The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Blue Bird (NASDAQ: BLBD) and the rest of the heavy transportation equipment stocks fared in Q4.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 14 heavy transportation equipment stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.1% since the latest earnings results.

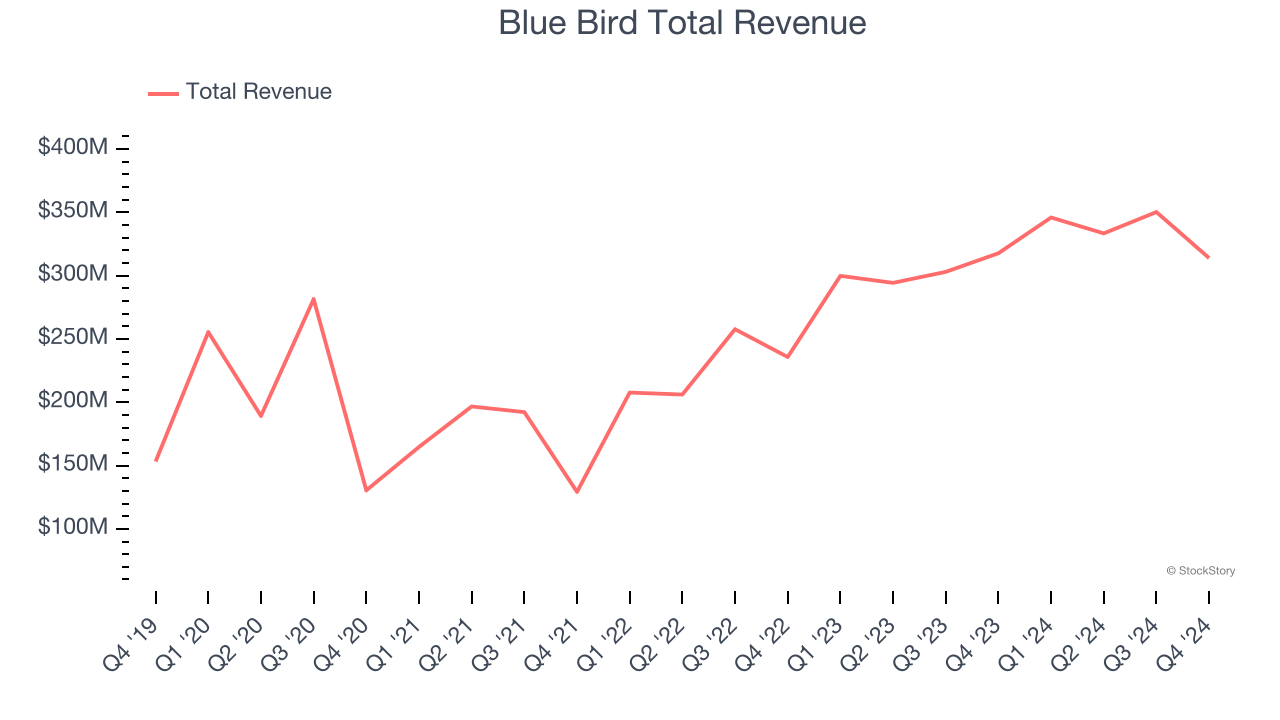

Blue Bird (NASDAQ: BLBD)

With around a century of experience, Blue Bird (NASDAQ: BLBD) is a manufacturer of school buses and complementary parts.

Blue Bird reported revenues of $313.9 million, down 1.2% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ sales volume estimates and a solid beat of analysts’ EBITDA estimates.

“I am incredibly proud of our team’s achievements in delivering another outstanding result and near record profit in the first quarter,” said Phil Horlock, President & CEO of Blue Bird Corporation.

The stock is down 2.9% since reporting and currently trades at $34.72.

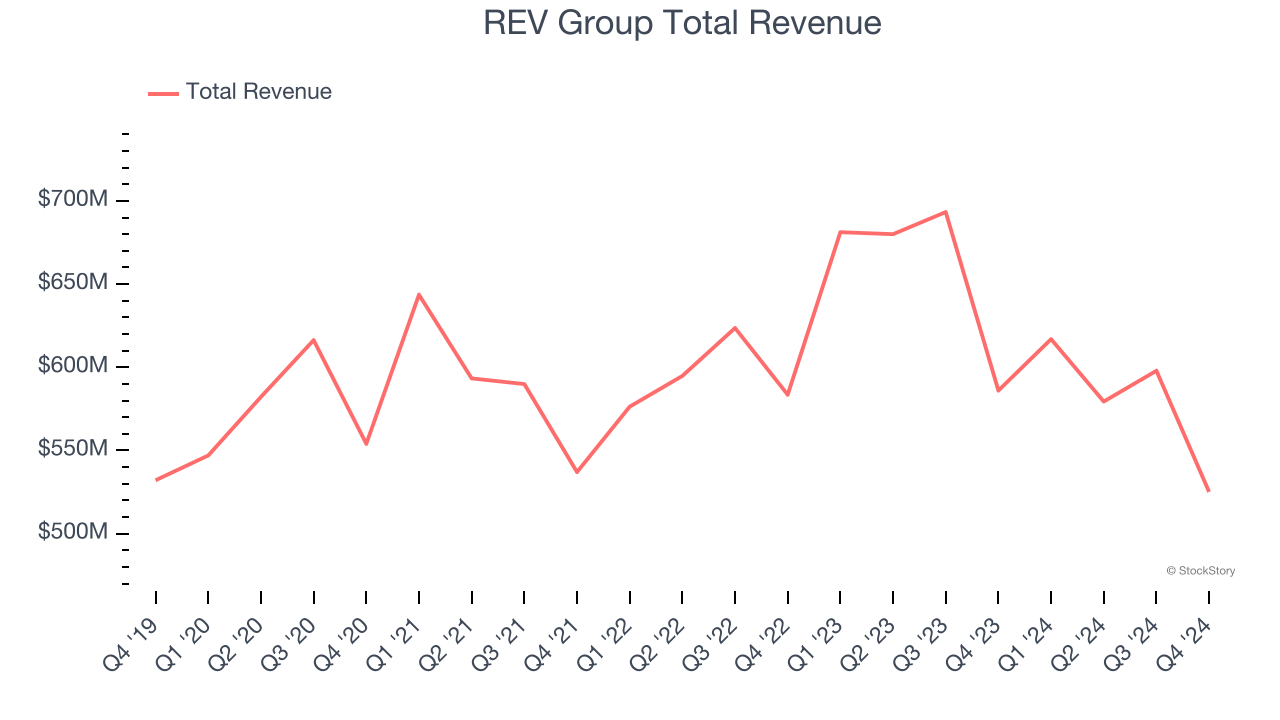

Best Q4: REV Group (NYSE: REVG)

Offering the first full-electric North American fire truck, REV (NYSE: REVG) manufactures and sells specialty vehicles.

REV Group reported revenues of $525.1 million, down 10.4% year on year, outperforming analysts’ expectations by 6.5%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 22.3% since reporting. It currently trades at $33.37.

Is now the time to buy REV Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Wabtec (NYSE: WAB)

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE: WAB) provides equipment, systems, and related software for the railway industry.

Wabtec reported revenues of $2.58 billion, up 2.3% year on year, falling short of analysts’ expectations by 0.6%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 9.1% since the results and currently trades at $188.95.

Read our full analysis of Wabtec’s results here.

Shyft (NASDAQ: SHYF)

Notably receiving an order from FedEx for electric vehicles, Shyft (NASDAQ: SHYF) offers specialty vehicles and truck bodies for various industries.

Shyft reported revenues of $201.4 million, flat year on year. This result came in 4.3% below analysts' expectations. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a miss of analysts’ Fleet Vehicles revenue estimates.

The stock is down 26.7% since reporting and currently trades at $9.19.

Read our full, actionable report on Shyft here, it’s free.

Wabash (NYSE: WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE: WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $416.8 million, down 30.1% year on year. This print surpassed analysts’ expectations by 0.9%. Aside from that, it was a slower quarter as it produced full-year EPS guidance missing analysts’ expectations.

Wabash scored the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is down 29.6% since reporting and currently trades at $11.01.

Read our full, actionable report on Wabash here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.