WD-40 has followed the market’s trajectory closely. The stock is down 6.2% to $241.80 per share over the past six months while the S&P 500 has lost 1.4%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in WD-40, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with WDFC and a stock we'd rather own.

Why Is WD-40 Not Exciting?

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ: WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

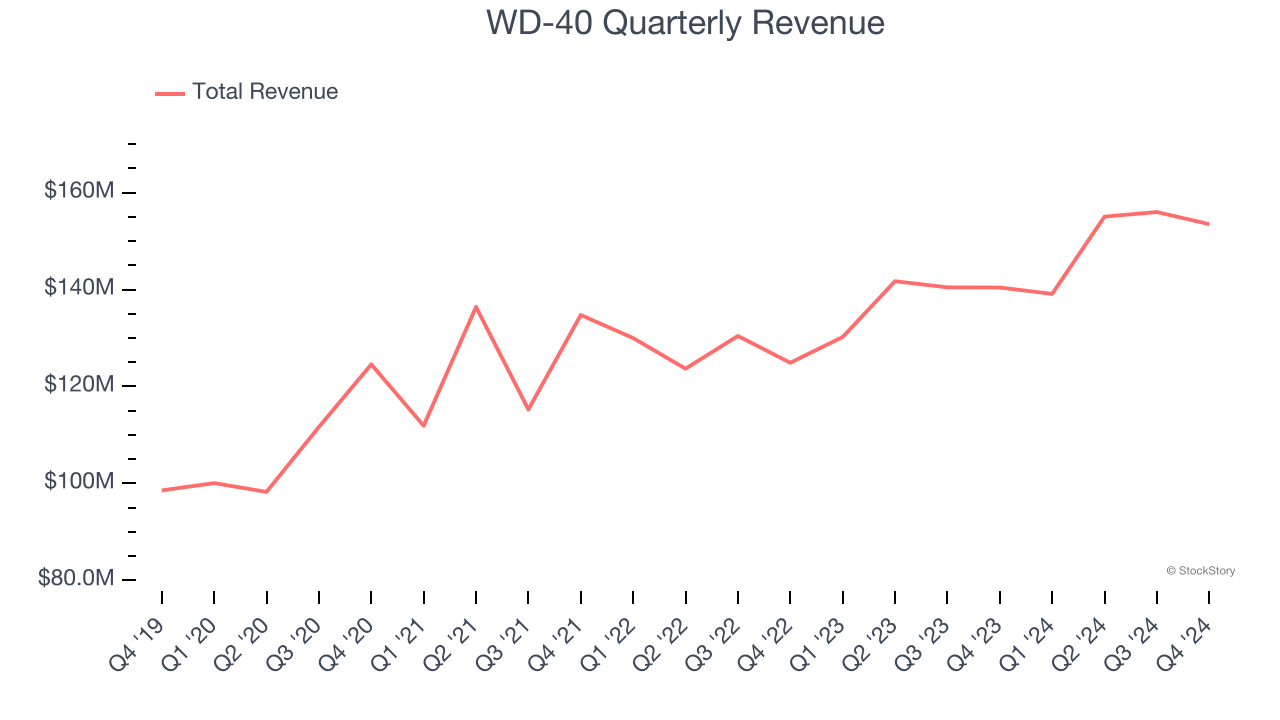

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, WD-40’s sales grew at a mediocre 6.6% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer staples sector.

2. Fewer Distribution Channels Limit its Ceiling

With $603.6 million in revenue over the past 12 months, WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

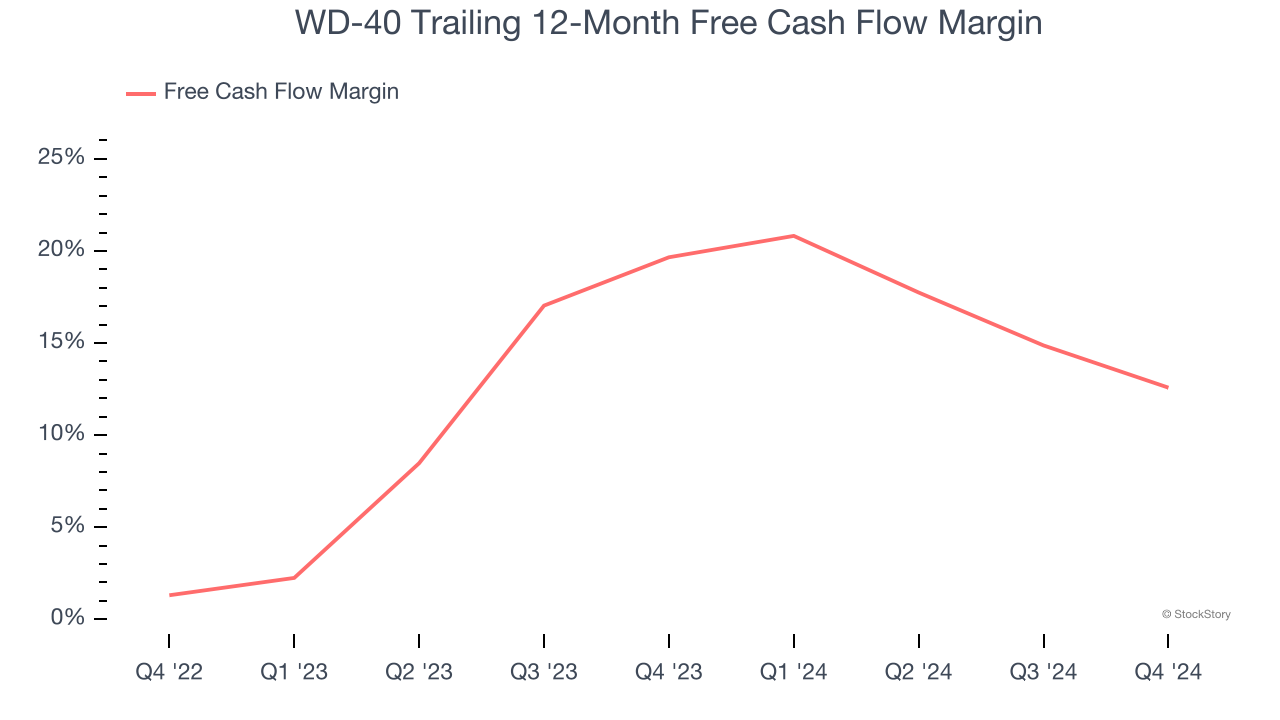

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, WD-40’s margin dropped by 7.1 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. WD-40’s free cash flow margin for the trailing 12 months was 12.6%.

Final Judgment

WD-40 isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 44.2× forward price-to-earnings (or $241.80 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of WD-40

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.