First Hawaiian Bank has been treading water for the past six months, recording a small return of 4.6% while holding steady at $24.40. The stock also fell short of the S&P 500’s 19.8% gain during that period.

Is now the time to buy First Hawaiian Bank, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is First Hawaiian Bank Not Exciting?

We're sitting this one out for now. Here are three reasons there are better opportunities than FHB and a stock we'd rather own.

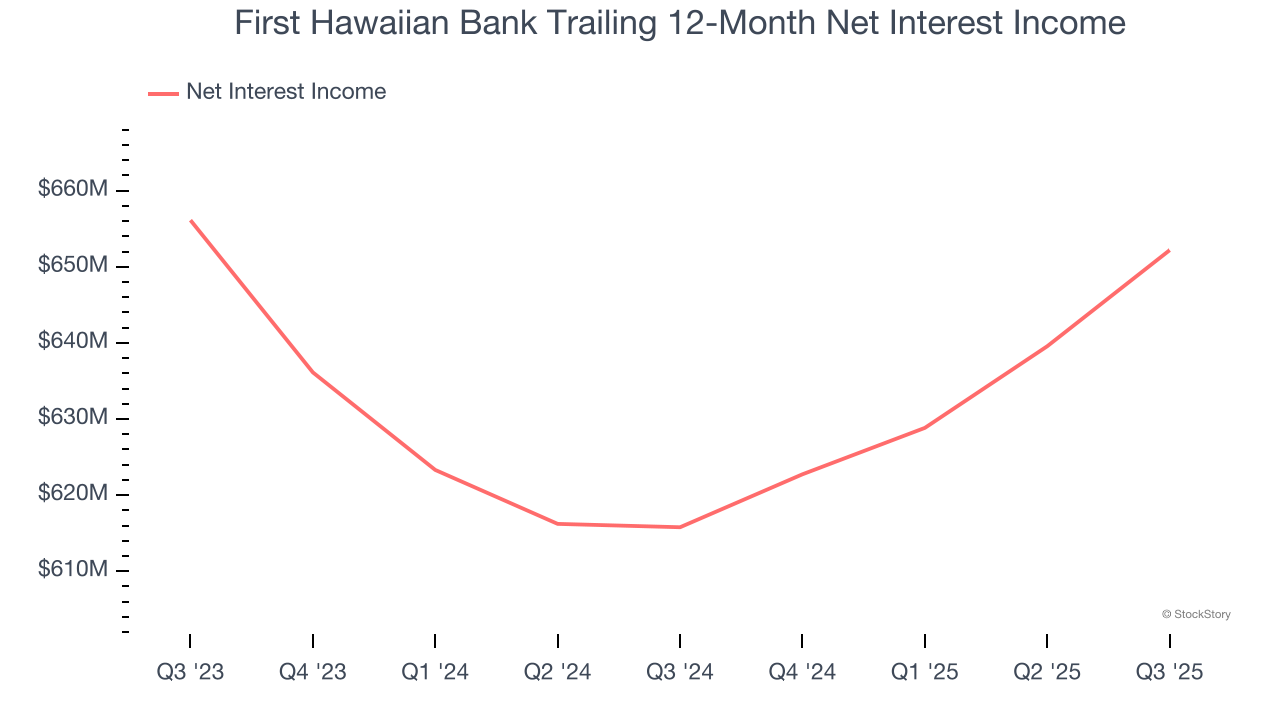

1. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

First Hawaiian Bank’s net interest income has grown at a 4.3% annualized rate over the last five years, worse than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

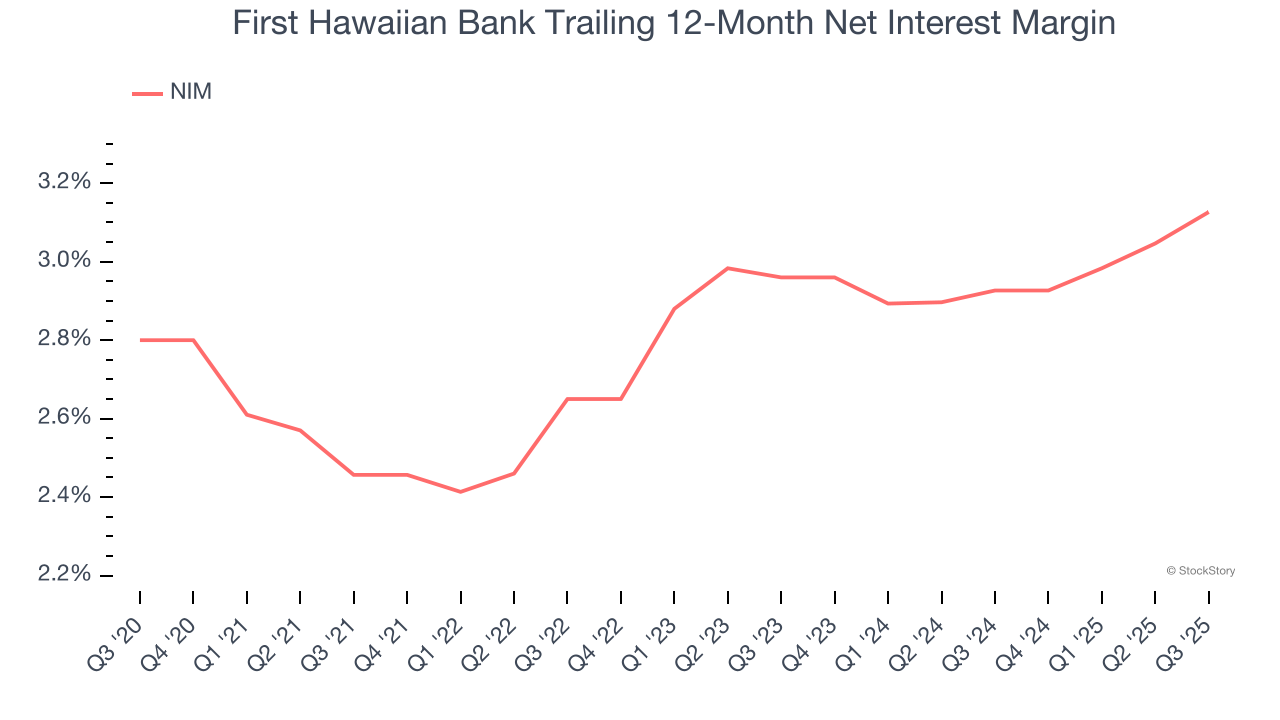

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that First Hawaiian Bank’s net interest margin averaged a weak 3%. This metric is well below other banks, signaling its loans aren’t very profitable.

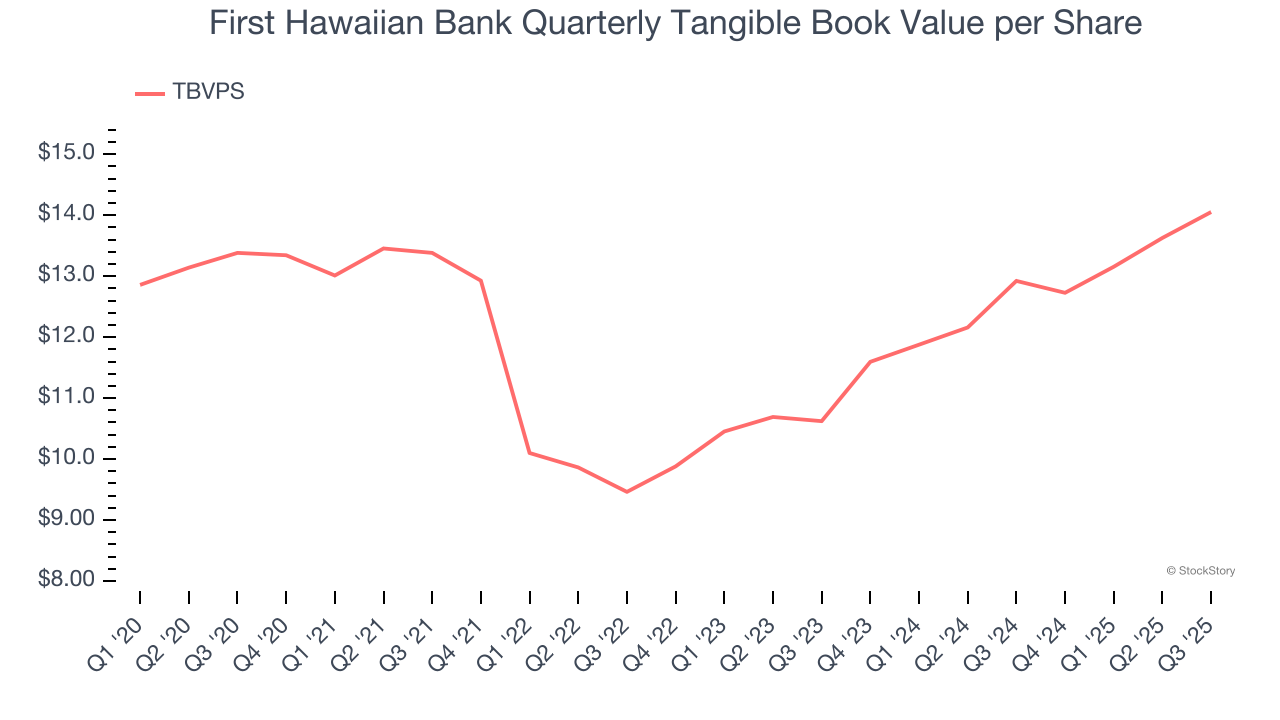

3. Growing TBVPS Reflects Strong Asset Base

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Although First Hawaiian Bank’s TBVPS was flat over the last five years. the good news is that its growth has recently accelerated as TBVPS grew at an impressive 15% annual clip over the past two years (from $10.62 to $14.05 per share).

Final Judgment

First Hawaiian Bank isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 1.1× forward P/B (or $24.40 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than First Hawaiian Bank

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.