IoT solutions provider Samsara (NYSE: IOT) announced better-than-expected revenue in Q2 CY2025, with sales up 30.4% year on year to $391.5 million. Guidance for next quarter’s revenue was better than expected at $399 million at the midpoint, 1.2% above analysts’ estimates. Its non-GAAP profit of $0.12 per share was 65.6% above analysts’ consensus estimates.

Is now the time to buy Samsara? Find out by accessing our full research report, it’s free.

Samsara (IOT) Q2 CY2025 Highlights:

- Revenue: $391.5 million vs analyst estimates of $372.3 million (30.4% year-on-year growth, 5.2% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.07 (65.6% beat)

- Adjusted Operating Income: $59.7 million vs analyst estimates of $33.6 million (15.2% margin, 77.6% beat)

- The company lifted its revenue guidance for the full year to $1.58 billion at the midpoint from $1.55 billion, a 1.6% increase

- Management raised its full-year Adjusted EPS guidance to $0.46 at the midpoint, a 15% increase

- Operating Margin: -6.8%, up from -19.4% in the same quarter last year

- Free Cash Flow Margin: 11.3%, down from 12.5% in the previous quarter

- Customers: 2,771 customers paying more than $100,000 annually

- Annual Recurring Revenue: $1.64 billion vs analyst estimates of $1.62 billion (29.8% year-on-year growth, 1% beat)

- Billings: $391.5 million at quarter end, up 16.9% year on year

- Market Capitalization: $20.22 billion

Company Overview

From sensors on vehicles to AI-powered cameras that help prevent accidents, Samsara (NYSE: IOT) is a cloud-based Internet of Things platform that helps businesses improve the safety, efficiency, and sustainability of their physical operations.

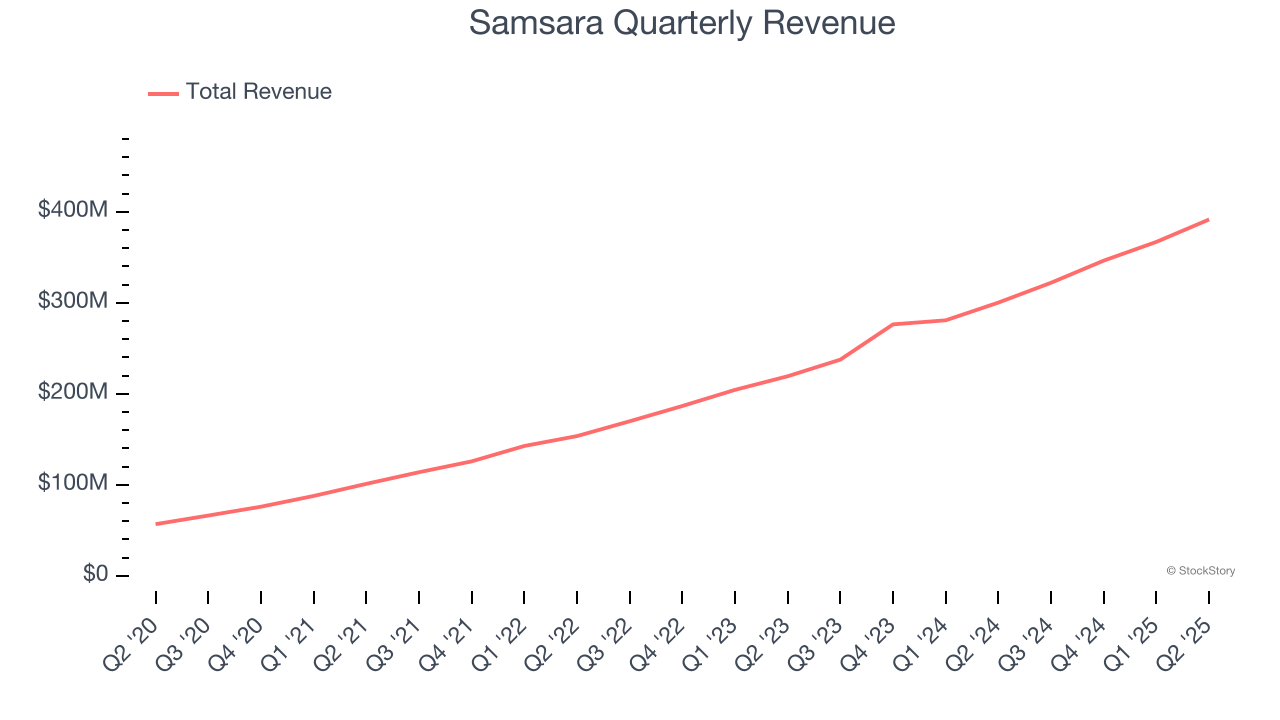

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Samsara’s sales grew at an exceptional 38.6% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Samsara reported wonderful year-on-year revenue growth of 30.4%, and its $391.5 million of revenue exceeded Wall Street’s estimates by 5.2%. Company management is currently guiding for a 23.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.2% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and indicates the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

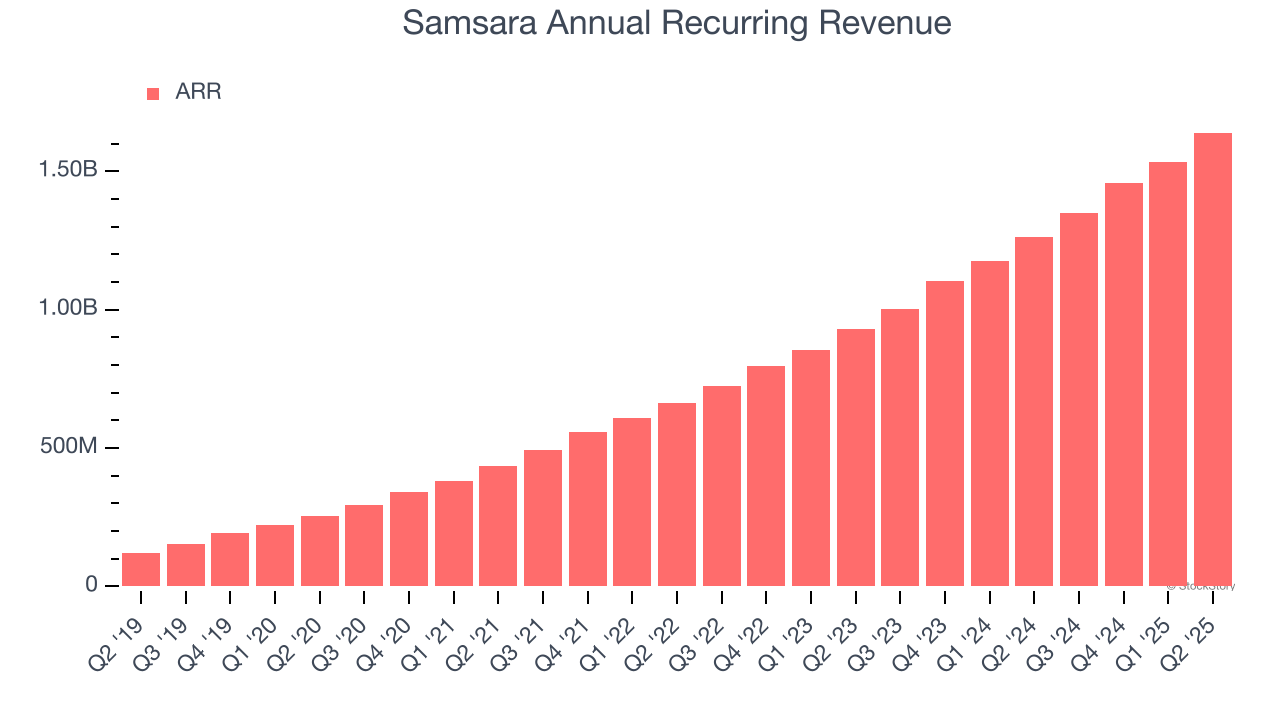

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Samsara’s ARR punched in at $1.64 billion in Q2, and over the last four quarters, its growth was fantastic as it averaged 31.8% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Samsara a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

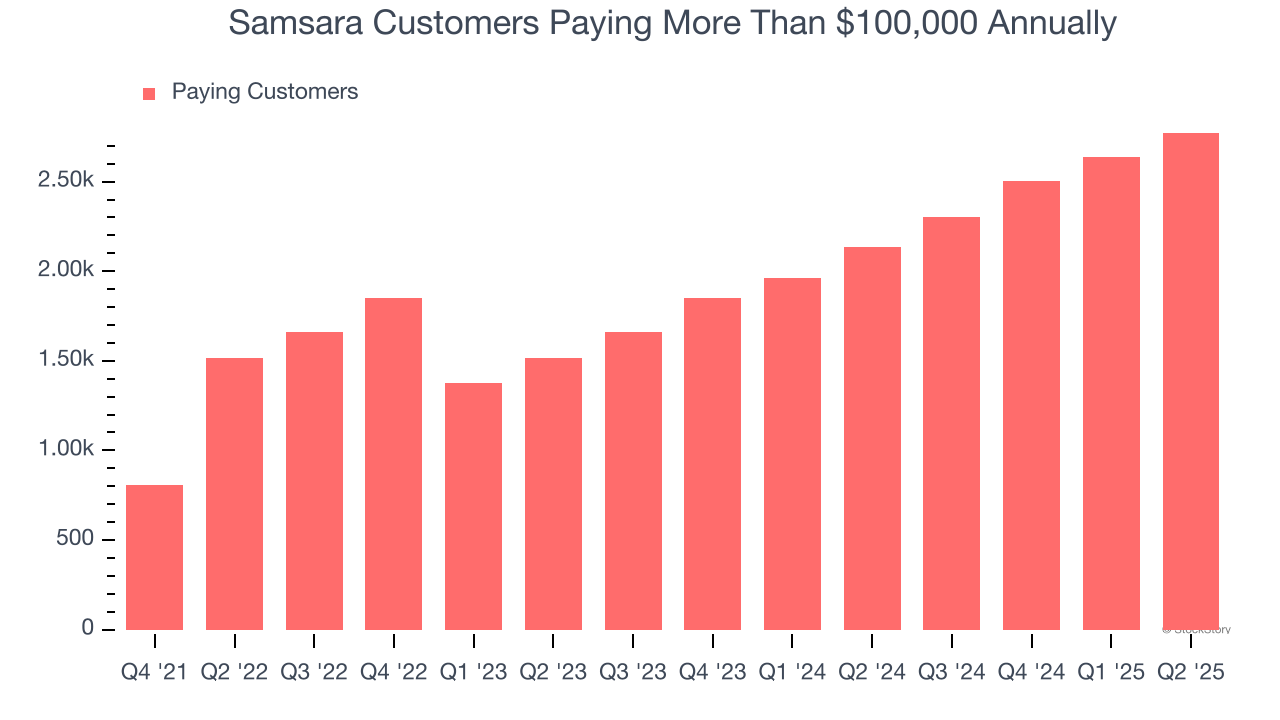

Enterprise Customer Base

This quarter, Samsara reported 2,771 enterprise customers paying more than $100,000 annually, an increase of 133 from the previous quarter. That’s in line with the number of contract wins in the last quarter and quite a bit above what we’ve seen over the previous year, confirming that the company is maintaining its sales momentum.

Key Takeaways from Samsara’s Q2 Results

This was a beat and raise quarter. Revenue and adjusted operating income beat convincingly, which was impressive. We also liked Samsara’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 7.4% to $38.50 immediately after reporting.

Samsara had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.