Clothing and accessories retailer Gap (NYSE: GAP) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 3.5% year on year to $4.15 billion. On the other hand, next quarter’s revenue guidance of $3.39 billion was less impressive, coming in 1.4% below analysts’ estimates. Its GAAP profit of $0.54 per share was 43.4% above analysts’ consensus estimates.

Is now the time to buy Gap? Find out by accessing our full research report, it’s free.

Gap (GAP) Q4 CY2024 Highlights:

- Revenue: $4.15 billion vs analyst estimates of $4.07 billion (3.5% year-on-year decline, 1.9% beat)

- EPS (GAAP): $0.54 vs analyst estimates of $0.38 (43.4% beat)

- Operating Profit Growth Guidance for 2025 of 8-10%, well above analyst estimates

- Free Cash Flow Margin: 12%, down from 13.2% in the same quarter last year

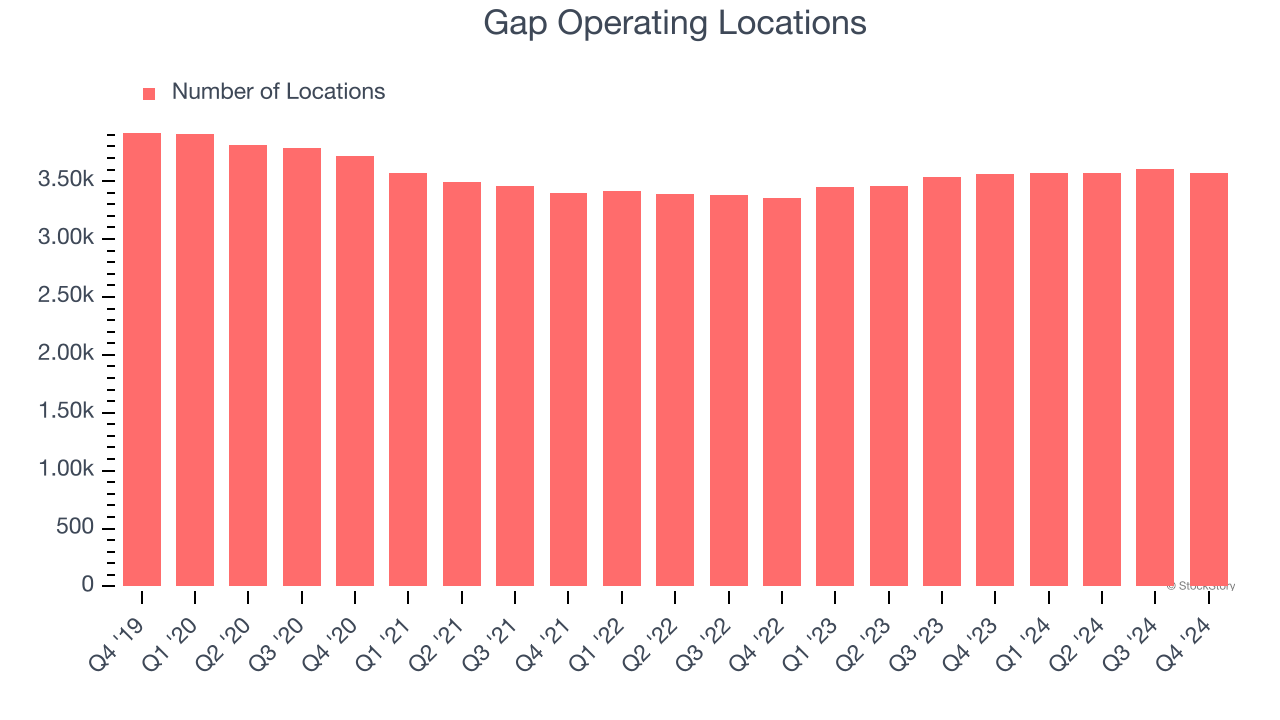

- Locations: 3,569 at quarter end, up from 3,560 in the same quarter last year

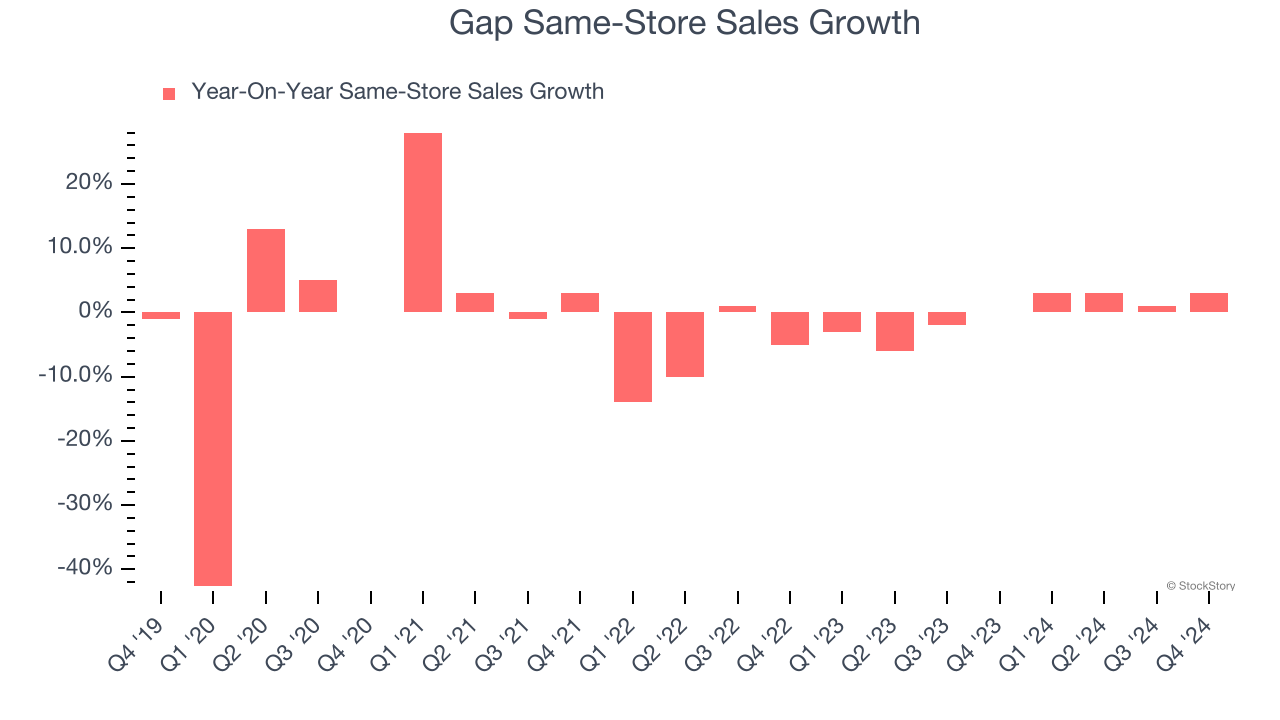

- Same-Store Sales rose 3% year on year (0% in the same quarter last year)

- Market Capitalization: $7.48 billion

"We ended the year delivering another successful quarter, exceeding financial expectations and gaining market share for the 8th consecutive quarter," said President and Chief Executive Officer, Richard Dickson.

Company Overview

Operating under the Gap, Old Navy, Banana Republic, and Athleta brands, Gap (NYSE: GAP) is an apparel and accessories retailer selling casual clothing to men, women, and children.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $15.09 billion in revenue over the past 12 months, Gap is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, Gap likely needs to tweak its prices or enter new markets.

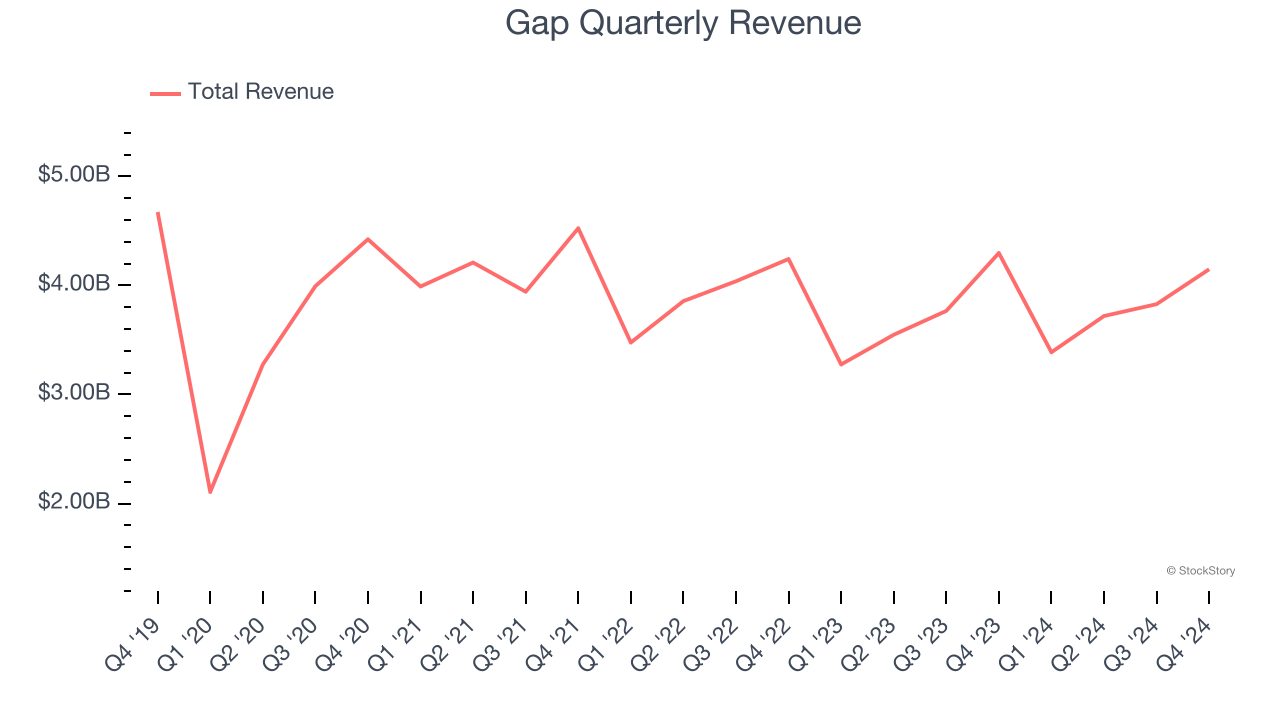

As you can see below, Gap’s demand was weak over the last five years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 1.6% annually despite opening new stores and expanding its reach.

This quarter, Gap’s revenue fell by 3.5% year on year to $4.15 billion but beat Wall Street’s estimates by 1.9%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. Although this projection indicates its newer products will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

Gap operated 3,569 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 2.8% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Gap’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Gap should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Gap’s same-store sales rose 3% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Gap’s Q4 Results

We liked how Gap beat analysts’ revenue and EPS expectations this quarter. What's driving shares up is the full-year guidance for operating profit growth. The company is calling for 8-10% growth, which is well above expectations. Overall, we think this was a good quarter. The stock traded up 18.4% to $23.09 immediately following the results.

Sure, Gap had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.