Over the past six months, Archer-Daniels-Midland has been a great trade, beating the S&P 500 by 14.6%. Its stock price has climbed to $67.23, representing a healthy 22.8% increase. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Archer-Daniels-Midland, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Archer-Daniels-Midland Will Underperform?

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons we avoid ADM and a stock we'd rather own.

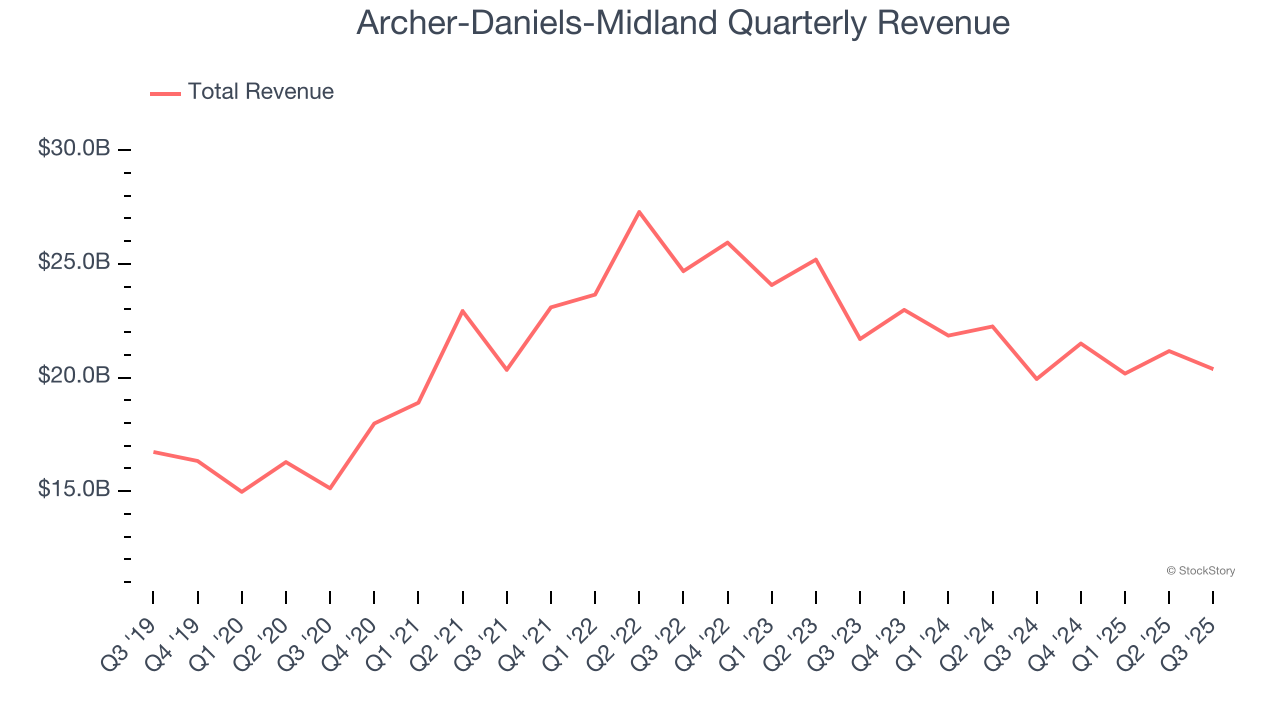

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Archer-Daniels-Midland’s demand was weak over the last three years as its sales fell at a 5.5% annual rate. This was below our standards and signals it’s a low quality business.

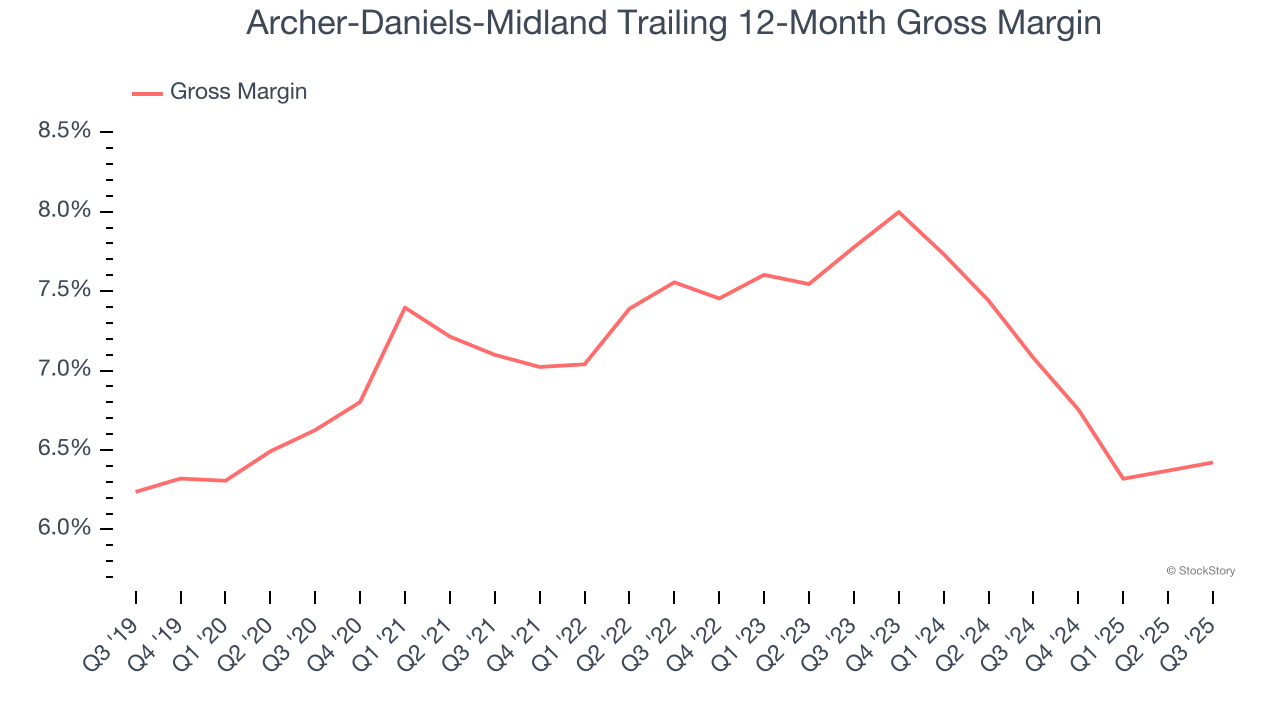

2. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Archer-Daniels-Midland has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 6.8% gross margin over the last two years. That means Archer-Daniels-Midland paid its suppliers a lot of money ($93.24 for every $100 in revenue) to run its business.

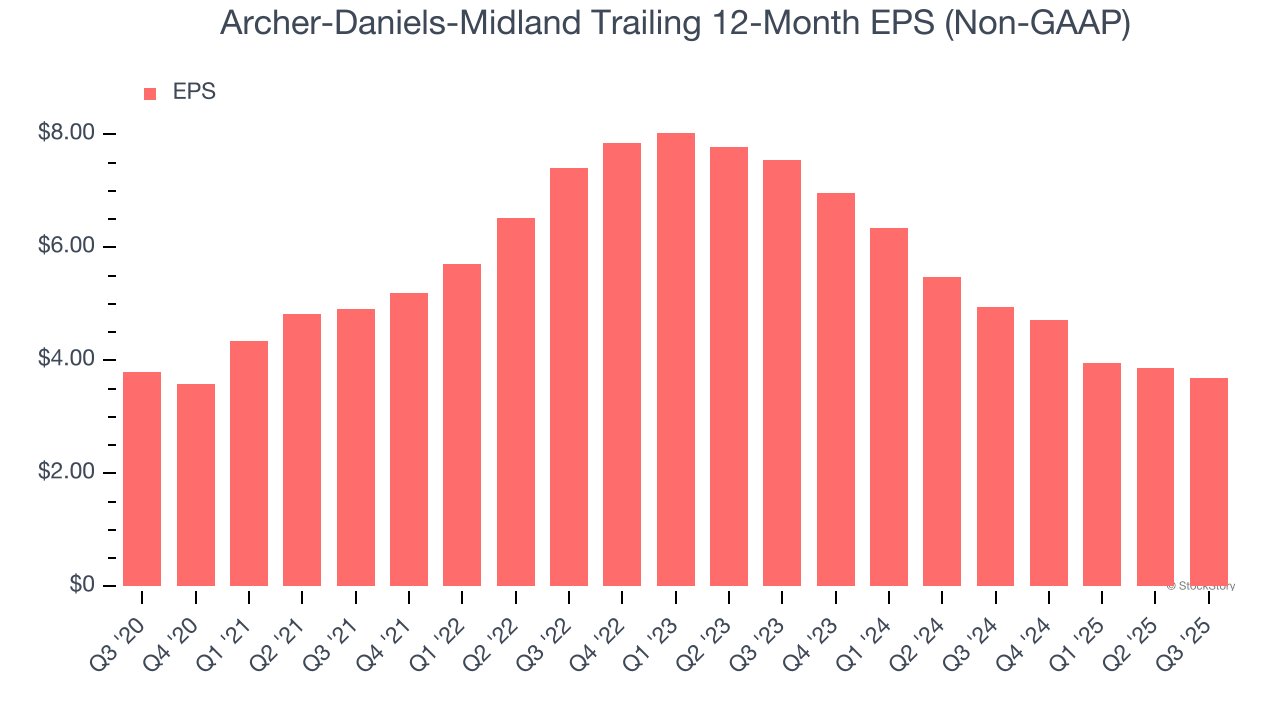

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Archer-Daniels-Midland, its EPS declined by 20.7% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Archer-Daniels-Midland falls short of our quality standards. With its shares topping the market in recent months, the stock trades at 17.4× forward P/E (or $67.23 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.