Health insurance company Alignment Healthcare (NASDAQ: ALHC) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 50.7% year on year to $701.2 million. On top of that, next quarter’s revenue guidance ($887.5 million at the midpoint) was surprisingly good and 4.1% above what analysts were expecting. Its GAAP loss of $0.16 per share was 11% above analysts’ consensus estimates.

Is now the time to buy Alignment Healthcare? Find out by accessing our full research report, it’s free.

Alignment Healthcare (ALHC) Q4 CY2024 Highlights:

- Revenue: $701.2 million vs analyst estimates of $676.9 million (50.7% year-on-year growth, 3.6% beat)

- EPS (GAAP): -$0.16 vs analyst estimates of -$0.18 (11% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.75 billion at the midpoint, beating analyst estimates by 7.7% and implying 38.6% growth (vs 48.2% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $47.5 million at the midpoint, above analyst estimates of $44.77 million

- Operating Margin: -3.2%, up from -9% in the same quarter last year

- Free Cash Flow was -$18 million compared to -$198.1 million in the same quarter last year

- Customers: 189,100, up from 182,300 in the previous quarter

- Market Capitalization: $2.52 billion

“2024 was a milestone year that proved health plans can win by providing more care, not less,” said John Kao, founder and CEO.

Company Overview

Founded in 2013, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage plans with a focus on technology such as telemedicine and a proprietary platform that digitizes care coordination and features predictive analytics.

Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Sales Growth

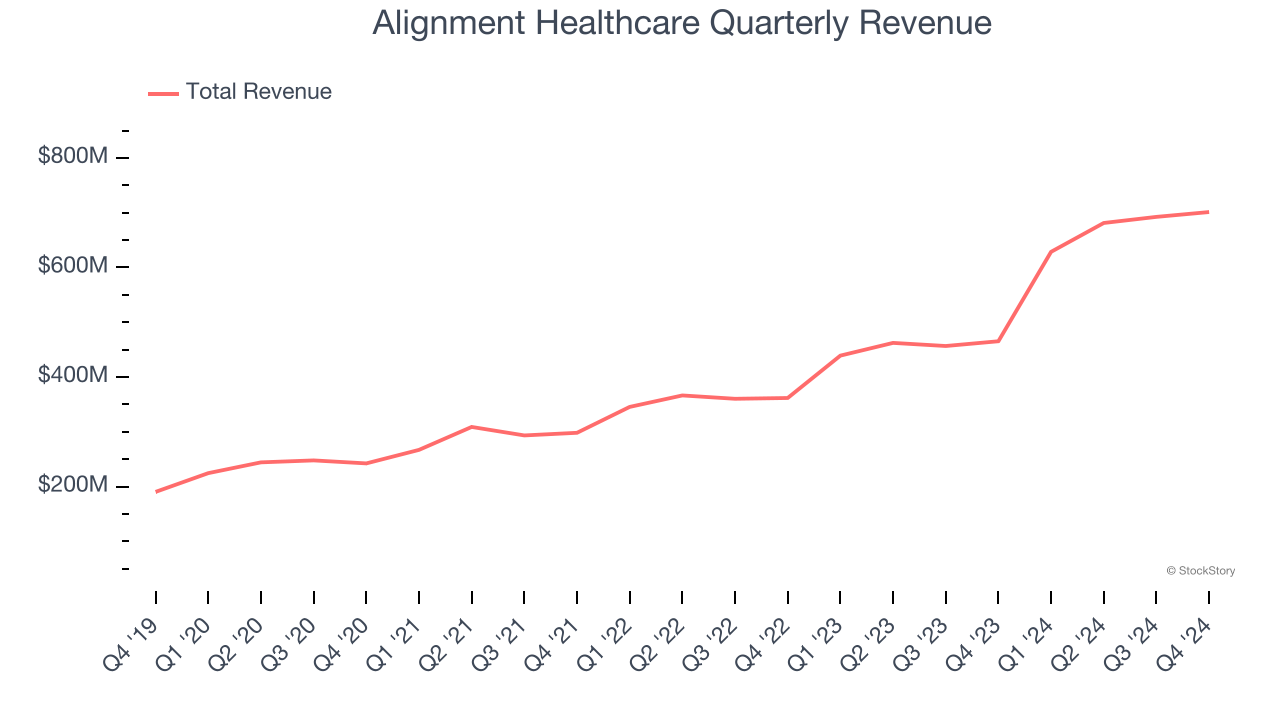

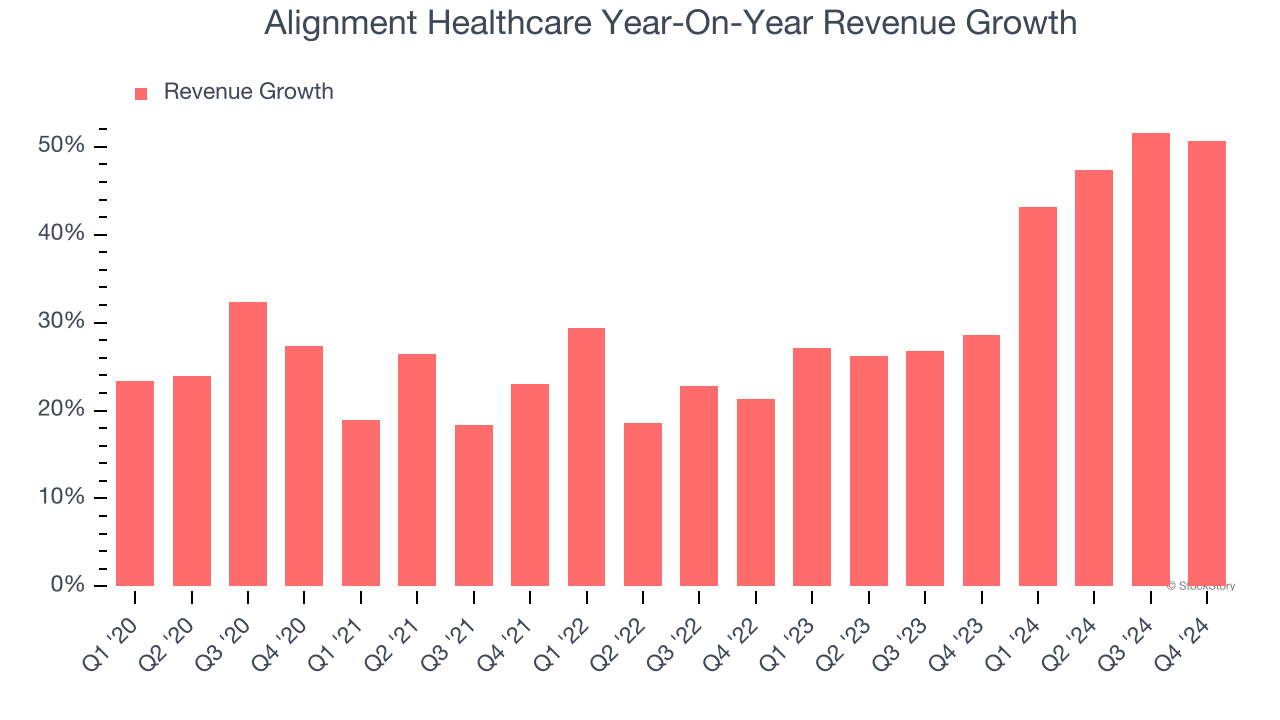

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Alignment Healthcare’s sales grew at an exceptional 29% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Alignment Healthcare’s annualized revenue growth of 37.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

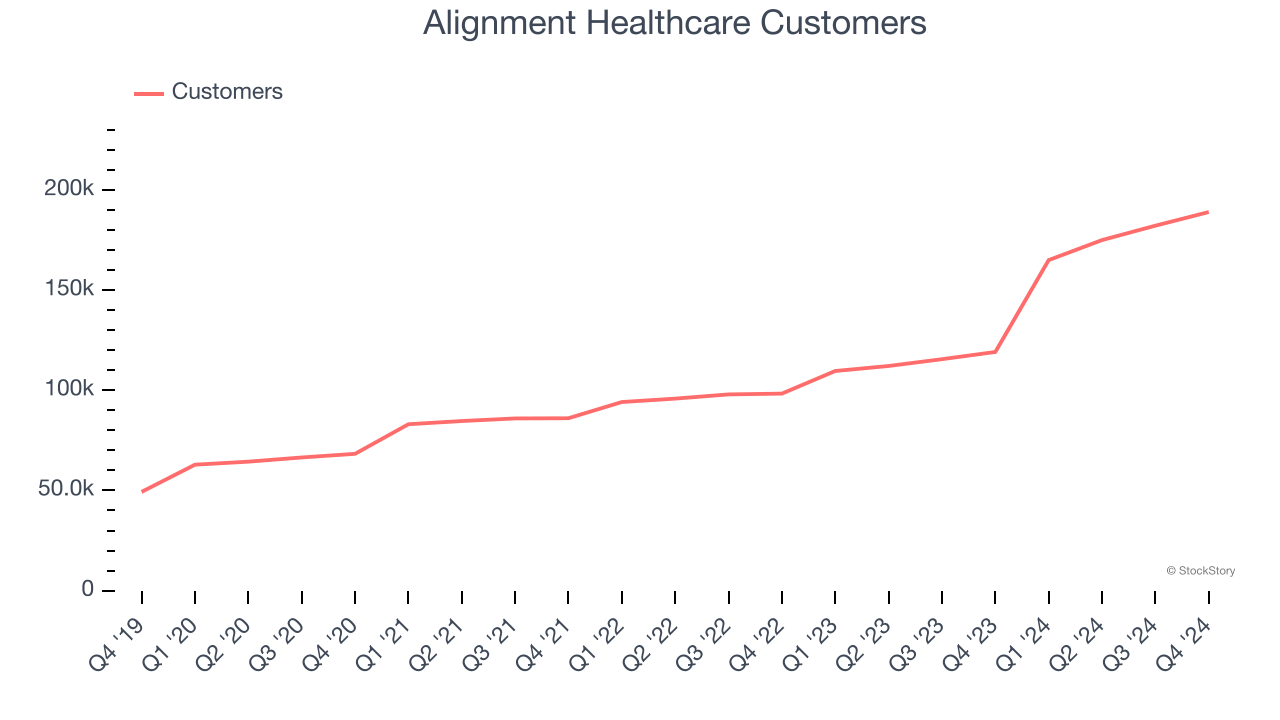

We can dig further into the company’s revenue dynamics by analyzing its number of customers, which reached 189,100 in the latest quarter. Over the last two years, Alignment Healthcare’s customer base averaged 36.9% year-on-year growth. Because this number is in line with its revenue growth, we can see the average customer spent roughly the same amount each year on the company’s products and services.

This quarter, Alignment Healthcare reported magnificent year-on-year revenue growth of 50.7%, and its $701.2 million of revenue beat Wall Street’s estimates by 3.6%. Company management is currently guiding for a 41.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 28.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and indicates the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

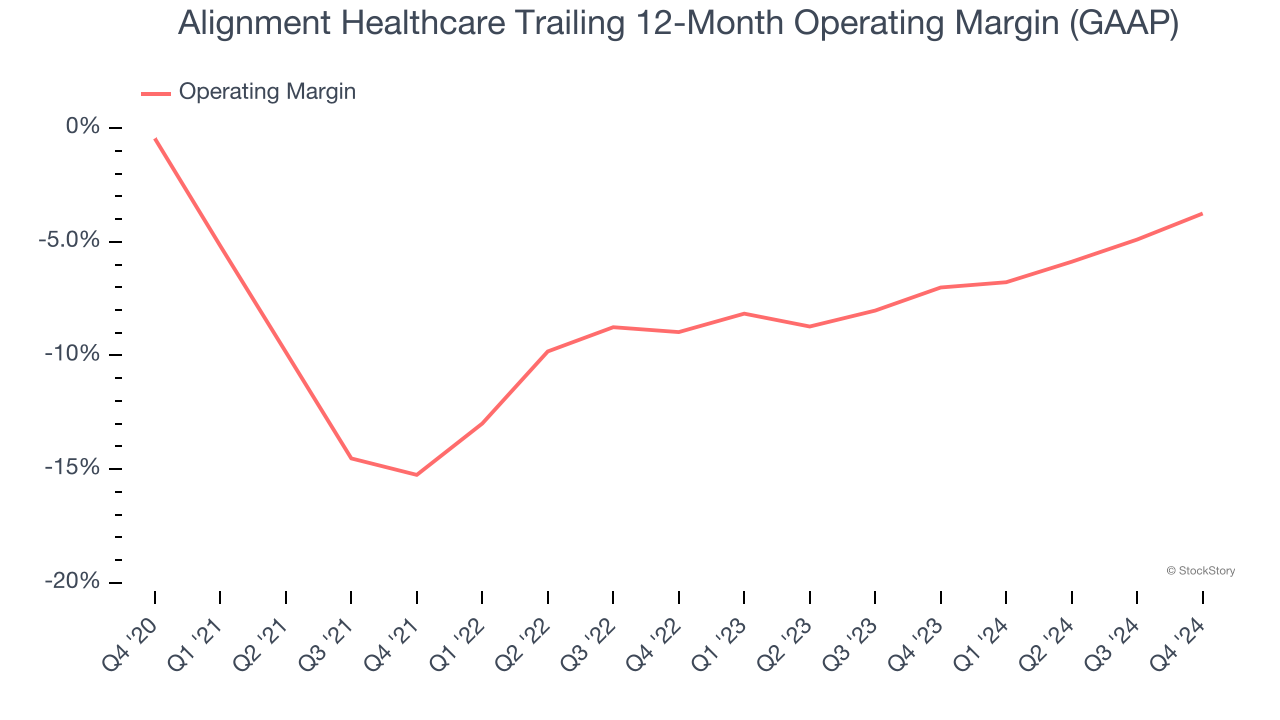

Alignment Healthcare’s high expenses have contributed to an average operating margin of negative 6.7% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Alignment Healthcare’s operating margin decreased by 3.3 percentage points over the last five years, but it rose by 5.2 percentage points on a two-year basis. We like Alignment Healthcare and hope it can right the ship.

In Q4, Alignment Healthcare generated a negative 3.2% operating margin. The company's consistent lack of profits raise a flag.

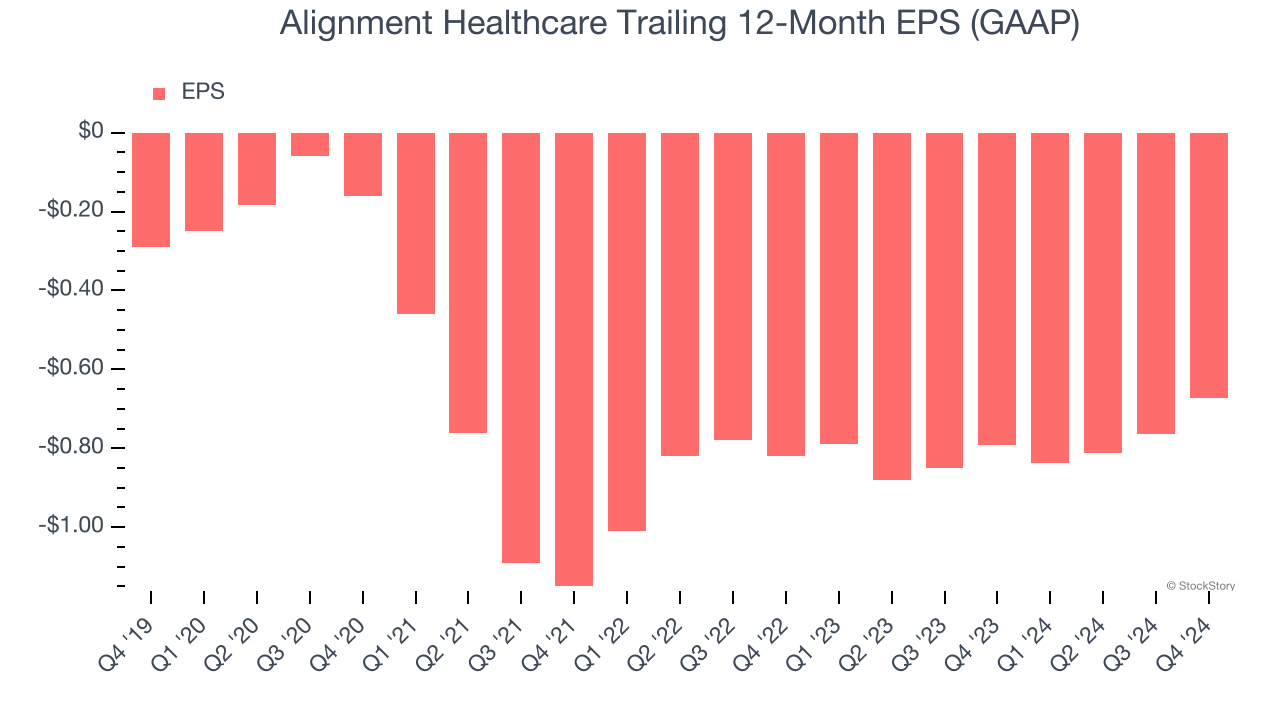

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Alignment Healthcare’s earnings losses deepened over the last five years as its EPS dropped 18.2% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q4, Alignment Healthcare reported EPS at negative $0.16, up from negative $0.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Alignment Healthcare to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.67 will advance to negative $0.53.

Key Takeaways from Alignment Healthcare’s Q4 Results

We were impressed by Alignment Healthcare’s optimistic full-year revenue and EBITDA guidance, which blew past analysts’ expectations. We were also glad this quarter's revenue and EPS beat Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 5.9% to $14.26 immediately following the results.

Alignment Healthcare had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.