The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Old Dominion Freight Line (NASDAQ: ODFL) and the rest of the ground transportation stocks fared in Q4.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 15 ground transportation stocks we track reported a slower Q4. As a group, revenues were in line with analysts’ consensus estimates.

While some ground transportation stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.8% since the latest earnings results.

Old Dominion Freight Line (NASDAQ: ODFL)

With its name deriving from the Commonwealth of Virginia’s nickname, Old Dominion (NASDAQ: ODFL) delivers less-than-truckload (LTL) and full-container load freight.

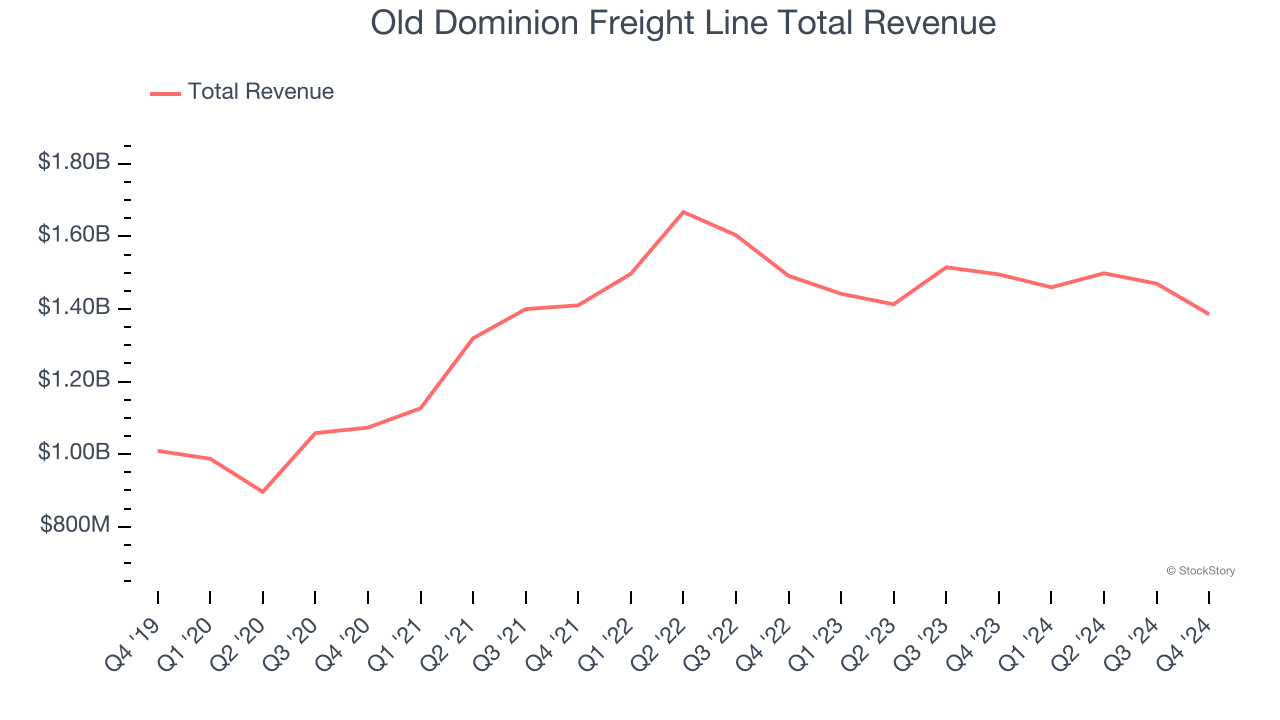

Old Dominion Freight Line reported revenues of $1.39 billion, down 7.3% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ EPS estimates but sales volume in line with analysts’ estimates.

Marty Freeman, President and Chief Executive Officer of Old Dominion, commented, “Old Dominion’s financial results for the fourth quarter reflect the ongoing softness in the domestic economy. While our revenue declined 7.3% in the quarter, our market share remained relatively consistent. In addition, we continued to operate efficiently while maintaining our best-in-class service. Providing our customers with superior service at a fair price remains the cornerstone of our long-term strategic plan, and we were pleased to achieve an on-time service performance of 99% and a cargo claims ratio below 0.1% during the fourth quarter.

The stock is up 8.5% since reporting and currently trades at $199.22.

Is now the time to buy Old Dominion Freight Line? Access our full analysis of the earnings results here, it’s free.

Best Q4: XPO (NYSE: XPO)

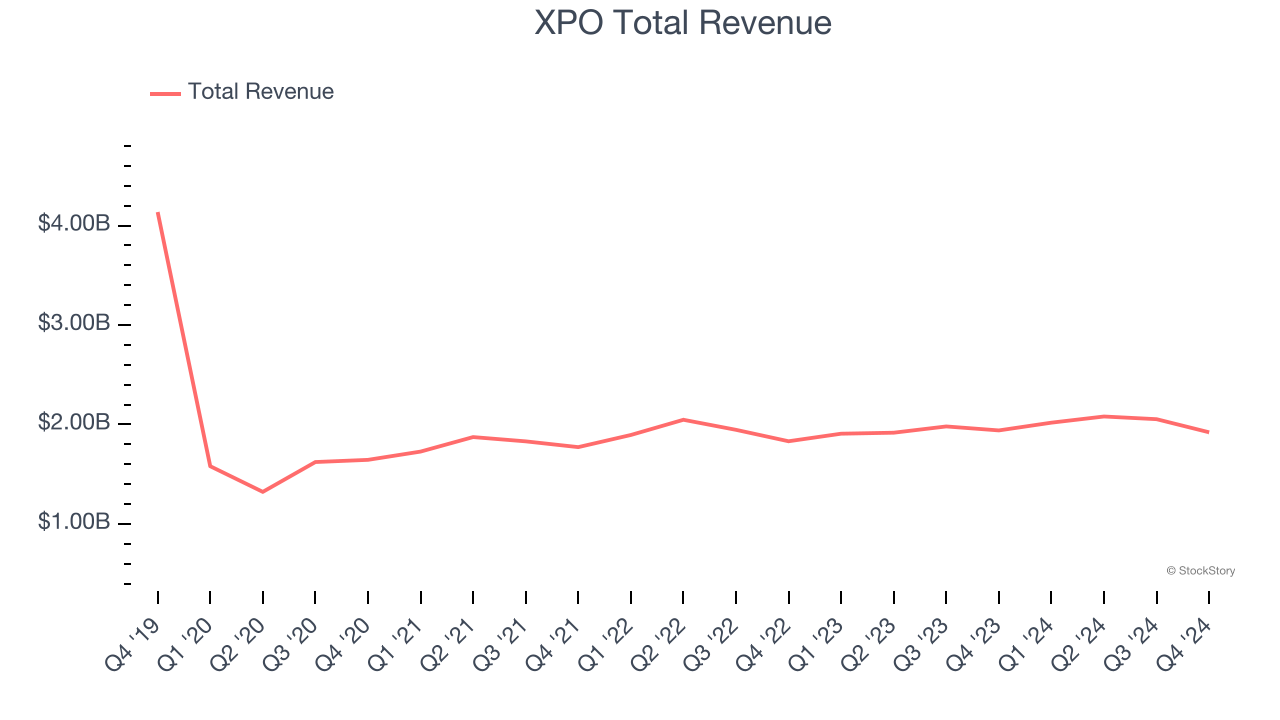

Owning a mobile game simulating freight operations for the Tour de France, XPO (NYSE: XPO) is a transportation company specializing in expedited shipping services.

XPO reported revenues of $1.92 billion, flat year on year, in line with analysts’ expectations. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 3.7% since reporting. It currently trades at $131.33.

Is now the time to buy XPO? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Avis Budget Group (NASDAQ: CAR)

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ: CAR) is a provider of car rental and mobility solutions.

Avis Budget Group reported revenues of $2.71 billion, down 2% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 3.6% since the results and currently trades at $93.

Read our full analysis of Avis Budget Group’s results here.

Knight-Swift Transportation (NYSE: KNX)

Covering 1.6 billion loaded miles in 2023 alone, Knight-Swift Transportation (NYSE: KNX) offers less-than-truckload and full truckload delivery services.

Knight-Swift Transportation reported revenues of $1.86 billion, down 3.5% year on year. This result missed analysts’ expectations by 1.2%. It was a slower quarter as it also recorded a significant miss of analysts’ adjusted operating income estimates and a slight miss of analysts’ sales volume estimates.

The stock is down 2.8% since reporting and currently trades at $53.42.

Read our full, actionable report on Knight-Swift Transportation here, it’s free.

RXO (NYSE: RXO)

With access to millions of trucks, RXO (NYSE: RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

RXO reported revenues of $1.67 billion, up 70.4% year on year. This number surpassed analysts’ expectations by 0.6%. More broadly, it was a mixed quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates but EBITDA guidance for next quarter missing analysts’ expectations.

RXO pulled off the fastest revenue growth among its peers. The stock is down 17.1% since reporting and currently trades at $21.

Read our full, actionable report on RXO here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.