Since March 2025, Strategic Education has been in a holding pattern, posting a small loss of 2.4% while floating around $79.30. The stock also fell short of the S&P 500’s 10.5% gain during that period.

Is now the time to buy Strategic Education, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Strategic Education Will Underperform?

We're cautious about Strategic Education. Here are three reasons there are better opportunities than STRA and a stock we'd rather own.

1. Weak Growth in Domestic Students Points to Soft Demand

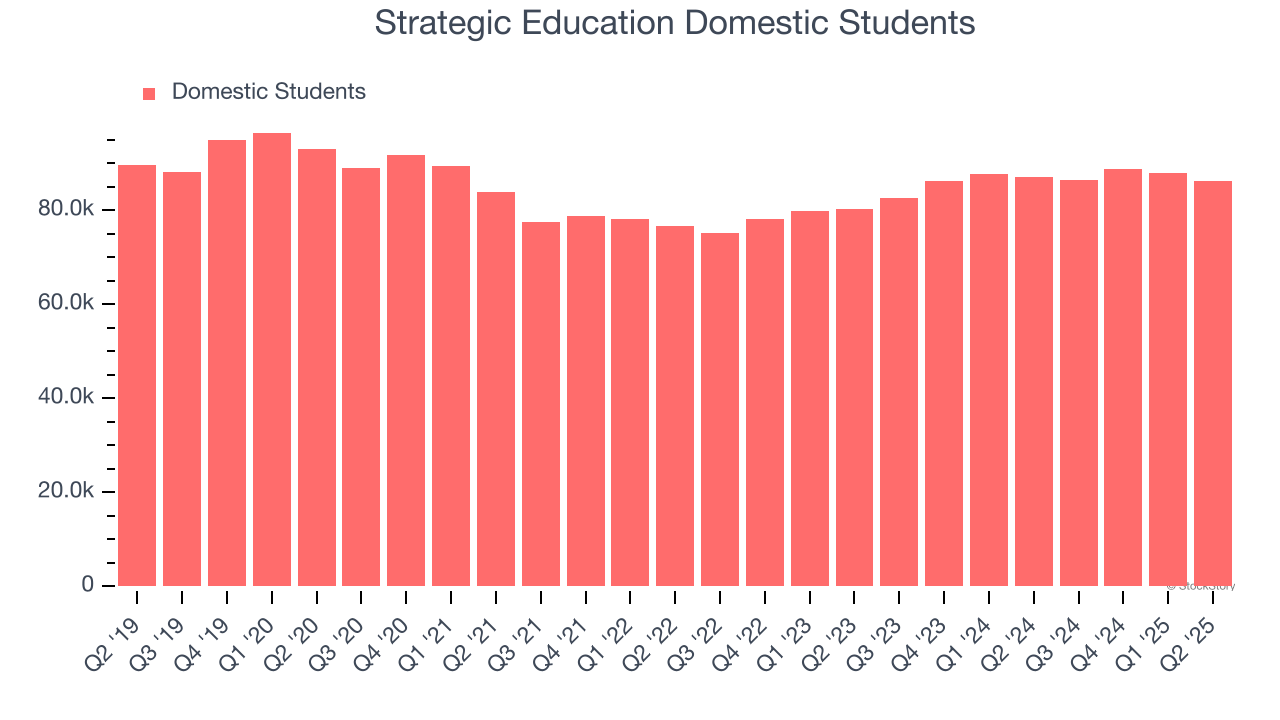

Revenue growth can be broken down into changes in price and volume (for companies like Strategic Education, our preferred volume metric is domestic students). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Strategic Education’s domestic students came in at 86,339 in the latest quarter, and over the last two years, averaged 5.7% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

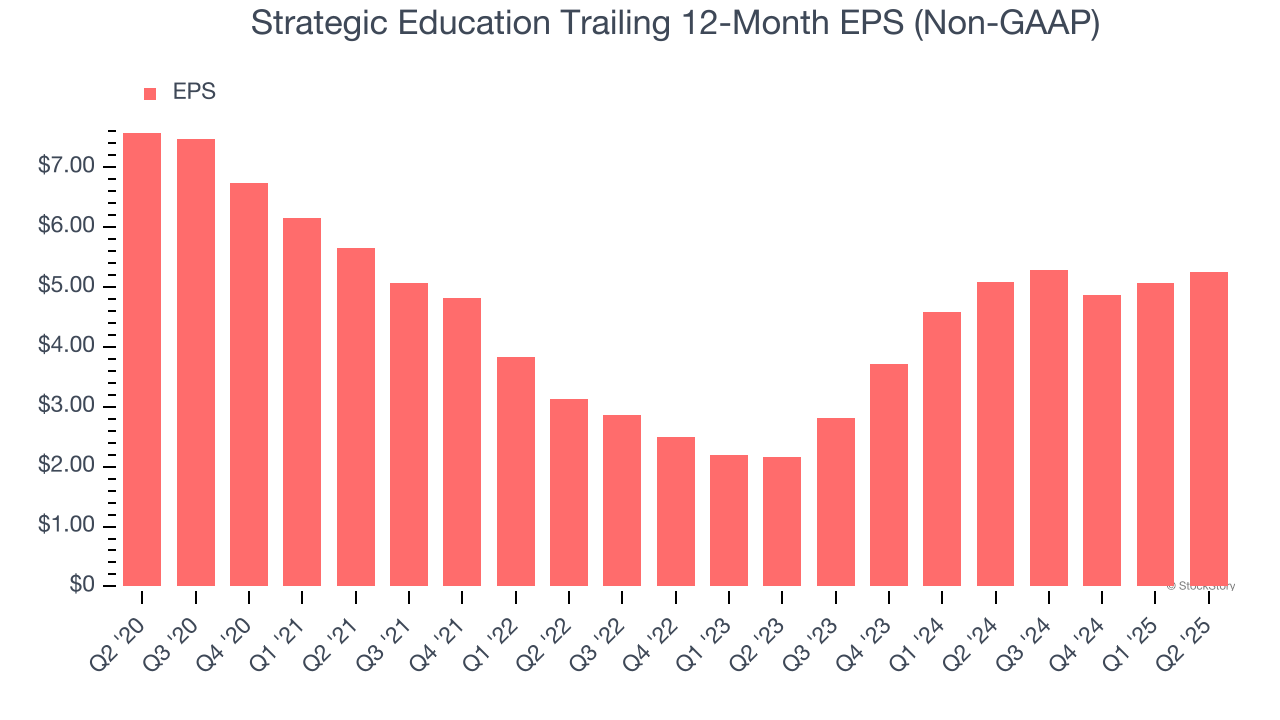

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Strategic Education, its EPS declined by 7.1% annually over the last five years while its revenue grew by 3.9%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Impressed

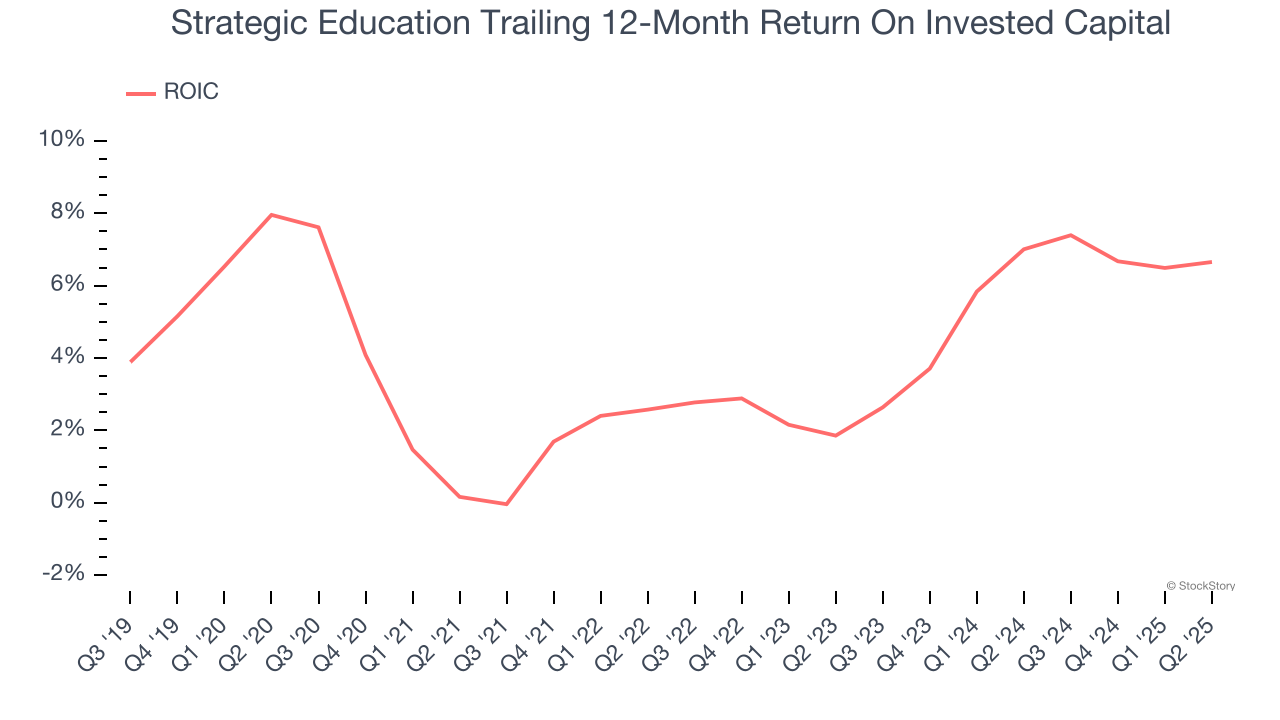

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Strategic Education historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.7%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Strategic Education, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 13.4× forward P/E (or $79.30 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than Strategic Education

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.