Over the last six months, ServiceNow shares have sunk to $797, producing a disappointing 15.6% loss - worse than the S&P 500’s 7.2% drop. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy NOW? Find out in our full research report, it’s free.

Why Are We Positive On ServiceNow?

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE: NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

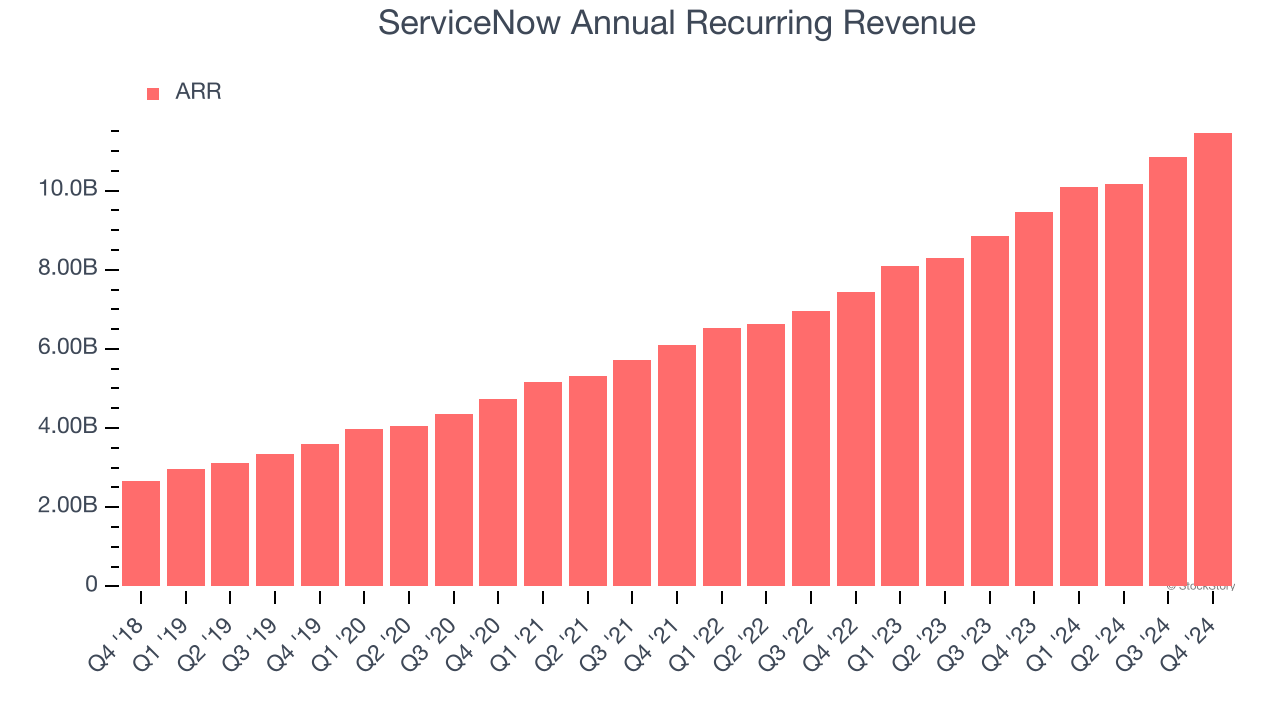

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

ServiceNow’s ARR punched in at $11.46 billion in Q4, and over the last four quarters, its year-on-year growth averaged 22.7%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes ServiceNow a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

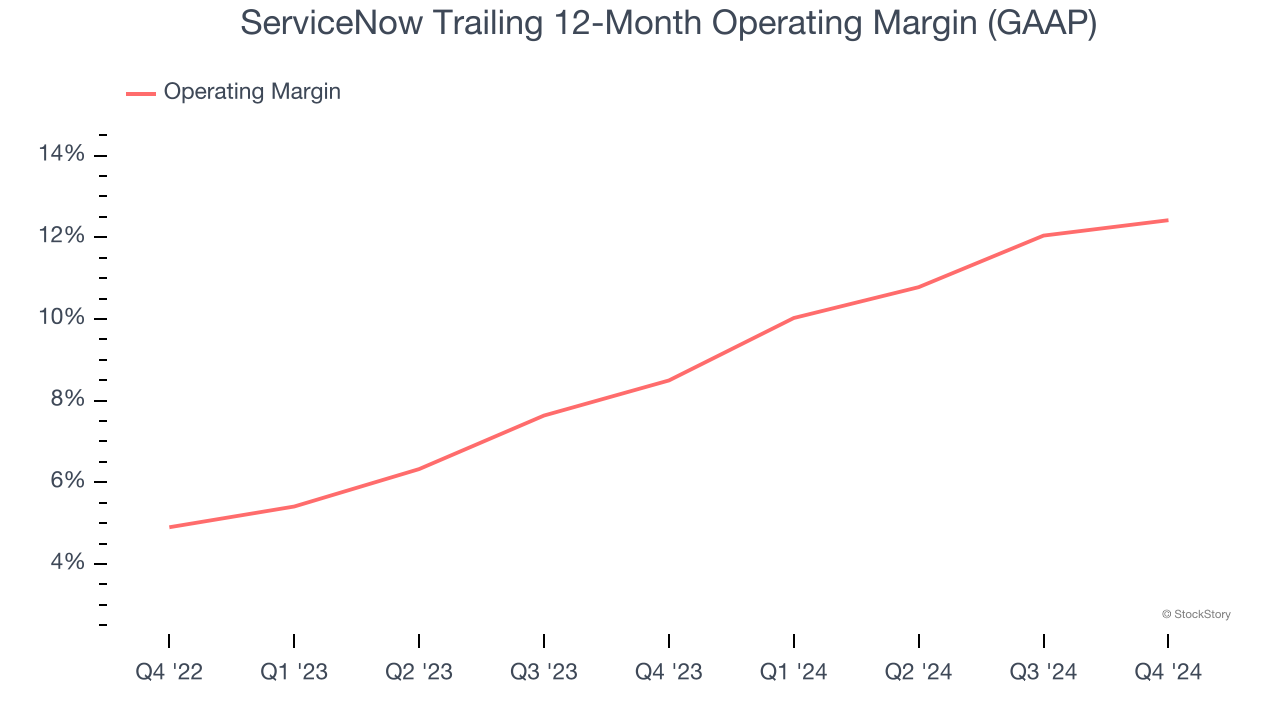

2. Operating Margin Reveals a Well-Run Organization

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

ServiceNow has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 12.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

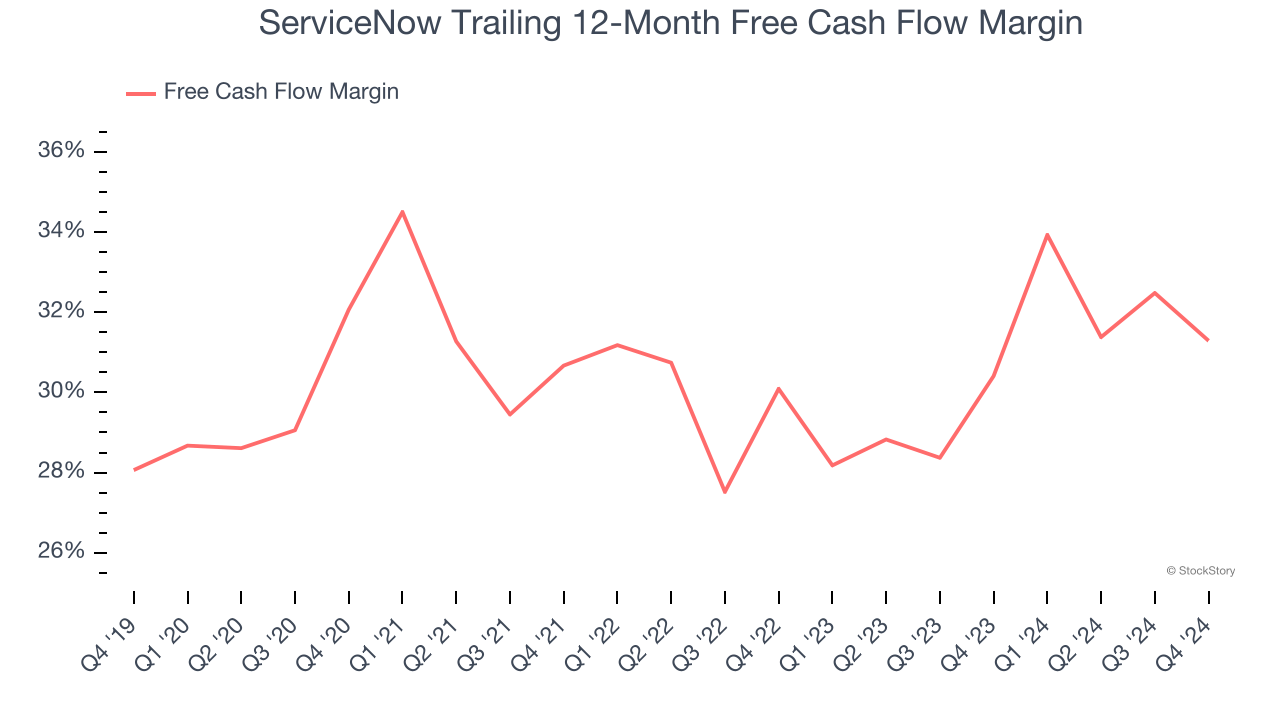

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

ServiceNow has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.3% over the last year.

Final Judgment

These are just a few reasons ServiceNow is a rock-solid business worth owning. With the recent decline, the stock trades at 12.6× forward price-to-sales (or $797 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than ServiceNow

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.