Boat and marine products retailer OneWater Marine (NASDAQ: ONEW) met Wall Streets revenue expectations in Q4 CY2025, with sales up 1.3% year on year to $380.6 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.88 billion at the midpoint. Its non-GAAP loss of $0.04 per share was 93% above analysts’ consensus estimates.

Is now the time to buy OneWater? Find out by accessing our full research report, it’s free.

OneWater (ONEW) Q4 CY2025 Highlights:

- Revenue: $380.6 million vs analyst estimates of $382.2 million (1.3% year-on-year growth, in line)

- Adjusted EPS: -$0.04 vs analyst estimates of -$0.58 (93% beat)

- Adjusted EBITDA: $3.60 million vs analyst estimates of $1.90 million (0.9% margin, 90.1% beat)

- The company reconfirmed its revenue guidance for the full year of $1.88 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.50 at the midpoint

- EBITDA guidance for the full year is $75 million at the midpoint, in line with analyst expectations

- Operating Margin: -1.4%, in line with the same quarter last year

- Same-Store Sales were flat year on year (4.2% in the same quarter last year)

- Market Capitalization: $219 million

“We delivered a solid first quarter supported by a strong inventory position and consistent execution across the business. Gross margins were modestly better than we anticipated, driven by favorable model mix and the benefits of portfolio optimization efforts, which we expect to be realized in various amounts throughout the year. As the first quarter is seasonally our smallest, our focus remains on disciplined execution as industry conditions begin to improve. Supported by a healthy inventory mix and improved aging profile, we believe we are well positioned to execute on our priorities of higher profitability and improved balance sheet leverage,” commented Austin Singleton, Executive Chairman at OneWater.

Company Overview

A public company since early 2020, OneWater Marine (NASDAQ: ONEW) sells boats, yachts, and other marine products.

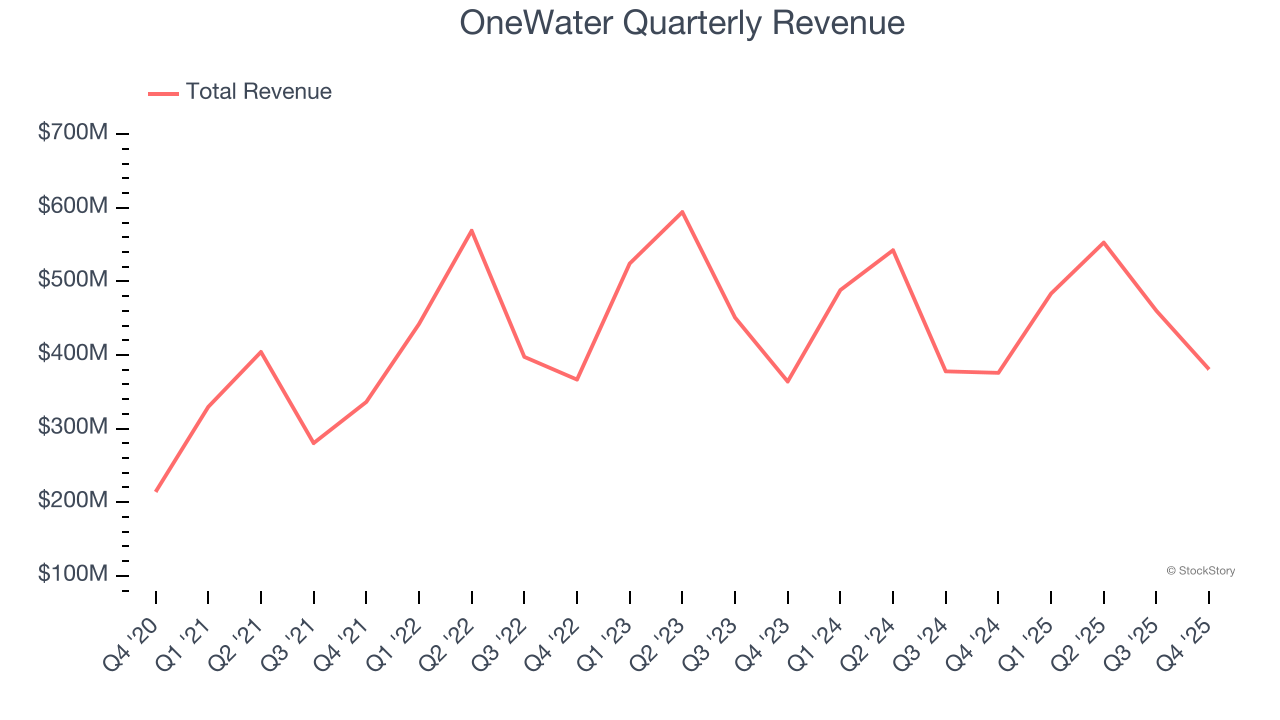

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.88 billion in revenue over the past 12 months, OneWater is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, OneWater’s 1.9% annualized revenue growth over the last three years was sluggish as it didn’t open many new stores.

This quarter, OneWater grew its revenue by 1.3% year on year, and its $380.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and suggests its products will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Store Performance

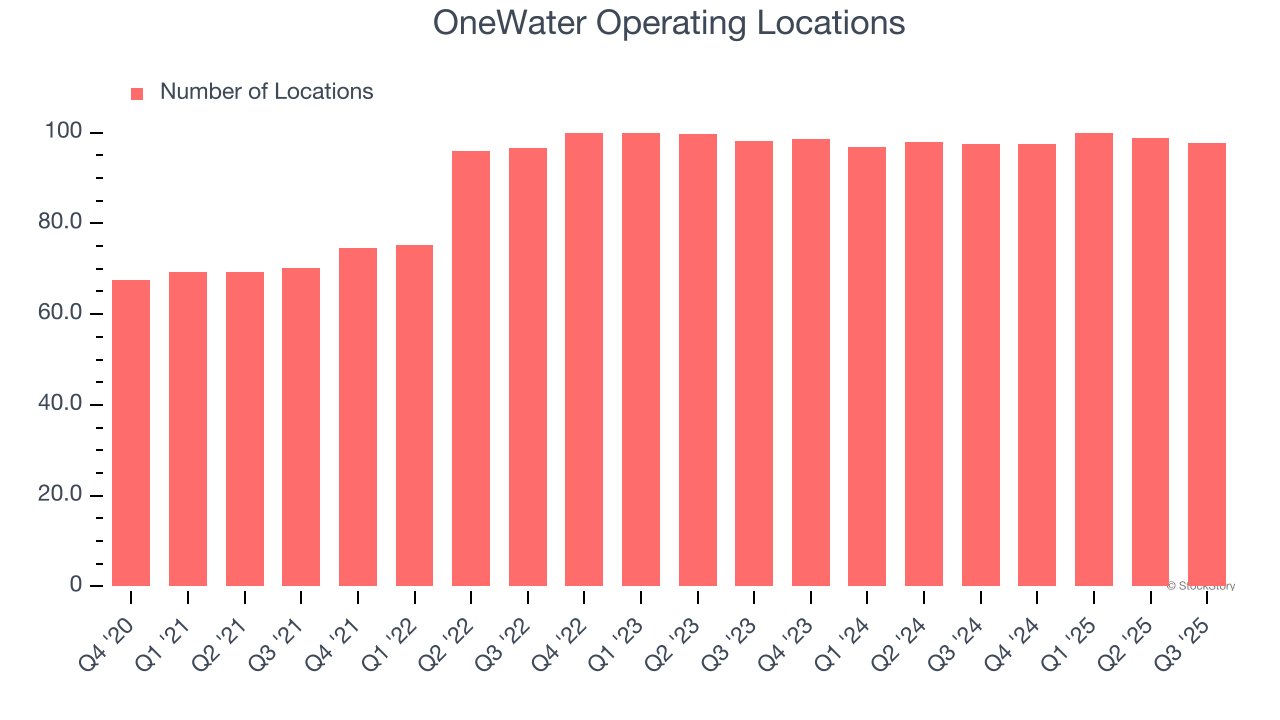

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Over the last two years, OneWater has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Note that OneWater reports its store count intermittently, so some data points are missing in the chart below.

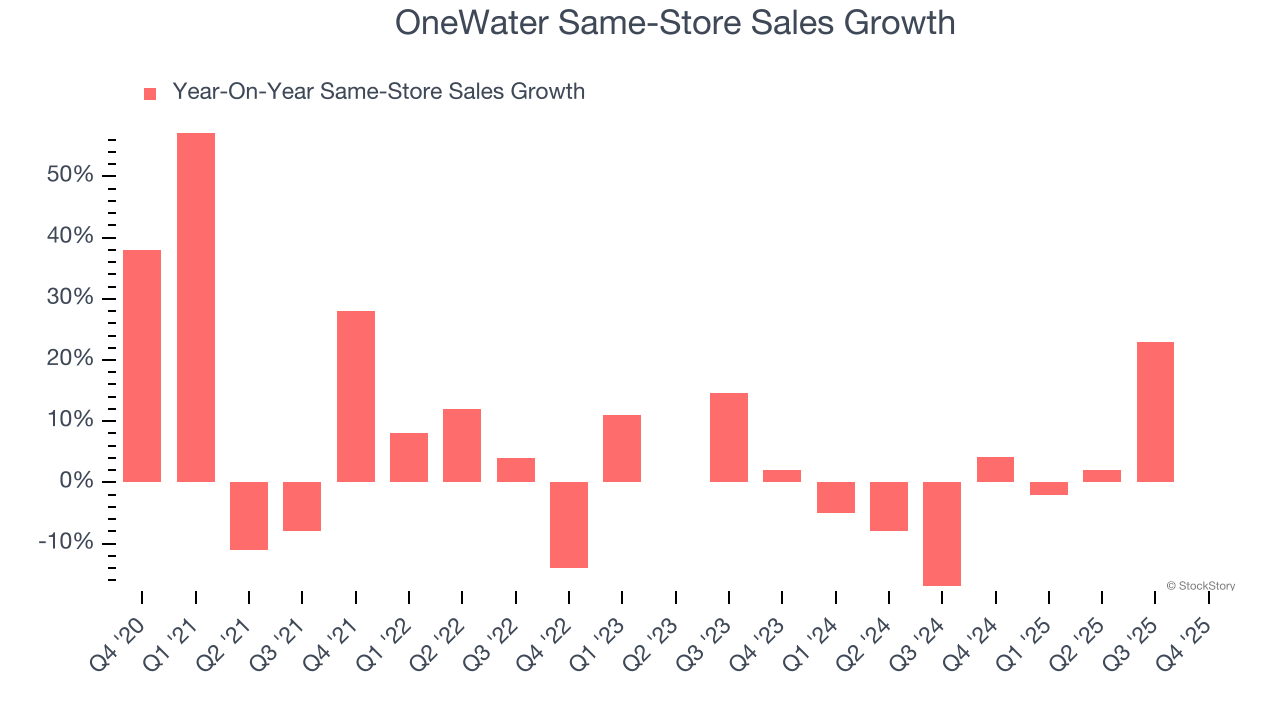

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

OneWater’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if OneWater starts opening new stores to artificially boost revenue growth.

In the latest quarter, OneWater’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from OneWater’s Q4 Results

It was good to see OneWater beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue was in line. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.7% to $14.10 immediately following the results.

OneWater may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).