E-commerce florist and gift retailer 1-800-FLOWERS (NASDAQ: FLWS) met Wall Streets revenue expectations in Q4 CY2025, but sales fell by 9.5% year on year to $702.2 million. Its non-GAAP profit of $1.20 per share was 39.5% above analysts’ consensus estimates.

Is now the time to buy 1-800-FLOWERS? Find out by accessing our full research report, it’s free.

1-800-FLOWERS (FLWS) Q4 CY2025 Highlights:

- Revenue: $702.2 million vs analyst estimates of $700.6 million (9.5% year-on-year decline, in line)

- Adjusted EPS: $1.20 vs analyst estimates of $0.86 (39.5% beat)

- Adjusted EBITDA: $98.12 million vs analyst estimates of $96.85 million (14% margin, 1.3% beat)

- Operating Margin: 10.6%, down from 11.7% in the same quarter last year

- Free Cash Flow Margin: 43%, up from 41% in the same quarter last year

- Market Capitalization: $257.2 million

“Our teams remained focused on executing against our key strategic priorities throughout the holiday period, which continues to reflect the early stages of our broader transformation,” said Adolfo Villagomez, Chief Executive Officer.

Company Overview

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

Revenue Growth

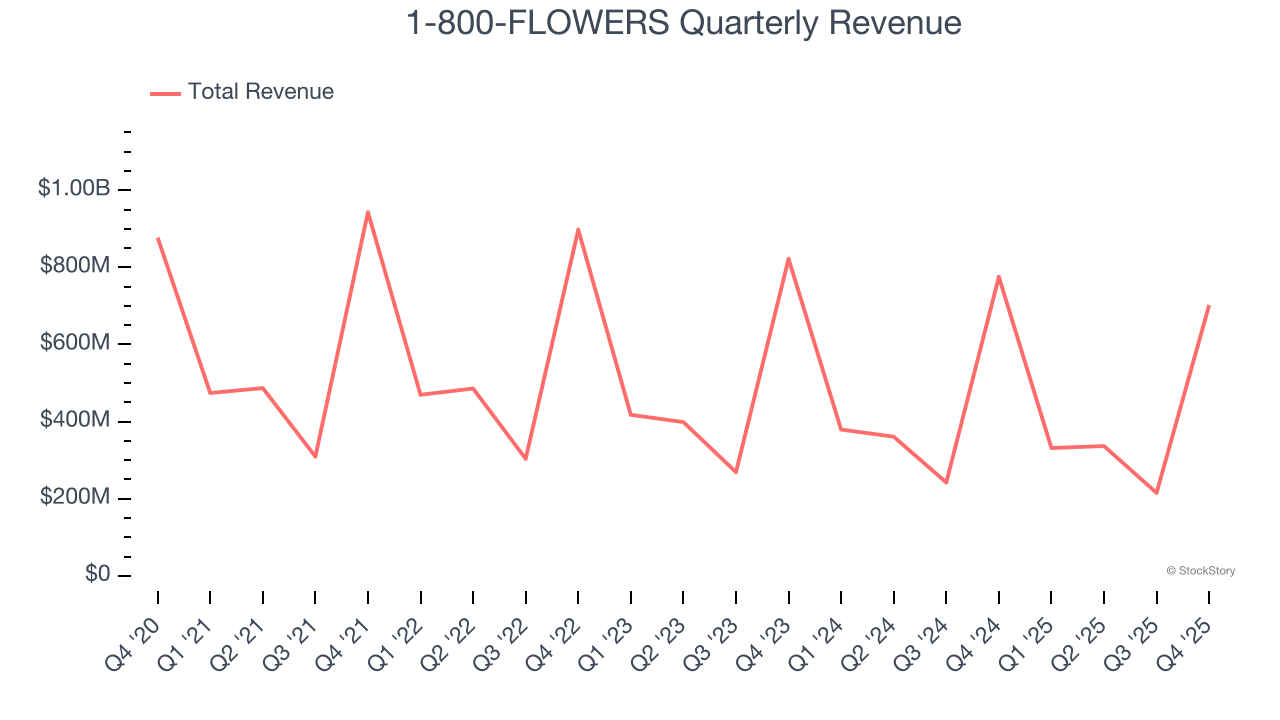

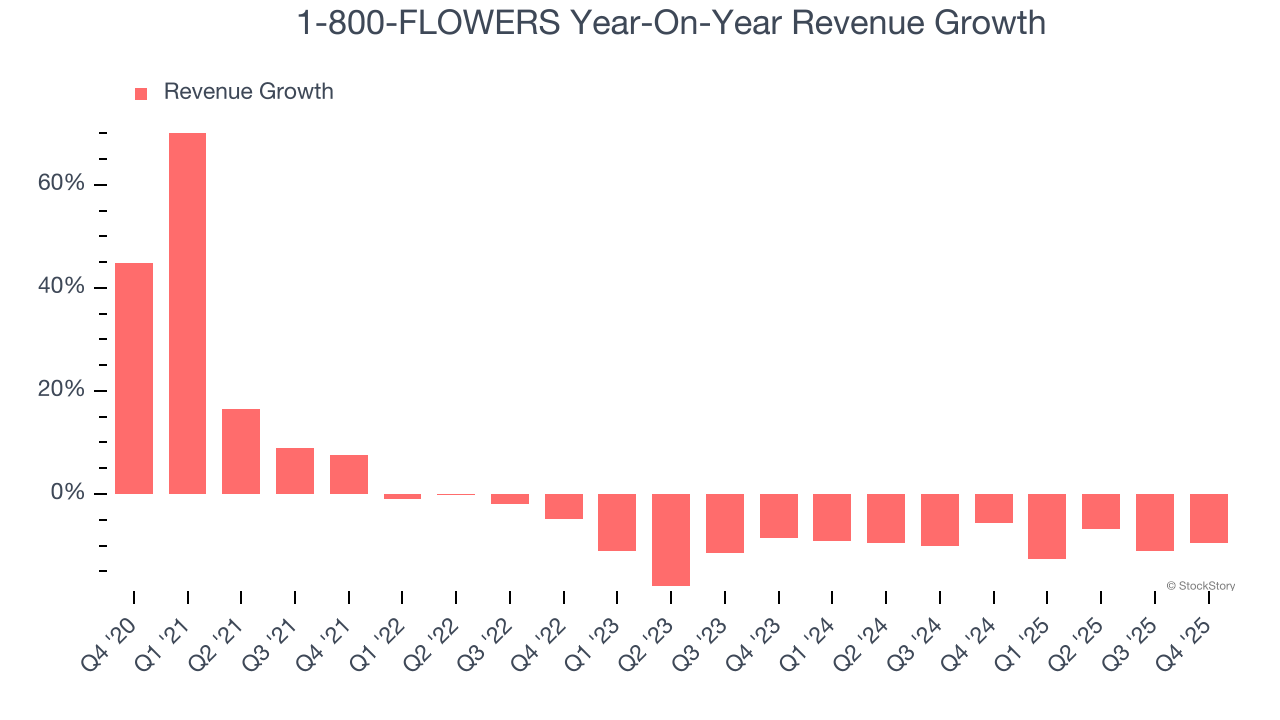

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. 1-800-FLOWERS’s demand was weak over the last five years as its sales fell at a 3.1% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. 1-800-FLOWERS’s recent performance shows its demand remained suppressed as its revenue has declined by 8.8% annually over the last two years.

This quarter, 1-800-FLOWERS reported a rather uninspiring 9.5% year-on-year revenue decline to $702.2 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

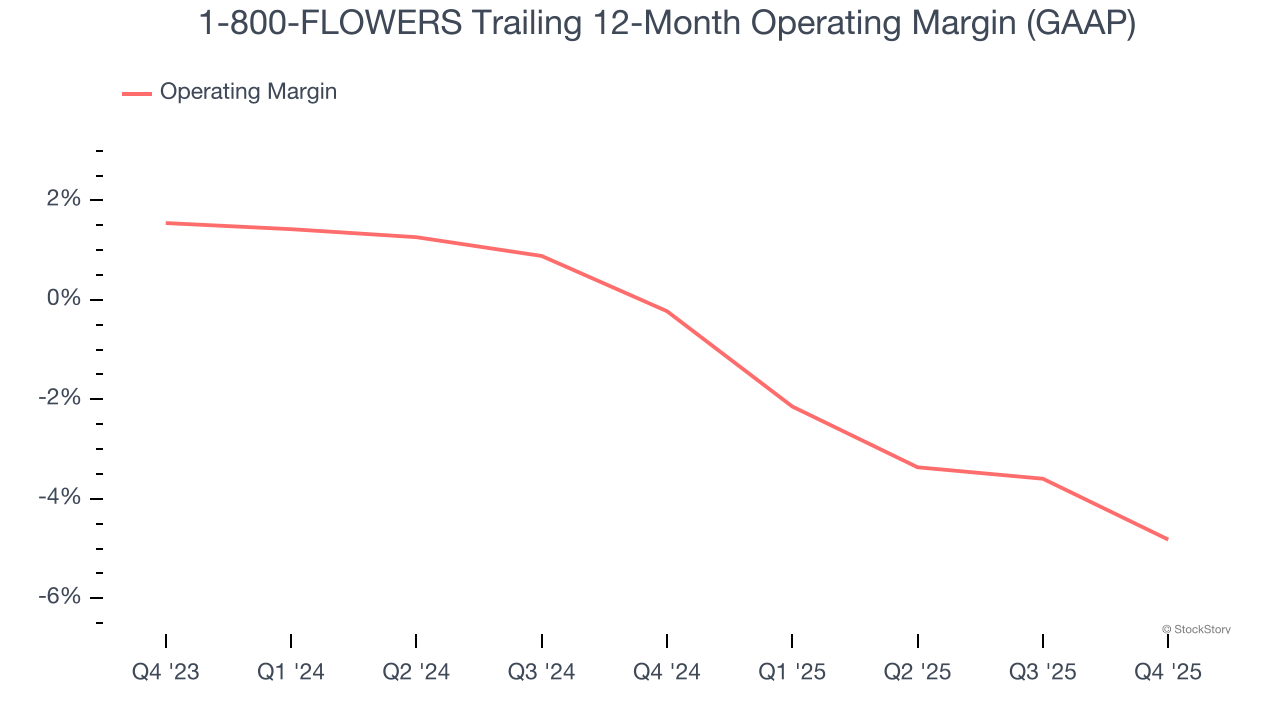

1-800-FLOWERS’s operating margin has been trending down over the last 12 months and averaged negative 2.4% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q4, 1-800-FLOWERS generated an operating margin profit margin of 10.6%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

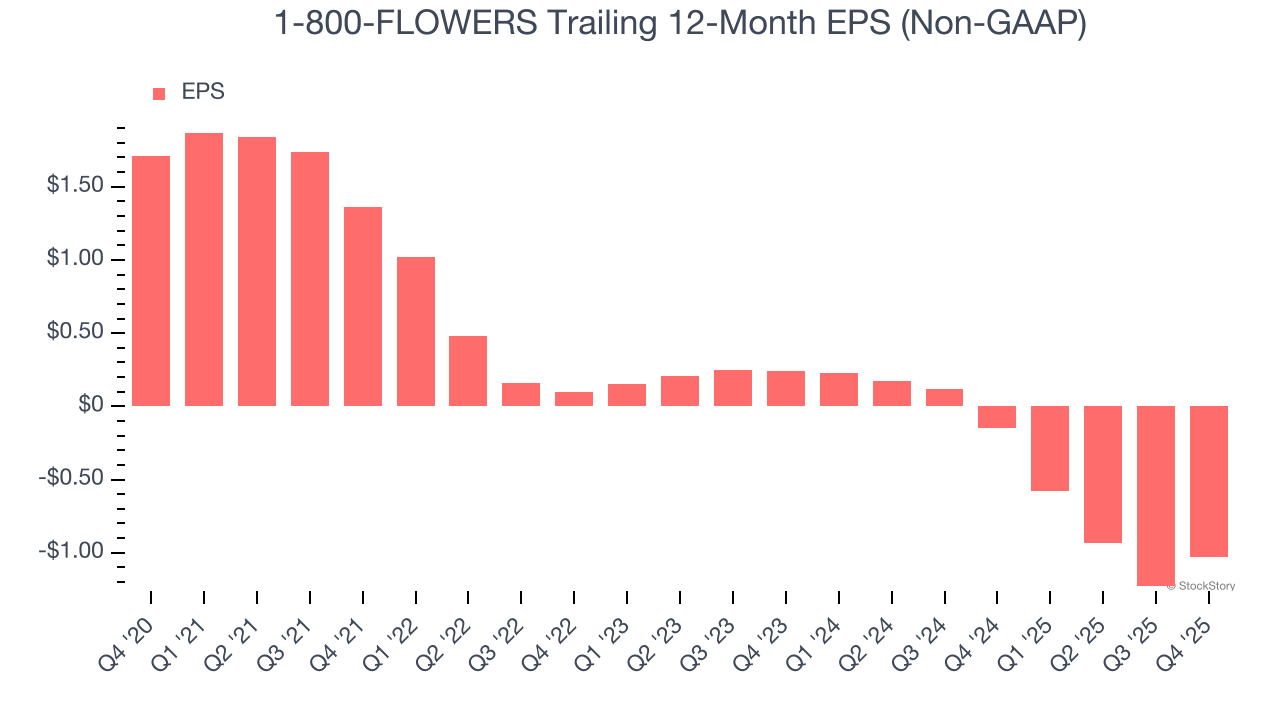

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for 1-800-FLOWERS, its EPS declined by 21.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, 1-800-FLOWERS reported adjusted EPS of $1.20, up from $1 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects 1-800-FLOWERS to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.03 will advance to negative $0.37.

Key Takeaways from 1-800-FLOWERS’s Q4 Results

It was good to see 1-800-FLOWERS beat analysts’ EPS expectations this quarter. Free cash flow margin was strong and improved from the same period last year. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.8% to $4.28 immediately after reporting.

1-800-FLOWERS put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).