Sculptor Capital Management, Inc. (“Sculptor” or the “Company”) (NYSE: SCU) today responded to the Section 220 Demand for Inspection (“Section 220”) letter sent by Daniel S. Och, Harold Kelly, Richard Lyon, James O’Connor, and Zoltan Varga (the “Och Group”) dated August 22, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230829781225/en/

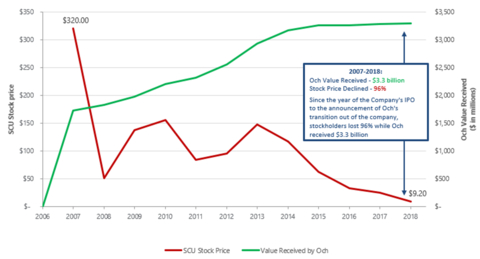

Mr. Och took home $3.3 billion since 2007 while the Company's stock price dropped by 96%. (Graphic: Business Wire)

Below is a cover letter and a Section 220 response letter delivered to the Och Group today.

Cover Letter

August 29, 2023

via Email

Daniel S. Och

Harold Kelly

Richard Lyon

James O’Connor

Zoltan Varga

c/o Andrew J. Levander, Esq.

Dechert LLP

Three Bryant Park

1095 Avenue of the Americas

New York, NY 10036

andrew.levander@dechert.com

Re: Letter Seeking Inspection of Books and Records of Sculptor Capital Management, Inc.

Dear Messrs. Och, Kelly, Lyon, O’Connor, and Varga:

We write to you (the “Och Group”) on behalf of Sculptor Capital Management, Inc. (“Sculptor” or the “Company”) in response to your letter dated August 22, 2023 to the Special Committee of the Board of Directors (the “Letter”) and Section 220 Demand for Inspection (the “Demand”). As set forth in the enclosed response to the Demand, the Company believes that your requests are improper as they continue to propagate and rely upon a false narrative as a cover for your true motives: to disparage the Company, its Board of Directors and management, and to make self-interested demands. This is demonstrated by the following points which are further detailed in our response:

-

The Demand appears to be improperly motivated by Mr. Och’s longstanding resentment from his having been exited from the Company.

While ostensibly requesting information about the sales process described in the Company’s preliminary proxy statement, your Demand for books and records is set against historical context that makes clear that purpose is pretextual, and that the true purpose is the continuation of what the company views as Mr. Och’s well-publicized, years’ long smear campaign against the Company’s management. The Company believes that campaign has been fueled by Mr. Och’s longstanding animus arising from his having been exited from the Company following the Africa bribery scandal that almost put the Company out of business seven years ago and for which Mr. Och personally paid $2.2 million to resolve a related SEC enforcement action. The Company believes that the Demand is just the latest salvo in Mr. Och’s efforts to seek retribution, which in recent years alone has included him, by all indications, engineering the noisy resignation of his Board designee, J. Morgan Rutman, on the basis of a misleading diatribe regarding management compensation, followed by a books-and-records lawsuit publicizing yet more false and disparaging information under the guise of seeking information that, in any event, Mr. Och already possessed.

-

The Och Group’s professed concern for public stockholders cannot be reconciled with Mr. Och’s repeated efforts to undermine the Special Committee’s sales process.

Moreover, your stated concerns about seeking to “protect the interests of all [Company] stockholders” in respect of the Company’s sales efforts rings particularly hollow considering all that you have done in recent months that seemed to undermine those efforts. After pledging to support the Special Committee’s sales process, you then dragged your feet for months on signing a standard non-disclosure agreement, depriving yourself of the facts. At the same time, you publicized baseless attacks about the process on Schedule 13D, seemingly ignoring contrary information provided to you in correspondence from the Special Committee and its counsel. And even worse, after signing the non-disclosure agreement, following what the Company viewed as disruptive behavior by you, a potential transaction for $12 per share with Bidder D.

-

In negotiations with Rithm Capital Corp. (“Rithm”), the Och Group’s focus seems to have been on self-interested demands.

Your professed concerns for the Company’s public stockholders is also belied by your more recent interactions with Rithm in which you appear to have focused on maximizing your own economic interests. For example, you requested that, as part of any closing, Rithm agree to accelerate tens of millions of dollars as a prepayment at a favorable discount rate of the Tax Receivable Agreement and pay you an additional $5.5 million in cash for your legal expenses supposedly incurred in connection with the Company’s sales process, including costs for counsel that were negotiating for your own economic benefits. The transaction under discussion between the Och Group and Rithm would have included the option for a rollover in order to allow you to avoid recognizing significant taxable gain received in the transaction. Notably missing from those discussions were meaningful concessions by any of you for the benefit of public stockholders.

-

We believe that Mr. Och’s purported concern for public stockholders is in stark contrast to his record when running the Company.

Mr. Och took home $3.3 billion since 2007 while the Company’s stock price dropped by 96%. [Please see accompanying chart]

-

The Och Group’s attacks on the Special Committee process are rebutted by the facts of the robust and independent process the Special Committee ran.

The Company believes that the criticisms you seek to level against the Special Committee’s sales process do not have even the slightest merit. The Special Committee ran a robust sales process supported by world-class legal and financial advisors. They reached out to seventy potential acquirors and bidders, and management were appropriately instructed not to engage in any negotiations regarding management’s go-forward employment until principal terms had been agreed.

-

The Och Group’s misguided criticisms of the Rithm transaction are based upon distortions and misrepresentations.

Furthermore, the attacks on the Rithm transaction are equally misplaced. The suggestion that there were other credible bids that provided greater value and certainty of closing, with or without current management, is distorted - no such bid exists. Nor does Rithm’s bid crystallize supposed losses from the adoption of Mr. Levin’s compensation package. Mr. Levin has also agreed to substantial reductions in his compensation to support a Rithm transaction.

For all of these reasons and the others set forth in the response to the Demand, it is clear that you lack the proper purpose mandated by Delaware law to be entitled to books and records from the Company. To the contrary, we believe that you are abusing the process accorded to stockholders under Delaware law as a means of presenting false narratives about the Company while shielding your own undisclosed conflicts which put you at odds with the public stockholders. While this would justify the Company refusing your requests in full, in the interest of avoiding yet more unnecessary litigation, as set forth in additional detail in the Company’s response, we are prepared to meet and confer with you regarding the production of the limited set of materials typically subject to requests under Section 220. This letter is without prejudice to the rights of the Company and the Board, all of which are preserved.

Very truly yours,

Jonathan Pickhardt

cc: Michael Carlinsky

Blair Adams

Brendan Carroll

Brock E. Czeschin

Full Response Letter

August 29, 2023

via Email

Andrew J. Levander, Esq.

Dechert LLP

Three Bryant Park

1095 Avenue of the Americas

New York, NY 10036

andrew.levander@dechert.com

Re: Letter Seeking Inspection of Books and Records of Sculptor Capital Management, Inc.

Dear Mr. Levander:

We write on behalf of Sculptor Capital Management, Inc. (“Sculptor” or the “Company”) in response to the August 22, 2023 demand (the “Demand”) from your clients, Daniel S. Och, Harold Kelly, Richard Lyon, James O’Connor, and Zoltan Varga (the “Och Group”), to inspect Company books and records pursuant to 8 Del. C. § 220 (“Section 220”) in regard to the proposed acquisition of the Company by Rithm (“Merger”) as detailed in the preliminary proxy statement filed by the Company on August 21, 2023 (the “Preliminary Proxy”).

The Och Group does not have any valid grounds under Section 220 to inspect Company books and records. While they profess to make the Demand in order to “protect the interests of all [Company] stockholders,” the Och Group’s well-documented history makes clear that their actual motivations are otherwise and inappropriate. In reality, the Demand is nothing more than a pretext for Mr. Och and his colleagues to continue their years’ long campaign against the Company’s current management while masking their own conflicts in having repeatedly demanded economic benefits for themselves.

The Company believes this campaign was borne out of Mr. Och’s resentment at being exited from the Company’s helm following a highly-publicized Foreign Corrupt Practices Act (“FCPA”) bribery scandal that nearly destroyed the Company seven years ago. Since then, Mr. Och has orchestrated a series of public attacks against the Company’s management, the Demand being but the latest chapter. This included the January 2022 noisy resignation of Mr. Och’s designee to the Company’s Board of Directors (“Board”), J. Morgan Rutman, a long-time employee of Mr. Och’s, regarding the compensation paid to the Company’s CEO, James Levin, who seems to have been Mr. Och’s primary target ever since Mr. Levin supported the independent directors’ effort to exit Mr. Och from the Company. Later in 2022, notwithstanding Mr. Och’s already-extensive knowledge of Mr. Levin’s compensation arrangements, the Och Group initiated a Section 220 demand purportedly to obtain information about those arrangements, as well as follow-on litigation that served no apparent purpose other than to attack the Company, its Board and management despite the obvious potential for injury to the Company’s business and prospects.

Now the Och Group has returned to the same playbook, seeking once again to use Section 220 as a rhetorical platform to attack the Company and its sale process, while masking the economic self-interest and personal vendettas that the Company believes motivate Mr. Och’s behavior, and presenting a false narrative to the Company’s stockholders. Once again, the Och Group has no real need for the information demanded as they have been receiving information about the sales process for months from the Special Committee and its advisers pursuant to a non-disclosure agreement. This access included meeting with each of the two bidders that the Special Committee determined to have presented the best overall offers for purchase of the Company.1 Had Mr. Och actually had legitimate concerns about the process, including whether steps were taken to favor management (when, to be clear, no such steps were actually taken), he could have simply asked the bidders with whom he met. Given the multiple weeks of negotiation afforded Mr. Och with these bidders, he had multiple opportunities to raise his concerns. However, the Section 220 demand does not even make mention of an attempt by him to learn the facts. Instead, his Demand relies only on unfounded allegations stemming from purported conversations with third parties whose identities he has consistently withheld.

To the extent Mr. Och’s focus has extended beyond his continuing vendetta against the Company and Mr. Levin, it has been to negotiate for Mr. Och’s own economic interests stemming from his years running the Company. For example, Mr. Och proposed as a condition of supporting any transaction that Rithm provide him with acceleration of tens of millions of dollars as a prepayment at a favorable discount rate of a lucrative Tax Receivable Agreement (“TRA”) asset structured by members of the Och Group at the time of the Company’s IPO. The Och Group also sought to structure any transaction to permit them to delay hundreds of millions of dollars of taxable income that they have already delayed for more than a decade and a half. In addition, the Och Group demanded payment of $5.5 million to cover legal fees incurred by them in connection with actions taken against the Company. The Och Group also sought, among other things, enhanced credit protection. It was only when Rithm refused to accede to Mr. Och’s demands that he chose to oppose the deal.

Moreover, the criticisms that the Och Group levels at the Special Committee’s process and the Rithm transaction itself are flatly false. As described in detail in the Preliminary Proxy, the Special Committee—comprised of two unassailably independent directors—implemented and ran a robust sales process that was supported and validated by world-class financial and legal advisors. The suggestion of any interference in the process to entrench management and protect their supposedly outsized compensation has it exactly backwards. Nothing about the process required or even encouraged the retention of management which was entirely up to the bidders. Further, existing management—especially Mr. Levin—made significant concessions in support of obtaining a deal with Rithm that would maximize benefits to stockholders. This included Mr. Levin agreeing to accept a cap on his annual compensation that would leave him earning less than what Mr. Och regularly paid him when Mr. Och was CEO of the Company—and a small fraction of what Mr. Och routinely paid himself. Indeed, the only current or former management stakeholders involved in the discussions who failed to provide meaningful concessions to improve the benefits of the Rithm transaction for stockholders are the Och Group members, who have not only proposed their personal stakes being paid in full but who have, in fact, sought preferential treatment.

As explained in further detail below, these considerations demonstrate that the Demand is pretextual, lacks a proper purpose and otherwise fails to comply with the requirements of Section 220.

1. The Demand Is Improperly Motivated by Longstanding and Well-Documented Animus.

Under Delaware law, a showing that a Section 220 demand is motivated by animus establishes an improper purpose. Compare Highland Select Equity Fund, L.P. v. Motient Corp., 906 A.2d 156, 167 (Del. Ch. 2006), aff’d sub nom. Highland Equity Fund, L.P. v. Motient Corp., 922 A.2d 415 (Del. 2007) (denying Section 220 demand where stockholder’s purported purpose in bringing the demand was a “ruse” and instead motivated by a desire to “derive[] utility from the demand itself as a rhetorical platform”), with Grimes vs. DSC Communications Corp., 724 A.2d 561 (Del. Ch. 1998) (ordering production of materials in response to Section 220 demand where “there is nothing in the record to date suggesting that [the demand] is motivated by some improper animus”).

Here, the Demand is just the latest installment in Mr. Och’s historical effort to harm the Company, its Board and its management. The genesis of Mr. Och’s animus has nothing to do with the transaction at issue or its terms, but rather traces back to the events leading up to his departure from the Company, when it was known as Och-Ziff. Mr. Och, as Chairman, CEO and controlling stockholder, built Och-Ziff into a hedge fund behemoth, but its success was squandered when, in September 2016, Och-Ziff was required to enter a Deferred Prosecution Agreement (“DPA”) with the U.S. Department of Justice (a serious sanction effectively serving as a form of probation for its multi-year duration) and its Africa subsidiary was forced to plead guilty to a criminal charge for conspiracy to violate the Foreign Corrupt Practices Act for a bribery scandal that took place in the Democratic Republic of Congo (the “DRC”) and Libya. The Securities and Exchange Commission brought related charges. In total, the Company was ordered to pay $412 million to resolve the matter. Mr. Och himself paid $2.2 million to resolve a related SEC enforcement action in which the SEC found Mr. Och had “caused violations in two Och-Ziff transactions in the [DRC]” and detailed how he had been “aware of the risk of corruption in the transactions with [Och-Ziff’s] DRC Partner” and “approved the use of Och-Ziff investor funds in those transactions” even though proceeding with the transactions was “contrary to the recommendation of his legal and compliance team.” Faced with massive capital withdrawals in the wake of the scandal and restrictive regulatory penalties that barred the Company from key investor channels, the Company had no choice but to attempt to distance itself from Mr. Och, including by ultimately rebranding as Sculptor.

In December 2017, the independent directors of the Board unanimously voted to recommend that Mr. Och be removed as CEO. Mr. Och refused to recognize the idea that his continued presence at the Company was detrimental to its future success. Instead, he became enraged by the perceived disloyalty of Company executives and Board members who made this decision. Chief among those whom Mr. Och blamed for his exit from the Company is Mr. Levin, its current chief executive and chief investment officer, whom Mr. Och had previously anointed as his heir-apparent. Mr. Och contemporaneously instructed a group of his allies, including certain members of the Och Group and Mr. Rutman: “We have to make clear that I/we will be the winning team” and that “Jimmy [Levin] cannot be the winning team.”

Since that time, Mr. Och has repeatedly taken steps that have disrupted Sculptor’s business. These actions have peaked over the past eighteen months. Among other things, by all indications Mr. Och caused Mr. Rutman—his hand-picked board representative and longtime president of Mr. Och’s family office (that manages his personal wealth) and to whom he has paid millions of dollars—to noisily resign from the Board in stated protest of a compensation package agreed with Mr. Levin at the end of 2021 (“2021 Compensation Package”). As part of his resignation, Mr. Rutman sent the Board a seven-page, single-spaced letter containing a diatribe against the Company’s corporate governance process and decisions, including numerous disparaging remarks about the Company, its Board, and its officers. Mr. Och and Mr. Rutman were both well aware that Sculptor would be forced to disclose a letter of this type. The public resurgence of a dispute with Mr. Och had its obvious effect, negatively impacting Sculptor’s publicly traded share price and causing meaningful disruption among Sculptor’s clients and to its capital-raising efforts.

Mr. Och then used Mr. Rutman’s resignation letter as a basis to demand books and records from the Company regarding the Board’s process for approving Mr. Levin’s 2021 Compensation Package. The books-and-records requests were themselves a charade, largely targeting Board materials to which Mr. Och already had access through Mr. Rutman. While the Company was in the midst of diligently producing the requested documents, and without any warning or notice to the Company, Mr. Och used the books-and-records demand as an excuse to publicly file an unnecessary lawsuit filled with additional disparaging statements that were not even relevant to the demand for books and records. Although Mr. Och did not provide Sculptor with any advance notice of the Complaint, it seems he had his media relations team aggressively push it to the press.

Faced with Mr. Och’s disruptive and injurious behavior, the Company worked to find a solution. In mid-November, the Company was able to finally reach an agreement with Mr. Och to dismiss the books-and-records lawsuit in exchange for some additional documents in conjunction with the Board also announcing publicly that a Special Committee of the Board (which had been established months earlier) had been created to explore potential transactions (which could include a sale of the Company). Sculptor only agreed to announce the Special Committee’s ongoing exploration of potential transactions publicly because Mr. Och represented he would approach the process in good faith and without conditioning his consideration on any particular structure (such as the exclusion of existing management). This commitment was reflected in the public statement accompanying the agreement, where he stated: “we will be supportive of a vigorous, independent, and thorough process that puts shareholders first.”

Unfortunately, Mr. Och did not honor his commitments. Shortly after settling the Section 220 litigation, the Company sent Mr. Och a proposed non-disclosure agreement so that it could share information with him regarding the sale process. Mr. Och did not even provide comments on the draft for almost two months. Instead, Mr. Och used the interim period to spread a false narrative that the Special Committee was not running an open and transparent sales process. For example, Mr. Och filed a Schedule 13D containing materially incorrect statements such as that the Special Committee was “implying to potential buyers that management’s approval is effectively necessary for any deal” and that the Special Committee was discouraging bidders from presenting certain types of offers for the Company. (January 27, 2023 Schedule 13D.) Mr. Och finally responded to the draft non-disclosure agreement—showing his first interest in learning the actual facts—on January 28, 2023, the day after he filed this Schedule 13D. That agreement was eventually signed on February 15, 2023.

As disclosed in the Preliminary Proxy, the Company believes that Mr. Och was also responsible for the collapse of a potential transaction with Bidder D earlier this year. By March 2023, the Special Committee was in advanced discussions with Bidder D, having agreed on price, a draft merger agreement, and all material conditions. As of March 27, 2023, the key gating item standing in the way of a definitive merger agreement with Bidder D was Bidder D’s desire to secure the Och Group’s support for the transaction. Mr. Och sent two letters refusing to support the transaction without even engaging with Bidder D. Once Mr. Och eventually allowed his representative (Mr. Rutman) to meet with Bidder D, Bidder D became concerned that Mr. Och did not intend to engage in a constructive dialogue. Then, in the midst of the Company’s discussions with Bidder D, Mr. Och wrote to the Special Committee on April 5, 2023, contending that the Company should abandon the sales process altogether—even though he had publicly pledged support just a few month earlier. A few weeks later, with no change in Mr. Och’s actions, Bidder D walked away, relaying to the Special Committee’s advisors that they had no appetite to engage further with the Och Group.

2. The Och Group’s Supposed Concern for Protecting Stockholder Value Is Belied by Its Self-Interested Demands.

Given the experience with Bidder D, the Special Committee sought to re-engage with potential acquirors willing to consider a transaction that would not be conditioned on Mr. Och’s support. In late May 2023, Rithm provided an updated proposal to the Special Committee and confirmed that it did not intend to condition the signing or closing of the potential transaction on the support of Mr. Och. Through June 2023, the Special Committee negotiated with Rithm to improve its proposal (while also engaging with other potential bidders). In late June 2023, Rithm indicated that it wanted to have discussions with Mr. Och about the potential transaction before proceeding to execute a definitive merger agreement.

On July 6, 2023, the Och Group entered into a confidentiality agreement with Rithm so they could discuss a potential transaction. Over the next two weeks, Rithm responded to extensive requests for information from the Och Group and engaged with them on a number of issues they raised as conditions for supporting any transaction. The issues that Mr. Och raised in those discussions made clear to the Company that Mr. Och’s focus was on continuing to inflict additional pay cuts on Mr. Levin and on maximizing his own economic interests not shared with public stockholders.

For example, the Och Group focused heavily on the TRA asset that Mr. Och had bestowed on himself and the other Och Group members at the time of the Company’s IPO in 2007. The TRA assets have allowed the Och Group to reap over $150 million in payments from the Company in connection with the use of certain tax assets that had been created at the time of the IPO. The TRA by its terms expressly contemplated change-of-control transactions such as the merger by providing for assumptions favorable to the Och Group in calculating TRA payments but did not provide for any required acceleration of those TRA payments, which instead would continue to be paid over a several years. Nevertheless, in his discussions with Rithm, Mr. Och requested that, as part of closing any transaction, Rithm agree to prepay a significant portion of the more than $170 million in estimated remaining TRA payments, a substantial portion of which would be paid to the Och Group. Moreover, the Och Group demanded a highly favorable discount rate on the prepayment. Similarly, the Och Group insisted as a condition of supporting any transaction that Rithm agree to pay them an additional $5.5 million in cash for legal expenses incurred in connection with the Company’s sales process, including counsel costs related to negotiating for their own economic benefits.

The transaction under discussion between the Och Group and Rithm would have included the option for a rollover of the Class A Unit interests that they hold, in a fully tax-deferred transaction, which would allow them to avoid recognizing significant taxable gain in excess of proceeds to be received in the transaction (as a result of taxable gain attributable in large part to tax-deferred distributions previously received by the Och Group).

Finally, the Och Group even demanded that they be given personal consent rights over any press statements announcing the transaction, presumably to ensure they can continue their false narrative of being on the side of stockholders.

In contrast to the actions taken by the Och Group, Mr. Levin agreed to make significant modifications to his employment agreement that would materially reduce his overall compensation, including imposing an annual cap. Even with these concessions, Mr. Och still sought to insist that Mr. Levin’s compensation be reduced further as a condition of the Och Group’s support for the Rithm transaction. Aside from ignoring the importance of Mr. Levin to investors, it is also inexplicable why Mr. Och feels the need to overturn the independent decision of a third party, i.e., Rithm, as to what is appropriate compensation for Mr. Levin going forward. Notably, when Mr. Och was CEO, he regularly approved compensation for Mr. Levin in excess of the cap agreed to by Mr. Levin.

Mr. Och’s behavior in his negotiations with Rithm is nothing new. Mr. Och has regularly focused on his personal economic benefits. For example, at the time of the Company’s IPO, Mr. Och caused the Company to take on $750 million in debt with the majority of the proceeds going to fund a personal distribution to himself and members of his group. Thereafter, Mr. Och continued to distribute substantially all of the Company’s earnings, with himself as the largest recipient, leaving the business with little retained earnings and saddled with debt. When this left the Company insufficiently capitalized to pay the $412 million penalty imposed as a result of the Africa bribery scandal, he conditioned providing any personal financing to the Company on receiving “preferred” interests in exchange that would ensure he got repaid ahead of public stockholders. Because no asset management company had ever had a DPA, there was a question about the Company’s survival. However, when it came time to pay the penalty and there were no retained earnings to do so, Mr. Och insisted on receiving preferred interests that would pay him back completely before public shareholders would receive a penny in the event of a bankruptcy. Mr. Och also insisted as a condition of providing financing that he receive a broad-based release.

Mr. Och’s ability to bestow these benefits upon himself was enabled by his complete control over the Company—at the time of the IPO, Mr. Och awarded himself a voting proxy and certain other powers, giving him control over stockholder votes and Board decisions on material matters. These powers were removed and governance was democratized as part of Mr. Och’s exit from the Company. And current management has since diligently paid down the debt with which Mr. Och had saddled the Company.

3. The Och Group’s Criticisms of the Special Committee Process and Proposed Transaction Are Based Upon Distortions and Misrepresentations.

Setting aside the Och Group’s animus, the Demand does not identify a “proper purpose” for the books-and-records demand, as it must. Thomas & Betts Corp. v. Leviton Mfg. Co., 681 A.2d 1026, 1028 (Del. 1996) (“[A] stockholder has the burden of showing . . . a proper purpose entitling the stockholder to an inspection of every item sought.”). A stockholder’s obligation to identify a proper purpose is more than “a mere speed bump” that she must clear. Hoeller v. Tempur Sealy Int’l, Inc., 2019 WL 551318, at *1 (Del. Ch. Feb. 12, 2018). According to the Demand, the Och Group’s purpose for demanding books and records are to investigate potential breaches of fiduciary duty related to: (i) the sales process, including approval of the merger; (ii) the negotiation, execution, and approval of management compensation; (iii) the negotiation, execution, and approval of voting agreements; to “investigate the possible aiding and abetting” of those breaches by Rithm; to evaluate the fairness of the merger; to assess the veracity and completeness of the Company’s public disclosures; and to communicate with other stockholders. Demand at 5. But all of these so-called “purposes” are underpinned by the baseless allegations of wrongdoing leveled by the Och Group in the Demand letter itself. Such allegations do not establish a proper purpose for inspection of books and records under Delaware law.

In the context of similar demands, the Delaware Supreme Court has held that “stockholders seeking inspection under Section 220 must present ‘some evidence’ to suggest a ‘credible basis’ from which a court can infer that mismanagement, waste or wrongdoing may have occurred.” Seinfeld v. Verizon Commc’ns, Inc., 909 A.2d 117, 118 (Del. 2006). A stockholder “must do more than state, in a conclusory manner” that a desire to investigate mismanagement or wrongdoing is a proper purpose. See W. Coast Mgmt. & Capital, LLC v. Carrier Access Corp., 914 A.2d 636, 646 (Del. Ch. 2006); see also AmerisourceBergen Corp. v. Lebanon Cty. Emps. Ret. Fund, 243 A.3d 417, 428 (Del. 2020) (stockholders cannot use Section 220 demands to engage in an “indiscriminate fishing expedition”). The Och Group has adduced no such evidence, and no credible basis to infer that mismanagement, waste or wrongdoing occurred in the sale process or anywhere else at the Company.

The Och Group’s complaints about the Special Committee sales process are simply false. As disclosed in the Preliminary Proxy, the Board appointed a Special Committee composed of directors whose independence is unassailable. The Special Committee retained experienced world-class advisors, including Latham & Watkins as its independent legal advisor and PJT Partners as its financial advisor.2 The Special Committee reached out to seventy potential acquirors, twenty-five of which signed confidentiality agreements and commenced due diligence, and eleven of which submitted non-binding preliminary indications of interest. The Special Committee ran the process from start to finish, and instructed bidders and management, including in the bid process letters sent to interested parties, not to engage in any negotiations regarding management’s go-forward employment until after the principal terms of any transaction had been agreed between the Company and the bidder.

The Demand asserts two arguments regarding the Special Committee’s independence, both of which are entirely without merit.

First, Mr. Och falsely accuses Marcy Engel, Chair of the Board, of being conflicted because her compensation for Board service increased during her tenure on the Board. That is false and outrageous. Ms. Engel’s compensation was increased when she assumed the Chair role, to the exact same amount that her predecessor as Chair received—an amount that was proposed by one of Mr. Och’s designees. Notably, Mr. Och’s designee Mr. Rutman voted in favor of Ms. Engel becoming Chair, and approved her compensation. Other increases to Ms. Engel’s compensation were similarly based on her assuming additional duties, including as chair of certain committees, for which she also has been paid at levels consistent with her predecessors. The Och Group’s suggestion that Ms. Engel is somehow beholden to Mr. Levin is even more absurd. It was Mr. Och himself who invited Ms. Engel to join the Board; she had no preexisting relationship with Mr. Levin, and did not even meet him until after she joined the Board. Mr. Och and his designee also supported Ms. Engel’s role as lead independent director while he was Chairman, and also voted to reaffirm Ms. Engel’s independence each year.

Mr. Och next argues that both Ms. Engel and Charmel Maynard were conflicted because they were “subject to a potential lawsuit” for approving the 2021 Compensation Package. That reasoning is equally specious. As described in the filings responding to the Och Group’s prior Section 220 action, the Board followed a robust process in approving the 2021 Compensation Package; it was advised by leading compensation consultants, originally chosen by Mr. Och, who concluded it was reasonable for the Board to support that package. The Board exercised its business judgment to award a “pay for performance” package that also took into account management’s continued efforts in addressing the ramifications of the Africa bribery matter, the DPA and the disputes and disagreements with Mr. Och and related publicity. Any possible claim based on that decision would also be subject to exculpation under Section 102(b)(7) of the Delaware General Corporation Law. Notably, in the 20 months since the 2021 Compensation Package was announced, and 18 months since Mr. Rutman’s noisy resignation, no lawsuit has sought to question the Board’s decisions regarding Mr. Levin’s compensation. Indeed, the only lawsuit filed relating to the 2021 Compensation Package was the Section 220 action that the Company believes Mr. Och filed in furtherance of his retribution campaign. There is no credible threat of liability for the 2021 Compensation Package vote, and accordingly there is no basis for alleging that the Special Committee members were conflicted in voting to approve the Merger.

The Demand’s other complaints about the Special Committee’s process or the Rithm transaction itself are equally unfounded.

First, the claim that there were other third-party bidders prepared to acquire the Company for greater value without current management is distorted. The Special Committee stood ready to entertain a transaction in any form—with or without current management—that would maximize stockholder value. The Special Committee and its advisers are unaware of any such credible bid. Indeed, after Mr. Och made public comments suggesting that such bidders existed, the Special Committee repeatedly asked Mr. Och either to refer them to the Special Committee or identify them so that the Special Committee could deal with them directly. Despite stating in multiple SEC filings that he is in communication with bidders, Mr. Och has never identified a single interested party to the Special Committee.

Second, the price of $11.15 per share proposed for the Rithm transaction does not crystallize any losses attributable to supposed off-market terms in the 2021 Compensation Package. To the contrary, the market and the main analyst following the Company reacted positively to the Package when it was first adopted, undoubtedly recognizing that its performance-based metrics aligned Mr. Levin’s pay with the interests of Sculptor’s stockholders and clients. It was not until Mr. Och reignited his attacks on the Company at the end of January 2022 that the Company’s stock price dropped, reflecting what the Company believes was the weight of concerns that the return of internecine squabbles with Mr. Och would impact the Company’s ability to retain and grow its client base. The Company believes that Mr. Och’s decision to pursue his unnecessary Section 220 action last year, followed by repeated misleading public filings, only served to exacerbate the impact. The Company disclosed these impacts in a series of periodic filings with the SEC, detailing the elevated redemption requests and difficulty in raising new capital that the Company believes Mr. Och’s attacks had occasioned.

Third, the suggestion that Rithm’s bid was negatively impacted by the cost of Mr. Levin’s compensation package is false. As explained in the Preliminary Proxy, while Rithm did decrease its bid from $12 per share to $11.15 per share, that decrease had little to do with Mr. Levin seeking additional compensation. To the contrary, in his discussions with Rithm, Mr. Levin agreed to accept major cuts in his compensation as well as in the value of his equity interests. As described in the Preliminary Proxy, Rithm revised its offer price to $11.00 per share due to Rithm’s belief that it would need to spend more money than anticipated in the form of a long-term incentive plan and retention plan for the Company’s senior leadership (excluding Mr. Levin, with whom Rithm intended to enter into revised employment agreement terms which substantially reduce his compensation). Rithm had concluded, following additional diligence and focus on the proceeds allocation among the key employees, that it would be required to spend more than was provided for in its original model in order to retain and incentivize key members of senior leadership of the Company (excluding Mr. Levin), particularly in light of the significant amount of equity incentives which would not receive any consideration in connection with the potential transaction. As a result, Rithm had agreed to establish (a) a long-term incentive plan and (b) a $30 million retention pool (in which Mr. Levin would not participate), also for incentive purposes. Rithm subsequently agreed to increase the retention incentive program from $30 million to $35 million and allocate $5 million of its retention incentive program to Mr. Levin, and the offer price was not reduced in connection with such revision to the retention incentive program; instead, Rithm subsequently increased its offer price to $11.15 per share.

Finally, the Demand falsely contends that the required stockholder vote has been skewed in favor of the Board’s desired outcome of supporting the Rithm transaction. In support, the Demand cites to the fact that the Class A Unit Holders will be excluded from the majority-of-the-minority approval as supposed evidence that the Och Group is being disadvantaged. This is not accurate. Rithm and the Company provided for the required corporate approvals—a majority vote of all shareholders, including the Class A Unit Holders, in accordance with the Company’s governing documents. But then in addition to, and not in lieu of, that vote, given the potential conflicts of interests attributable to both management and the Och Group, the parties opted to go a step further – which was not required – to provide even greater protection and provide that the deal must be approved by the truly disinterested stockholders in an additional majority of the minority vote. The reason the Class A Unit Holders are excluded from the majority-of-the-minority vote is because they are to receive interests different from public stockholders under the proposed Merger, namely the opportunity to rollover their Class A Units into Rithm stock, which gives them a right they demanded. Indeed, the need for a tax-free rollover opportunity has been a longstanding demand of the Och Group, as it will permit them to defer significant tax obligations. That the Och Group seeks to portray the unique benefits they have sought and are being accorded into an effort by the Company to disenfranchise them reveals the lengths to which they are prepared to go to distort the record.

4. The Och Group’s Document Demands Are Impermissibly Overbroad

The Demand as drafted is also vastly overbroad, and improper for that reason as well. A Section 220 demand is not the equivalent of discovery in litigation—which is precisely how the requests read. Indeed, the Demand seeks “all documents and communications” related to a litany of far-reaching, broad topics—including (but far from limited to) “negotiation of the Voting Agreements,” “the treatment of the Compensation Package and compensation arrangements,” and all communications with Rithm regarding “the Merger.”

Delaware courts have been clear: the scope of documents produced in response to a Section 220 request should be narrowly tailored to the documents that are truly necessary for the stockholder’s proper purpose. Helsman Mgmt. Servs., Inc., v. A & S Consultants, Inc., 525 A.2d 160, 167 (Del. Ch. 1987) (allowing inspection of only records that are “essential and sufficient” to the stockholder’s purpose); see also Se. Pennsylvania Transportation Auth. v. Facebook, Inc., No. CV 2019-0228-JRS, 2019 WL 5579488, at *6 (Del. Ch. Oct. 29, 2019), judgment entered sub nom. Se. Pennsylvania Transp Auth. v. Facebook, Inc. (Del. Ch. 2019) (“[M]ere curiosity or a desire for a fishing expedition will not suffice.”) (citation omitted). Indeed, the Och Group bears the burden of making “specific and discrete identification, with rifled precision, . . . [to] establish that each category of books and records is essential to the accomplishment of their articulated purpose.” Brehm v. Eisner, 746 A.2d 244, 266-67 (Del. 2000); accord Espinoza v. Hewlett-Packard Co., 32 A.3d 365, 31-772 (Del. 2011). Thus, even assuming the Och Group could state a proper purpose, the scope of its requests falls well short of the “rifled precision” standard that Delaware requires.

* * *

In sum, the Och Group’s Demand lacks a proper basis under Section 220 because it is motivated by animus, lacks a proper purpose, and is impermissibly overbroad in its requests. It is evident that the Och Group seeks to abuse the process accorded to stockholders under Delaware law as a means of amplifying their unfounded accusations and to distract from their own conflicts, which put them at odds with public stockholders. The Company thus has no legal obligation to produce any books or records in response.

Nonetheless, in the interest of avoiding yet more unnecessary litigation, the Company is willing to meet and confer to discuss providing the Och Group with an appropriate production of materials typically subject to requests under Section 220, including the non-privileged portions of the relevant minutes of the Board and Special Committee’s meetings and the related presentations, following the execution of a satisfactory non-disclosure agreement.

I look forward to hearing from you regarding your availability to meet and confer, including to finalize the non-disclosure agreement related to production of materials. The Company reserves the right to supplement this response and it is without prejudice to the rights of the Company and the Board, all of which are preserved.

Very truly yours,

Jonathan Pickhardt

cc: Michael Carlinsky

Blair Adams

Brendan Carroll

Brock E. Czeschin

About Sculptor

Sculptor is a leading global alternative asset manager and a specialist in opportunistic investing. For over 25 years, Sculptor has pursued consistent outperformance by building an operating model and culture which balance the ability to act swiftly on market opportunity with rigorous diligence that minimizes risk. Sculptor’s model is driven by a global team that is predominantly home-grown, long tenured and incentivized to put client outcomes first. With offices in New York, London and Hong Kong, Sculptor invests across credit, real estate and multi-strategy platforms in all major geographies. As of August 1, 2023, Sculptor had approximately $34.0 billion in assets under management. For more information, please visit our website (www.sculptor.com).

Additional Information About the Transaction and Where to Find It

This communication relates to a proposed transaction between Rithm Capital Corp. and Sculptor Capital Management, Inc. (“Sculptor”). In connection with the proposed transaction, Sculptor filed a preliminary proxy statement on Schedule 14A on August 21, 2023 with the Securities and Exchange Commission (“SEC”). Promptly after filing its definitive proxy statement on Schedule 14A (the “Proxy Statement”) with the SEC, Sculptor intends to mail or otherwise provide to its stockholders such Proxy Statement. Sculptor may also file other documents with the SEC regarding the proposed transaction. BEFORE MAKING ANY VOTING DECISION, SCULPTOR'S STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the Proxy Statement and other documents containing information about Sculptor and the proposed transaction filed with the SEC (when available) from the SEC's website at www.sec.gov and Sculptor's website at www.sculptor.com. In addition, the Proxy Statement and other documents filed by Sculptor with, or furnished to, the SEC (when available) may be obtained from Sculptor free of charge by directing a request to Sculptor's Investor Relations at investorrelations@sculptor.com.

Participants in the Solicitation

Sculptor and certain of its directors, executive officers and employees may be considered to be participants in the solicitation of proxies from Sculptor's stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the stockholders of Sculptor in connection with the proposed transaction, including a description of their respective direct or indirect interests, by security holdings or otherwise are included in the preliminary proxy statement and will be included in the Proxy Statement when it is filed with the SEC. You may also find additional information about Sculptor's directors and executive officers in Sculptor's proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2023. You can obtain a free copy of this document from Sculptor using the contact information above.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. The proposed transaction will be implemented solely pursuant to the terms and conditions of the merger agreement, which contain the full terms and conditions of the proposed transaction.

Cautionary Note Regarding Forward-Looking Statements

The communication contains statements which may constitute “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the proposed transaction. All statements, other than statements of current or historical fact, contained in this communication may be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects,” “may,” “should,” “could,” “estimate,” “intend” (or the negative of these terms) and other similar expressions are intended to identify forward-looking statements. These statements represent Sculptor’s current expectations regarding future events and are subject to a number of assumptions, trends, risks and uncertainties, many of which are beyond Sculptor’s control, which could cause actual results to differ materially from those described in the forward-looking statements. Accordingly, you should not place undue reliance on any forward-looking statements contained herein. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see the sections entitled “Forward Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Sculptor’s most recent annual and quarterly reports and other filings filed with the SEC, which are available on Sculptor’s website (www.sculptor.com).

Factors that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied include, but are not limited to, the following risks relating to the proposed transaction: the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement; the satisfaction of closing conditions to the transaction on a timely basis or at all, including the ability to obtain required regulatory and stockholder approvals; uncertainties as to the timing of the transaction; litigation relating to the transaction; the impact of the transaction on Sculptor’s business operations (including the threatened or actual loss of employees, clients or suppliers); incurrence of unexpected costs and expenses in connection with the transaction; and financial or other setbacks if the transaction encounters unanticipated problems. Other important factors that could cause actual results to differ materially from those expressed or implied include, but are not limited to, risks related to changes in the financial, equity and debt markets, risks related to political, economic and market conditions and other risks discussed and identified in public filings made by Sculptor with the SEC.

New risks and uncertainties emerge from time to time, and it is not possible for Sculptor to predict or assess the impact of every factor that may cause its actual results to differ from those contained in any forward-looking statements. Forward-looking statements contained herein speak only as of the date of this communication, and Sculptor expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Sculptor’s expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.

_____________________________

1 The first bidder proposed a higher price per share but withdrew when faced with the Och Group’s refusal to support the deal and their extensive demands for information.

2 JP Morgan was also involved in the process as the Company’s financial advisor.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230829781225/en/

Contacts

Sculptor - Shareholder Services

Ellen Conti

Sculptor

212-719-7381

investorrelations@sculptor.com

Sculptor - Media Relations

Jonathan Gasthalter

Gasthalter & Co.

212-257-4170

sculptor@gasthalter.com