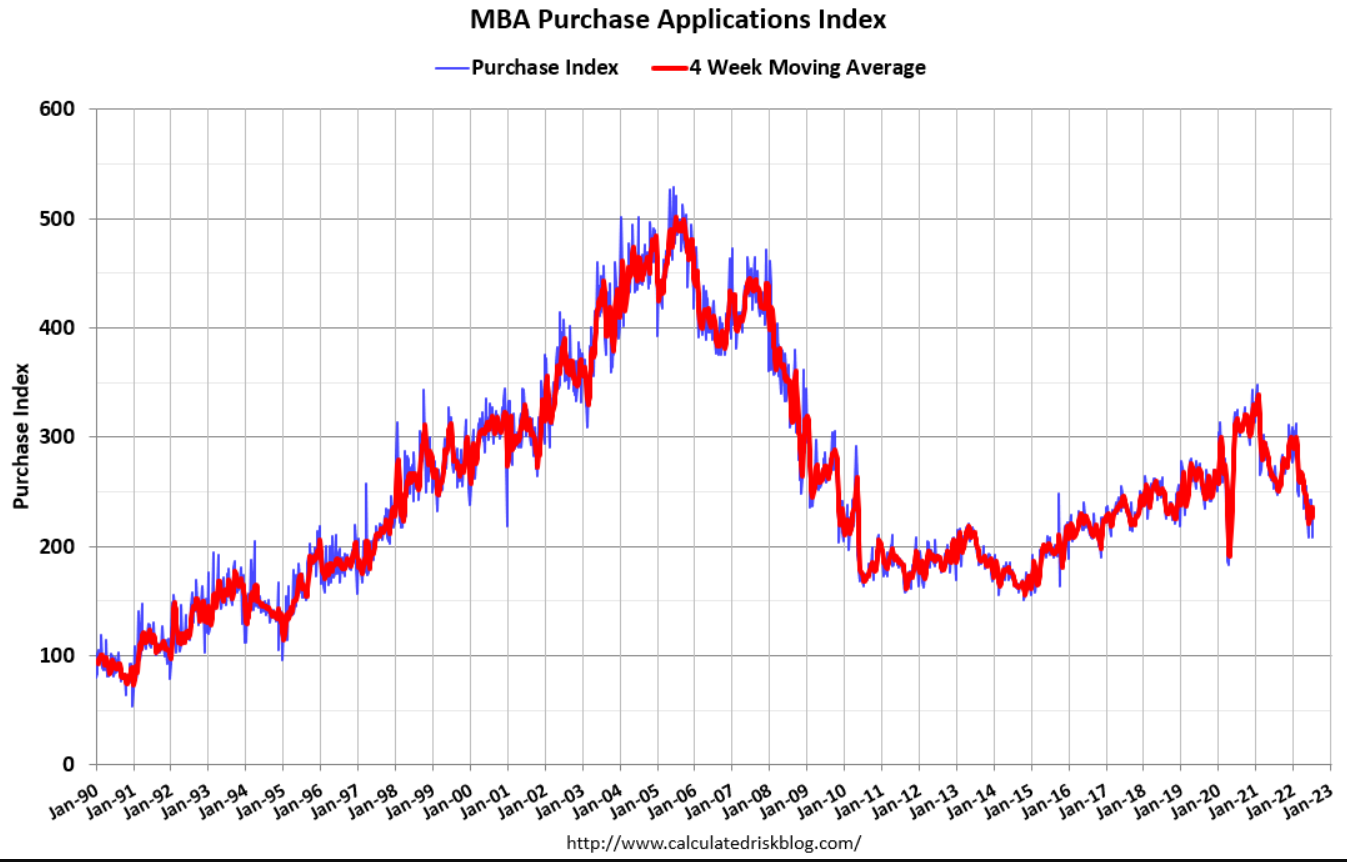

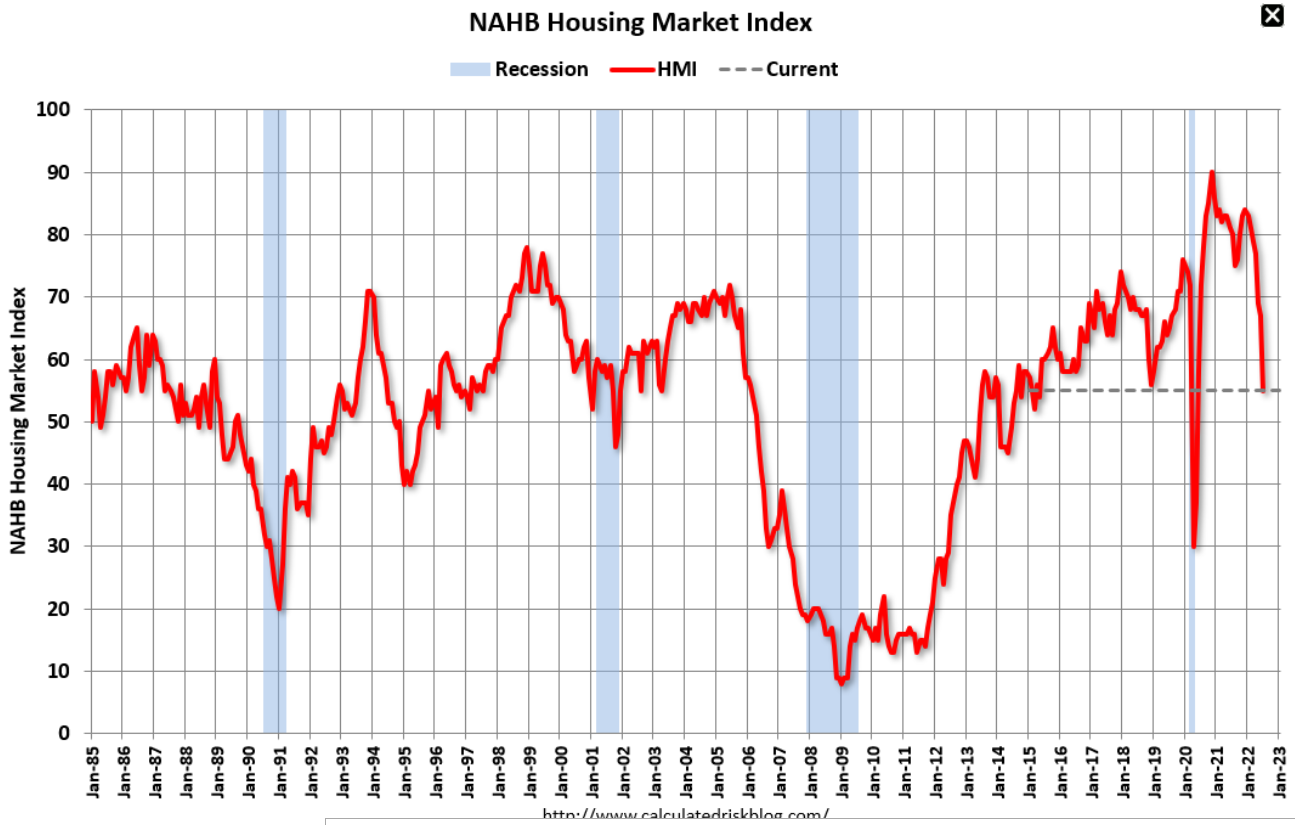

The post DFO optimism, homebuyer competition, Architecture index, mortgage purchase apps, builder confidence appeared first on Mosler Economics / Modern Monetary Theory.