Security and healthcare technology company OSI Systems (NASDAQ: OSIS) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 11.8% year on year to $384.6 million. The company’s full-year revenue guidance of $1.85 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $1.42 per share was 3.1% above analysts’ consensus estimates.

Is now the time to buy OSI Systems? Find out by accessing our full research report, it’s free for active Edge members.

OSI Systems (OSIS) Q3 CY2025 Highlights:

- Revenue: $384.6 million vs analyst estimates of $366.6 million (11.8% year-on-year growth, 4.9% beat)

- Adjusted EPS: $1.42 vs analyst estimates of $1.38 (3.1% beat)

- The company lifted its revenue guidance for the full year to $1.85 billion at the midpoint from $1.83 billion, a 1% increase

- Management slightly raised its full-year Adjusted EPS guidance to $10.34 at the midpoint

- Operating Margin: 8.6%, in line with the same quarter last year

- Market Capitalization: $4.20 billion

Company Overview

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ: OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.75 billion in revenue over the past 12 months, OSI Systems is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

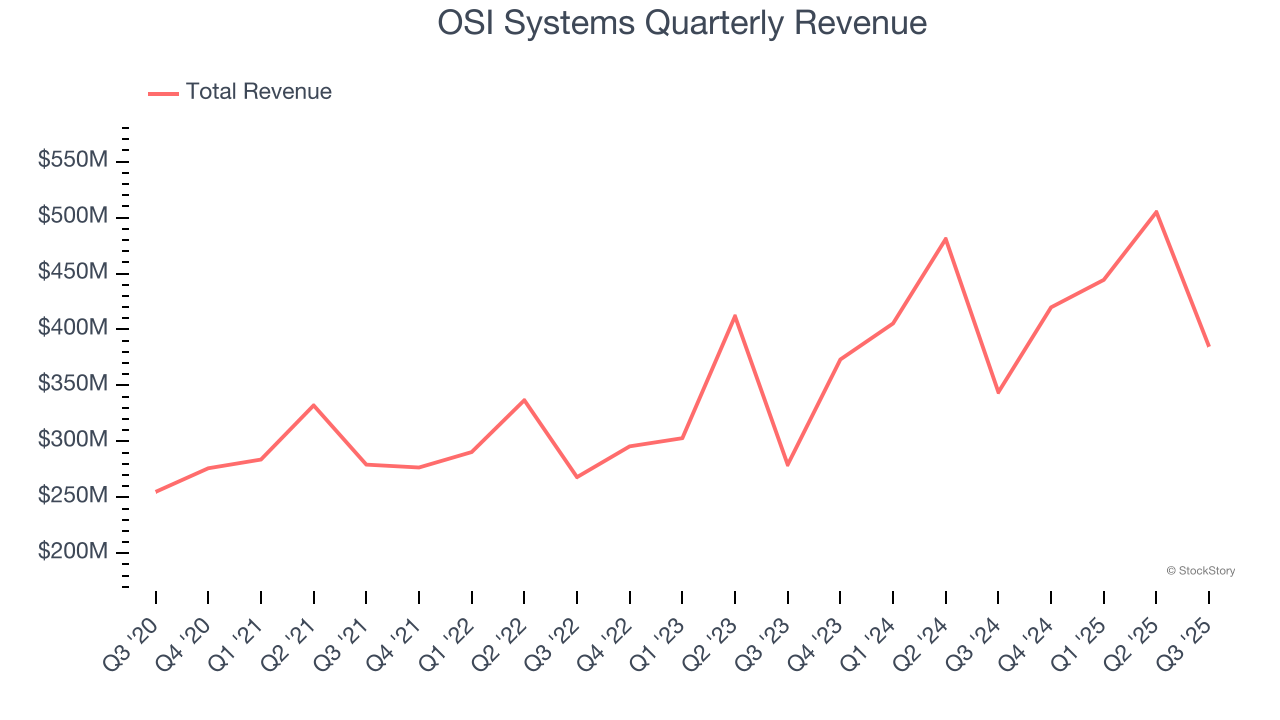

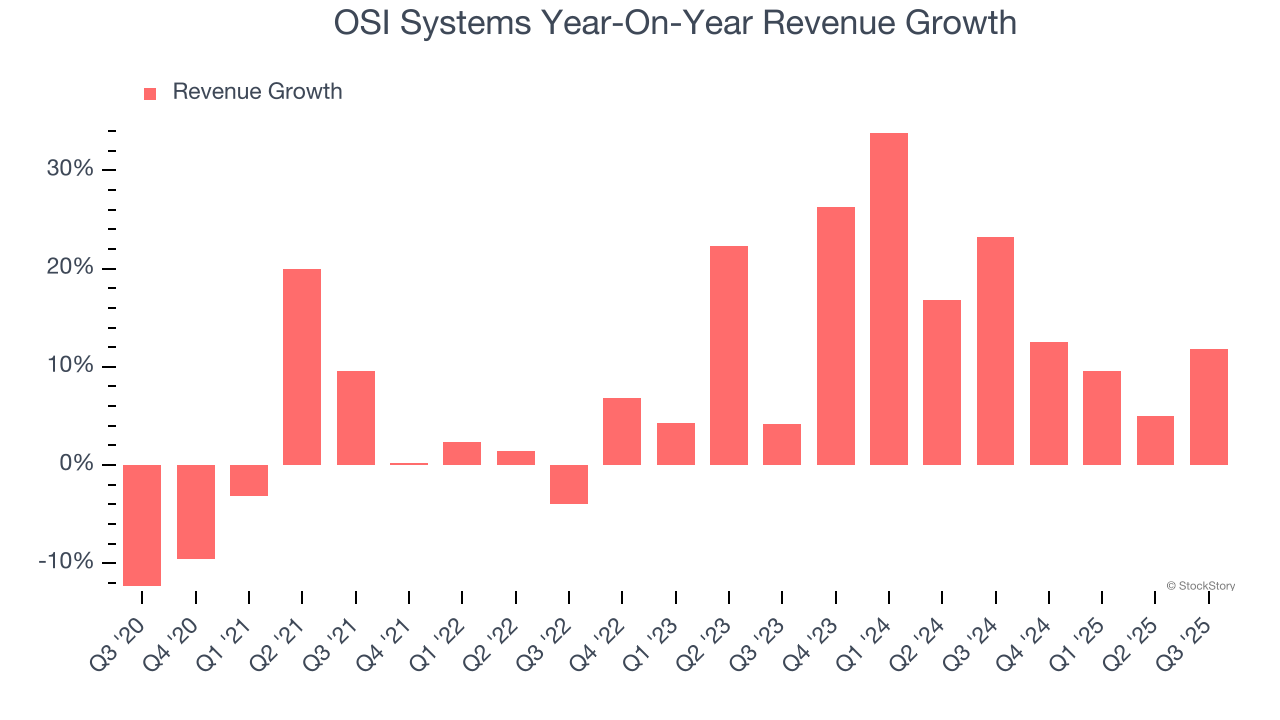

As you can see below, OSI Systems’s sales grew at an impressive 9.2% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows OSI Systems’s demand was higher than many business services companies.

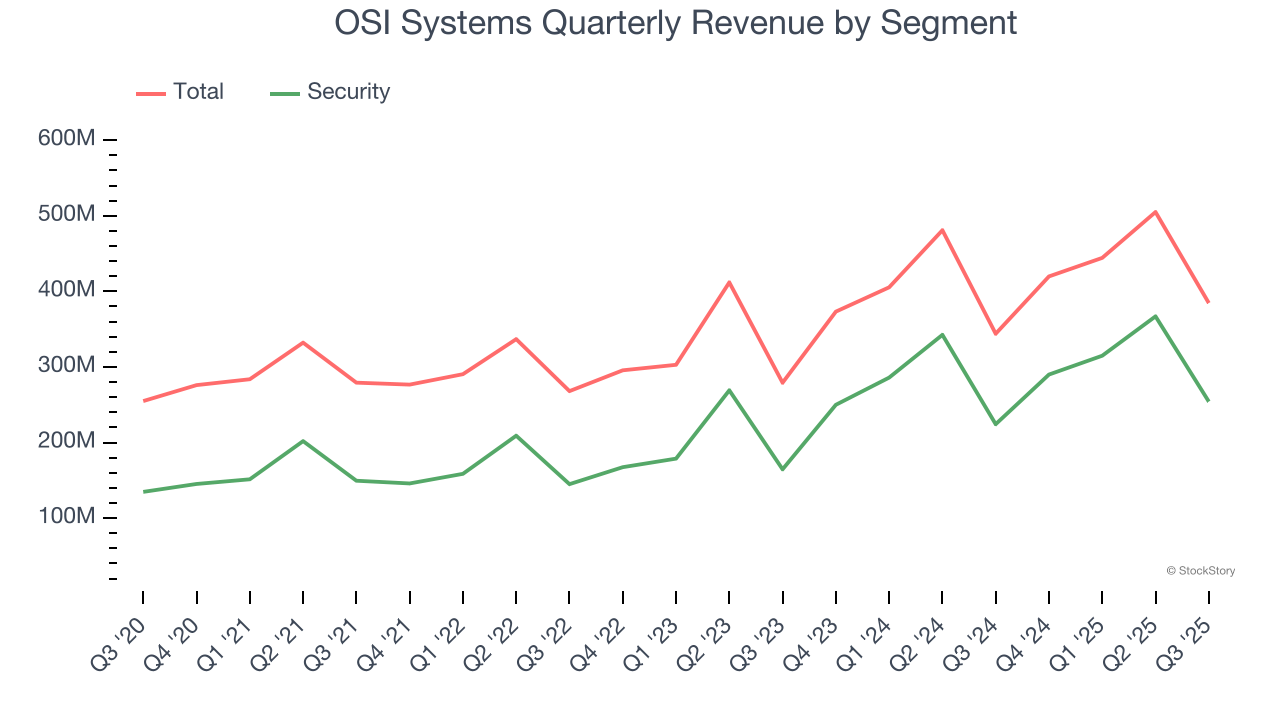

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. OSI Systems’s annualized revenue growth of 16.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

OSI Systems also breaks out the revenue for its most important segment, Security. Over the last two years, OSI Systems’s Security revenue (inspection systems) averaged 27.4% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, OSI Systems reported year-on-year revenue growth of 11.8%, and its $384.6 million of revenue exceeded Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

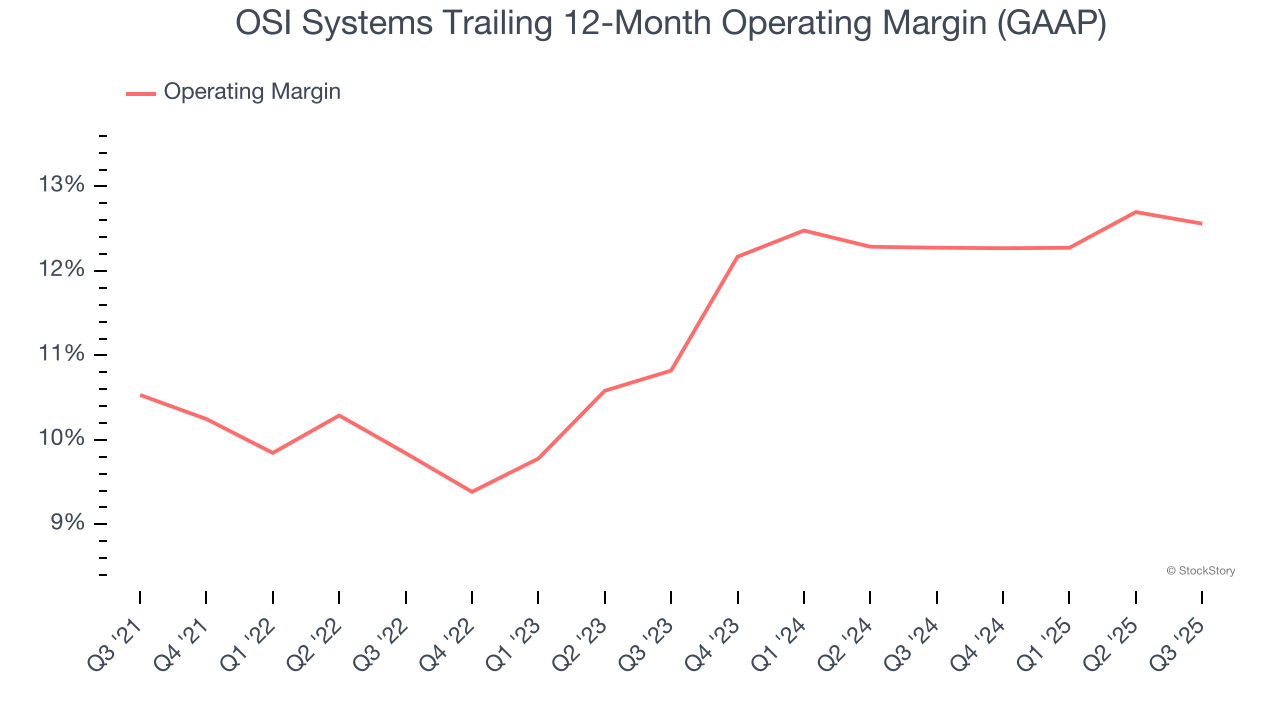

OSI Systems has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.4%, higher than the broader business services sector.

Looking at the trend in its profitability, OSI Systems’s operating margin rose by 2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, OSI Systems generated an operating margin profit margin of 8.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

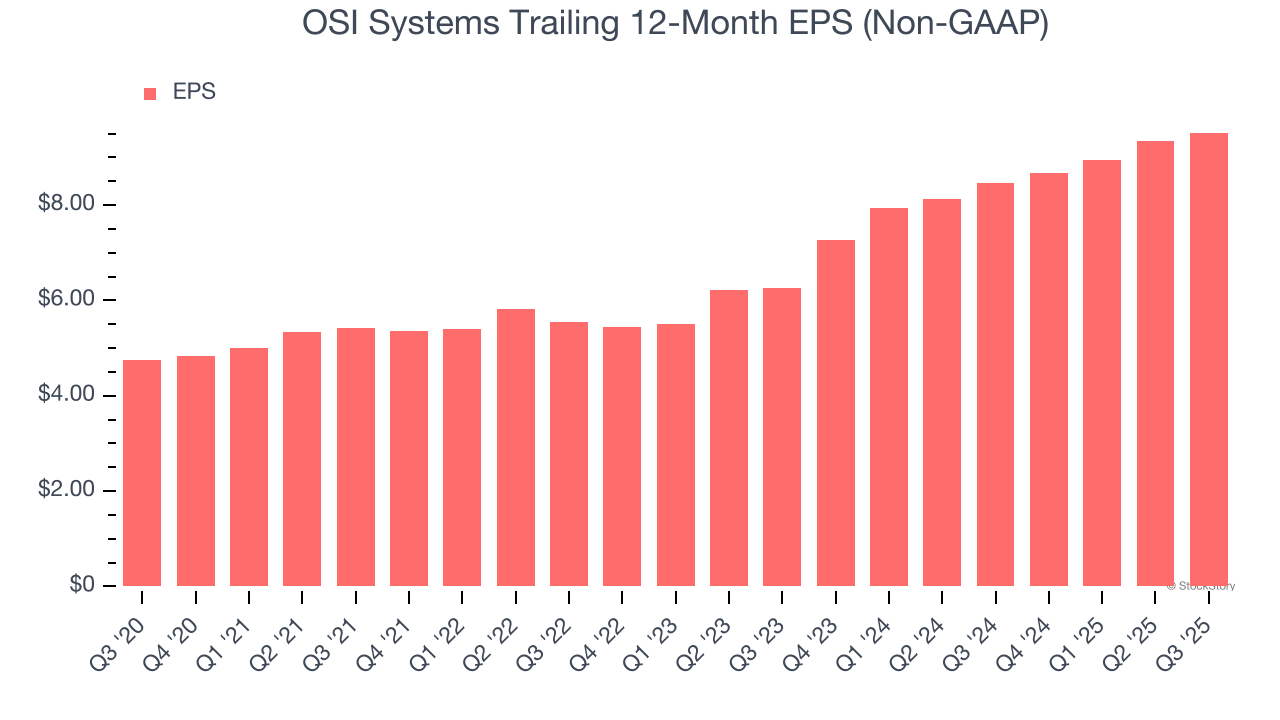

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

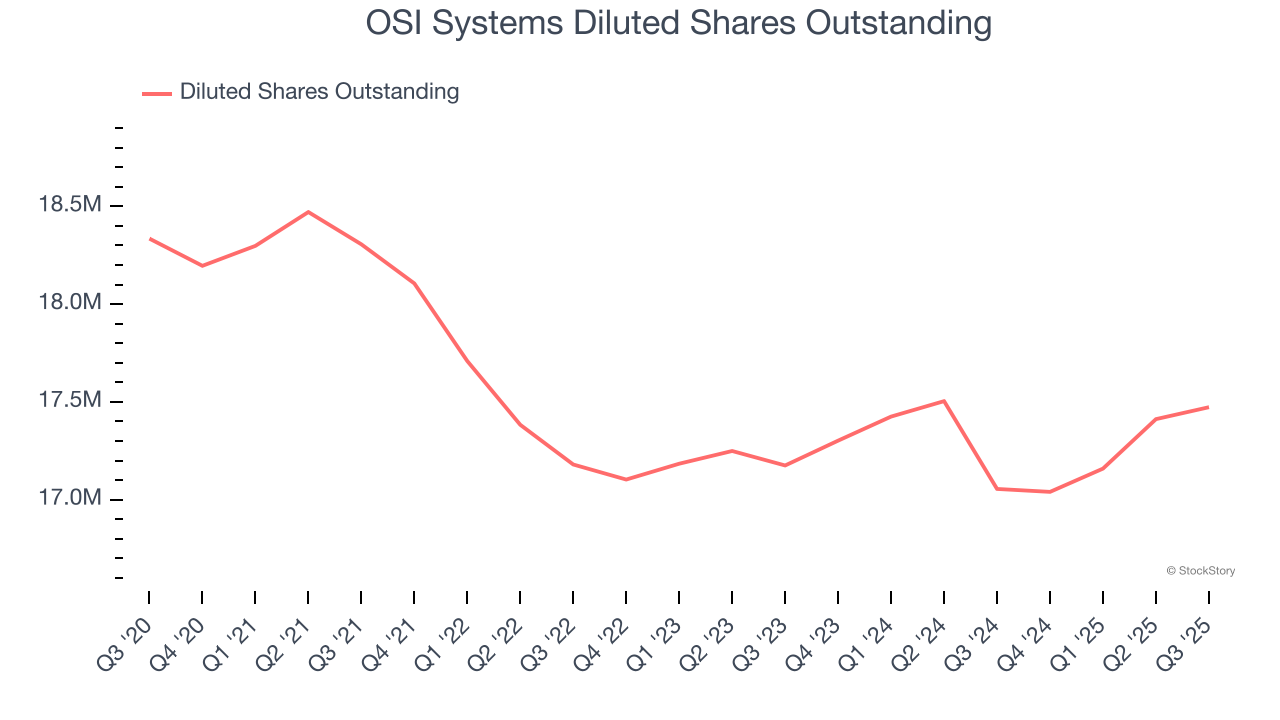

OSI Systems’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 9.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of OSI Systems’s earnings can give us a better understanding of its performance. As we mentioned earlier, OSI Systems’s operating margin was flat this quarter but expanded by 2 percentage points over the last five years. On top of that, its share count shrank by 4.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For OSI Systems, its two-year annual EPS growth of 23.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, OSI Systems reported adjusted EPS of $1.42, up from $1.25 in the same quarter last year. This print beat analysts’ estimates by 3.1%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from OSI Systems’s Q3 Results

We enjoyed seeing OSI Systems beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.2% to $248.80 immediately after reporting.

Sure, OSI Systems had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.