Tesla currently trades at $255.91 and has been a dream stock for shareholders. It’s returned 441% since April 2020, blowing past the S&P 500’s 90.9% gain. The company has also beaten the index over the past six months as its stock price is up 16.8%.

Is there a buying opportunity in Tesla, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We’re glad investors have benefited from the price increase, but we don't have much confidence in Tesla. Here are three reasons why you should be careful with TSLA and a stock we'd rather own.

Why Is Tesla Not Exciting?

Originally founded by Martin Eberhard and Marc Tarpenning in 2003, Tesla (NASDAQ: TSLA) is an electric vehicle company accelerating the world’s transition to sustainable energy.

1. Low Gross Margin Reveals Weak Structural Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Tesla has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

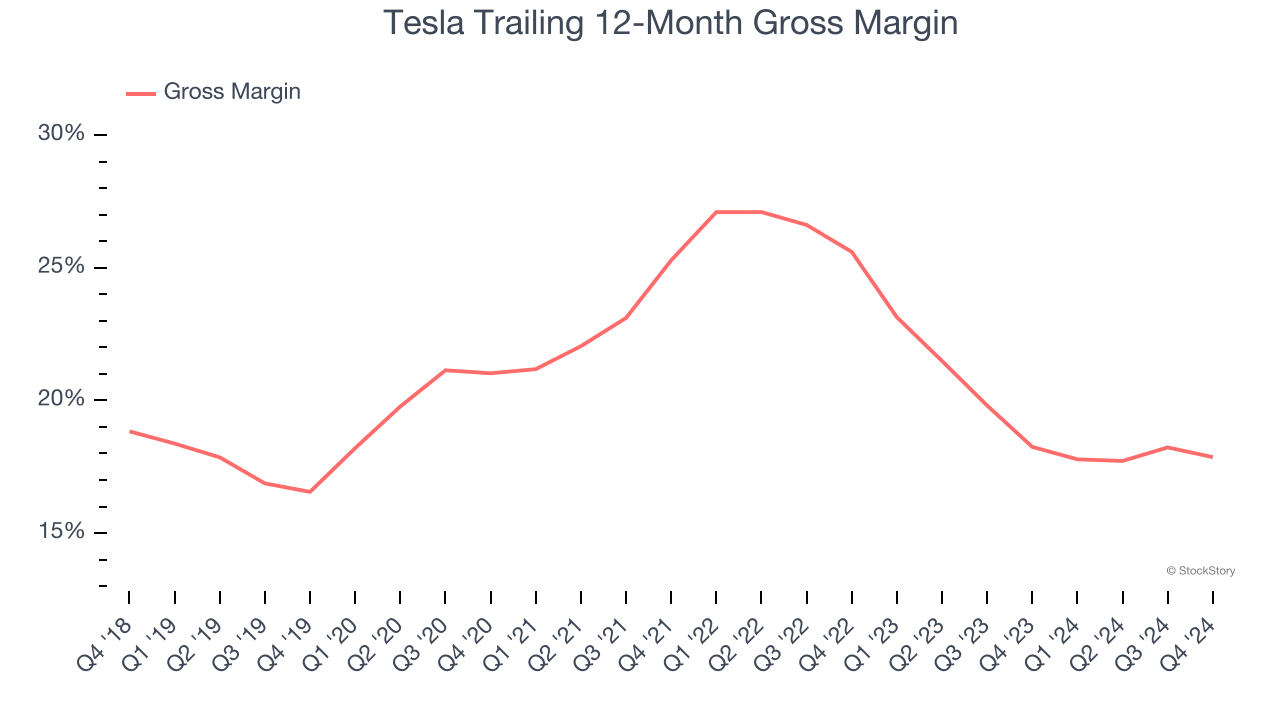

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants such as Rivian and Lucid have negative gross margins. As you can see below, these dynamics culminated in an average 21.1% gross margin for Tesla over the last five years.

2. EPS Took a Dip Over the Last Two Years

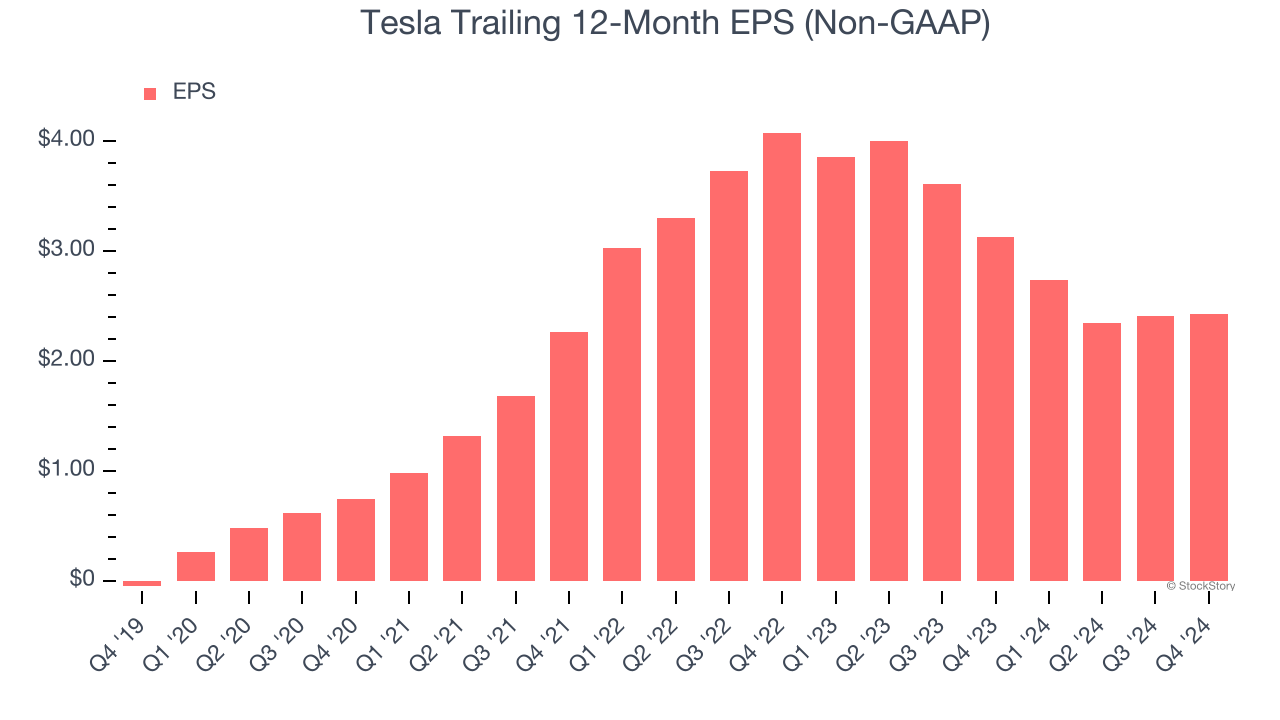

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Tesla, its EPS declined by 22.9% annually over the last two years while its revenue grew by 9.5%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

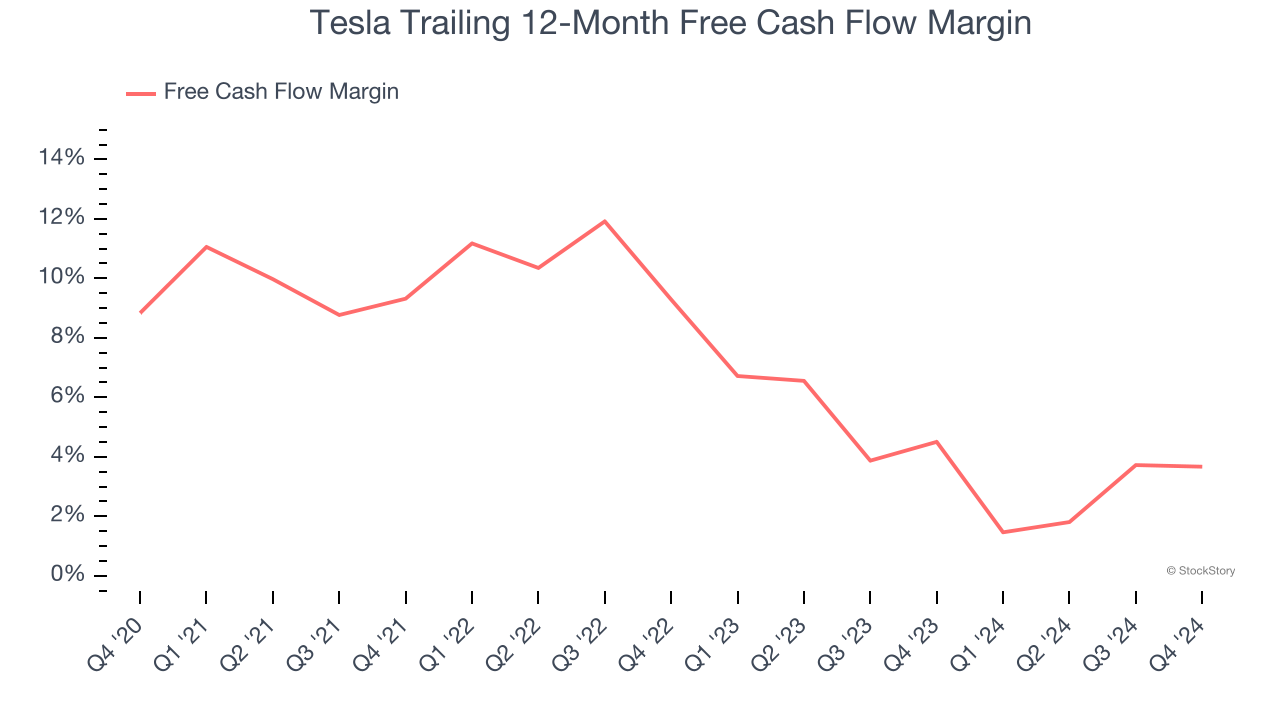

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Tesla’s margin dropped by 5.2 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle as it pursues new AI technologies such as a robotaxi or humanoid robot fleet. Tesla’s free cash flow margin for the trailing 12 months was 3.7%.

Final Judgment

Tesla isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 77.7× forward price-to-earnings (or $255.91 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Tesla

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.