Insurance industry-focused software maker Guidewire (NYSE: GWRE) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 20.2% year on year to $289.5 million. Guidance for next quarter’s revenue was optimistic at $286 million at the midpoint, 2.3% above analysts’ estimates. Its non-GAAP profit of $0.51 per share was in line with analysts’ consensus estimates.

Is now the time to buy Guidewire? Find out by accessing our full research report, it’s free.

Guidewire (GWRE) Q4 CY2024 Highlights:

- Revenue: $289.5 million vs analyst estimates of $285.4 million (20.2% year-on-year growth, 1.4% beat)

- Adjusted EPS: $0.51 vs analyst estimates of $0.51 (in line)

- Adjusted Operating Income: $53.95 million vs analyst estimates of $42.64 million (18.6% margin, 26.5% beat)

- The company slightly lifted its revenue guidance for the full year to $1.17 billion at the midpoint from $1.16 billion

- Operating Margin: 4%, up from -5.2% in the same quarter last year

- Free Cash Flow was $82.28 million, up from -$67.38 million in the previous quarter

- Annual Recurring Revenue: $918.1 million at quarter end, up 14.8% year on year

- Market Capitalization: $16.49 billion

Company Overview

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE: GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

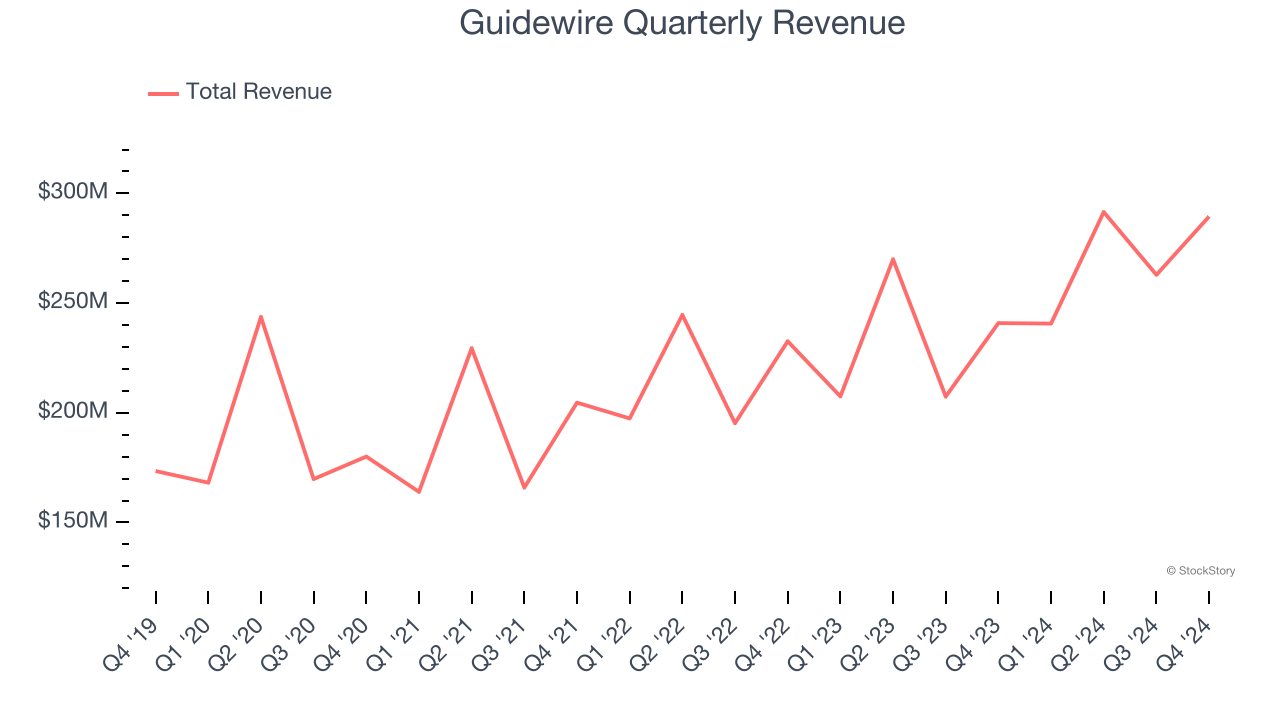

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Guidewire grew its sales at a 12.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Guidewire reported robust year-on-year revenue growth of 20.2%, and its $289.5 million of revenue topped Wall Street estimates by 1.4%. Company management is currently guiding for a 18.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.4% over the next 12 months, an acceleration versus the last three years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

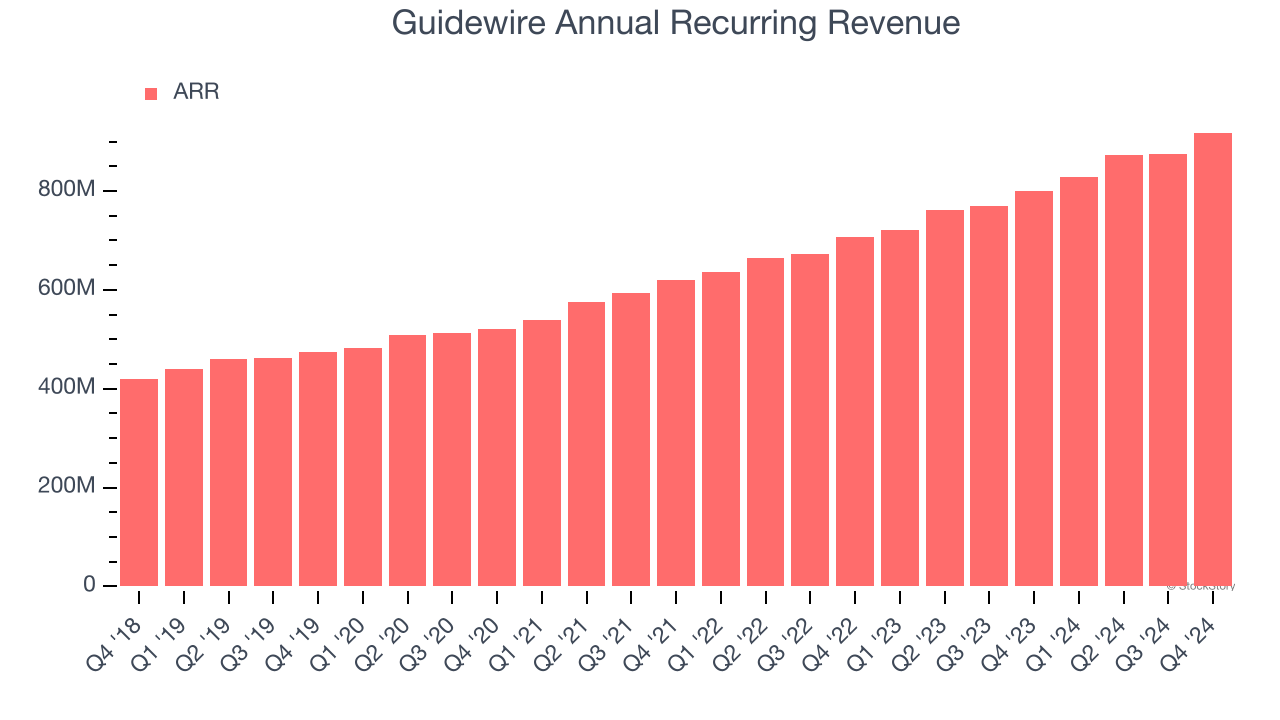

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Guidewire’s ARR punched in at $918.1 million in Q4, and over the last four quarters, its growth was solid as it averaged 14.4% year-on-year increases. This alternate topline metric grew slower than total sales, which likely means that the recurring portions of the business are growing slower than less predictable, choppier ones such as implementation fees. If this continues, the quality of its revenue base could decline.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Guidewire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Guidewire’s Q4 Results

It was encouraging to see Guidewire’s revenue guidance for next quarter beat analysts’ expectations. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 1.7% to $189.90 immediately after reporting.

Big picture, is Guidewire a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.