Business travel management company Global Business Travel Group (NYSE: GBTG) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 12.9% year on year to $674 million. Its GAAP loss of $0.13 per share was significantly below analysts’ consensus estimates.

Is now the time to buy American Express Global Business Travel? Find out by accessing our full research report, it’s free for active Edge members.

American Express Global Business Travel (GBTG) Q3 CY2025 Highlights:

- Revenue: $674 million vs analyst estimates of $613 million (12.9% year-on-year growth, 10% beat)

- EPS (GAAP): -$0.13 vs analyst estimates of $0.02 (significant miss)

- Adjusted EBITDA: $119 million vs analyst estimates of $125.7 million (17.7% margin, 5.3% miss)

- Operating Margin: 1.8%, down from 4.5% in the same quarter last year

- Free Cash Flow Margin: 5.6%, up from 4.3% in the previous quarter

- Transaction Value: 1.77 billion, down 5.98 billion year on year

- Market Capitalization: $4.21 billion

Company Overview

Originally spun off from American Express in 2014 but maintaining the Amex GBT brand, Global Business Travel Group (NYSE: GBTG) provides end-to-end business travel and expense management solutions, connecting corporate clients with travel suppliers and offering specialized software services.

Revenue Growth

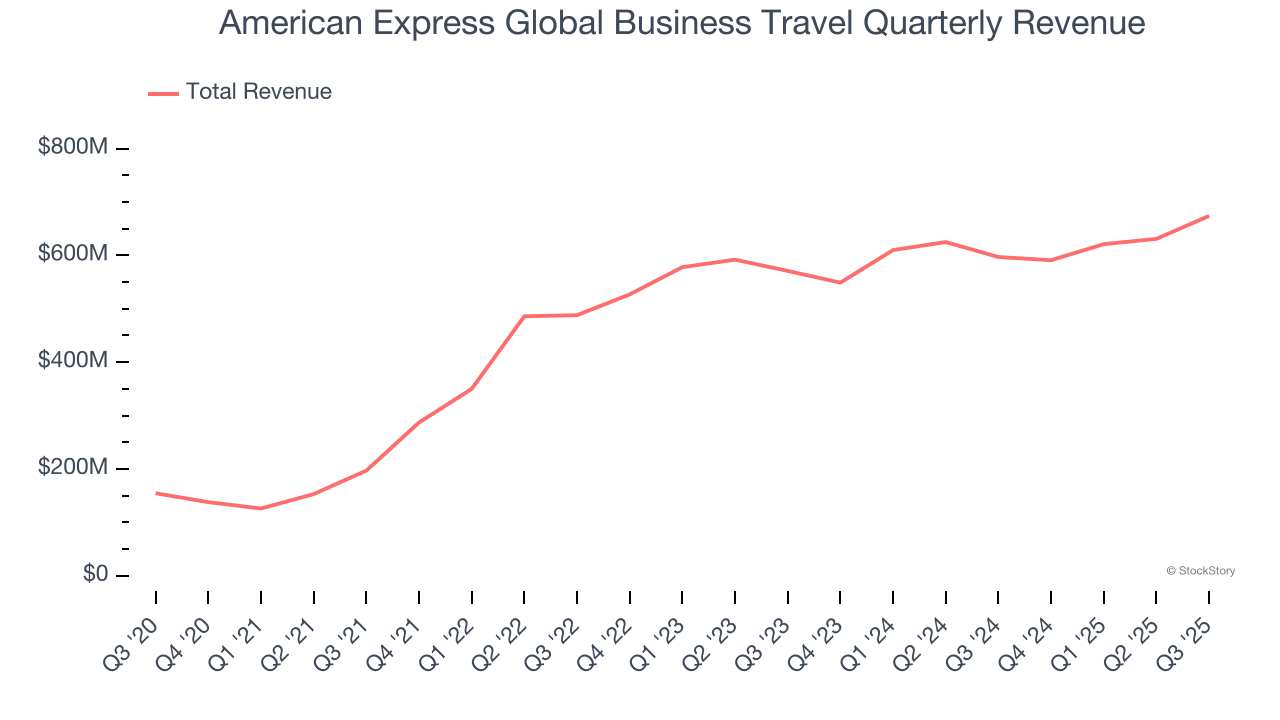

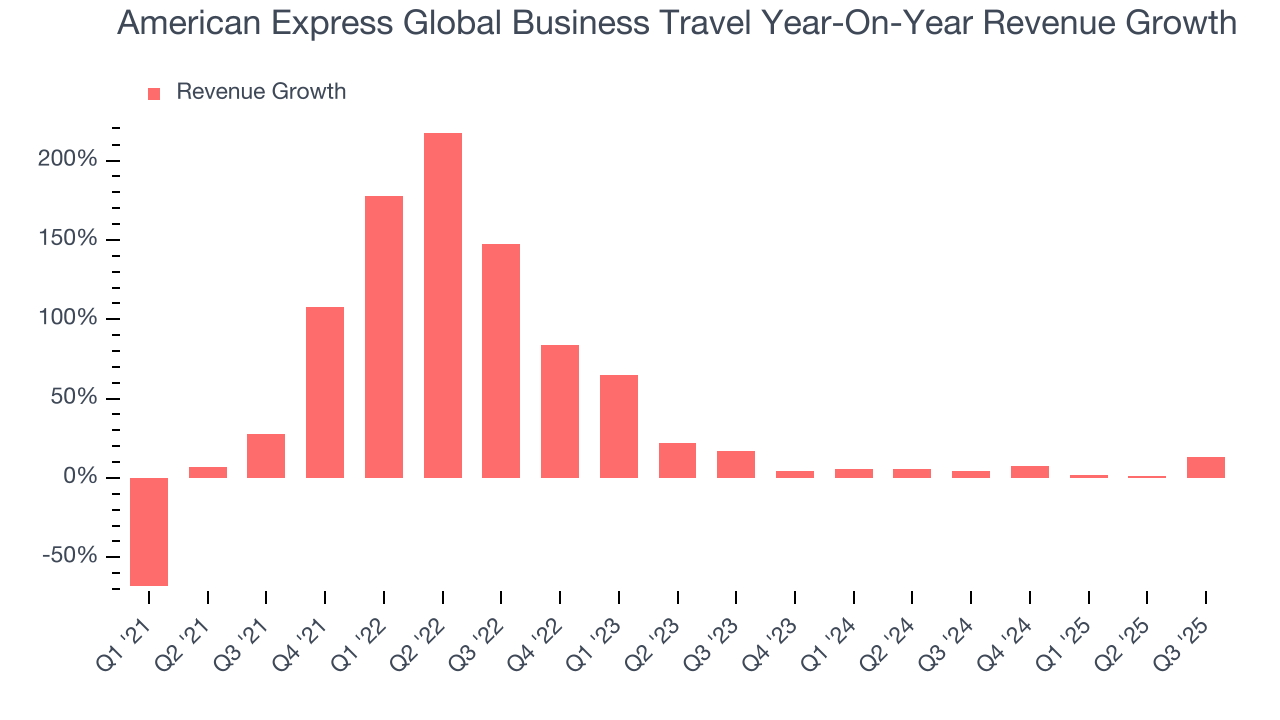

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, American Express Global Business Travel grew its sales at a solid 22.5% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. American Express Global Business Travel’s recent performance shows its demand has slowed as its annualized revenue growth of 5.3% over the last two years was below its five-year trend.

This quarter, American Express Global Business Travel reported year-on-year revenue growth of 12.9%, and its $674 million of revenue exceeded Wall Street’s estimates by 10%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

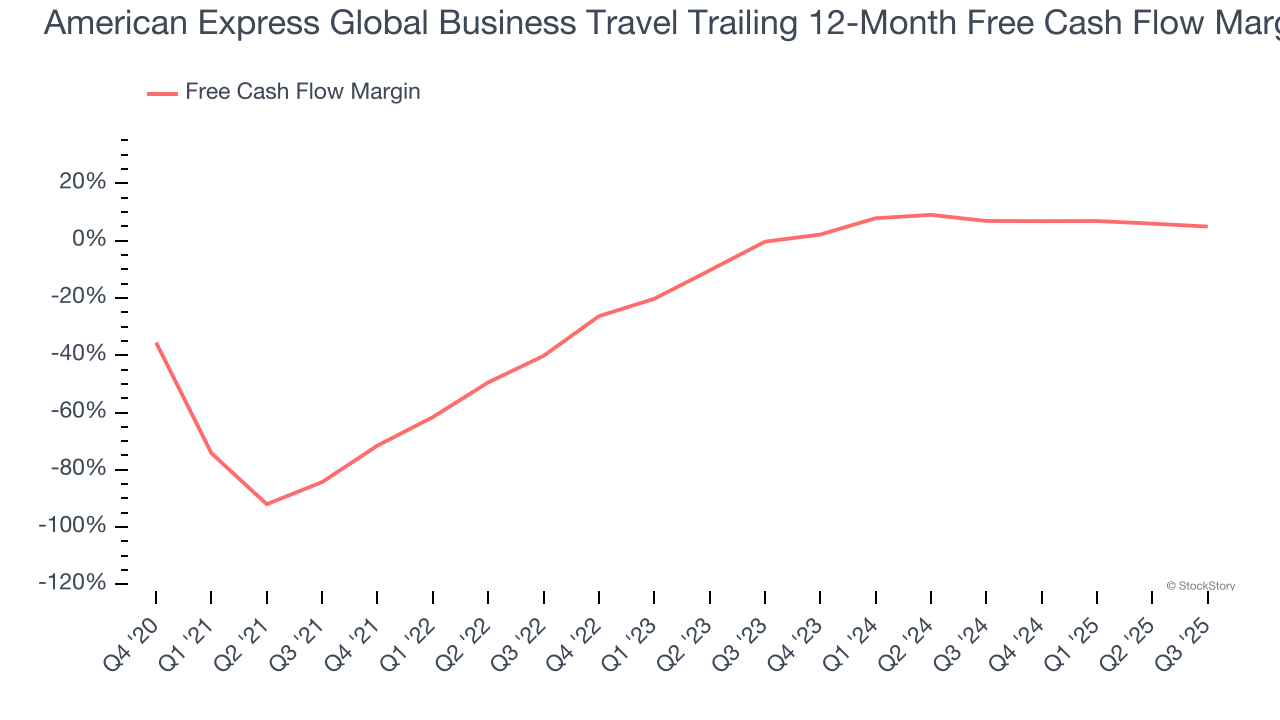

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

American Express Global Business Travel has shown poor cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, lousy for a software business. The divergence from its good operating margin stems from its capital-intensive business model, which requires American Express Global Business Travel to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

American Express Global Business Travel’s free cash flow clocked in at $38 million in Q3, equivalent to a 5.6% margin. The company’s cash profitability regressed as it was 4.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from American Express Global Business Travel’s Q3 Results

We enjoyed seeing American Express Global Business Travel beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed. Overall, this quarter was mixed. The stock traded up 3.9% to $8.27 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.