Abbott Laboratories' (NYSE: ABT) share price was corrected at the end of CQ1 2024 on growth, profitability and capital returns concerns. The FQ1 results, however, belie the fear and have the market set up for a rebound that could last for several quarters. Results point to normalization in the post-COVID world, sustainable growth and margin stability that supports healthy capital returns.

Abbott Laboratories' (NYSE: ABT) share price was corrected at the end of CQ1 2024 on growth, profitability and capital returns concerns. The FQ1 results, however, belie the fear and have the market set up for a rebound that could last for several quarters. Results point to normalization in the post-COVID world, sustainable growth and margin stability that supports healthy capital returns.

Among Abbott's attractions are its blue-chip quality business and fortress balance sheet. The company operates in a manner with shareholder interests as a priority. That manifests itself in the dividend distribution and history, which includes a 2% payout, a low 45% payout ratio, and membership in the Dividend Aristocrats and Dividend Kings.

Abbott's Growth Accelerates on Medical Devices Demand

Abbott Laboratories had a solid quarter supported by its diversified, global business model. The company reported $10 billion in net revenue for a gain of 2.2%, which is significant for several reasons. The 2.2% growth is better than expected, the second quarter of growth since growth resumed, and it is accelerating despite the impact of reduced COVID-19 testing. Organically, revenue is up 10.8%, excluding the effects of COVID-19 and acquisitions, driven by strength in three of the four operating segments.

The United States was the weak spot regionally, with sales down by 2.1%. International sales are up by 5.2%. Medical Devices is the strongest segmentally, with a growth of 14.2% supported by four of its sub-segments, including Diabetes and Heart. Nutrition gained 5.1%, Established Pharmaceuticals 3.1%, and Diagnostics fell 17.6% due to COVID-related business.

Margin news is mixed. The company's margins narrowed due to deleveraging and rising costs, but they were less than expected. The result is a high-single-digit decline in operating and net earnings that was less than forecasted. The 98 cents in adjusted earnings is down a nickel from the prior year but 3 cents ahead of consensus, leading the company to improve its guidance. Abbott Laboratories raised the low end of the range for revenue and earnings to increase the midpoint for both. The caveat is that the mid-point for top-line guidance is short of consensus, while that for the bottom is above.

[content-module:CompanyOverview|NYSE: ABT]

Analysts Lead Abbott Laboratories Higher

Abbott Laboratories is being led higher by analysts, so the post-release dip in the price action may not last long. The 13 analysts tracked by Marketbeat have the stock pegged at Moderate Buy and see it advancing about 12% at the consensus midpoint. The consensus is rising compared to last month, last quarter, and last year and is likely to continue rising now. The latest reports are from Citigroup and Evercore ISI, which raised their price targets. They see this stock trading between $125 and $128, or about 20% above the current action.

Abbott has risks, and they may weigh on the sentiment and price action this year. The company weathered the initial storm caused by its baby formula, but a second was brewing. A verdict against its healthcare competitor in a similar case is setting the company up for significant damages should juries in the United States agree.

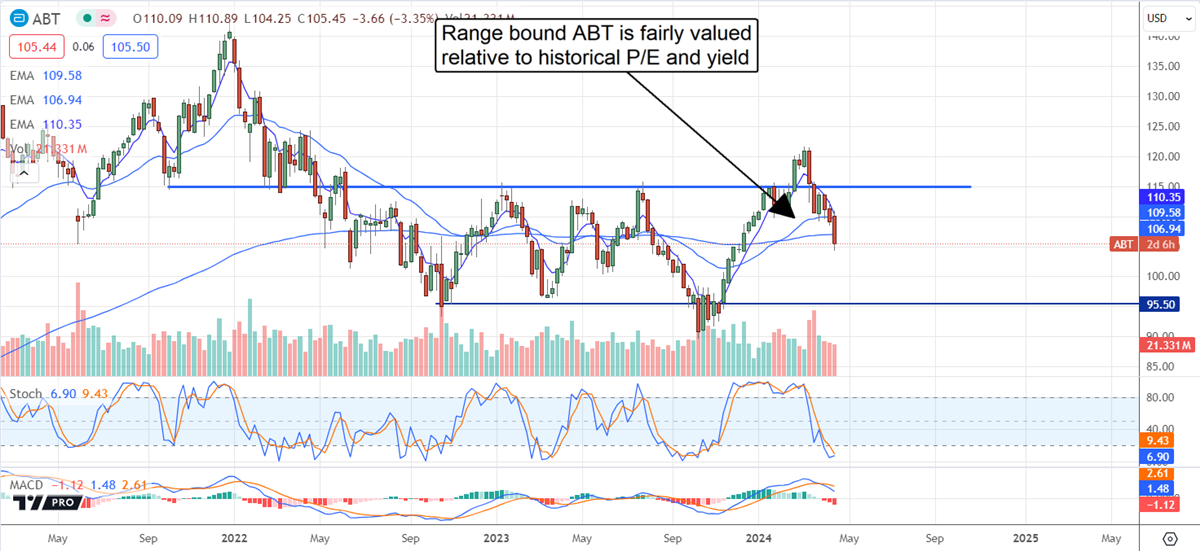

Abbott Laboratories Is Range Bound

Abbott Laboratories' share prices corrected at the end of Q1 to keep the stock moving sideways within an established range. The current action is near the midpoint of the range where the stock's valuation is near 25x and the middle of its historic range. The yield is also near the middle of the historical range, suggesting fair value for the market. Because the most recent action is downward, investors may expect ABT shares to move to the lower end of the trading range. In this scenario, the stock is a Buy when it's near $95 or when a bottom forms.