Global payments technology company Mastercard (NYSE: MA) met Wall Streets revenue expectations in Q4 CY2025, with sales up 17.6% year on year to $8.81 billion. Its non-GAAP profit of $4.76 per share was 12.3% above analysts’ consensus estimates.

Is now the time to buy Mastercard? Find out by accessing our full research report, it’s free.

Mastercard (MA) Q4 CY2025 Highlights:

- Volume: $0.10 vs analyst estimates of $0.07 (16.2% year-on-year decline, 43.5% beat)

- Revenue: $8.81 billion vs analyst estimates of $8.77 billion (17.6% year-on-year growth, in line)

- Pre-tax Profit: $4.88 billion (55.4% margin)

- Adjusted EPS: $4.76 vs analyst estimates of $4.24 (12.3% beat)

- Market Capitalization: $468.2 billion

Company Overview

Recognizable by its iconic "Priceless" advertising campaign that has run in over 120 countries, Mastercard (NYSE: MA) operates a global payments network that connects consumers, financial institutions, merchants, and businesses, enabling electronic transactions and providing payment solutions.

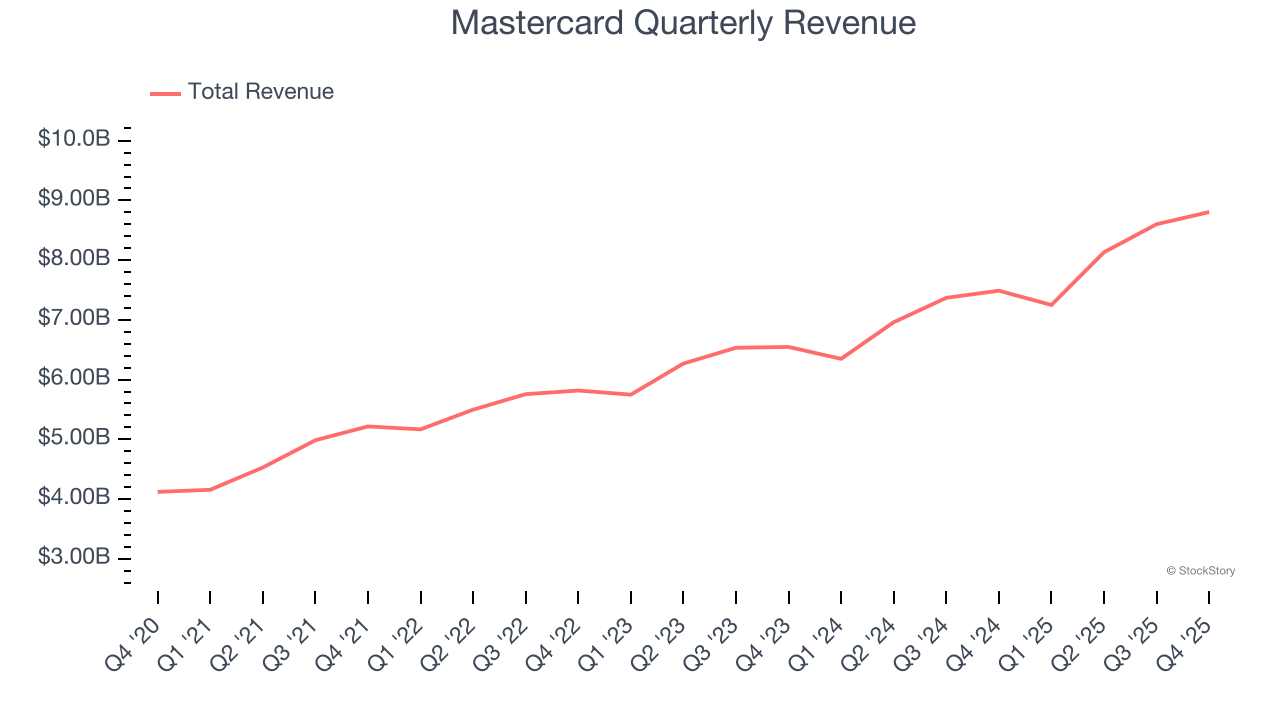

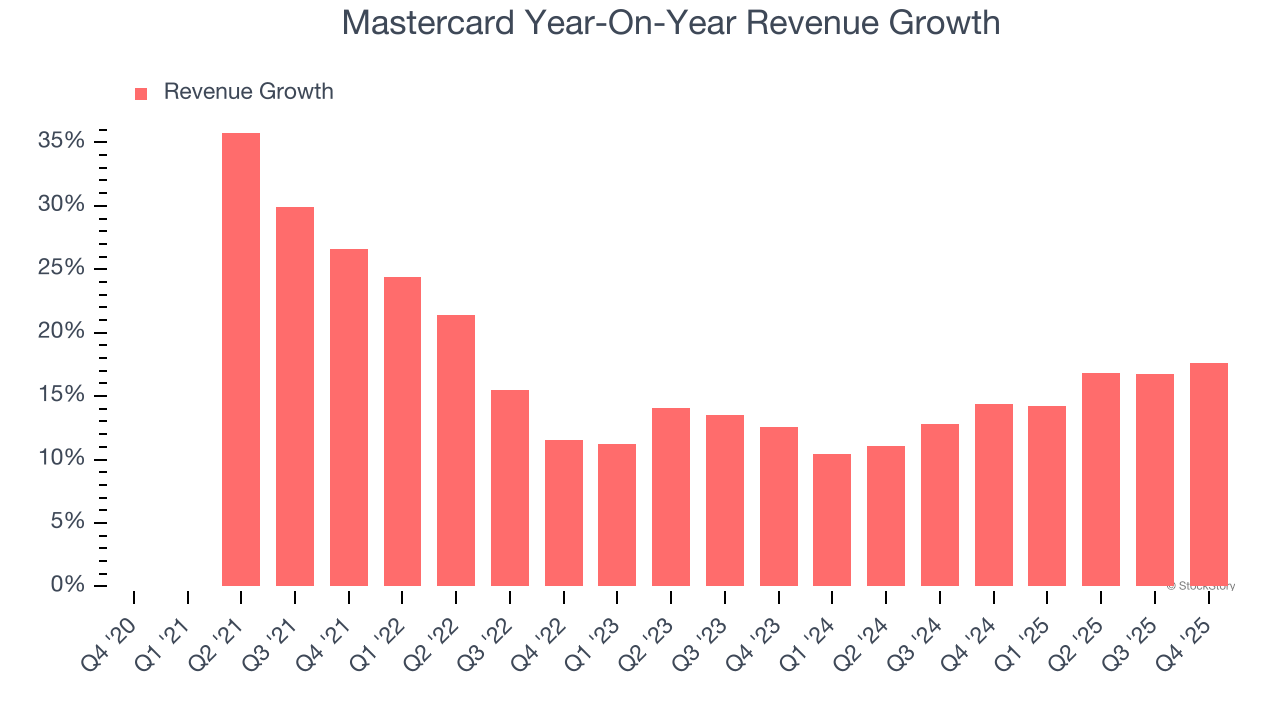

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Mastercard grew its revenue at an impressive 16.5% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Mastercard’s annualized revenue growth of 14.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Mastercard’s year-on-year revenue growth was 17.6%, and its $8.81 billion of revenue was in line with Wall Street’s estimates.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Volume

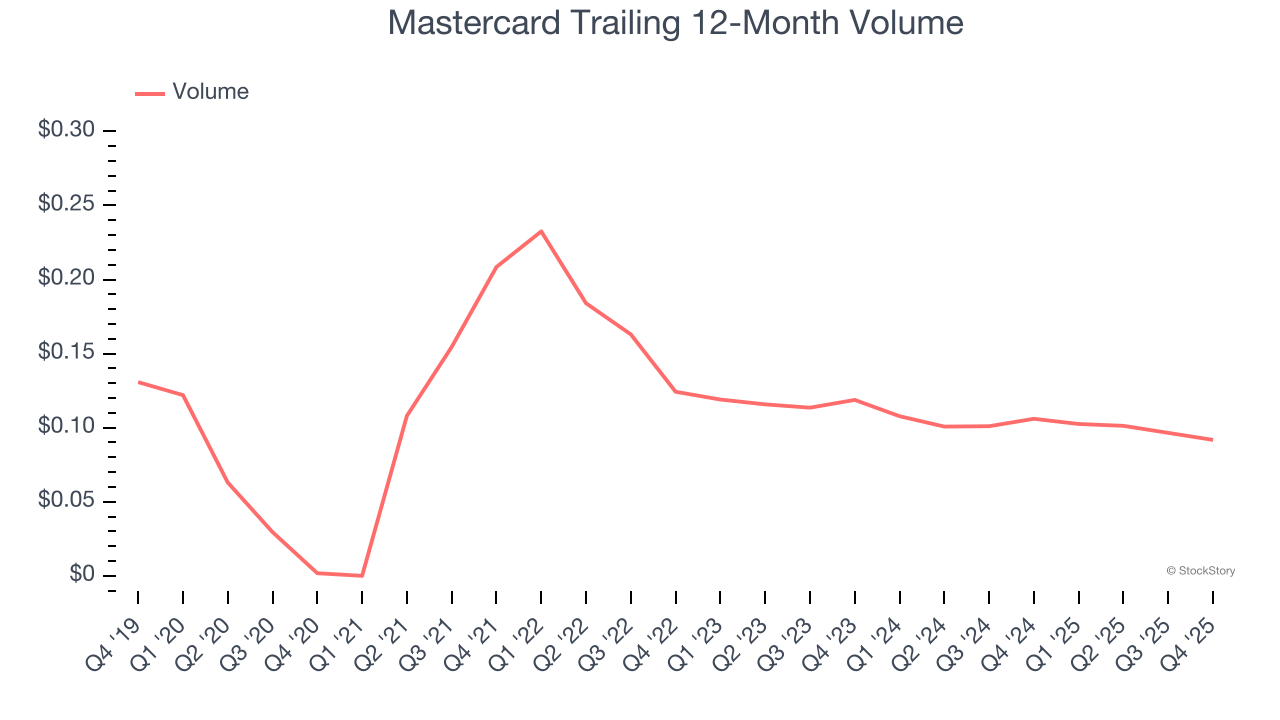

Transaction volume and loan originations represent the core activity metrics that drive revenue growth across the financial services landscape. This overall volume serves as the primary engine of a firm's top-line performance.

Mastercard’s volumes have grown at an annual rate of 121% over the last five years, much better than the broader financials industry and faster than its total revenue. When analyzing Mastercard’s volumes over the last two years, we can see its volumes dropped by 12.1% annually. Its recent performance could be a roadblock for any valuation multiple expansion.

In Q4, Mastercard’s volumes were $0.10, beating analysts’ expectations by 43.5%. This print was 16.2% lower than the same quarter last year.

Key Takeaways from Mastercard’s Q4 Results

We were impressed by how significantly Mastercard blew past analysts’ transaction volumes expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.3% to $533.14 immediately after reporting.

Mastercard may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).