Aircraft leasing company Air Lease Corporation (NYSE: AL) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 11.3% year on year to $738.3 million. Its non-GAAP profit of $1.51 per share was 28% above analysts’ consensus estimates.

Is now the time to buy Air Lease? Find out by accessing our full research report, it’s free.

Air Lease (AL) Q1 CY2025 Highlights:

- Revenue: $738.3 million vs analyst estimates of $710.5 million (11.3% year-on-year growth, 3.9% beat)

- Adjusted EPS: $1.51 vs analyst estimates of $1.18 (28% beat)

- Adjusted EBITDA: $788.3 million vs analyst estimates of $633.7 million (107% margin, 24.4% beat)

- Operating Margin: 63.9%, up from 49.8% in the same quarter last year

- Free Cash Flow was -$197.4 million compared to -$459.4 million in the same quarter last year

- owned aircraft: 487, up 15 year on year

- Market Capitalization: $5.38 billion

“AL had a strong quarter with fleet expansion, healthy sales gains, significant insurance settlements related to our aircraft in Russia, and achieving our target debt to equity ratio which now allows us to consider all capital allocation opportunities. To date, we have no aircraft delivering to any country that has announced reciprocal tariffs applicable to aircraft. We continue to benefit from robust global aircraft demand in both leasing and aircraft trading as significant aircraft supply constraints persist,” said John L. Plueger, Chief Executive Officer and President.

Company Overview

Established by a founder of Century City in Los Angeles, Air Lease Corporation (NYSE: AL) provides aircraft leasing and financing solutions to airlines worldwide.

Sales Growth

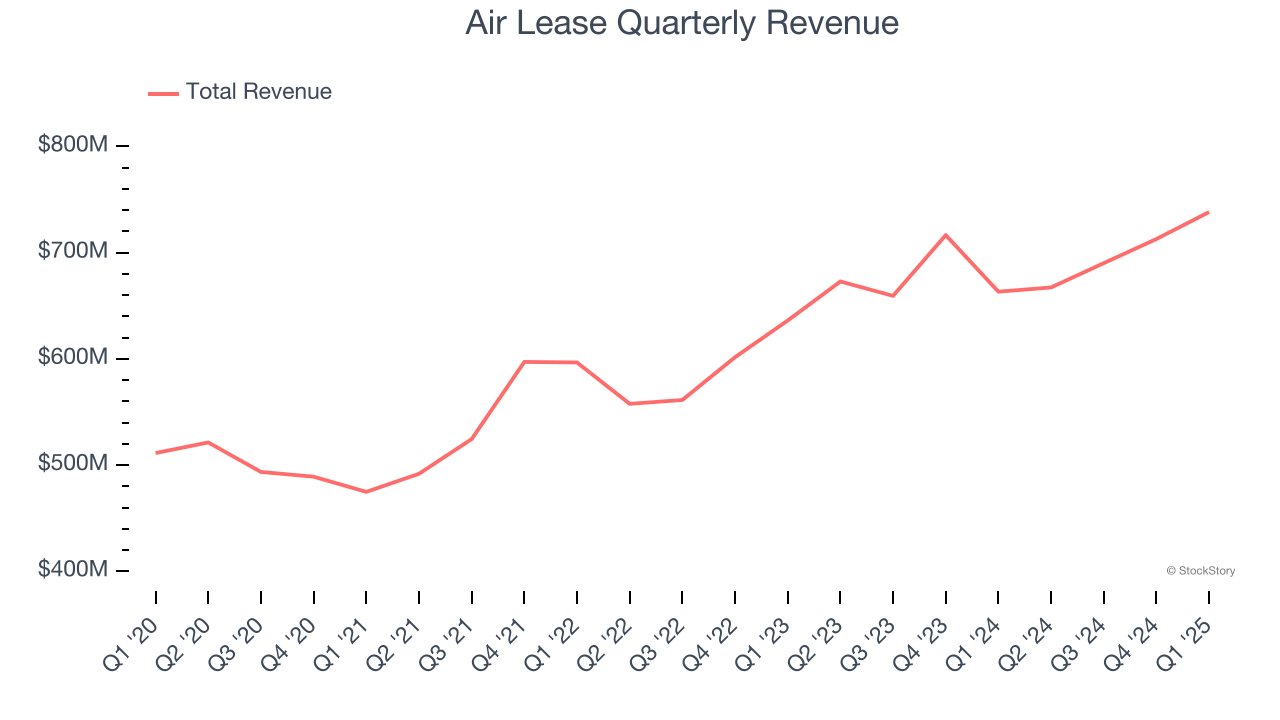

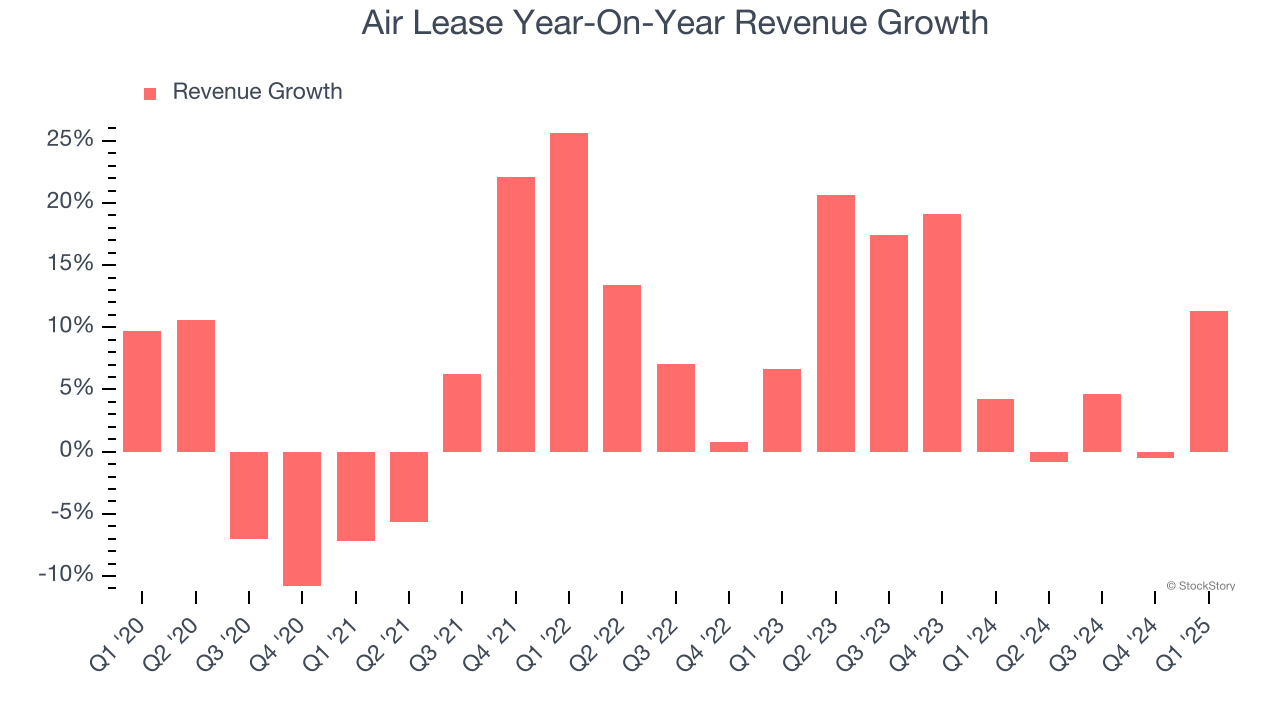

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Air Lease grew its sales at a mediocre 6.4% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Air Lease’s annualized revenue growth of 9.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

Air Lease also discloses its number of owned aircraft, which reached 487 in the latest quarter. Over the last two years, Air Lease’s owned aircraft averaged 8.3% year-on-year growth. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Air Lease reported year-on-year revenue growth of 11.3%, and its $738.3 million of revenue exceeded Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

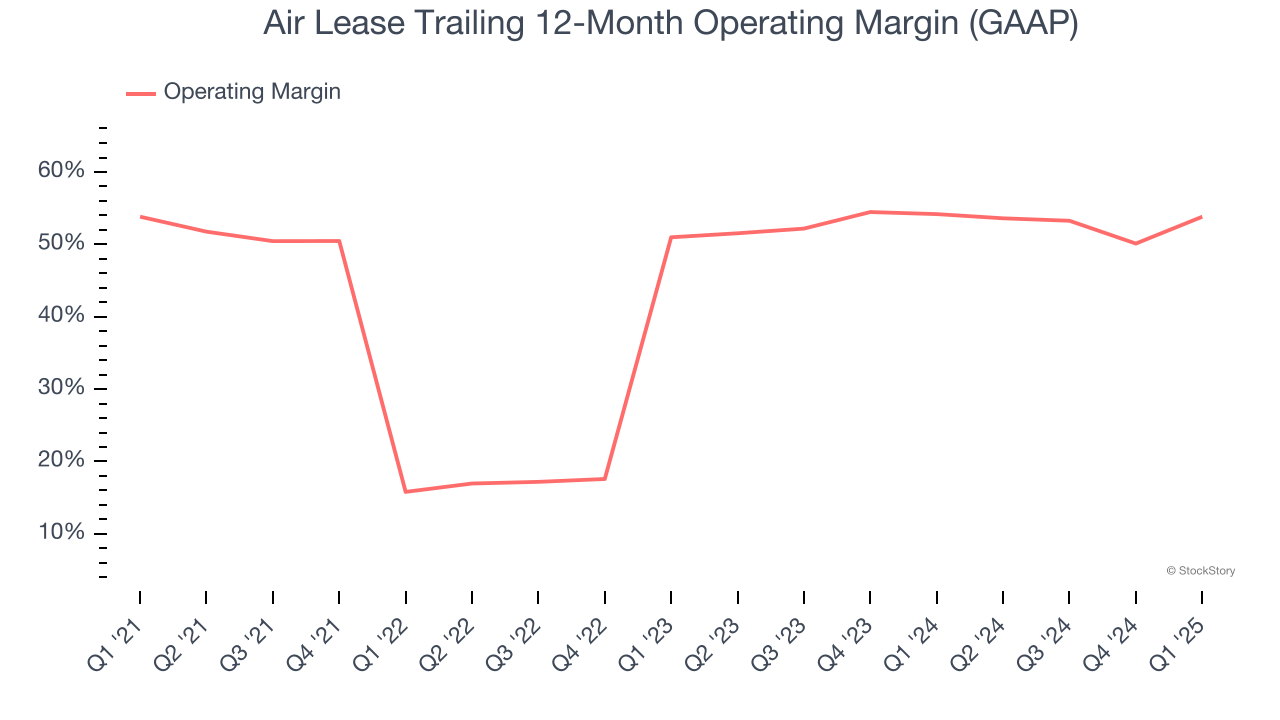

Air Lease has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 46.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Air Lease’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Air Lease generated an operating profit margin of 63.9%, up 14.1 percentage points year on year. The increase was solid and shows its expenses recently grew slower than its revenue, leading to higher efficiency.

Earnings Per Share

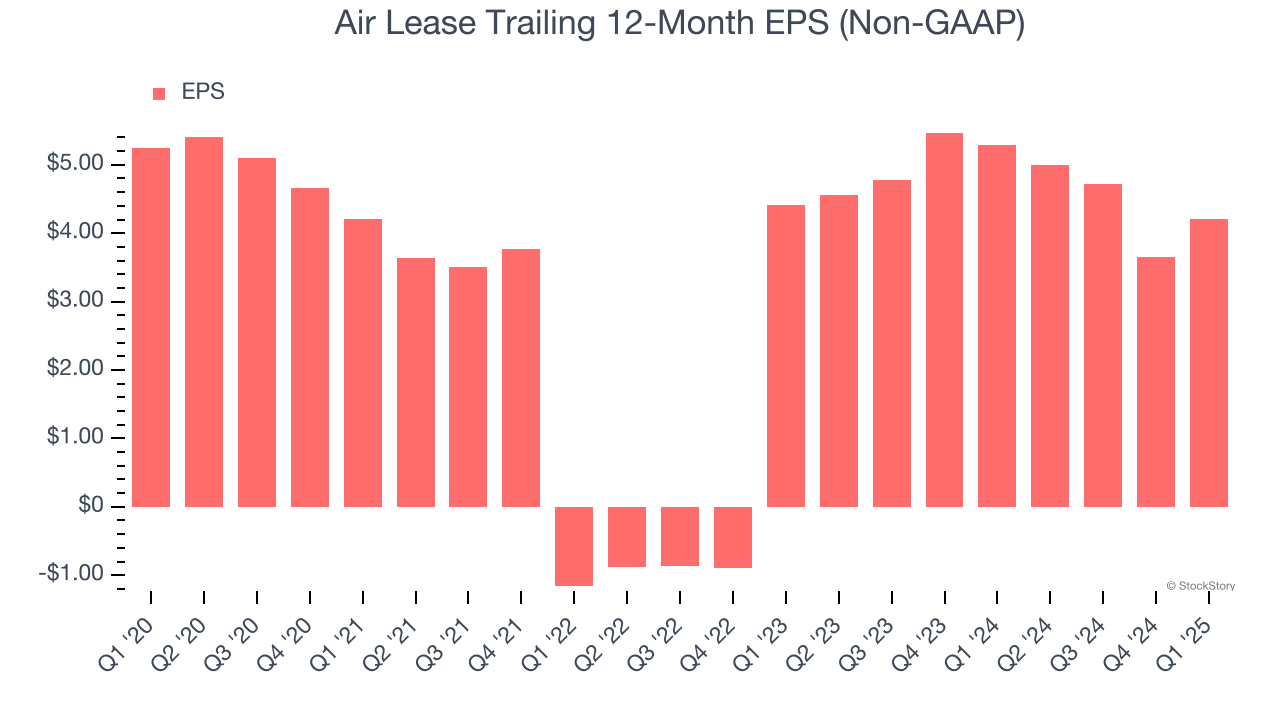

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Air Lease, its EPS declined by 4.3% annually over the last five years while its revenue grew by 6.4%. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Air Lease, its two-year annual EPS declines of 2.3% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q1, Air Lease reported EPS at $1.51, up from $0.95 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Air Lease’s Q1 Results

We were impressed by how significantly Air Lease blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 2.7% to $50.05 immediately after reporting.

Sure, Air Lease had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.