In a rare and dramatic reversal, Aletheia Capital has sharply shifted its outlook on ASML Holding (ASML). Analyst Warren Lau upgraded the stock from “Sell” to “Buy” and doubled the price target on shares from $750 to $1,500. This bold move has quickly grabbed Wall Street’s attention and sparked fresh momentum in ASML stock, which has already reacted with significant gains.

The upgrade comes amid growing optimism around demand for semiconductor lithography tools, especially extreme ultraviolet (EUV) systems critical for next-generation chips powering artificial intelligence (AI), memory, and advanced logic devices. But with ASML stock trading well below the new target and global tech demand shifting rapidly, is now the time to buy shares?

About ASML Holding Stock

ASML Holding is a multinational technology company and the world’s leading supplier of photolithography systems, the highly specialized machines that semiconductor manufacturers use to print circuit patterns on silicon wafers. Headquartered in the Netherlands, the company plays an indispensable role in the global chip supply chain, especially as the only provider of cutting-edge EUV lithography equipment used for the most advanced semiconductor nodes. ASML has a market capitalization of $478 billion, reflecting its dominant position in the semiconductor equipment industry.

ASML stock has delivered a strong performance over the past 52 weeks, rising around 62%, driven by optimism around demand for its semiconductor lithography systems, particularly as AI-related chip deployment accelerates.

Recent analyst upgrades — particularly the one by Aletheia Capital — pushed shares of ASML to a fresh 52-week high of $1,246.38 on Jan. 6. Intraday gains this week signal strong investor interest and bullish sentiment building around the firm's future growth prospects. While the stock has experienced occasional pullbacks and volatility tied to earnings results, macroeconomic concerns, and geopolitical headwinds earlier in 2025, the latest trend reflects renewed momentum and a strong rebound.

ASML stock is currently trading at a premium compared to industry peers at 35.4 times forward earnings.

Stable Q3 Results

ASML Holding released its third-quarter 2025 results on Oct. 15. For total net sales, ASML reported €7.5 billion in Q3 2025, slightly higher than the €7.47 billion it logged in Q3 2024. Meanwhile, its gross margin improved from 50.8% in Q3 2024 to 51.6 % in Q3 2025.

In terms of net income, ASML posted €2.1 billion in Q3 2025, again representing slight year-over-year (YOY) growth in profitability. EPS also edged up, from €5.28 in Q3 2024 to €5.49 in Q3 2025.

Additionally, net bookings more than doubled YOY, rising from around €2.6 billion in Q3 2024 to €5.4 billion in Q3 2025. This underscores strengthening demand, particularly for advanced tooling such as EUV systems.

Finally, installed base management revenue contributed almost €2 billion in Q3 2025, pointing to a continued expansion of ASML’s recurring revenue streams.

ASML forecast Q4 2025 (which is to be reported on Jan. 28) total net sales between €9.2 billion and €9.8 billion with a gross margin of roughly 51% to 53%, reflecting sequential growth as customer shipments accelerate. For the full-year 2025, the company reaffirmed expectations for around 15% growth in net sales compared with 2024, with a gross margin near 52%. Plus, ASML did not expect total net sales in 2026 to fall below 2025 levels, although it flagged potential softness in China-related demand.

Analysts tracking ASML project EPS to climb 40% YOY to $29.06 in fiscal 2025, then grow another 4% to $30.19 in fiscal 2026.

What Do Analysts Expect for ASML Stock?

Apart from Aletheia Capital, several other analysts have also shown optimism around ASML’s prospects. This month, Bernstein SocGen Group upgraded ASML stock from “Market Perform” to “Outperform,” citing a powerful multi-year demand setup. The firm expects ASML to be a key beneficiary of an upcoming DRAM super cycle, as leading memory makers plan major capacity additions in 2026 and accelerate migration to the more lithography-intensive 1c node.

Last month, Morgan Stanley also reiterated its “Overweight” rating on ASML, citing strong momentum in lithography demand driven by a strengthening DRAM cycle and rising foundry spending. The firm recently named ASML a “Top Pick,” pointing to signs of a memory supercycle, tight DRAM supply, and accelerating transitions to advanced technologies, all of which support sustained order growth.

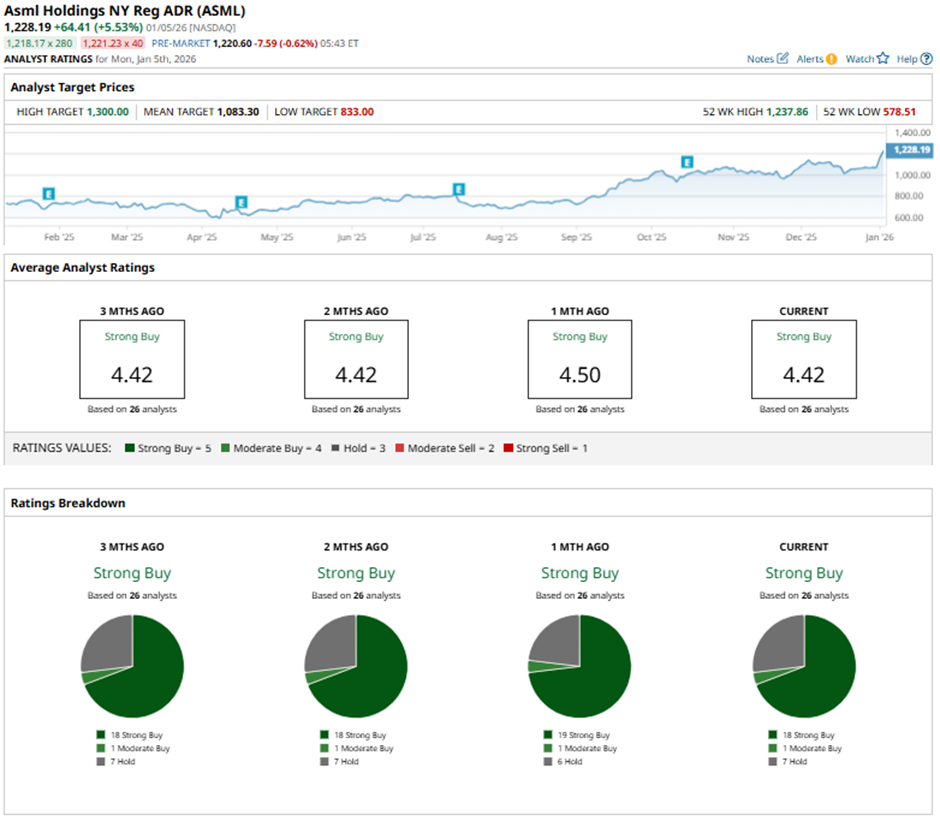

Wall Street’s bullishness is evident in ASML stock having a consensus “Strong Buy” rating. Of the 26 analysts covering the stock, 18 advise a “Strong Buy,” one suggests a “Moderate Buy,” and seven analysts are on the sidelines with a “Hold” rating.

The stock has already surged past its average analyst price target of $1,083.30. Meanwhile, Aletheia Capital’s Street-high target price of $1,500 suggests that the stock could rally as much as 21% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- S&P 500, MidCap 400, and SmallCap 600 Welcome New Members as Indexes Rebalance for 2026

- We ‘Can't Determine Whether We are Dealing With a Pet Rock or a Barbie’: Warren Buffett Warns Investors to Only Invest In Industries They Know

- LCID Stock Crashed Last Year, But Will Robotaxis Save the Day for Lucid in 2026?

- 'Robots & Rockets Aren’t Made from Hopes & Wishes,' and How the AI Revolution is Shaping the Next Metals Bull Market