Sends Letter to Masimo Shareholders and Files Definitive Proxy Materials

Encourages Shareholders to Help Fix Masimo’s Broken Corporate Governance by Voting for Politan Nominees Michelle Brennan and Quentin Koffey on the BLUE Card

Visit www.AdvanceMasimo.com for Additional Information

Politan Capital Management (together with its affiliates, “Politan”), a 9% shareholder of Masimo Corporation (“Masimo” or the “Company”) (NASDAQ: MASI), today sent a letter to the Company’s shareholders outlining why independent oversight and greater accountability is urgently needed on the Masimo Board. Politan also filed definitive proxy materials in connection with Masimo’s Annual Meeting of Stockholders (the “Annual Meeting”), which is currently scheduled for June 26, 2023. Shareholders can support change by voting for Politan’s two ideally qualified nominees – Michelle Brennan and Quentin Koffey – for election to the Company’s Board.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230521005029/en/

Figure 1 (Graphic: Business Wire)

For more information, shareholders can visit: www.AdvanceMasimo.com. The full text of the letter is below:

Dear Fellow Masimo Shareholders,

Politan owns 9% of Masimo – an approximately $800 million investment that makes us one of the Company’s largest shareholders. We believe Masimo has tremendous potential. However, change is needed to fix its broken corporate governance that has resulted in a deeply discounted valuation and an inability to profitably innovate and grow. This is why we have nominated two ideally qualified individuals to the Board, Michelle Brennan and Quentin Koffey. Our nominees have the skills, experience and shareholder alignment to help refresh Masimo’s governance, bring discipline to its capital allocation and refocus its strategy.

Despite our continual efforts over the past year to work privately and constructively with the Company, Masimo’s Board has demonstrated zero interest in good faith discussions. Instead, it has taken a hostile approach to our engagement by adopting widely criticized bylaws, aggressively using litigation in an attempt to force us to disclose commercially sensitive information and trying to identify and pressure Politan’s own investors.

While these actions violate norms of behavior for public companies, they are entirely consistent with Masimo’s long record of poor governance. As a result, the only option left open to us is to bring our concerns directly to shareholders. This is why we are writing to you now.

Fundamentally, what this upcoming vote is about is simple: fixing the prolonged and deliberate refusal by Masimo’s Board to properly oversee management. Consider the following:

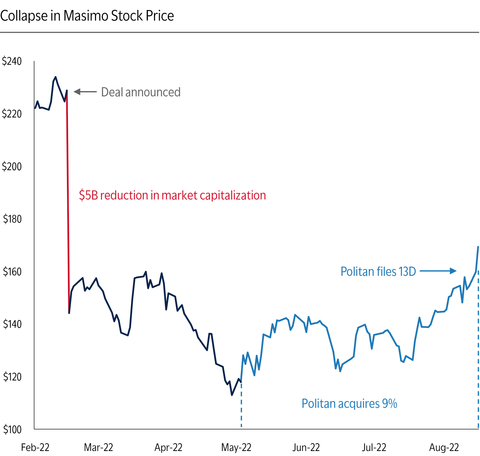

- Masimo’s unprecedented collapse in value reveals a crisis of confidence. Declining by five times the purchase price, Masimo’s $5 billion drop in market value following the Sound United acquisition was not simply about the transaction. Rather, it revealed shareholders' concern that no Board oversight exists to stop future value destruction.

- Undisciplined capital allocation and an unfocused strategy have gone unchecked and severely depress valuation. Masimo’s efforts to enter adjacent markets have missed every target by over 50% and caused the Company to miss company-wide cash flow targets by 55% and ROIC to decline by 30%. Yet, management is only accelerating its investments into adjacent markets without any sign of fixing its flawed process. The result is that Masimo’s stock price has significantly underperformed any relevant set of peers over any relevant time period.

- Masimo’s governance is broken. The Company ranks in the bottom 2nd percentile of the Russell 3000 for votes against directors and the bottom 0.1% for Say-on-Pay. This problem starts with the Board whose lead director believes, “Better governance doesn’t drive better stock price.”

- Compensation and side payments to the CEO epitomize the Board’s poor oversight. The size and terms of Mr. Kiani’s employment agreement led a Delaware judge to call it “astounding,” “truly amazing” and even to say it may “amount to abdication [of the Board’s fiduciary duties].” A longtime compensation expert called it “the most egregious and problematic that I have ever seen or believe exists in the United States.” Even Masimo’s own director called it a “poison pill.”

- The Board has an established history of undermining shareholder intentions. While the Board gained widespread notoriety for adopting bylaws aimed at disenfranchising shareholders, these actions were part of a recurring pattern of behavior. For example, Masimo reneged on its previous commitment in 2015 to expand the Board to seven members. Today, the Board is at it again with its March 23rd governance maneuvers.

- This may be the only chance to deliver change. We have spent over $15 million to navigate the Board’s hostile maneuvers and Mr. Kiani’s entrenching employment agreement. Given the lengths to which this Board and Mr. Kiani have gone, it is reasonable to think no shareholder will undertake the effort to nominate again if we do not succeed.

An unprecedented collapse in value reveals a crisis of confidence

The decline in Masimo’s valuation following its acquisition of Sound United last year demonstrates just how concerned Masimo’s shareholders are. Upon announcing the $1 billion cash acquisition, Masimo’s market valuation fell by over $5 billion. At five times the purchase price, such a loss of value is unprecedented. It is 19x the standard deviation seen in US public markets following a deal, and three times worse than the second largest decline in the past decade. See Figure 1.

This violent market reaction revealed a long-simmering crisis of investor confidence. In fact, seven of the Company’s 20 largest shareholders exited their investments, despite on average having owned Masimo for six years. If Masimo had dropped by $1 billion (the purchase price), perhaps that could be seen simply as shareholders not supporting the Board’s specific decision to acquire Sound United. But declining by $4 billion more than the acquisition price reveals something much more fundamentally damaging: a concern there is no Board oversight in place to stop future value destruction.

By nominating independent directors who are aligned with long-term focused shareholders, we hope to fix the deep-seated governance, capital allocation and strategy problems that precipitated this drastic collapse. While merely recouping the decline from Sound United would mean a 60+% increase in Masimo’s valuation, we believe that fixing the fundamental issues that triggered it can lead to much larger increases in value over time.

Undisciplined capital allocation and an unfocused strategy negate the strength of Masimo’s core

We have tremendous respect for Masimo as an organization and for how Mr. Kiani and his team built the core pulse oximetry business (SET) over the last 30 years. But we are concerned by how Masimo repeatedly spends the cash flow generated by SET on failed efforts to enter adjacent markets without any accountability.

Masimo’s dominant SET business ought to deliver outstanding shareholder returns given its favorable duopoly industry structure with significant barriers to entry and a high recurring revenue model. Unfortunately, the Company has substantially underperformed peers despite those medical device peers facing much more competitive end markets and less favorable sector dynamics.

|

|

|

Sound United

|

3 Years |

5 Years |

|

|

Bloomberg Peers(1) |

(35%) |

(133%) |

(102%) |

Masimo Total Shareholder Return

|

|

Proxy Peers(2) |

(15%) |

(42%) |

(3%) |

Proxy Peers with Same Growth Profile(3) |

(39%) |

(89%) |

(140%) |

||

Medical Devices Index(4) |

(23%) |

(65%) |

(9%) |

||

Comparable Business Quality Peers(5) |

(24%) |

(83%) |

(53%) |

||

|

|

Wall Street Sell-Side Peers(6) |

(26%) |

(71%) |

(37%) |

Masimo meaningfully underearns as it invests in new product launches into adjacent markets and has drastically missed any and all targets outside of SET. Rather than fixing its methods, Masimo seems to be only accelerating its efforts – throwing ever larger sums of money into what appears to be a broken process.

- Adjacent market efforts have missed every target by 50+%: At each of its investor days, held in 2012, 2017 and 2019, Masimo established revenue targets for non-SET products – targets it claimed were conservative at the time – and proceeded to miss every one of them by a wide mark.

- Shortfalls cause Masimo to miss margin expansion targets by 54%, miss cash flow targets by 55% and ROIC to decline by 30%: Accelerating investments with little revenue and no profits have resulted in Masimo missing company-wide margin and cash flow targets. Most notably, ROIC has consistently declined despite a recurring revenue model that ought to result in expanding ROIC.

- Masimo avoids accountability by removing disclosure and misstating prior targets: Instead of acknowledging and fixing its market entry problems – which would help restore investor confidence – Masimo consistently removes disclosure such that today shareholders do not know how much is invested in new products, what revenue these efforts generate or even what segment margins are.

- Despite all the warning signs, Masimo is accelerating investments into areas further and further afield from its core competencies: Masimo appears to be doing everything everywhere all at once. Across hospital automation, smart watches, adaptive acoustic earbuds, and baby monitors (just to name a few), Masimo is entering new markets against new competitors through new distribution channels. The result has been a frenetic proliferation of new product launches, but no indication that Masimo is even cognizant of the need to build a repeatable and successful market entry process.

Investing for future growth can yield terrific results and be well-rewarded in public markets, but it must be done with accountability, discipline and focus – attributes that are clearly lacking at Masimo. While the success of SET deserves admiration, it has not bestowed upon Masimo’s management team and CEO a Midas Touch or granted them immunity from market realities.

We want to fix innovation at Masimo. We believe the Company has adjacent markets in which it can be very successful – such as patient care in the home setting – but we fear that by diverting its focus across multiple product launches at the same time, Masimo is increasing the likelihood that it fails at all of them. The market applies more than $5 billion of negative value for Masimo’s adjacent market efforts out of a concern that not only will Masimo fail, but also that Masimo’s Board will allow such failures to continue indefinitely.

Masimo’s broken governance is an extreme outlier by any measure

When it comes to governance, Masimo is in a category all of its own. This is not a subjective view – the Company ranks last or among the bottom couple percent of all US public companies across numerous governance measures, and is unique in ranking so poorly across all of them. See Figure 2.

- The bottom 0.1% for votes against executive compensation: Masimo has ranked in the bottom 0.1% of the entire Russell 3000 for “Say-on-Pay” since such votes were first required in 2011. In six of the last 12 years (including last year), Masimo has failed this vote. Only three other companies have had as many failures.

- The bottom 2% for “withhold” votes against Board members: Over the past decade, Masimo shareholders have withheld against Masimo directors at consistently high levels. Only twice during this period has even a single independent director done better than the bottom 33rd percentile, despite Masimo directors always running unopposed. At Masimo’s last annual meeting, Directors Mikkelson and Reynolds (the only directors up for election) placed in the bottom 5th and 2nd percentiles.

- No independent director has ever bought a single share of Masimo stock: Even with Masimo’s valuation collapsing after directors approved the Sound United acquisition, no independent Board member has bought a single share.

Compensation and side payments epitomize the Board’s poor oversight

The Board has permitted Masimo’s CEO to enrich himself to an astonishing degree – aspects of which we believe have repeatedly crossed the line into illegality.

- Annual compensation is 2x peers: Mr. Kiani’s annual salary is twice that of CEOs of peer medtech companies, despite Masimo having underperformed those peers.

- Unusual side payments are even larger: The Board permits various side payments to Mr. Kiani. Masimo pays $17 million a year in royalties to Cercacor, a company where Mr. Kiani is CEO, Chairman and majority-owner. Masimo also contributed over $30 million to the Masimo Foundation, yet tens of millions of dollars of donations go to Mr. Kiani’s personal causes and the majority of the Board has consisted of Mr. Kiani, his wife and his sister for most of its history.

- Special payment in employment agreement is an additional ~$600 million (over 5% of Masimo): Mr. Kiani’s employment agreement includes a special payment that is triggered by common governance changes such as appointing a Lead Independent Director or shareholders voting to change more than one-third of the Board. As a change in control payment, Mr. Kiani’s arrangement is a staggering 38x the peer median and in the top 0.1 percentile of S&P 1500 companies. As a penalty on shareholders exercising their right to vote, it is unprecedented and likely illegal.

- Shareholders have sued successfully in the past, but nothing changed: In 2015 shareholders sued the Board for granting Mr. Kiani three times the permitted number of options in Masimo’s compensation policy for four consecutive years. The Board entered a governance agreement requiring it to expand to seven directors. Not only did the Board not comply with the commitment, the directors approved the egregious 2015 employment agreement just a few months later.

Despite all of the above, the Board was in discussions to give Mr. Kiani even more. Dismissive of Say-on-Pay results and shareholder lawsuits, the Board was entertaining Mr. Kiani’s demands for even more compensation prior to Politan’s engagement. In Mr. Kiani’s own words, he wanted “to get large sums of stock…like the Elon Musk deal with Tesla.” These discussions are in keeping with the reality that governance and compensation policies have gotten progressively worse despite over a decade of bottom percentile shareholder vote results and even litigation.

The Board has an established history of undermining shareholder intentions and is doing so again with its March 23rd announcements

While Masimo’s Board gained widespread notoriety for adopting bylaws this fall aimed at disenfranchising its shareholders, the Board’s actions were part of a recurring pattern of behavior. This has included pushing a director off the Board who opposed Mr. Kiani’s compensation demands, supporting a compensation agreement that a Delaware judge indicated “preclude[s] the board from exercising its statutory and fiduciary duties,” and undermining its 2015 commitment to expand Masimo’s Board to seven members. Consistent with its track record, Masimo’s Board made three governance announcements on March 23rd – and immediately proceeded to undermine each one.

- Create Lead Independent Director (LID) role; yet appoint Mr. Cohen as LID: While we strongly support independent leadership of Masimo’s Board, Mr. Cohen is the wrong choice. He testified under oath that he doesn’t see the point of corporate governance, stating, “Better governance doesn’t drive better stock price.” Proving he really holds this dismissive view, Mr. Cohen also testified under oath that despite having been on the Board for nearly five years and on the compensation committee for two years, he had never read or even reviewed Mr. Kiani’s 12-page compensation agreement. He did, however, approve changes to the agreement he never read that resulted in Masimo failing Say-on-Pay.

- Destagger Board; yet will not waive employment agreement provision that effectively keeps the Board permanently staggered: Destaggering the Board is sleeves off Masimo’s proverbial vest, given that Mr. Kiani’s employment agreement means that no more than one-third of the Board can be replaced over three election cycles without triggering a massive penalty payment of ~$600 million to Mr. Kiani.

- Announced (once again) that the Board would expand to seven members: We strongly support Masimo expanding its Board, but not in a manner that undermines the shareholder franchise. Having failed to block shareholder nominations with its bylaws, Masimo’s Board has moved to dilute the impact from the 2023 annual meeting by packing the Board – something that is impermissible under settled Delaware law. In a transparent effort to somehow cleanse the action, Masimo is putting the Board expansion up to a vote, but not the actual directors. We asked the Board to commit to using a search firm to find director candidates (every current director was preselected by Mr. Kiani), to not include people with pre-existing relationships to the Board and to allow the newly constituted Board to carry out the search. Masimo flatly denied each of our requests with no explanation as to why.

The 2023 AGM is a unique opportunity for change

Politan has navigated unprecedented impediments thrown up by Masimo’s Board. We have spent more than $15 million in litigation fees to remove the entrenching bylaws. While the Board ultimately did remove the bylaws, it has refused to commit to not restore them again after this annual meeting. Further, to deter us, the Board hired private investigators to research Politan employees and family members, attempted to harass our investors, and endeavored to force Politan to disclose sensitive business information. Given the lengths this Board will go, it is reasonable to think no other shareholder will undertake this effort again if we do not succeed.

It is also critical to keep in mind that Mr. Kiani’s employment agreement gives him enormous control over the Board while serving as a poison pill that denies fundamental rights of Masimo’s shareholders. In order to delay the trial on his compensation after losing a key court hearing, Mr. Kiani granted a limited waiver to his agreement: only for this year’s annual meeting will the election of shareholder nominees not trigger Mr. Kiani’s ~$600 million payment. Mr. Kiani has refused to permanently waive the provision and it will return for the 2024 annual meeting. As one of Masimo’s own directors stated, “[triggering the Special Payment is] a very scary prospect for me in that it’s a lot of shares and a lot of dollars… I thought the employment agreement that existed alone was a sufficient poison pill and it was surprising to me that anyone would want two board seats…”

All of these facts add up to a clear conclusion: now may be the only opportunity to see real change at Masimo.

Shareholder nominees can deliver needed change

We believe independent, shareholder-aligned oversight is needed on the Board. This is why Politan has nominated two ideally qualified director candidates for election at the 2023 Annual Meeting who are committed to representing the interests of all shareholders:

- Michelle Brennan, a former senior executive at Johnson & Johnson (“J&J”) for more than 30 years, where she oversaw medical device businesses globally as well as consumer pharmaceutical businesses. At J&J, Michelle successfully scaled multiple businesses from inception to several billion dollars in revenue and led efforts to invest in innovation that resulted in successful new product launches. Michelle is currently an independent director at Cardinal Health (NYSE: CAH) and recently served on the Board of Coupa Software (NASDAQ: COUP).

- Quentin Koffey, Managing Partner and Chief Investment Officer of Politan. Quentin has an established track record of working constructively with boards and management teams to enhance shareholder value, including at companies such as Centene (NYSE: CNC), Lowe’s Companies (NYSE: LOW), Louisiana-Pacific (NYSE: LPX), Bunge (NYSE: BG), and Marathon Petroleum (NYSE: MPC).

Together, Michelle and I would bring a unique set of needed skills to the Masimo Board. Michelle has deep expertise from decades spent in relevant roles at one of the most respected healthcare and consumer products companies in the world, in addition to experience as a public company director. She has led a medical device business nearly four times the size of Masimo and fixed innovation processes to deliver consistently successful new product launches. I would add a true independent ownership perspective and my experience from dozens of collaborative engagements focused on improving capital allocation and corporate governance at companies across sectors. Michelle and Politan have no pre-existing relationship. Politan used a nationally recognized search firm to identify and contact candidates.

Michelle and I both believe in the future of Masimo and that it has the opportunity for tremendous ongoing success. By electing us, shareholders will be adding to the Board independent, objective directors with the right skills and experience to help the Company realize its potential.

***

Sincerely,

Quentin Koffey

Politan Capital Management

About Politan Capital Management

We are long-term focused shareholders with the substantial majority of the capital we have invested in Masimo committed for at least three years. We conduct extensive due diligence in advance of making investments, working with top-tier operating partners, consultants, and law firms. We seek to engage constructively with management teams and boards of directors to unlock long-term value through strategic, operational, and governance changes. Our firm was started in August 2021 and the investment partners have 35+ years of experience engaging productively for the benefit of all shareholders at companies such as Bunge, Centene, CoreLogic, Hess, Louisiana-Pacific, Lowe’s, and Marathon Petroleum. We have placed ~30 directors on public company boards—nearly all through privately negotiated settlement agreements.

Biographies of Politan’s Nominees

Michelle Brennan is an accomplished healthcare executive with over 30 years of experience at Johnson & Johnson. Michelle most recently served as Global Value Creation Leader and a member of the Medical Device Executive Leadership Team. Prior to this, she held a variety of roles, including Company Group Chair of J&J’s Medical Device business in Europe, Middle East & Africa. Over her tenure, Michelle had P&L responsibility for a more than $5 billion medical device business operating across diverse business models and geographies. She also successfully scaled multiple businesses from inception to several billion in revenue and led efforts to invest in innovation as well as optimize the R&D process, which resulted in more effective and profitable product launches and more efficient spend. Michelle has broad operational experience across medical devices and consumer pharmaceuticals and is known for her expertise in strategy implementation, new product innovation, and business transformation.

Michelle is currently an independent director at Cardinal Health (NYSE: CAH) and is a member of the Audit and Human Resources & Compensation Committees. She recently served on the Board of Coupa Software (NASDAQ: COUP) as an independent director, where she was Chair of the Nominating and Corporate Governance Committee and a member of the Audit Committee, until the completion of Coupa’s acquisition by Thoma Bravo for $8 billion in February of 2023. Michelle holds a BA from the University of Kansas and has attended Executive MBA courses at the Wharton School of the University of Pennsylvania.

Quentin Koffey is the Managing Partner and Chief Investment Officer of Politan Capital, a top shareholder of Masimo Corporation. In this role, Quentin leads efforts to work actively with management teams, boards of directors, and shareholders of portfolio companies on strategic, operational, and corporate governance matters to unlock long-term value for shareholders. Prior to founding Politan, Quentin was a partner at Senator Investment Group LP, where he created and led its shareholder engagement efforts, and a Portfolio Manager for Strategic Investments at The D.E. Shaw Group, where he started and led the firm’s shareholder engagement strategy. Quentin also served as a Portfolio Manager at Elliott Management Corporation where he focused on active investments in public and private equity and credit.

Over his career, Quentin has established a track record of working constructively with boards and management teams to enhance shareholder value, including at companies such as Centene (NYSE: CNC), Lowe’s Companies (NYSE: LOW), Louisiana-Pacific (NYSE: LPX), Bunge (NYSE: BG), and Marathon Petroleum (NYSE: MPC). Quentin holds a BA from Yale College, a JD from Stanford Law School, and an MBA from Stanford Graduate School of Business.

***

Your vote is important, no matter how many shares of Common Stock you own. We urge you to sign, date, and return the enclosed BLUE universal proxy card today to vote FOR the election of the Politan Nominees and in accordance with the Politan Parties’ recommendations on the other proposals on the agenda for the 2023 Annual Meeting.

|

Data and quotes throughout this letter are sourced from Masimo and other companies’ filings, presentations and transcripts, third-party data sources including Bloomberg, legal filings and transcripts including the Verified Second Amended and Supplemented Complaint in Politan Capital Management LP and California State Teachers’ Retirement System v Masimo Corporation. Data on shareholder voting is sourced from Institutional Shareholder Services Corporate Solutions. A more detailed description of calculations and company analysis will be available in Politan's upcoming shareholder presentation.

- Bloomberg Peers include: SWAV, INSP, PEN, GMED, NARI, IRTC, ENOV, AXNX, ITGR, ATRC.

- 2022 Proxy Peers include: ABMD, ALGN, COO, XRAY, DXCM, GMED, HAE, HOLX, PODD, ICUI, IART, LIVN, NUVA, RMD, TDOC, TNDM, TFX, WST.

- Proxy Peers with Same Growth Profile are 2022 Proxy Peers that have a 3-year forward sales CAGR exceeding 10%. Includes: ABMD, DXCM, HOLX, PODD, RMD, WST.

- Dow Jones US Medical Equipment Index.

- Comparable Business Quality Peers: EW, IDEXX, RMD, ISRG.

- Wall Street Sell-Side Peers is peers used for Wolfe Research healthcare segment valuation: ABT, BSX, EW, RMD, STE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Politan’s (defined below) underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Politan that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein have been sourced from third parties. Politan does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Politan Capital Management LP (“Politan”) and the other Participants (as defined below) have filed a definitive proxy statement and accompanying BLUE universal proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit proxies for, among other matters, the election of its slate of director nominees at the 2023 annual stockholders meeting (the “2023 Annual Meeting”) of Masimo Corporation, a Delaware corporation (“Masimo”).

The participants in the proxy solicitation are Politan, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, Politan Capital NY LLC, Politan Intermediate Ltd., Politan Capital Partners Master Fund LP (“Politan Master Fund”), Politan Capital Partners LP (“Politan LP”), Politan Capital Offshore Partners LP (“Politan Offshore” and collectively with Politan Master Fund and Politan LP, the “Politan Funds”), Quentin Koffey, Matthew Hall, Aaron Kapito and Michelle Brennan (collectively, the “Participants”).

As of the date hereof, (i) Politan Master Fund directly owns 4,712,518 shares of common stock, par value $0.001 per share, of Masimo (the “Common Stock”), and (ii) Politan Capital NY LLC is the direct and record owner of 1,000 shares of Common Stock.

Politan, as the investment adviser to the Politan Funds, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) 4,713,518 shares of Common Stock (the “Politan Shares”) and, therefore, Politan may be deemed to be the beneficial owner of all of the Politan Shares. The Politan Shares collectively represent approximately 8.9% of the outstanding shares of Common Stock based on 52,779,770 shares of Common Stock outstanding as of April 1, 2023, as reported in Masimo’s Quarterly Report on Form 10-Q filed on May 10, 2023. As the general partner of Politan, Politan Capital Management GP LLC may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Politan Shares and, therefore, Politan Capital Management GP LLC may be deemed to be the beneficial owner of all of the Politan Shares. As the general partner of the Politan Funds, Politan Capital Partners GP LLC may be deemed to have the shared power to vote or to direct the vote of (and the shared power to dispose or direct the disposition of) all of the Politan Shares and, therefore, Politan Capital Partners GP LLC may be deemed to be the beneficial owner of all of the Politan Shares. By virtue of Mr. Koffey’s position as the managing partner and chief investment officer of Politan and as the managing member of Politan Capital Management GP LLC and Politan Capital Partners GP LLC, Mr. Koffey may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) all of the Politan Shares and, therefore, Mr. Koffey may be deemed to be the beneficial owner of all of the Politan Shares. As of the date hereof, none of Mr. Hall, Mr. Kapito or Ms. Brennan own beneficially or of record any shares of Common Stock.

IMPORTANT INFORMATION AND WHERE TO FIND IT

POLITAN STRONGLY ADVISES ALL STOCKHOLDERS OF MASIMO TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY POLITAN WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS, ARE ALSO AVAILABLE ON WWW.ADVANCEMASIMO.COM AND THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, D.F. KING & CO., INC., 48 WALL STREET, 22ND FLOOR, NEW YORK, NEW YORK 10005 (STOCKHOLDERS CAN CALL TOLL-FREE: +1 (866) 620-9554).

View source version on businesswire.com: https://www.businesswire.com/news/home/20230521005029/en/

Contacts

Investors

D.F. King & Co., Inc.

Edward McCarthy

emccarthy@dfking.com

Media

Dan Zacchei / Joe Germani

Longacre Square Partners

dzacchei@longacresquare.com / jgermani@longacresquare.com