Digital advertising technology company PubMatic (NASDAQ: PUBM) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 5.3% year on year to $67.96 million. The company expects next quarter’s revenue to be around $75 million, close to analysts’ estimates. Its non-GAAP profit of $0.03 per share was significantly above analysts’ consensus estimates.

Is now the time to buy PubMatic? Find out by accessing our full research report, it’s free for active Edge members.

PubMatic (PUBM) Q3 CY2025 Highlights:

- Revenue: $67.96 million vs analyst estimates of $64.02 million (5.3% year-on-year decline, 6.1% beat)

- Adjusted EPS: $0.03 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $11.15 million vs analyst estimates of $8.61 million (16.4% margin, 29.5% beat)

- Revenue Guidance for Q4 CY2025 is $75 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q4 CY2025 is $20 million at the midpoint, below analyst estimates of $20.14 million

- Operating Margin: -12.4%, down from -1.9% in the same quarter last year

- Free Cash Flow Margin: 33.5%, up from 13% in the previous quarter

- Market Capitalization: $338.4 million

Company Overview

Powering billions of daily ad impressions across the open internet, PubMatic (NASDAQ: PUBM) operates a technology platform that helps publishers maximize revenue from their digital advertising inventory while giving advertisers more control and transparency.

Revenue Growth

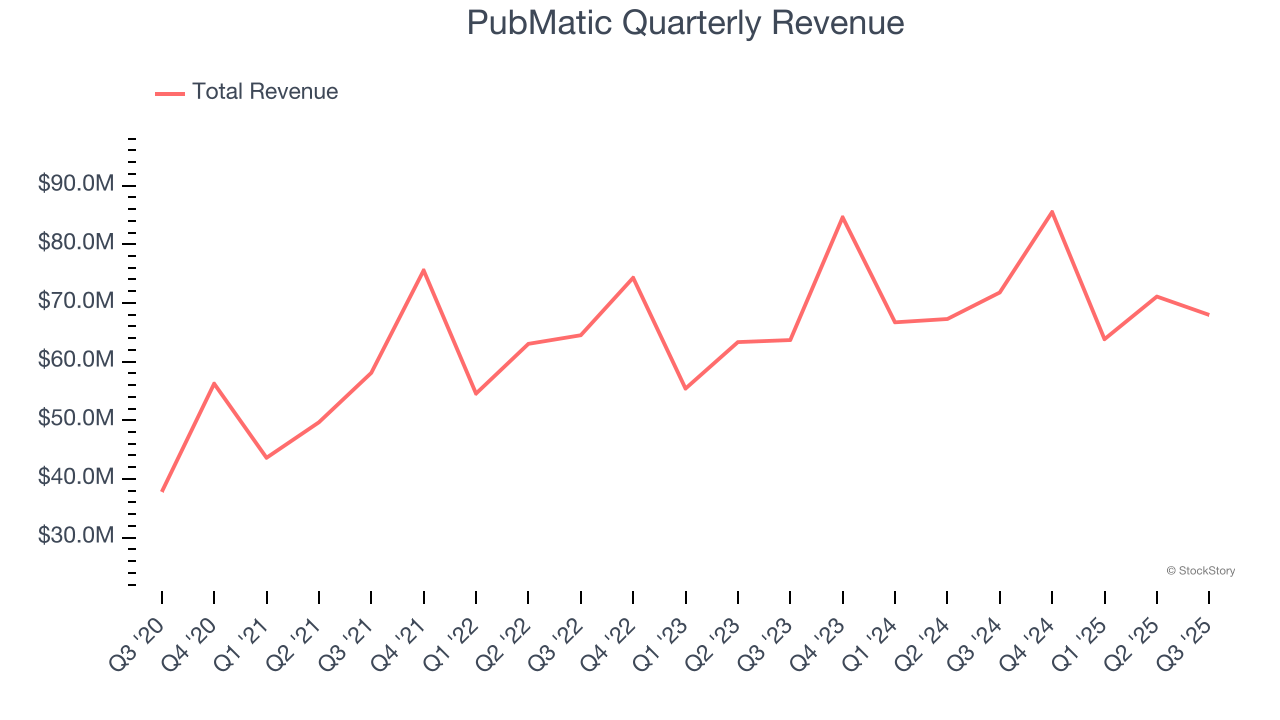

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, PubMatic’s 17.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. PubMatic’s recent performance shows its demand has slowed as its annualized revenue growth of 6% over the last two years was below its five-year trend.

This quarter, PubMatic’s revenue fell by 5.3% year on year to $67.96 million but beat Wall Street’s estimates by 6.1%. Company management is currently guiding for a 12.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

PubMatic’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between PubMatic’s products and its peers.

Key Takeaways from PubMatic’s Q3 Results

We were impressed by how significantly PubMatic blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter slightly missed and its revenue guidance for next quarter was in line with Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 14.3% to $8.73 immediately after reporting.

PubMatic may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.