As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the office & commercial furniture industry, including HNI (NYSE: HNI) and its peers.

The sector faces a tepid outlook as workplace dynamics continue to evolve. Hybrid work means that enterprise demand for office furniture is lower. Consumer demand for the same products likely will not offset the loss from enterprises, as individual workers tend to have less space and need for the sector's wares. The Trump administration also possesses a high willingness to impose tariffs on key partners, which could result in retaliatory actions, all of which could pressure those selling furniture that may feature components or labor from overseas. Lastly, the COVID-19 pandemic showed that there is always a risk that something disrupts supply chains, and companies need contingency plans for this.

The 4 office & commercial furniture stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 3.3% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 13.5% since the latest earnings results.

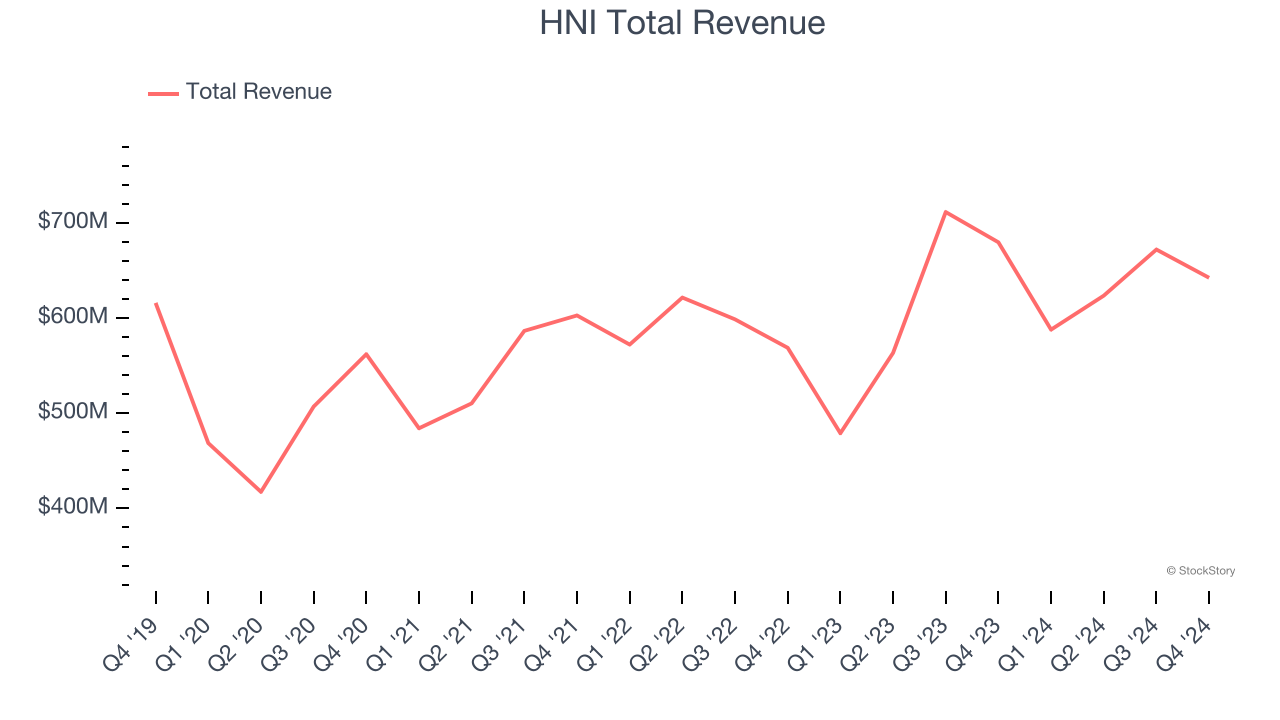

HNI (NYSE: HNI)

With roots dating back to 1944 and a significant acquisition of Kimball International in 2023, HNI (NYSE: HNI) manufactures and sells office furniture systems, seating, and storage solutions, as well as residential fireplaces and heating products.

HNI reported revenues of $642.5 million, down 5.5% year on year. This print fell short of analysts’ expectations by 2.2%, but it was still a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates.

HNI delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 11% since reporting and currently trades at $43.61.

Is now the time to buy HNI? Access our full analysis of the earnings results here, it’s free.

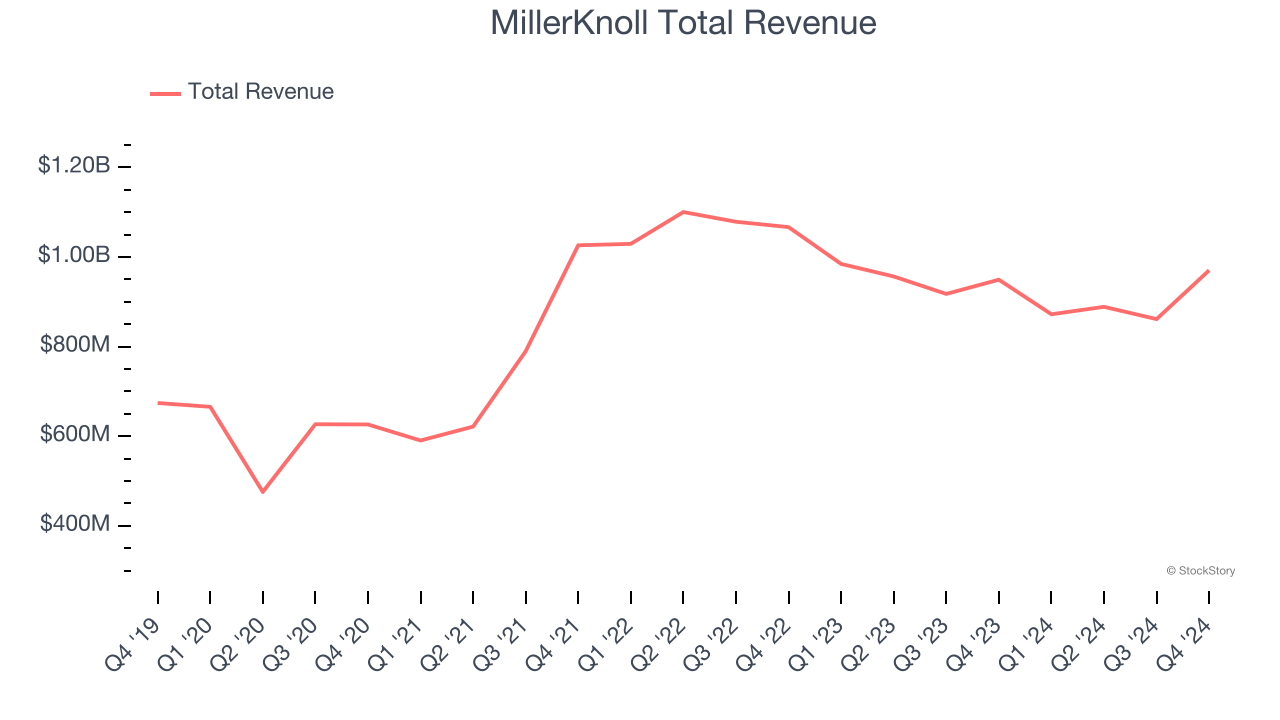

Best Q4: MillerKnoll (NASDAQ: MLKN)

Created through the 2021 merger of industry icons Herman Miller and Knoll, MillerKnoll (NASDAQ: MLKN) designs, manufactures, and distributes interior furnishings for offices, healthcare facilities, educational settings, and homes worldwide.

MillerKnoll reported revenues of $970.4 million, up 2.2% year on year, outperforming analysts’ expectations by 1.1%. The business had a strong quarter with a decent beat of analysts’ EPS estimates.

MillerKnoll delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 22.6% since reporting. It currently trades at $18.82.

Is now the time to buy MillerKnoll? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Steelcase (NYSE: SCS)

Founded in 1912 when metal office furniture was replacing wooden alternatives, Steelcase (NYSE: SCS) is a global office furniture manufacturer that designs and produces workplace solutions including desks, chairs, architectural products, and services.

Steelcase reported revenues of $794.9 million, up 2.2% year on year, in line with analysts’ expectations. It was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 14.9% since the results and currently trades at $10.60.

Read our full analysis of Steelcase’s results here.

Interface (NASDAQ: TILE)

Pioneering carbon-neutral flooring since its founding in 1973, Interface (NASDAQ: TILE) is a global manufacturer of modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring that specializes in carbon-neutral and sustainable flooring solutions.

Interface reported revenues of $335 million, up 3% year on year. This result lagged analysts' expectations by 1%. More broadly, it was a mixed quarter as it also produced a solid beat of analysts’ EPS estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Interface delivered the fastest revenue growth among its peers. The stock is down 5.6% since reporting and currently trades at $20.09.

Read our full, actionable report on Interface here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.