Rural goods retailer Tractor Supply (NASDAQ: TSCO) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.3% year on year to $3.90 billion. Its GAAP profit of $0.43 per share was 7.2% below analysts’ consensus estimates.

Is now the time to buy Tractor Supply? Find out by accessing our full research report, it’s free.

Tractor Supply (TSCO) Q4 CY2025 Highlights:

- Revenue: $3.90 billion vs analyst estimates of $3.99 billion (3.3% year-on-year growth, 2.4% miss)

- EPS (GAAP): $0.43 vs analyst expectations of $0.46 (7.2% miss)

- Adjusted EBITDA: $425.5 million vs analyst estimates of $459.6 million (10.9% margin, 7.4% miss)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $2.18 at the midpoint, missing analyst estimates by 5.6%

- Operating Margin: 7.6%, in line with the same quarter last year

- Free Cash Flow Margin: 1.5%, down from 7.2% in the same quarter last year

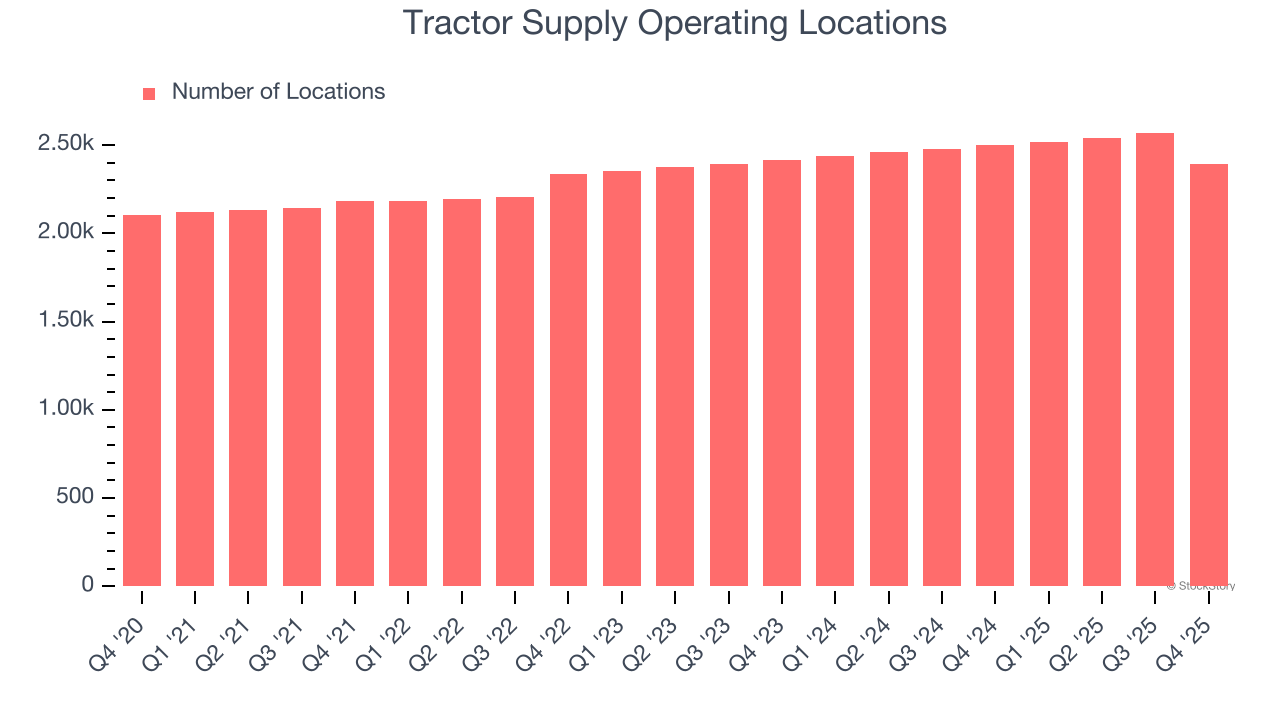

- Locations: 2,395 at quarter end, down from 2,502 in the same quarter last year

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $29.14 billion

Company Overview

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ: TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $15.52 billion in revenue over the past 12 months, Tractor Supply is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Tractor Supply to boost its sales, it likely needs to adjust its prices or lean into foreign markets.

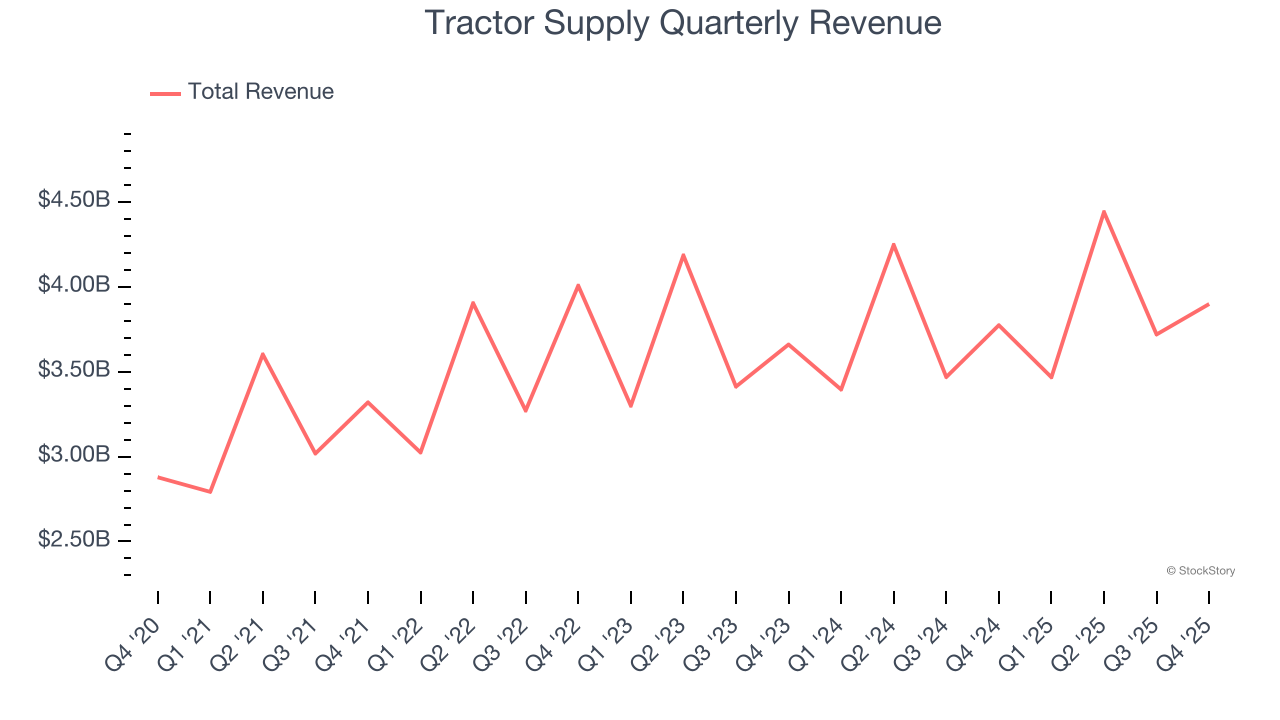

As you can see below, Tractor Supply’s sales grew at a sluggish 3% compounded annual growth rate over the last three years.

This quarter, Tractor Supply’s revenue grew by 3.3% year on year to $3.90 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and suggests its newer products will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Tractor Supply operated 2,395 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 2.6% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

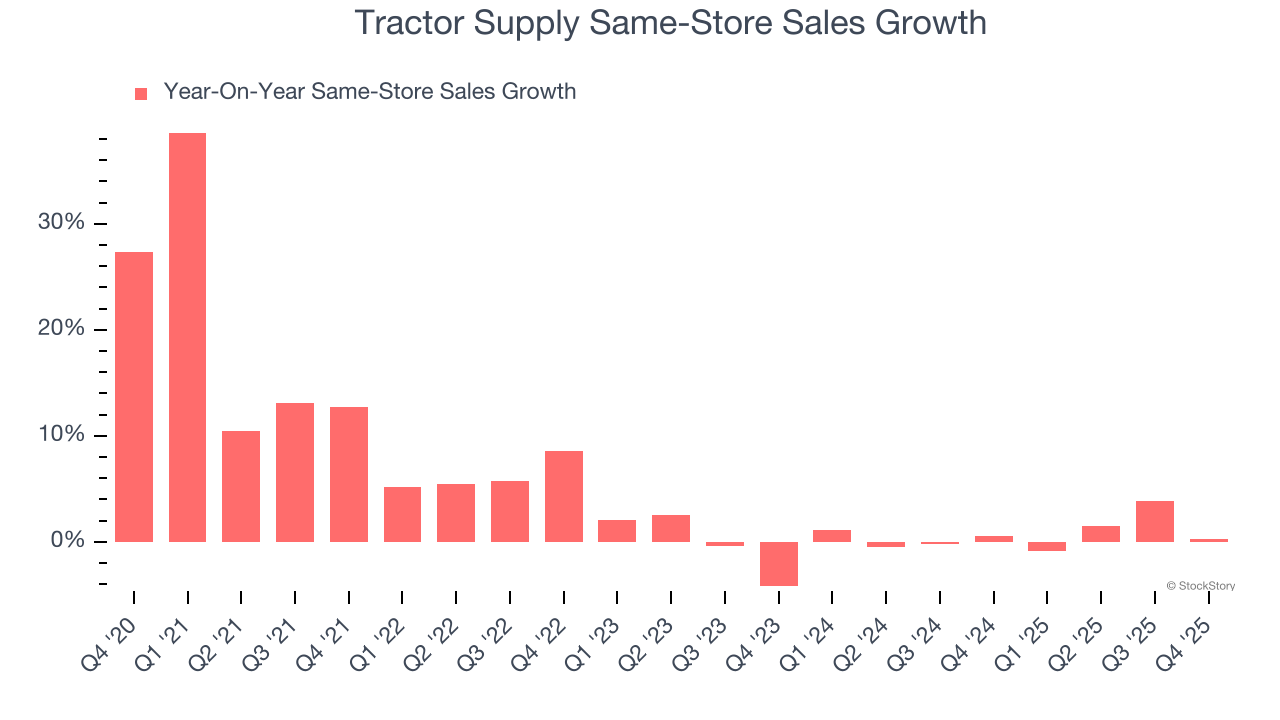

Tractor Supply’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Tractor Supply should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Tractor Supply’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from Tractor Supply’s Q4 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.8% to $52.50 immediately following the results.

Tractor Supply’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).