Fast food chain El Pollo Loco (NASDAQ: LOCO) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 1.8% year on year to $114.3 million. Its non-GAAP profit of $0.20 per share was 48.1% above analysts’ consensus estimates.

Is now the time to buy El Pollo Loco? Find out by accessing our full research report, it’s free.

El Pollo Loco (LOCO) Q4 CY2024 Highlights:

- Revenue: $114.3 million vs analyst estimates of $113.2 million (1.8% year-on-year growth, 1% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.14 (48.1% beat)

- Adjusted EBITDA: $14.34 million vs analyst estimates of $11.49 million (12.5% margin, 24.7% beat)

- Operating Margin: 7.9%, up from 6.6% in the same quarter last year

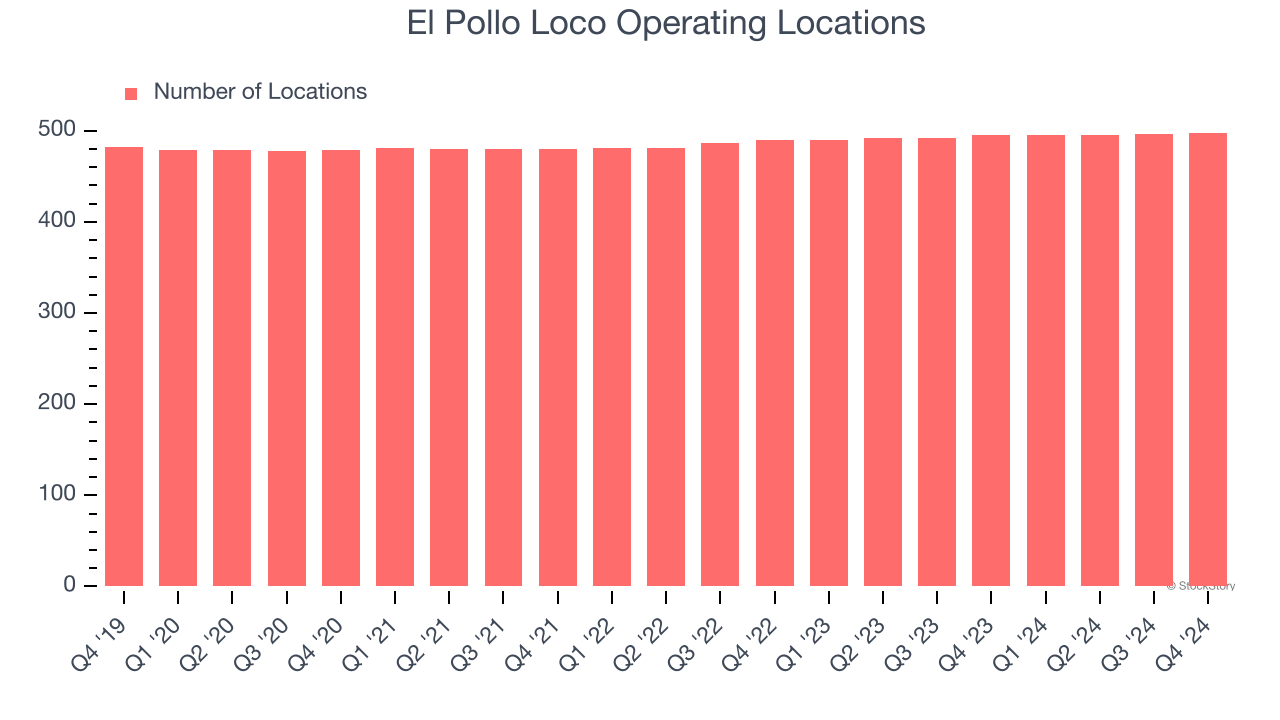

- Locations: 498 at quarter end, up from 495 in the same quarter last year

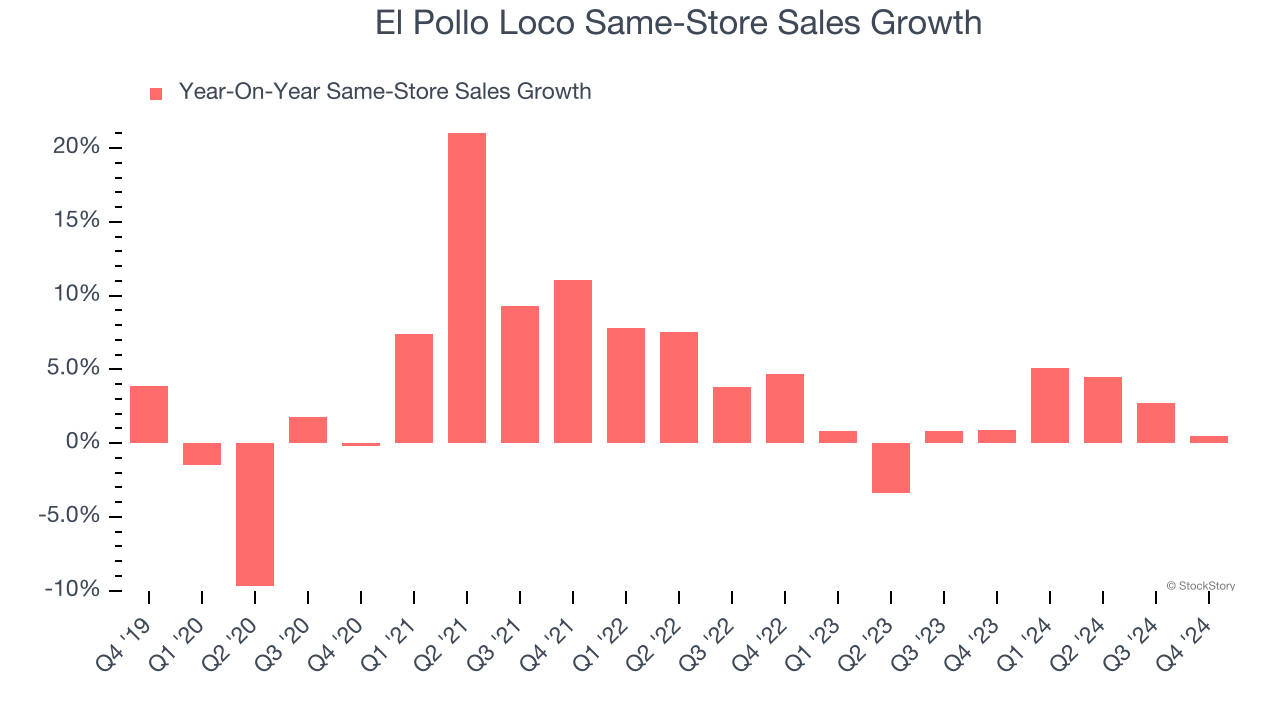

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $315.3 million

Liz Williams, Chief Executive Officer of El Pollo Loco Holdings, Inc., stated, “2024 was a foundational year for El Pollo Loco as we made tremendous progress across all our key objectives. More importantly, our accomplishments in 2024 are just the beginning and I’m thrilled with what is ahead for 2025. From our robust culinary pipeline filled with quality and flavor, to our upcoming brand re-launch and our improved operational foundation, we look forward to continuing our profitable growth as we progress toward our goal of making El Pollo Loco the national fire-grilled chicken brand.”

Company Overview

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ: LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $473 million in revenue over the past 12 months, El Pollo Loco is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, El Pollo Loco’s 1.4% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was weak as it barely increased sales at existing, established dining locations.

This quarter, El Pollo Loco reported modest year-on-year revenue growth of 1.8% but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months. Although this projection indicates its newer menu offerings will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

El Pollo Loco sported 498 locations in the latest quarter. Over the last two years, it has generally opened new restaurants, averaging 1.2% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

El Pollo Loco’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.5% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, El Pollo Loco’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if El Pollo Loco can reaccelerate growth.

Key Takeaways from El Pollo Loco’s Q4 Results

We were impressed by how significantly El Pollo Loco blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 5.6% to $11.20 immediately after reporting.

El Pollo Loco may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.