Record second quarter revenue of $402.0 million, up 23% year over year

Record second quarter gross profit of $209.1 million, up 32% year over year

Second quarter diluted EPS of $0.28, up 65% year over year

Celsius Holdings, Inc. (Nasdaq: CELH), maker of CELSIUS®, the premium lifestyle energy drink formulated to power active lifestyles with ESSENTIAL ENERGY™, today reported record second quarter 2024 financial results.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240806461910/en/

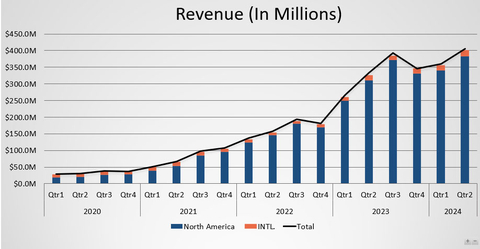

Revenue (in millions) (Graphic: Business Wire)

Summary Financials |

2Q 2024 |

2Q 2023 |

Change |

1H 2024 |

1H 2023 |

Change |

(Millions except for percentages and EPS) |

||||||

Revenue |

$402.0 |

$325.9 |

23% |

$757.7 |

$585.8 |

29% |

N. America |

$382.4 |

$310.8 |

23% |

$721.9 |

$559.4 |

29% |

International |

$19.6 |

$15.1 |

30% |

$35.8 |

$26.4 |

36% |

Gross Margin |

52.0% |

48.8% |

+320 BPS |

51.6% |

46.6% |

+500 BPS |

Net Income |

$79.8 |

$51.5 |

55% |

$157.6 |

$92.7 |

70% |

Net Income att. to Common Shareholders |

$66.7 |

$40.8 |

63% |

$131.5 |

$72.2 |

82% |

Diluted EPS |

$0.28 |

$0.17 |

65% |

$0.55 |

$0.31 |

77% |

Adjusted EBITDA* |

$100.4 |

$78.1 |

29% |

$188.4 |

$126.9 |

48% |

John Fieldly, Chairman and CEO of Celsius Holdings, Inc., said: “Celsius today reported its best second quarter financial results ever, delivering records in revenue, gross profit and gross margin. Celsius continued to lead the energy drink category, contributing 47 percent of all second-quarter growth, and we believe that we are well-positioned to capture incremental category dollar share. Celsius innovation is giving consumers great tasting, better-for-you energy drink products that are filling a whitespace and bringing new consumers to an evolving energy drink category.”

FINANCIAL HIGHLIGHTS FOR THE SECOND QUARTER OF 2024

Revenue for the second quarter of 2024 increased 23% to $402.0 million compared to $325.9 million for the prior-year period, driven primarily by the North American business and the company’s success in sustaining consumer demand growth. Revenue in the quarter was offset in part by reduction in inventory days on hand by a large distributor.

Retail sales of Celsius in total U.S. MULOC grew by 36.5% year over year in the second quarter of 20241 as reported by Circana for the last-thirteen-week period ended June 30, 2024.

International sales of $19.6 million increased 30% year over year in the second quarter from $15.1 million, driven by ongoing velocity improvements and brand awareness.

Gross profit for the second quarter of 2024 increased 32% to $209.1 million compared to $159.0 million for the prior-year period. Gross profit as a percentage of revenue was 52.0% for the three months ended June 30, 2024, up from 48.8% for the prior-year period, as a result of freight optimization and lower materials costs.

Diluted earnings per share for the second quarter increased 65% to $0.28 compared to $0.17 for the prior-year period, driven by improvements in gross margin and leverage across SG&A.

FINANCIAL HIGHLIGHTS FOR THE FIRST HALF OF 2024

Revenue for the first half of 2024 increased 29% to $757.7 million compared to $585.8 million for the prior-year period. International sales of $35.8 million increased 36% from $26.4 million for the prior-year period.

Gross profit for the first half of 2024 increased 43% to $391.3 million compared to $272.8 million for the prior-year period. Gross profit as a percentage of revenue was 51.6% for the six months ended June 30, 2024, up from 46.6% for the prior-year period.

Diluted earnings per share for the first half of the year increased 77% to $0.55 compared to $0.31 for the prior-year period, driven by improvements in gross margin and leverage across SG&A.

BUSINESS OPERATIONS AND COMPANY HIGHLIGHTS

Share Growth

Celsius’ energy drink category dollar share in MULOC in the last-four-week period ended July 14, 2024, was 11%, an increase of 1.4 points compared to the year-ago period2. This share performance delivered quarter-over-quarter sales growth for Celsius of 11.8% within the category3.

Celsius gained approximately 35% more retail shelf space, increasing the average SKUs selling per store to 20 from 15, according to Circana’s last-four-week read ended July 14, 2024, compared to the last-four-week period ended Dec. 3, 20234.

Alternative Growth Drivers

Club channel sales for the quarter ended June 30, 2024, increased 30% to $88.0 million compared to $67.9 million for the prior-year period.

Celsius sales to Amazon increased 41% year over year to approximately $39.9 million for the quarter ended June 30, 2024.

Approximately 12.1% of Celsius’ total U.S. sales to PepsiCo in the second quarter of 2024 was to the food service channel.

Innovation and Marketing

Sales of CELSIUS Essentials continue to exceed the company’s expectations and have reached 64% ACV and 4.4 average items sold per store5. CELSIUS Essentials were sold in more than 124,602 stores in the last-four-week period ended July 14, 20246.

Celsius introduced three great tasting and refreshing 12-ounce flavors during the summer: CELSIUS Sparkling Watermelon Lemonade, CELSIUS Sparkling Kiwi Strawberry and CELSIUS Sparkling Cherry Cola. Additionally, three new CELSIUS On The Go powders debuted in the second quarter: CELSIUS On The Go Peach Vibe, CELSIUS On The Go Tropical Vibe and CELSIUS On The Go Arctic Vibe.

International Expansion

Celsius began sales in the UK and Ireland in the second quarter of 2024 through the fitness channel and in select gyms.

Sales in Canada continued to exceed the company’s initial expectations in the second quarter of 2024, during which we introduced CELSIUS Sparkling Green Apple Cherry to the Canadian market.

Sales in Australia, France and New Zealand are expected to begin in the second half of this year with broadening reach throughout 2025.

Second Quarter 2024 Earnings Webcast

Management will host a webcast at 8 a.m. EDT on Tuesday, Aug. 6, 2024, to discuss the company’s second quarter financial results with the investment community. Investors are invited to join the webcast accessible from https://ir.celsiusholdingsinc.com. Downloadable files, an audio replay and transcript will be made available on the Celsius Holdings investor relations website.

*The company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), but management believes that disclosure of Adjusted EBITDA, a non-GAAP financial measure that management uses to assess our performance, may provide users with additional insights into operating performance. Please see “Use of Non-GAAP Measures” and reconciliations of this non-GAAP measure to the most directly comparable GAAP measure, both of which can be found below.

1Circana Total US MULOC L13W ended 6/30/24, RTD Energy |

2Circana Total US MULOC L4W ended 7/14/24, RTD Energy |

3Circana Total US MULOC L13W ended 6/30/24, RTD Energy |

4Circana Total US MULOC L4W ended 12/3/23 v. L4W ended 7/14/24, RTD Energy |

5Circana Total US MULOC L4W ended 7/14/24, RTD Energy |

6Circana Total US MULOC L4W ended 7/14/24, RTD Energy |

About Celsius Holdings, Inc.

Celsius Holdings, Inc. (Nasdaq: CELH) is the maker of energy drink brand CELSIUS®, a lifestyle energy drink born in fitness and a pioneer in the rapidly growing energy category. For more information, please visit www.celsiusholdingsinc.com.

Forward-Looking Statements

This press release contains statements that are not historical facts and are considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements contain projections of Celsius Holdings’ future results of operations or financial position, or state other forward-looking information. You can identify these statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would,” “could,” “project,” “plan,” “potential,” “designed,” “seek,” “target,” and variations of these terms, the negatives of such terms and similar expressions. You should not rely on forward-looking statements because Celsius Holdings’ actual results may differ materially from those indicated by forward-looking statements as a result of a number of important factors. These factors include but are not limited to: the strategic investment by and long term partnership with PepsiCo, Inc.; management’s plans and objectives for international expansion and future operations globally; general economic and business conditions; our business strategy for expanding our presence in our industry; our expectations of revenue; operating costs and profitability; our expectations regarding our strategy and investments; our expectations regarding our business, including market opportunity, consumer demand and our competitive advantage; anticipated trends in our financial condition and results of operation; the impact of competition and technology change; existing and future regulations affecting our business; the Company’s ability to satisfy, in a timely manner, all Securities and Exchange Commission (the “SEC”) required filings and the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and the rules and regulations adopted under that Section; and other risks and uncertainties discussed in the reports Celsius Holdings has filed previously with the SEC, such as its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Forward-looking statements speak only as of the date the statements were made. Celsius Holdings does not undertake any obligation to update forward-looking information, except to the extent required by applicable law.

CELSIUS HOLDINGS, INC. - FINANCIAL TABLES CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except par value) (Unaudited) |

|||||||

|

June 30,

|

|

December 31,

|

||||

ASSETS |

|

|

|

||||

Current assets: |

|

|

|

||||

Cash and cash equivalents |

$ |

903,210 |

|

|

$ |

755,981 |

|

Accounts receivable-net |

|

262,920 |

|

|

|

183,703 |

|

Note receivable-current-net |

|

1,166 |

|

|

|

2,318 |

|

Inventories-net |

|

180,669 |

|

|

|

229,275 |

|

Deferred other costs-current |

|

14,124 |

|

|

|

14,124 |

|

Prepaid expenses and other current assets |

|

22,900 |

|

|

|

19,503 |

|

Total current assets |

|

1,384,989 |

|

|

|

1,204,904 |

|

|

|

|

|

||||

Property and equipment-net |

|

36,282 |

|

|

|

24,868 |

|

Deferred tax assets |

|

22,727 |

|

|

|

29,518 |

|

Right of use assets-operating leases |

|

1,507 |

|

|

|

1,957 |

|

Right of use assets-finance leases |

|

233 |

|

|

|

208 |

|

Deferred other costs-non-current |

|

241,276 |

|

|

|

248,338 |

|

Intangibles-net |

|

11,491 |

|

|

|

12,139 |

|

Goodwill |

|

13,730 |

|

|

|

14,173 |

|

Other long-term assets |

|

6,653 |

|

|

|

291 |

|

Total Assets |

$ |

1,718,888 |

|

|

$ |

1,536,396 |

|

|

|

|

|

||||

LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY |

|

|

|

||||

|

|

|

|

||||

Current liabilities: |

|

|

|

||||

Accounts payable |

$ |

47,423 |

|

|

$ |

42,840 |

|

Accrued expenses |

|

79,633 |

|

|

|

62,120 |

|

Income taxes payable |

|

5,374 |

|

|

|

50,424 |

|

Accrued promotional allowance |

|

156,479 |

|

|

|

99,787 |

|

Lease liability obligation-operating leases-current |

|

729 |

|

|

|

980 |

|

Lease liability obligation-finance leases |

|

61 |

|

|

|

59 |

|

Deferred revenue-current |

|

9,513 |

|

|

|

9,513 |

|

Other current liabilities |

|

13,772 |

|

|

|

10,890 |

|

Total current liabilities |

|

312,984 |

|

|

|

276,613 |

|

|

|

|

|

||||

Lease liability obligation-operating leases-non-current |

|

762 |

|

|

|

955 |

|

Lease liability obligation-finance leases-non-current |

|

228 |

|

|

|

193 |

|

Deferred tax liabilities |

|

2,201 |

|

|

|

2,880 |

|

Deferred revenue-non-current |

|

162,471 |

|

|

|

167,227 |

|

Total Liabilities |

|

478,646 |

|

|

|

447,868 |

|

|

|

|

|

||||

Commitment and contingencies (Note 15) |

|

|

|

||||

|

|

|

|

||||

Mezzanine Equity: |

|

|

|

||||

Series A convertible preferred shares, $0.001 par value, 5% cumulative dividends; 1,466,666 shares issued and outstanding at each of June 30, 2024 and December 31, 2023, aggregate liquidation preference of $550,000 as of June 30, 2024 and December 31, 2023. |

|

824,488 |

|

|

|

824,488 |

|

|

|

|

|

||||

Stockholders’ Equity: |

|

|

|

||||

Common stock, $0.001 par value; 300,000,000 shares authorized, 233,344,377 and 231,787,482 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively. |

|

78 |

|

|

|

77 |

|

Additional paid-in capital |

|

286,173 |

|

|

|

276,717 |

|

Accumulated other comprehensive loss |

|

(2,363 |

) |

|

|

(701 |

) |

Retained earnings (accumulated deficit) |

|

131,866 |

|

|

|

(12,053 |

) |

Total Stockholders’ Equity |

|

415,754 |

|

|

|

264,040 |

|

Total Liabilities, Mezzanine Equity and Stockholders’ Equity |

$ |

1,718,888 |

|

|

$ |

1,536,396 |

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (In thousands, except per share amounts) (Unaudited) |

|||||||||||||||

|

For the Three Months Ended

|

|

For the Six Months Ended

|

||||||||||||

|

2024 |

|

2023 |

|

2024 |

|

2023 |

||||||||

Revenue |

$ |

401,977 |

|

|

$ |

325,883 |

|

|

$ |

757,685 |

|

|

$ |

585,822 |

|

Cost of revenue |

|

192,879 |

|

|

|

166,889 |

|

|

|

366,380 |

|

|

|

313,010 |

|

Gross profit |

|

209,098 |

|

|

|

158,994 |

|

|

|

391,305 |

|

|

|

272,812 |

|

Selling, general and administrative expenses |

|

114,850 |

|

|

|

94,181 |

|

|

|

213,867 |

|

|

|

163,086 |

|

Income from operations |

|

94,248 |

|

|

|

64,813 |

|

|

|

177,438 |

|

|

|

109,726 |

|

|

|

|

|

|

|

|

|

||||||||

Other income (expense): |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

Interest income on note receivable |

|

— |

|

|

|

28 |

|

|

|

28 |

|

|

|

73 |

|

Interest income, net |

|

10,647 |

|

|

|

5,545 |

|

|

|

20,259 |

|

|

|

10,469 |

|

Foreign exchange loss |

|

(264 |

) |

|

|

(931 |

) |

|

|

(633 |

) |

|

|

(1,049 |

) |

Total other income |

|

10,383 |

|

|

|

4,642 |

|

|

|

19,654 |

|

|

|

9,493 |

|

|

|

|

|

|

|

|

|

||||||||

Net income before provision for income taxes |

|

104,631 |

|

|

|

69,455 |

|

|

|

197,092 |

|

|

|

119,219 |

|

|

|

|

|

|

|

|

|

||||||||

Provision for income taxes |

|

(24,848 |

) |

|

|

(17,946 |

) |

|

|

(39,498 |

) |

|

|

(26,483 |

) |

Net income |

$ |

79,783 |

|

|

$ |

51,509 |

|

|

$ |

157,594 |

|

|

$ |

92,736 |

|

|

|

|

|

|

|

|

|

||||||||

Dividends on Series A convertible preferred stock |

|

(6,838 |

) |

|

|

(6,856 |

) |

|

|

(13,675 |

) |

|

|

(13,637 |

) |

Income allocated to participating preferred stock |

|

(6,289 |

) |

|

|

(3,890 |

) |

|

|

(12,417 |

) |

|

|

(6,898 |

) |

Net income attributable to common stockholders |

$ |

66,656 |

|

|

$ |

40,763 |

|

|

$ |

131,502 |

|

|

$ |

72,201 |

|

|

|

|

|

|

|

|

|

||||||||

Other comprehensive (loss) income: |

|

|

|

|

|

|

|

||||||||

Foreign currency translation adjustments, net of income tax |

|

(308 |

) |

|

|

(590 |

) |

|

|

(1,662 |

) |

|

|

4 |

|

Comprehensive income |

$ |

66,348 |

|

|

$ |

40,173 |

|

|

$ |

129,840 |

|

|

$ |

72,205 |

|

|

|

|

|

|

|

|

|

||||||||

*Earnings per share: |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

0.29 |

|

|

$ |

0.18 |

|

|

$ |

0.56 |

|

|

$ |

0.31 |

|

Dilutive |

$ |

0.28 |

|

|

$ |

0.17 |

|

|

$ |

0.55 |

|

|

$ |

0.31 |

|

*Please refer to Note 3 in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024, for Earnings per Share reconciliations. |

|||||||||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Reconciliation of GAAP net income to non-GAAP adjusted EBITDA |

|||||||||||||||

|

Three months ended

|

|

Six months ended

|

||||||||||||

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Net income (GAAP measure) |

$ |

79,783 |

|

|

$ |

51,509 |

|

|

$ |

157,594 |

|

|

$ |

92,736 |

|

Add back/(Deduct): |

|

|

|

|

|

|

|

||||||||

Net interest income |

|

(10,647 |

) |

|

|

(5,573 |

) |

|

|

(20,287 |

) |

|

|

(10,542 |

) |

Provision for income taxes |

|

24,848 |

|

|

|

17,946 |

|

|

|

39,498 |

|

|

|

26,483 |

|

Depreciation and amortization expense |

|

1,418 |

|

|

|

698 |

|

|

|

2,648 |

|

|

|

1,246 |

|

Non-GAAP EBITDA |

|

95,402 |

|

|

|

64,580 |

|

|

|

179,453 |

|

|

|

109,923 |

|

Stock-based compensation1 |

|

4,746 |

|

|

|

5,735 |

|

|

|

8,309 |

|

|

|

11,242 |

|

Foreign exchange |

|

264 |

|

|

|

931 |

|

|

|

633 |

|

|

|

1,049 |

|

Distributor Termination2 |

|

— |

|

|

|

(1,007 |

) |

|

|

— |

|

|

|

(3,241 |

) |

Legal Settlement Costs3 |

|

— |

|

|

|

7,900 |

|

|

|

— |

|

|

|

7,900 |

|

Non-GAAP Adjusted EBITDA |

$ |

100,412 |

|

|

$ |

78,139 |

|

|

$ |

188,395 |

|

|

$ |

126,873 |

|

___________________________

| 1Selling, general and administrative expenses related to employee non-cash stock-based compensation expense. Stock-based compensation expense consists of non-cash charges for the estimated fair value of unvested restricted share unit and stock option awards granted to employees and directors. The Company believes that the exclusion provides a more accurate comparison of operating results and is useful to investors to understand the impact that stock-based compensation expense has on its operating results. |

22023 distributor termination represents reversals of accrued termination payments. The unused funds designated for termination expense payments to legacy distributors were reimbursed to Pepsi for the quarter ended June 30, 2023. |

32023 Legal class action settlement pertained to the McCallion vs Celsius Holdings class action lawsuit, which we settled during the quarter ended June 30, 2023. |

USE OF NON-GAAP MEASURES

Celsius defines Adjusted EBITDA as net income before net interest income, income tax expense (benefit), and depreciation and amortization expense, further adjusted by excluding stock-based compensation expense, foreign exchange gains or losses, distributor termination fees, legal settlement costs and certain impairment charges. Adjusted EBITDA is a non-GAAP financial measure.

Celsius uses Adjusted EBITDA for operational and financial decision-making and believes these measures are useful in evaluating its performance because they eliminate certain items that management does not consider indicators of Celsius’ operating performance. Adjusted EBITDA may also be used by many of Celsius’ investors, securities analysts, and other interested parties in evaluating its operational and financial performance across reporting periods. Celsius believes that the presentation of Adjusted EBITDA provides useful information to investors by allowing an understanding of measures that it uses internally for operational decision-making, budgeting and assessing operating performance.

Adjusted EBITDA is not a recognized term under GAAP and should not be considered as a substitute for net income or any other financial measure presented in accordance with GAAP. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of Celsius’ results as reported under GAAP. Celsius strongly encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure.

Because non-GAAP financial measures are not standardized, Adjusted EBITDA, as defined by Celsius, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare Celsius’ use of these non-GAAP financial measures with those used by other companies.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240806461910/en/

Celsius today reported its best second quarter financial results ever, delivering records in revenue, gross profit and gross margin. Celsius continued to lead the energy drink category, contributing 47 percent of all second-quarter growth.

Contacts

Paul Wiseman

Investors: investorrelations@celsius.com

Press: press@celsius.com