Marvell Technology trades at $83.61 and has moved in lockstep with the market. Its shares have returned 9.5% over the last six months while the S&P 500 has gained 9.5%.

Is now a good time to buy MRVL? Find out in our full research report, it’s free.

Why Does Marvell Technology Spark Debate?

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Two Positive Attributes:

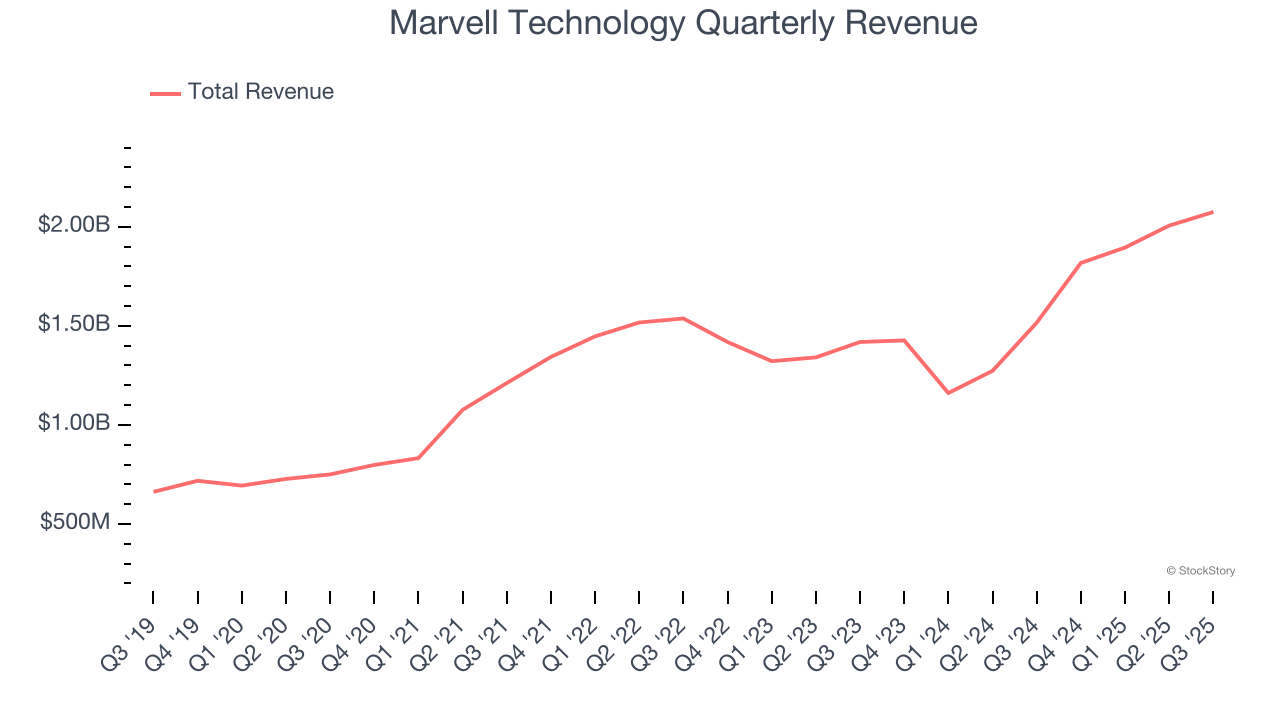

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Marvell Technology’s 22% annualized revenue growth over the last five years was incredible. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

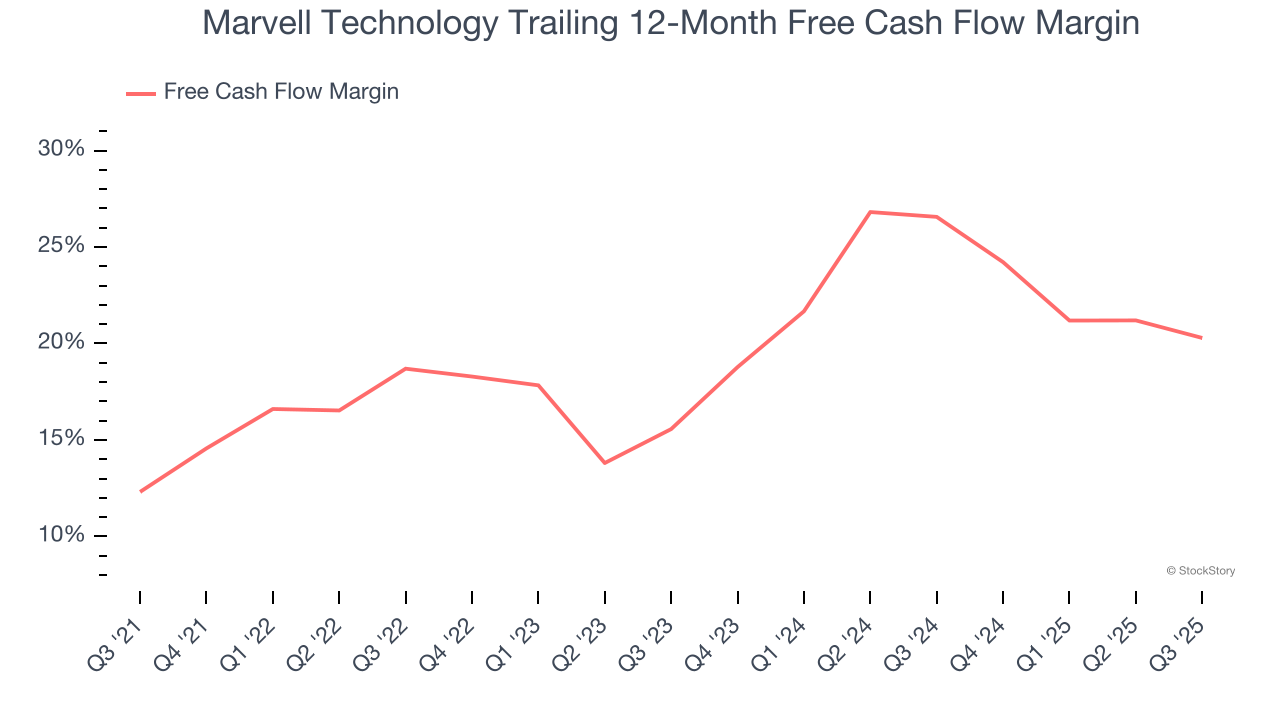

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Marvell Technology’s margin expanded by 8 percentage points over the last five years. This is encouraging because it gives the company more optionality. Marvell Technology’s free cash flow margin for the trailing 12 months was 20.3%.

One Reason to be Careful:

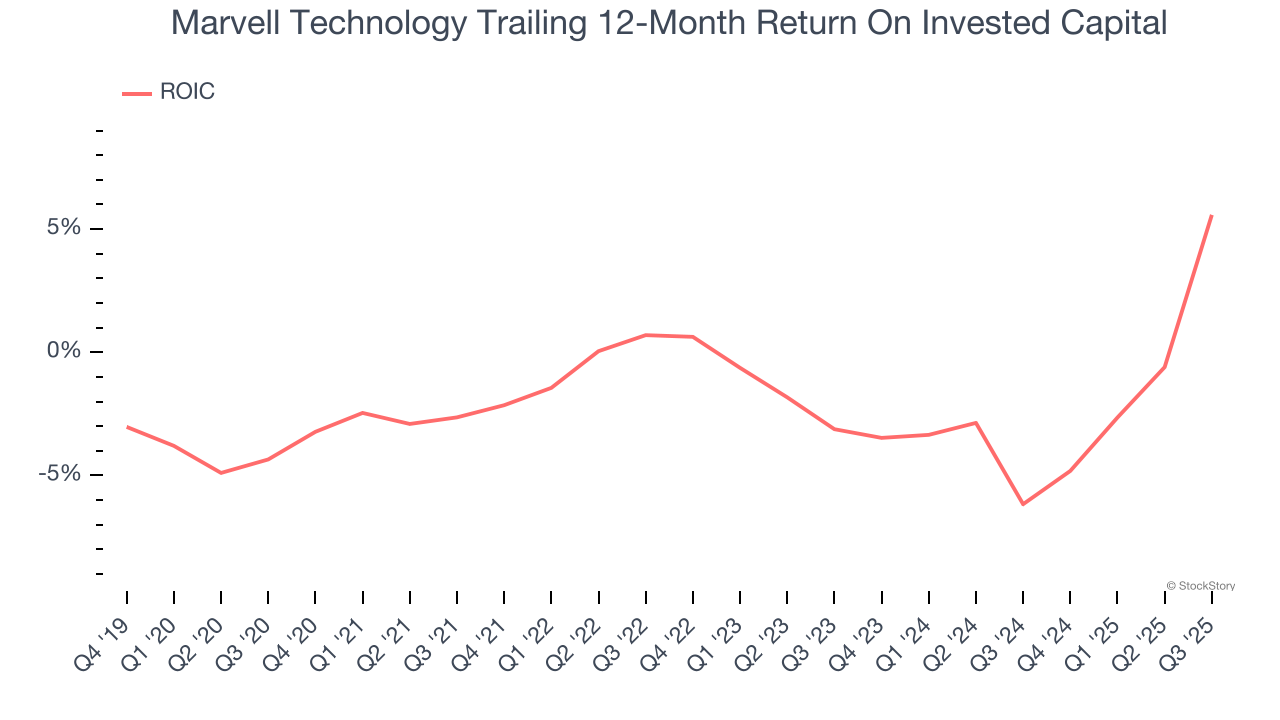

Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Marvell Technology has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 1.1%, meaning management lost money while trying to expand the business.

Final Judgment

Marvell Technology’s positive characteristics outweigh the negatives, but at $83.61 per share (or 24.7× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Marvell Technology

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.