Refrigerant services company Hudson Technologies (NASDAQ: HDSN) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 22.8% year on year to $34.64 million. Its GAAP loss of $0.06 per share was $0.03 below analysts’ consensus estimates.

Is now the time to buy Hudson Technologies? Find out by accessing our full research report, it’s free.

Hudson Technologies (HDSN) Q4 CY2024 Highlights:

- Revenue: $34.64 million vs analyst estimates of $37.96 million (22.8% year-on-year decline, 8.7% miss)

- EPS (GAAP): -$0.06 vs analyst estimates of -$0.03 ($0.03 miss)

- Operating Margin: -9.4%, down from 10.6% in the same quarter last year

- Free Cash Flow Margin: 55.3%, up from 30.5% in the same quarter last year

- Market Capitalization: $252.7 million

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies, commented, “Our fourth quarter 2024 results reflected the seasonally slower sales activity we have historically seen outside of our nine-month selling season. Full year 2024 results reflected a challenging selling season in which market pricing for certain HFC refrigerants declined by up to 45% from last year’s levels which more than offset the slight gains we achieved in sales volume. The decline in refrigerant pricing was driven by higher than anticipated inventory levels up stream in the marketplace built up in advance of the HFC phaseout. During our many decades in this industry, we have successfully weathered unfavorable pricing environments by staying focused on what we can control – ensuring that our customers have the right refrigerants where and when they need them and promoting recovery and reclamation activities as our industry transitions to lower GWP equipment and refrigerants. We navigated 2024 with that focus and remain committed to our operating strategy. In fact, our overall reclaim activity increased 18% in 2024.

Company Overview

Founded in 1991, Hudson Technologies (NASDAQ: HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Sales Growth

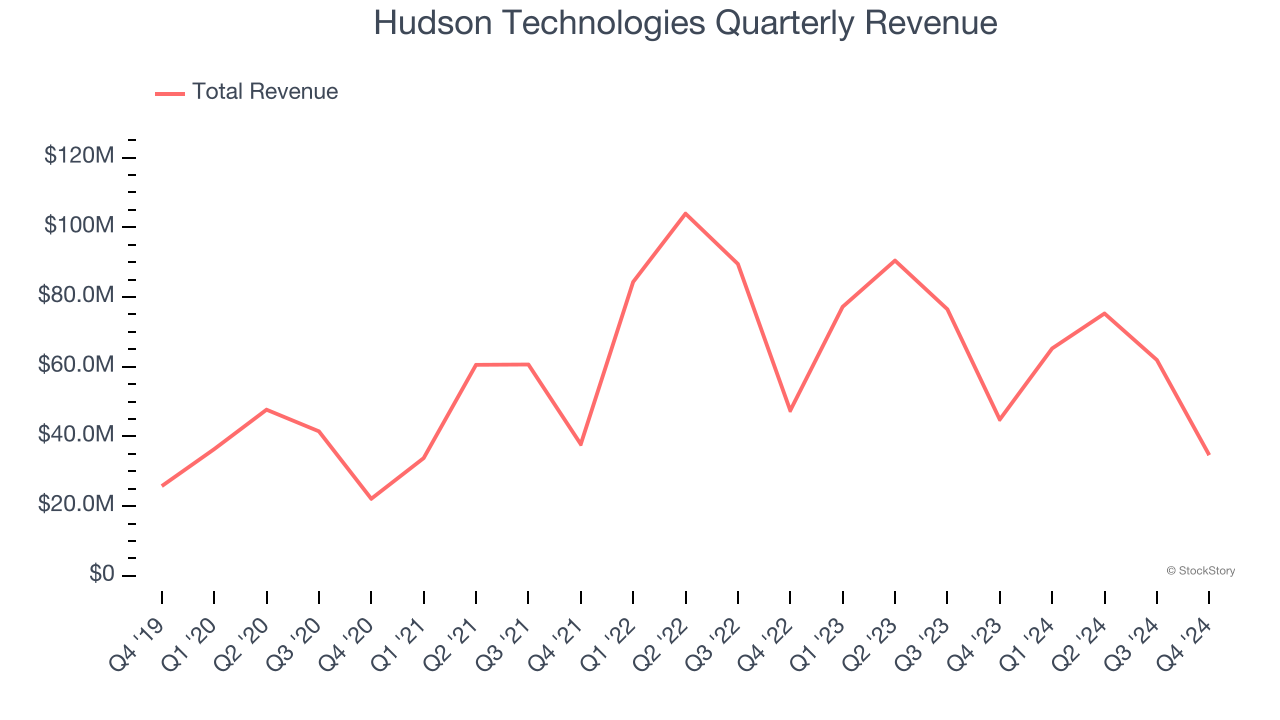

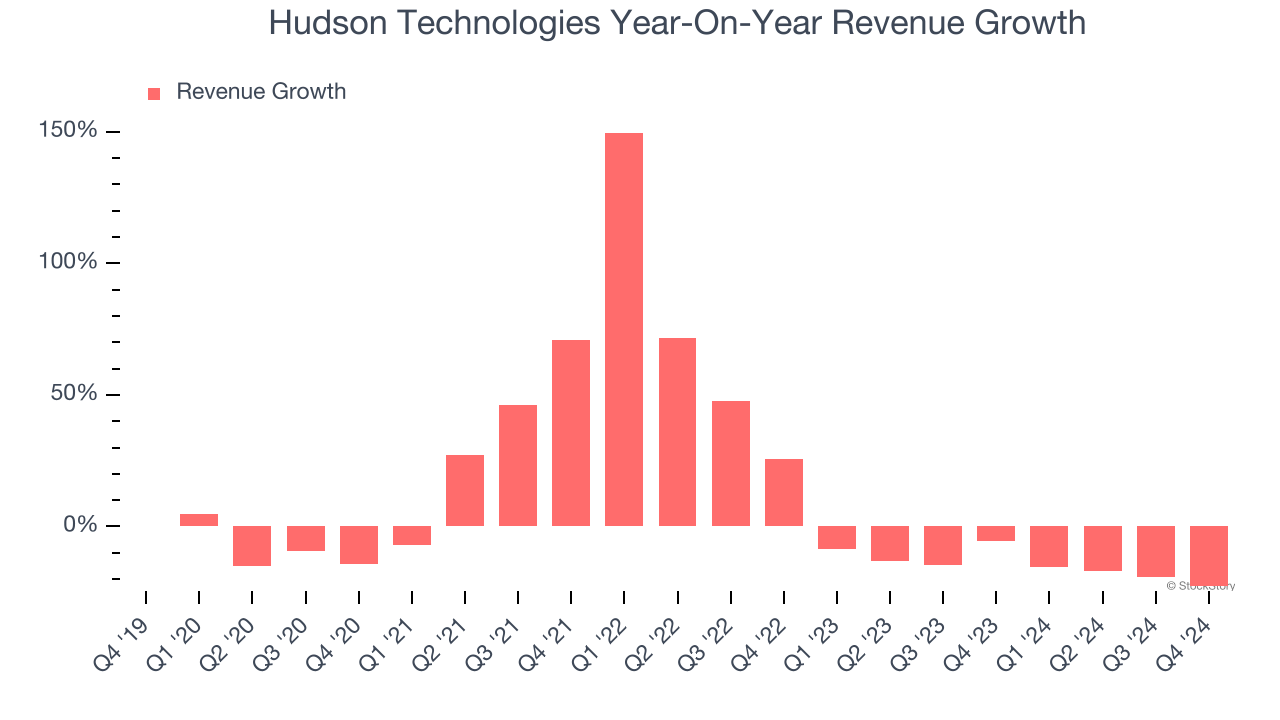

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Hudson Technologies’s 7.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hudson Technologies’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 14.6% over the last two years.

This quarter, Hudson Technologies missed Wall Street’s estimates and reported a rather uninspiring 22.8% year-on-year revenue decline, generating $34.64 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 1.2% over the next 12 months. While this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand. At least Hudson Technologies is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

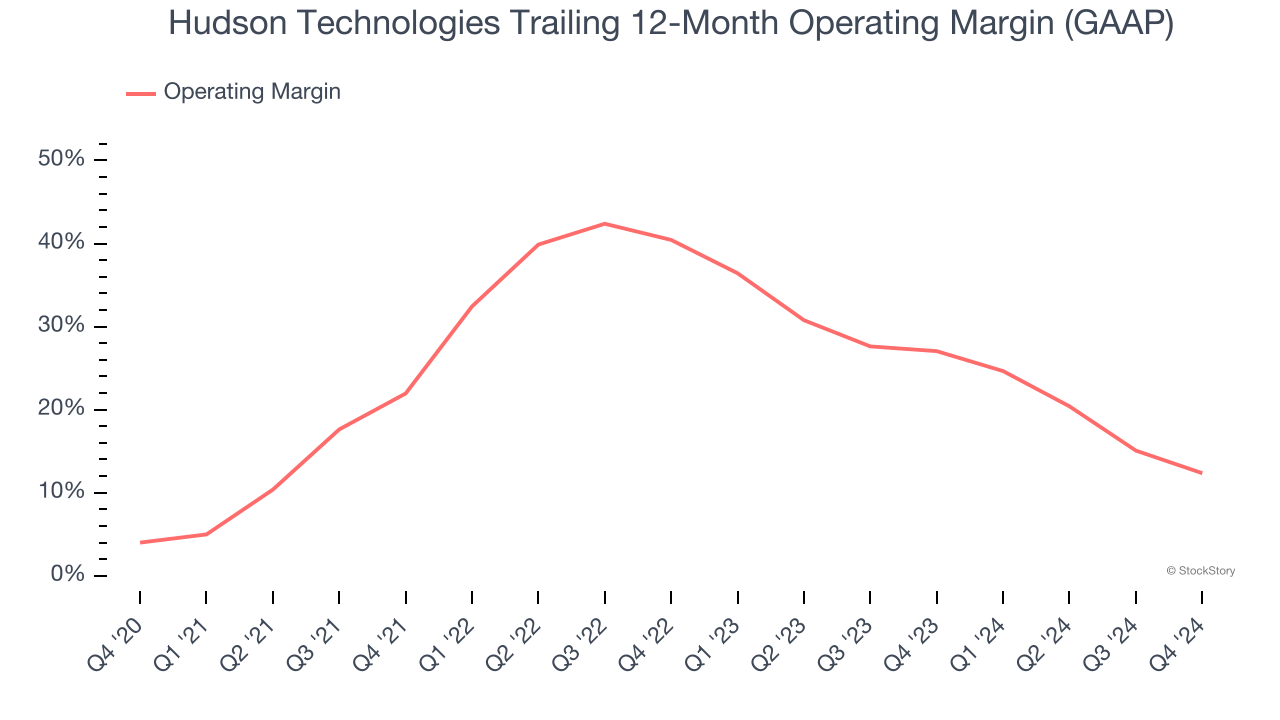

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hudson Technologies has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Hudson Technologies’s operating margin rose by 8.4 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Hudson Technologies generated an operating profit margin of negative 9.4%, down 19.9 percentage points year on year. Since Hudson Technologies’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

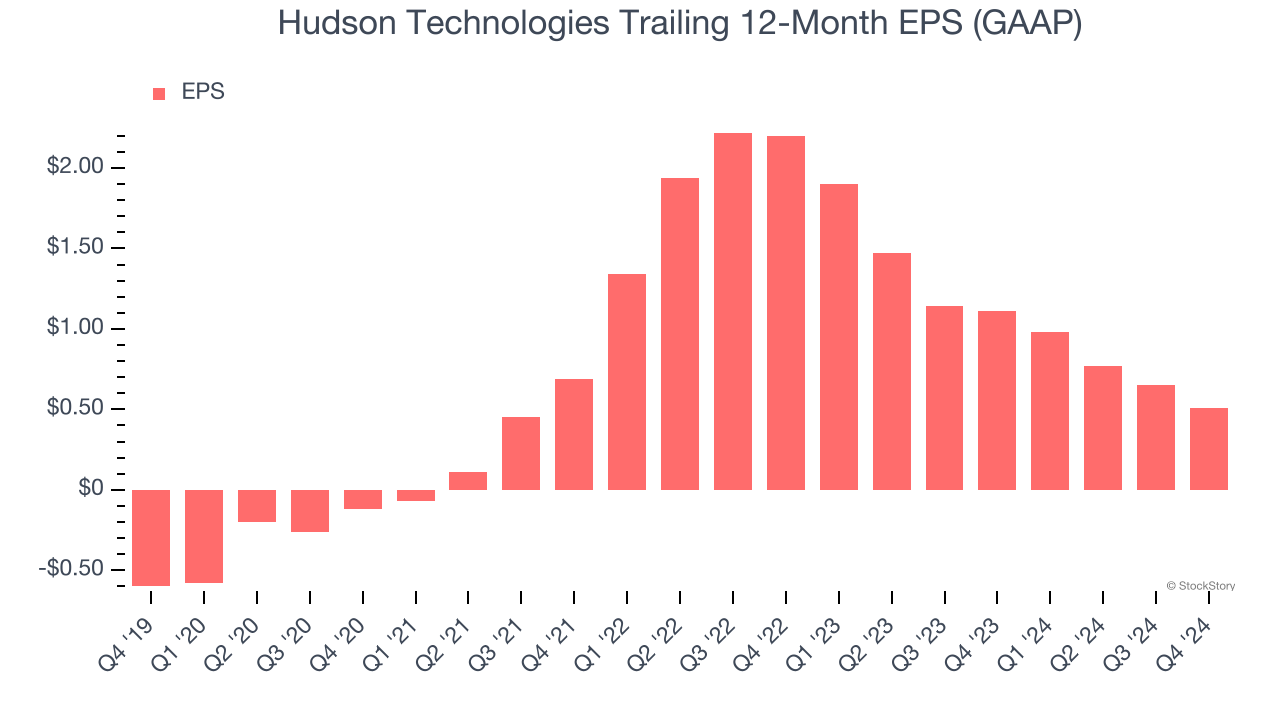

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hudson Technologies’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Hudson Technologies, its EPS declined by more than its revenue over the last two years, dropping 51.9%. This tells us the company struggled to adjust to shrinking demand.

We can take a deeper look into Hudson Technologies’s earnings to better understand the drivers of its performance. Hudson Technologies’s operating margin has declined by 24.3 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Hudson Technologies reported EPS at negative $0.06, down from $0.08 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Hudson Technologies to perform poorly. Analysts forecast its full-year EPS of $0.51 will hit $0.45.

Key Takeaways from Hudson Technologies’s Q4 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.2% to $5.25 immediately after reporting.

Hudson Technologies’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.